- December 12, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Dogecoin (DOGE) Poise For 20% Price Drop if This Happens appeared first on Coinpedia Fintech News

Dogecoin (DOGE), the popular and world’s largest crypto-meme coin, is poised to continue its downward momentum as whale activity and price action indicate a bearish sign.

Whale Dumped 146.6 Million DOGE

Recently, Whale Alert, a whale transaction tracker, posted on X (formerly Twitter) that an unknown wallet had transferred a significant 146.6 million DOGE worth $56.5 million to the cryptocurrency exchange Robinhood.

In the realm of cryptocurrency, the transfer of assets from wallets to exchanges is often seen as a negative sign. It indicates that these assets are being transferred with the intention of being sold, which can create selling pressure and lead to price declines.

Dogecoin (DOGE) Technical Analysis and Upcoming Levels

According to expert technical analysis, DOGE appears bearish as it has formed an inverted hammer candlestick pattern at the crucial resistance level of $0.42. Additionally, it has also begun to show downside momentum, which partially confirms this bearishness.

Based on recent price action and historical price momentum, if DOGE remains below the $0.42 level, there is a strong possibility it could decline by 20% to reach $0.35 in the coming days. However, this bearish thesis is only valid as long as DOGE is trading below the $0.42 level, otherwise, it may fail.

Despite this bearish outlook, the 200-day Exponential Moving Average (EMA) on a daily time frame indicates that it is in an uptrend.

Traders Bearish Outlook

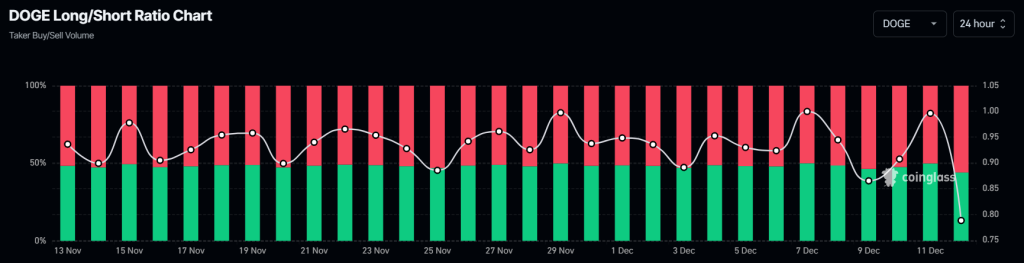

However, this bearish outlook is further supported by on-chain analytics firm Coinglass. Data from DOGE’s long/short ratio indicates that short sellers are currently dominating.

t press time, this ratio currently stands at 0.78, a record low since the beginning of November 2024. In addition to this, currently, 56% of top traders hold short positions, while 44% hold long positions.

61,160,251

61,160,251