- September 2, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

As it stands, the argument for Bitcoin as money has several components which could be called into question.

This is an opinion editorial by Taimur Ahmad, a graduate student at Stanford University, focusing on energy, environmental policy and international politics.

Author’s note: This is the first part of a three-part publication.

Part 1 introduces the Bitcoin standard and assesses Bitcoin as an inflation hedge, going deeper into the concept of inflation.

Part 2 focuses on the current fiat system, how money is created, what the money supply is and begins to comment on bitcoin as money.

Part 3 delves into the history of money, its relationship to state and society, inflation in the Global South, the progressive case for/against Bitcoin as money and alternative use-cases.

Bitcoin As Money: Progressivism, Neoclassical Economics, And Alternatives Part I

Prologue

I once heard a story that set me on my journey to try and understand money. It goes something like:

Imagine a tourist comes to a small, rural town and stays at the local inn. As with any respectable place, they are required to pay 100 diamonds (that’s what the town uses as money) as a damage deposit. The next day, the inn owner realizes that the tourist has hastily left town, leaving behind the 100 diamonds. Given that it is unlikely the tourist will venture back, the owner is delighted at this turn of events: a 100 diamond bonus! The owner heads to the local baker and pays off their debt with this extra money; the baker then goes off and pays off their debt with the local mechanic; the mechanic then pays off the tailor; and the tailor then pays off their debt at the local inn!

This isn’t the happy ending though. The next week, the same tourist comes back to pick up some luggage that had been left behind. The inn owner, now feeling bad for still having the deposit and liberated from paying off their debt to the baker, decides to remind the tourist of the 100 diamonds and hand them back. The tourist nonchalantly accepts them and remarks “oh these were just glass anyways,” before crushing them under his feet.

A deceptively simple story, but always hard to wrap my head around it. There are so many questions that come up: if everyone in the town was in debt to each other, why couldn’t they just cancel it out (coordination problem)? Why were the townsfolk paying for services to each other in debt — IOUs — but the tourist was required to pay money (trust problem)? Why did no one check whether the diamonds were real, and could they have even if they wanted (standardization/quality problem)? Does it matter that the diamonds weren’t real (what really is money then)?

Introduction

We are in the midst of a poly-crisis, to borrow from Adam Tooze. As cliché as it sounds, modern society is a major inflection point across multiple, interconnected fronts. Whether it is the global economic system — the U.S. and China playing complementary roles as consumer and producer respectively — the geopolitical order — globalization in a unipolar world — and the ecological ecosystem — cheap fossil fuel energy fueling mass consumption — the foundations atop which the past few decades were built are permanently shifting.

The benefits of this largely stable system, although unequal and at great cost to many social groups, such as low inflation, global supply chains, a semblance of trust, etc., are quickly unraveling. This is the time to ask big, fundamental questions, most of which we have been too afraid or too distracted to ask for a long time.

The idea of money is at the heart of this. Here I don’t mean wealth necessarily, which is the subject of many discussions in modern society, but rather the concept of money. Our focus is typically on who has how much money (wealth), how we can get more of it for ourselves, asking is the current distribution fair, etc. Underneath this discourse is the assumption that money is a largely inert thing, almost a sacrilegious object, that gets moved around every day.

In the past few years, however, as debt and inflation have become more pervasive topics in mainstream discourse, questions around money as a concept have garnered increasing attention:

- What is money?

- Where does it come from?

- Who controls it?

- Why is one thing money but the other isn’t?

- Does/can it change?

Two ideas and theories that have dominated this conversation, for better or for worse, are Modern Monetary Theory (MMT) and alternative currencies (mostly Bitcoin). In this piece, I will be primarily focusing on the latter and critically analyzing the arguments underpinning the Bitcoin standard — the theory that we should replace fiat currency with Bitcoin — its potential pitfalls, and what alternative roles Bitcoin could have. This will also be a critique of neoclassical economics which governs mainstream discourse outside the Bitcoin community but also forms the foundation for many arguments on top of which the Bitcoin standard rests.

Why Bitcoin? When I got exposed to the crypto community, the mantra I came across was “crypto, not blockchain.” While there are merits to that, for the specific use-case of money especially, the mantra to focus on is “Bitcoin, not crypto.” This is an important point because commentators outside the community too often conflate Bitcoin with other crypto assets as part of their critiques. Bitcoin is the only truly decentralized cryptocurrency, without a pre-mine, and with fixed rules. While there are plenty of speculative and questionable projects in the digital asset space, as with other asset classes, Bitcoin has well established itself to be a genuinely innovative technology. The proof-of-work mining mechanism, that often comes under attack for energy use (I wrote against that and explained how BTC mining helps clean energy here), is integral to Bitcoin standing apart from other crypto assets.

To repeat for the sake of clarity, I will be purely focusing on Bitcoin only, specifically as a monetary asset, and mostly analyzing arguments coming from the “progressive” wing of Bitcoiners. For most of this piece, I will be referring to the monetary system in Western countries, focusing on the Global South at the end.

Since this will be a long, occasionally meandering, set of essays, let me provide a quick summary of my views. Bitcoin as money does not work because it is not an exogenous entity that can be programmatically fixed. Similarly, assigning moralistic virtues to money (e.g. sound, fair, etc.) represents a misunderstanding of money. My argument is that money is a social phenomenon, coming out of, and in some ways representing, socioeconomic relations, power structures, etc. The material reality of the world creates the monetary system, not vice versa. This has always been the case. Therefore, money is a concept constantly in flux, necessarily so, and must be elastic to absorb the complex movements in an economy, and must be flexible to adjust to the idiosyncratic dynamics of each society. Lastly, money cannot be separated from the political and legal institutions that create property rights, the market, etc. If we want to change the broken monetary system of today — and I agree it is broken — we must focus on the ideological framework and institutions that shape society so we can better use existing tools for better ends.

Disclaimer: I hold bitcoin.

Critique Of The Current Monetary System

Proponents of the Bitcoin standard make the following argument:

Government control of the money supply has led to rampant inequality and devaluation of the currency. The Cantillon effect is one of the main drivers behind this growing inequality and economic distortion. The Cantillon effect being an increase of money supply by the state favors those who are close to the centers of power because they get access to it first.

This lack of accountability and transparency of the monetary system has ripple effects throughout the socioeconomic system, including decreasing purchasing power and limiting the saving capabilities of the masses. Therefore, a programmatic monetary asset that has fixed rules of issuance, low barriers to entry and no governing authority is required to counter the pervasive effects of this corrupt monetary system which has created a weak currency.

Before I begin to assess these arguments, it is important to situate this movement in the larger socioeconomic and political structure we live in. For the past 50-odd years, there is considerable empirical evidence to show that real wages have been stagnant even when productivity has been rising, inequality has been surging higher, the economy has been increasingly financialized which has benefited the wealthy and asset owners, financial entities have been involved in corrupt and criminal activities and most of the Global South has suffered from economic turmoil — high inflation, defaults, etc., — under an exploitative global financial system. The neoliberal system has been unequal, oppressive and duplicitous.

During the same period, political structures have been faltering, with even democratic countries having fallen victim to state capture by the elite, leaving little space for political change and accountability. Therefore, while there are many wealthy proponents of Bitcoin, a significant proportion of those arguing for this new standard can be seen as those who have been “left behind” and/or recognize the grotesqueness of the current system and are simply looking for a way out.

It is important to understand this as an explanation to why there is an increasing number of “progressives” — loosely defined as people arguing for some form of equality and justice — who are becoming pro-Bitcoin standard. For decades, the question of “what is money?” or the fairness of our financial system has been relatively absent from mainstream discourse, buried under Econ-101 fallacies, and confined to mostly ideological echo chambers. Now, as the pendulum of history turns back towards populism, these questions have become mainstream again, but there is a dearth of those in the expert class that can sufficiently be sympathetic towards, and coherently respond to, people’s concerns.

Therefore, it is critical to understand where this Bitcoin standard narrative emerges from and to not outrightly dismiss it, even if one disagrees with it; rather, we must recognize that many of us skeptical of the current system share a lot more than we disagree upon, at least at a first principles level, and that engaging in debate beyond the surface level is the only way to raise collective conscience to a stage that makes change possible.

Is A Bitcoin Standard The Answer?

I will attempt to tackle this question at various levels, ranging from the more operational ones such as Bitcoin being an inflation hedge, to the more conceptual ones such as the separation of money and The State.

Bitcoin As An Inflation Hedge

This is an argument that is widely used in the community and covers a number of features important to Bitcoiners (e.g., protection against loss of purchasing power, currency devaluation). Up until last year, the standard claim was that as prices are always going up under our inflationary monetary system, Bitcoin is a hedge against inflation as its price goes up (by orders of magnitude) more than the price of goods and services. This always seemed like an odd claim because during this period, many risk assets performed remarkably well, and yet they are not deemed as inflation hedges in any way. And also, developed economies were operating under a secular low inflation regime so this claim was never really tested.

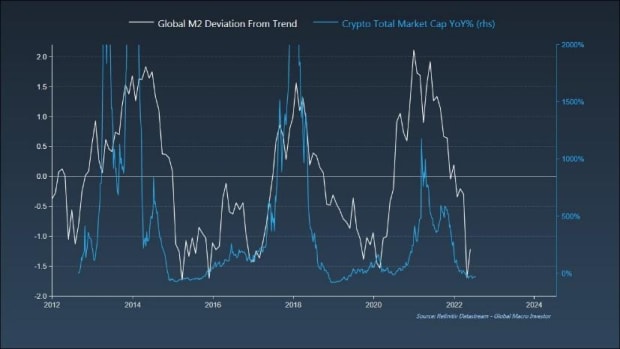

More importantly though, as prices surged higher over the past year and Bitcoin’s price plummeted, the argument shifted to “Bitcoin is a hedge against monetary inflation,” meaning that it doesn’t hedge against a rise in the price of goods and services per se, but against the “devaluation of currency through money printing.” The chart below is used as evidence for this claim.

This is also a peculiar argument for multiple reasons, each of which I will explain in more detail:

- It again relies on the claim that Bitcoin is uniquely a “hedge” and not simply a risk-on asset, similar to other high-beta assets that have performed well over periods of increasing liquidity.

- It relies on the monetarist theory that increase in the money supply directly and imminently leads to an increase in prices (if not, then why do we care about the money supply to begin with).

- It represents a misunderstanding of M2, money printing, and where money comes from.

1. Is Bitcoin Simply A Risk-On Asset?

On the first point, Steven Lubka on a recent episode of the What Bitcoin Did podcast remarked that Bitcoin was a hedge against inflation caused through excessive monetary expansion and not when that inflation was supply-side, which, as he rightly pointed out, is the current situation. In a recent piece on the same topic, he responds to the critique that other risk-on assets also go up during periods of monetary expansion by writing that Bitcoin goes up more than other assets and that only Bitcoin should be considered as a hedge because it is “just money,” while other assets are not.

However, the extent to which an asset’s price goes up shouldn’t matter as a hedge as long as it is positively correlated to the price of goods and services; I’d even argue that price going up too much — admittedly subjective here — pushes an asset from a hedge to speculative. And sure, his point that assets like stocks have idiosyncratic risks like bad management decisions and debt loads that make them distinctly different to Bitcoin is true, but other factors such as “risk of obsolescence,” and “other real-world challenges,” to quote him directly, apply to Bitcoin as much as they apply to Apple stock.

There are many other charts that show Bitcoin has a strong correlation with tech stocks in particular, and the equity market more broadly. The fact is that the ultimate driving factor behind its price action is the change in global liquidity, particularly U.S. liquidity, because that is what decides how far across the risk curve investors are willing to push out. In times of crisis, such as now, when safe haven assets like the USD are having a strong run, Bitcoin is not playing a similar role.

Therefore, there doesn’t seem to be any analytical reason that Bitcoin trades differently to a risk-on asset riding liquidity waves, and that it should be treated, simply from an investment point of view, as anything different. Granted, this relationship may change in the future but that’s for the market to decide.

2. How Do We Define Inflation And Is It A Monetary Phenomenon?

It is critical to the Bitcoiner argument that increases in money supply leads to currency devaluation, i.e., you can buy less goods and services due to higher prices. However, this is hard to even center as an argument because the definition of inflation seems to be in flux. For some, it is simply an increase in the price of goods and services (CPI) — this seems like an intuitive concept because that’s what people as consumers are most exposed to and care about. The other definition is that inflation is an increase in the money supply — true inflation as some call it — regardless of the impact on the price of goods and services, even though this should lead to price increases eventually. This is summarized by Milton Friedman’s, now meme-ified in my opinion, quote:

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.”

Okay so let’s try to understand this. Price increases due to non-monetary causes, such as supply chain issues, are not inflation. Price increases due to an expansion of the money supply are inflation. This is behind Steve Lubka’s point, at least how I understood it, about Bitcoin being a hedge against true inflation but not the current bout of supply-chain induced high prices. (Note: I am using his work specifically because it was well articulated but many others in the space make a similar claim).

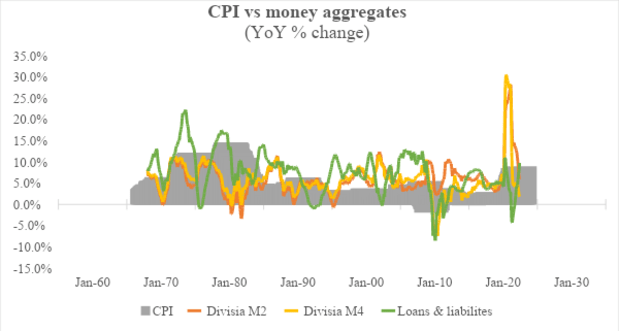

Since no one is arguing the effect of supply chain and other physical constraints on prices, let’s focus on the second statement. But why does change in the money supply even matter unless it is tied to a change in prices, regardless of when those price changes occur and how asymmetric they are? Here is a chart showing annual percentage change in different measures of the money supply and CPI.

Technical note: M2 is a narrower measure of money supply than M4 as the former does not include highly liquid money substitutes. However, the Federal Reserve in the U.S. only provides M2 data as the broadest measure of money supply because of the opaqueness of the financial system which limits proper estimation of the broad money supply. Also, here I use the Divisia M2 because it offers a methodologically superior estimation (by applying weight to different types of money) rather than the Federal Reserve’s approach which is a simple-sum average (regardless, the Fed’s M2 data is closely aligned with Divisia’s). Loans and leases is a measure of bank credit, and as banks create money when they lend rather than recycling savings, as I explain later, this is important to add as well.

We can see from the chart that there is weak correlation between changes in money supply and CPI. From the mid-1990s till the early 2000s, the rate of change of money supply is increasing while inflation is trending lower. The reverse is true in the early 2000s when inflation was picking up but money supply was coming down. Post-2008 perhaps stands out the most because it was the start of the quantitative easing regime when central bank balance sheets grew at unprecedented rates and yet developed economies continuously failed to meet their own inflation targets.

One potential counterargument to this is that inflation can be found in real estate and stocks, which have been surging higher through most of this period. While there is an undoubtedly strong correlation between these asset prices and M2, I don’t think stock market appreciation is inflation because it does not impact the purchasing power of consumers and hence, does not require a hedge. Are there distributional issues that lead to inequality? Absolutely. But for now I want to focus on the inflation narratively solely. With regards to housing prices, it’s tricky to count that as inflation because real estate is a major investment vehicle (which is a deep structural problem in and of itself).

Therefore, empirically there is no significant evidence that an increase in M2 necessarily leads to an increase in CPI (it is worth reminding here that I am focusing on developed economies primarily and will address the topic of inflation in the Global South later). If there was, Japan would not be stuck in a low inflationary economy, well below its inflation target, despite the expansion of the Bank of Japan balance sheet over the past few decades. The current inflationary bout is because of energy prices and supply chain disruptions, which is why countries in Europe — with their high dependence on Russian gas and poorly thought-out energy policy — for example, are facing higher inflation than other developed countries.

Sidenote: it was interesting to see Peter McCormack’s reaction when Jeff Snider made a similar case (regarding M2 and inflation) on the What Bitcoin Did podcast. Peter remarked how this made sense but felt so counter to the prevailing narrative.

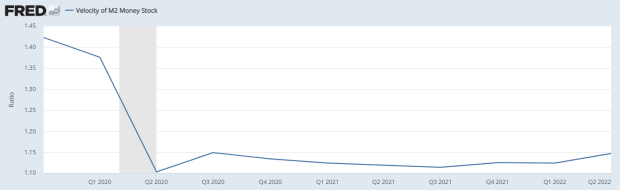

Even if we take the monetarist theory as correct, let’s get into some specifics. The key equation is MV = PQ.

M: money supply.

V: velocity of money.

P: prices.

Q: quantity of goods and services.

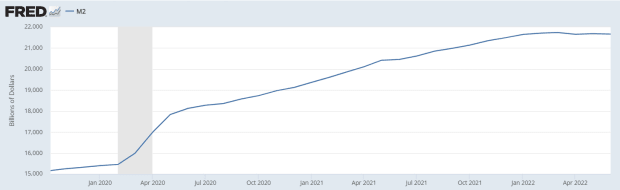

What these M2 based charts and analyses miss is how the velocity of money changes. Take 2020 for example. The M2 money supply surged higher because of the fiscal and monetary response of the government, leading many to predict hyperinflation around the corner. But while M2 increased in 2020 by ~25%, the velocity of money decreased by ~18%. So even taking the monetarist theory at face value, the dynamics are more complicated than simply drawing a causal link between money supply increase and inflation.

As for those who will bring up the Webster dictionary definition of inflation from the early 20th century as an increase in money supply, I’d say that change in money supply under the gold standard meant something completely different to what it is today (addressed next). Also, Friedman’s claim, which is a core part of the Bitcoiner argument, is essentially a truism. Yes, by definition higher prices, when not due to physical constraints, is when more money is chasing the same goods. But that does not in and of itself translate to the fact that increase in the money supply necessitates an increase in prices because that additional liquidity can unlock spare capacity, lead to productivity gains, expand the use of deflationary technologies, etc. This is a central argument for (trigger warning here) MMT, which argues that targeted use of fiscal spending can expand capacity, particularly through targeting the “reserve army of the unemployed,” as Marx called it, and employing them rather than treating them as sacrificial lambs at the neoclassical altar.

To bring this point to a close then, it’s hard to understand how inflation is, for all intents and purposes, anything different to an increase in CPI. And if the monetary expansion leads to inflation mantra does not hold, then what is the merit behind Bitcoin being a “hedge” against that expansion? What exactly is the hedge against?

I will admit there are a plethora of issues with how CPI is measured, but it is undeniable that changes in prices happen because of a myriad of reasons across the demand-side and supply-side spectrum. This fact has also been noted by Powell, Yellen, Greenspan, and other central bankers (eventually), while various heterodox economists have been arguing this for decades. Inflation is a remarkably complicated concept that cannot be simply reduced to monetary expansion. Therefore, this calls into question whether Bitcoin is a hedge against inflation if it is not protecting value when CPI is surging, and that this concept of hedging against monetary expansion is just chicanery.

In Part 2, I explain the current fiat system, how money gets created (it’s not all the government’s doing), and what Bitcoin as money could lack.

This is a guest post by Taimur Ahmad. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.