- July 9, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

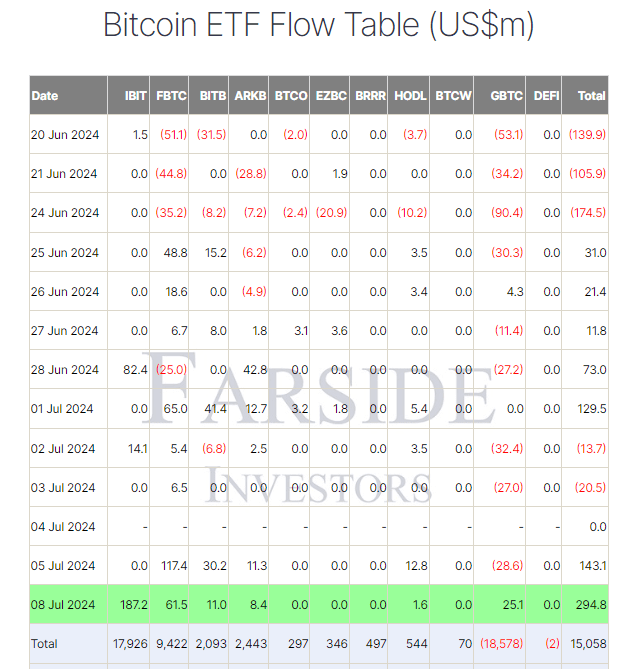

According to Farside data, Bitcoin ETFs experienced a significant surge in inflows on July 8, marking the largest influx since June 5. The total net inflow was $294.8 million. Leading the charge was BlackRock’s IBIT, which recorded an impressive $187.2 million inflow, the largest since June 6. This substantial addition brings BlackRock’s total net inflow to a remarkable $17.9 billion. Fidelity’s FBTC also saw a significant boost, with $61.5 million added, increasing its total net inflow to $9.4 billion.

Farside data shows that Bitwise’s BITB had an inflow of $11.0 million, bringing its total net inflow to $2.1 billion. Ark’s ARKB saw an inflow of $8.4 million, taking its total to $2.4 billion. Grayscale’s GBTC reported a $25.1 million inflow, though it still has a total outflow of $18.6 billion. Overall, the total net inflow for all ETFs reached $15.1 billion.

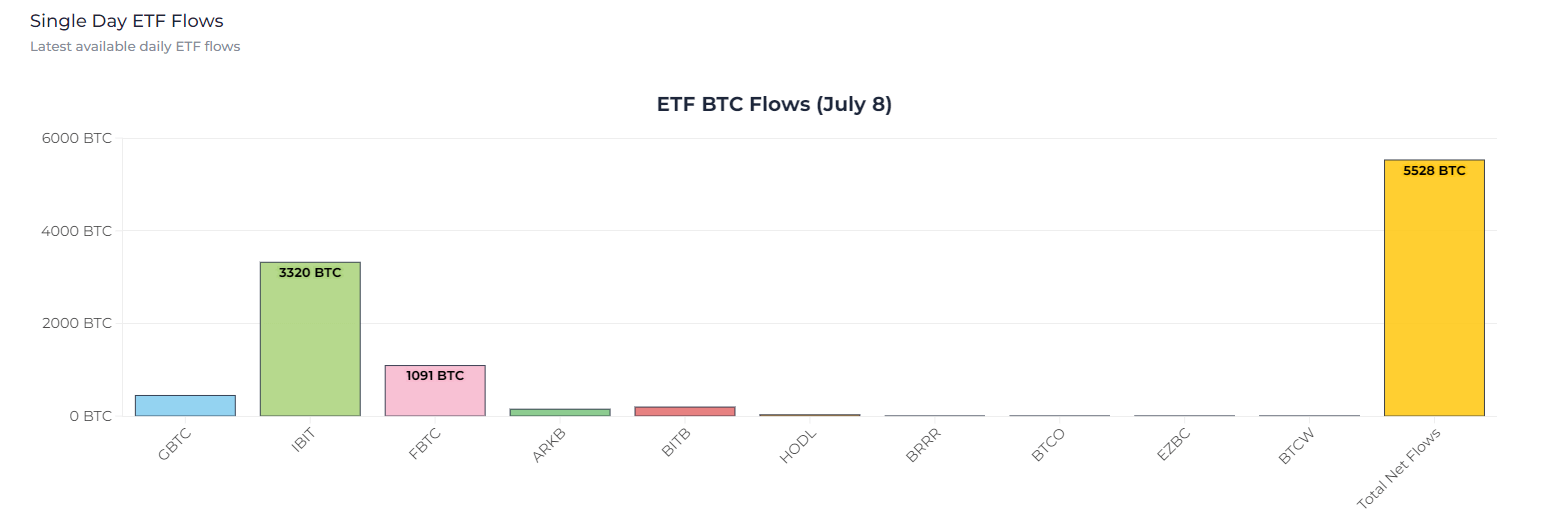

According to Heyapollo data, this inflow is equivalent to 5,528 BTC being injected into the ETFs.

The post Bitcoin ETFs see largest inflow since June 5 at $294 million appeared first on CryptoSlate.