- October 25, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The Beijing-based crypto firm Sino Global Capital launched a $200 million fund backed up by crypto exchange FTX to invest in projects such as DeFi, Web 3.0, and NFT infrastructure. The news was first reported by The Block, along with the firm’s CEO comments about their expectations and further approach.

Sino Global explained that Liquid Value Fund I will have a hard cap of $200 million and is going to focus in Asia, especially India, according to an official statement made to Coindesk.

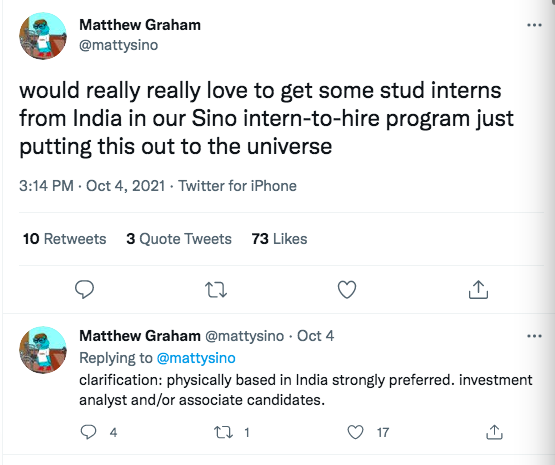

The focus on India was to be expected since the firm’s CEO Matthew Graham recently tweeted they are looking to hire investment analyst interns “physically based in India”.

The question was raised by other Twitter users whether this is just an intent for “a rotation away from China market”.

However, Graham has shown further interest in India’s knowledge of engineering and its prominent crypto space. He stated to The Block that at the firm they “see India as an extremely important, yet idiosyncratic, market for crypto”.

Recent reports show that India has 100 million crypto owners, a top number higher than the U.S. (27 million) and any other country. Their crypto space is increasingly growing at a rapid speed, being of great potential.

Related Reading | India Tops The List Of Crypto Ownership With 100 Million Hodlers, Where Does Your Country Place?

Graham Believes India Will Regulate Crypto

Sino Global’s stated they have invested in over 20 other projects, as shown in their portfolio, counting FTX, Solana, Clearpool, Delta Exchange, Mintbase, and others; Solana being the most successful so far. The current fund will be focusing on the Solana and Ethereum ecosystems.

Sam Bankman-Fried commented to The Block about FTX’s outlook on Sino Global and the fund:

“We are excited to support the launch of Sino Global Capital’s institutional fund, (…) From the very beginning, Matthew and the Sino Global Capital team supported the FTX vision and then worked with us to help make it a reality. The Fund will now provide more opportunities to projects that are pushing crypto and blockchain technologies to the next level.”

CoinDesk reported that the Liquid Value Fund I will purchase some of the firm’s investments at cost, “including LayerZero, Orca, and Clearpool”.

They also stated that this is the first time the Chinese crypto venture capital firm accepts outside investment “from a broad range of accredited investors”.

Recently, FTX raised $420 million from 69 investors getting to value the company at $25 billion”. In regards to the event Bankman-Fried commented the following to CNBC:

Today we are focused on establishing FTX as a trustworthy and innovative exchange by regularly engaging with regulators around the world, and constantly seeking opportunities to enhance our offerings for digital asset investors.

Graham believes India counts with the greatest crypto entrepreneurs and along with FTX aims to find opportunities in the country. Despite India’s unclear policies, Sino Global’s CEO remains positive about the government allowing clarity and regulations for digital assets in the near future.

Related Reading | Why Is India Leading In Crypto Adoption?