- February 22, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Since Thursday, Bitcoin has lost 20% in value, with Monday’s sell-off tanking its price below $37,000.

Over the past week, of the top-100, only Terra-based Anchor Protocol managed to stay green, posting 6% gains. The rest of the alts have fared badly, with Gala leading the losses at -34%.

At the same time, the large caps see XRP, Cardano, and Solana take the biggest hits coming in around -14% apiece over the same period.

Hopes are Bitcoin, as the market mover, can stabilize, but on-chain analysis paints a grim outlook ahead.

What’s driving the headwinds?

The latest Glassnode analysis states Bitcoin faces several sell-side headwinds leading to weakness.

The report attributes this to “persistent risk and uncertainty” to do with expected Fed rate hikes next month, the Russia-Ukraine crisis, and the increasingly oppressive stance by Canadian authorities.

It adds that if the downtrend continues to deepen, the likelihood of a bear market increases as investors look to cut their losses.

“The longer that investors are underwater on their position, and the further they fall into an unrealized loss, the more likely those held coins will be spent and sold.”

Bitcoin is currently trading down 47% from November highs and has been trending downwards for the past 15 weeks.

The risks mentioned in the report have been known for some time, suggesting investors are bracing for the worst with a flight to risk-off.

The debate on whether Bitcoin is a risk-off asset continues. But it appears that investors aren’t taking chances; instead, they are sticking with the known – gold.

2022 has seen a resurgence in gold as it continues to post higher lows. Things accelerated at the end of January with a sharp price increase, posting 6% gains since then. Today, the price touched $1,915/oz, a level not seen since July last year, and not far off its ATH of $2,067/oz.

But where does that leave “digital gold?”

On-chain metrics show trouble ahead for Bitcoin

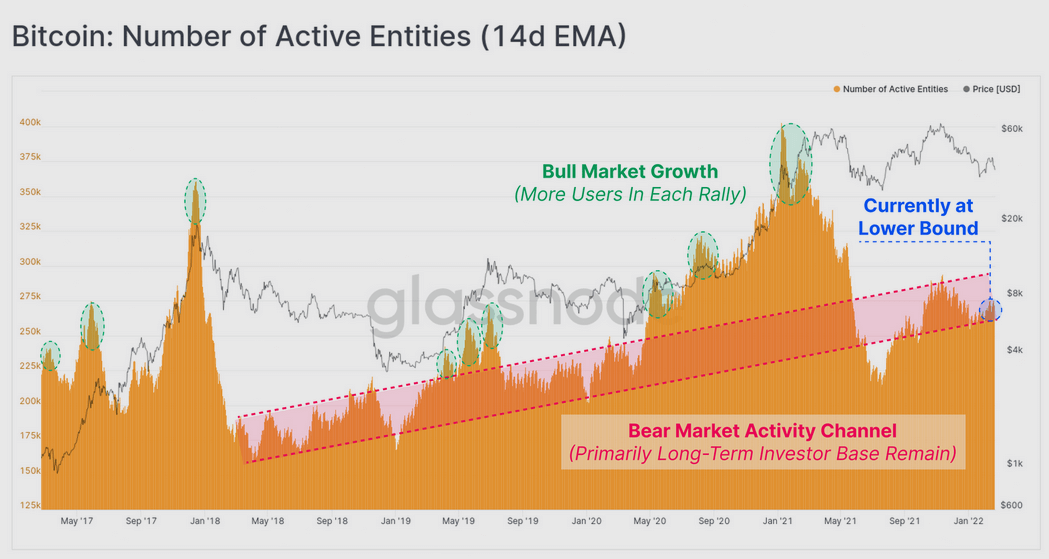

Low on-chain activity signals bearishness ahead. The number of active entities is currently within the lower bound range of the bear market channel, suggesting depressed demand and interest.

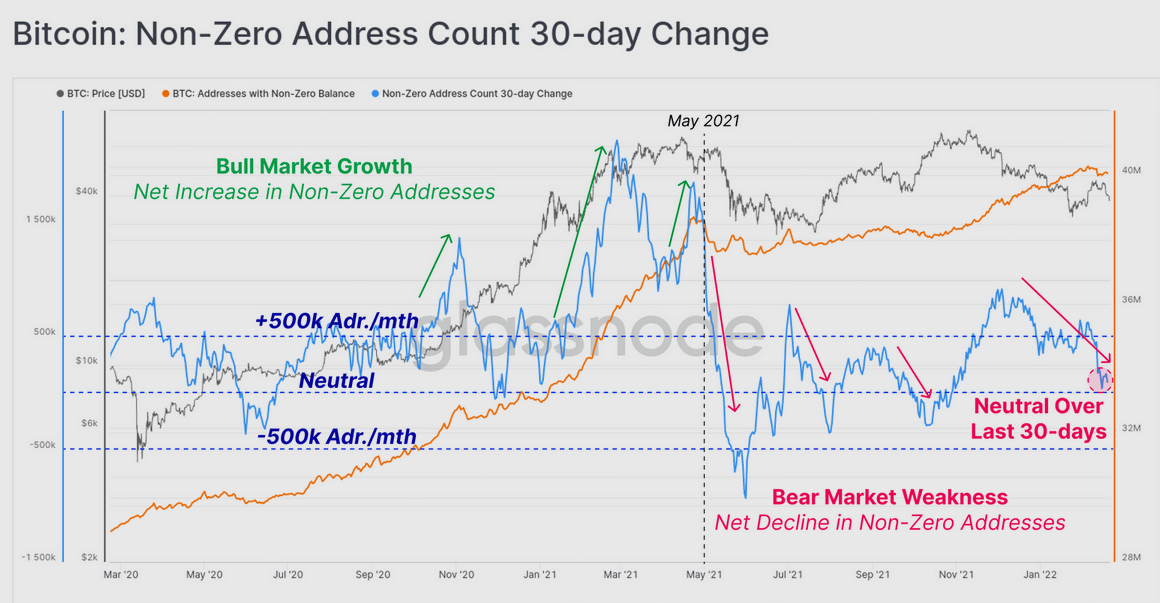

This view is supported by a substantial softening in the non-zero address count over the last 30-days. Periods of low demand and supply accumulation follow this pattern as investors empty their wallets, adding to net outflows from the network.

“This is the result of some investors emptying their address balances completely. Over the last month, around 219k addresses (0.54% of the total) have been emptied, which is a metric to watch in case this is the start of a period of net outflows of users from the network (as was seen in May 2021).”

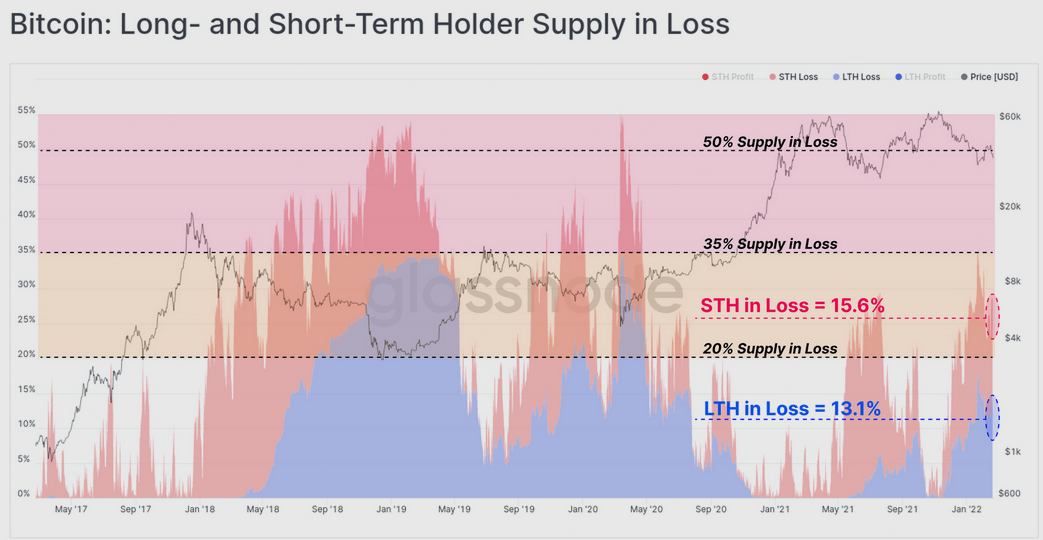

Bitcoin supply held at a loss takes a sharp increase for both long-term and short-term holders. Glassnode mentions this supply refers to balances held outside of exchanges, which they term sovereign supply.

With a combined 28.7% (or 4.7 million $BTC) of sovereign supply nursing losses, sell pressure is further heightened.

STH supply in loss is currently 15.6% of Sovereign Supply (2.56M BTC).

LTH supply in loss is currently 13.1% of Sovereign Supply (2.14M BTC).

Despite the grim metrics, Glassnode reminds readers that markets are cyclical, and long-term, they expect Bitcoin to bounce back.

The post Gold shines as Bitcoin sinks below $37,000, on-chain metrics indicate further trouble ahead appeared first on CryptoSlate.