- October 12, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Yield aggregators are protocols that automate the process known as “yield farming.” Yield farming is the term used to define the following process:

- To invest in a protocol that will generate interest (or yield)

- To collect these returns, usually paid in the native token of the protocol where the capital is invested (also called “harvest”)

- To sell these tokens in a DEX

- Take this profit and reinvest it at the same protocol, growing the investment size and the returns.

- Repeat all steps while it is profitable.

How do yield aggregators help investors?

To do all these steps manually requires a lot of time, knowledge, and interactions with different blockchains and protocols. The main benefits of using a yield aggregator to manage it are to reduce costs, optimize the harvest cycles (as the protocol is scanning the network constantly), and reduce the time needed to manage all investments.

By using a yield aggregator protocol, the only step that the investor will need to do is transfer the asset to their smart contract and receive a receipt of this transaction. It will then deploy the capital into different investment strategies. They will manage the positions and take care of reinvestments and compounding. Thome protocols will also add new strategies and automatically deploy capital to these new opportunities.

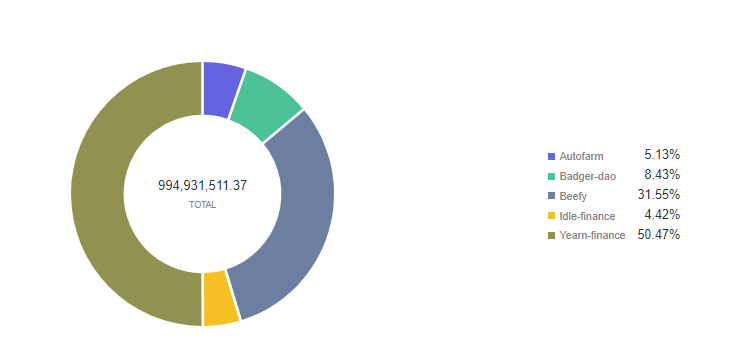

This article will cover the top 5 yield aggregators by TVL and explore their main features.

Yearn Finance

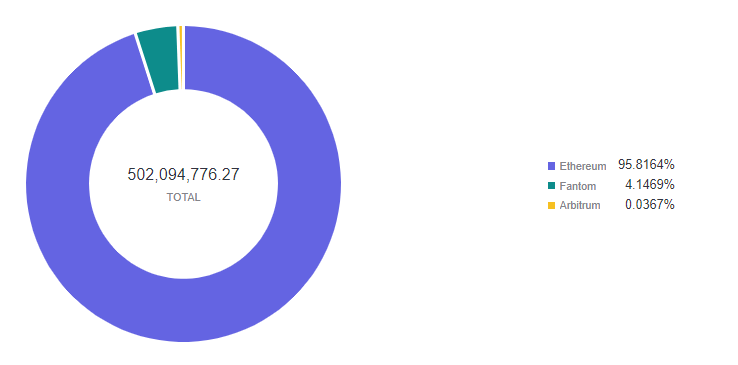

Yearn Finance was one of the first yield aggregators, launched on July 17, 2020. The prototype for it was a protocol called iEarn released by Andre Cronje on the Ethereum Blockchain. Currently, it is deployed at Ethereum, Fantom, and Arbitrum blockchains, with a scheduled expansion to Optimism. The chart below shows its TVL divided by chains:

Despite it being heavily concentrated on the Ethereum Blockchain, Yearn Finance started to integrate other chains at the beginning of 2022 as it identified new opportunities.

Yearn Finance Features

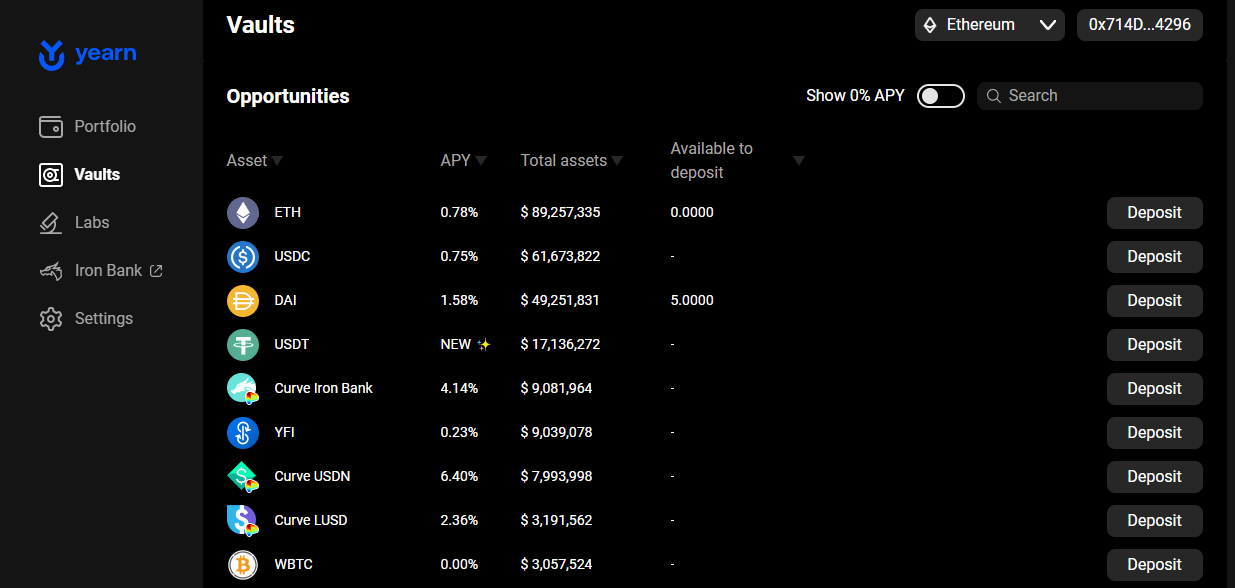

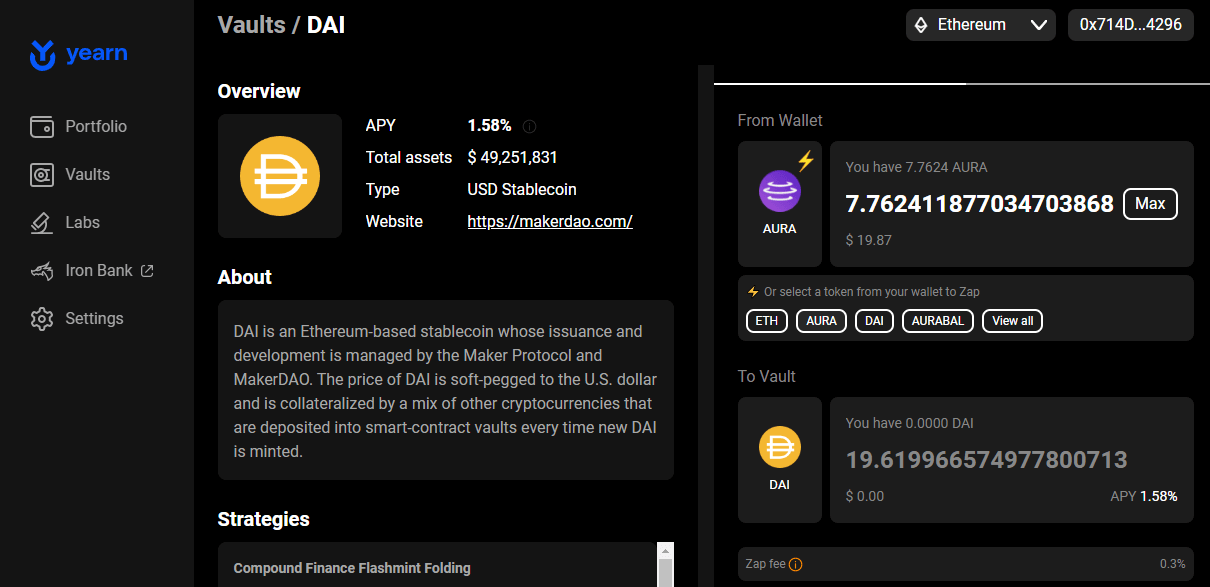

Its main product is the yVaults, where the investor can deposit an asset to receive returns (yield) over time. They have a huge selection of available assets (over 100), and the investor can filter the search by the APY (returns), total assets (TVL of each Vault), or the asset available in the wallet.

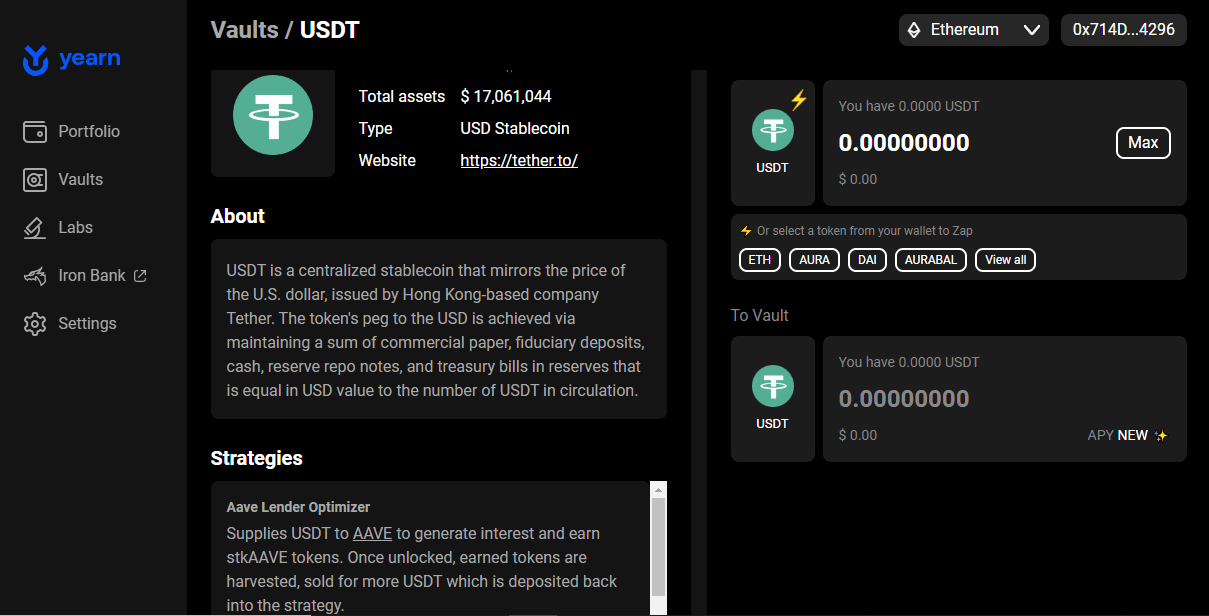

When clicking on an asset icon, the specific vault page opens, where more information can be found, such as the description of the investment strategies connected to the vault. Each yVault can handle 20 strategies at the same time.

Yearn Finance also makes available a swap function (called “Zap”) at the deposit. If the investor wants to make a deposit in the DAI vault, for example, but doesn’t have the DAI token in the wallet, he can use a different one, with the protocol taking care of the swap and the deposit into the vault.

Yearn Finance Token: YFI

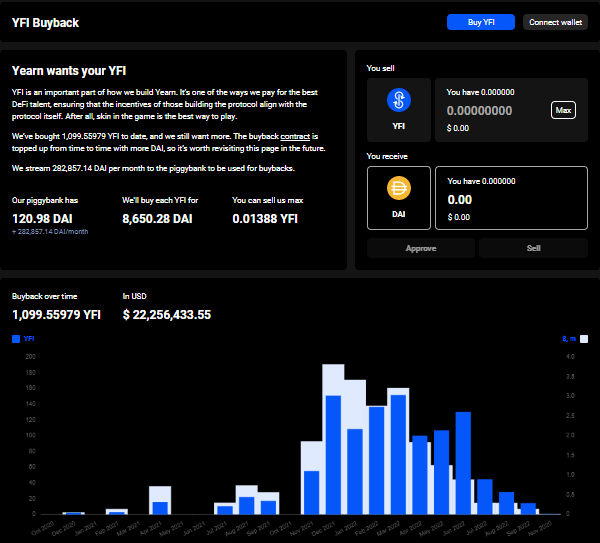

Yearn Finance has a token, YFI. Token holders can take an active part in the protocol’s governance. However, a proposal gave some freedom to the different groups of contributors working on the protocol. That means that not every decision will be submitted to a vote.

Currently, the token holders don’t receive any part of the revenues of the protocol. The running proposal is that the treasury buys back the token from the market, reducing the circulating supply. The governance approved a change on it, opening the possibility of part of the revenue to be shared with the token holders.

Yearn Finance Pros and Cons

Pros

- The investor can make a deposit in a token different from the one of the Vault

- Constant updates on the strategies used to generate returns

Cons

- The token holder doesn’t receive a share of the platform revenues.

Beefy Finance

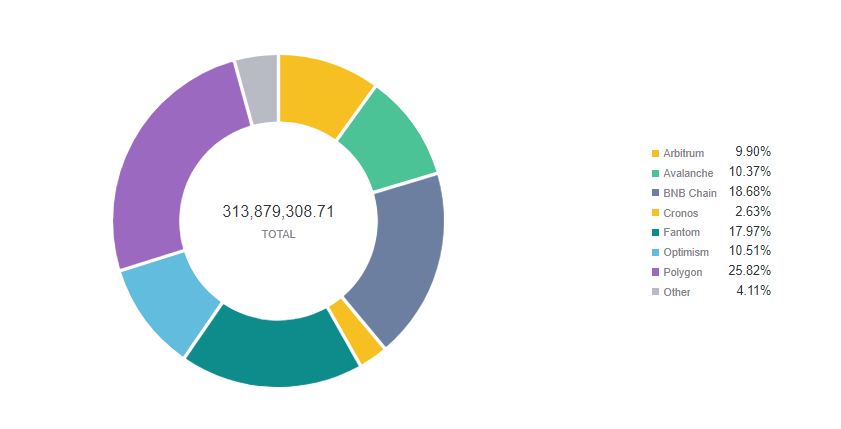

Beefy Finance went live on October 8, 2020, on the Binance Smart Chain (BNB Chain), being the first yield aggregator on BNB Chain. It later expanded to other blockchains (currently 15+), and the chart below shows Beefy Finance TVL for each chain:

Beefy is not available on the Ethereum blockchain, but compensates for it by having a strong presence, when we look at Assets Under Management (AUM), at Polygon ($78 million), BNB Chain ($66 million), and Fantom ($55 million).

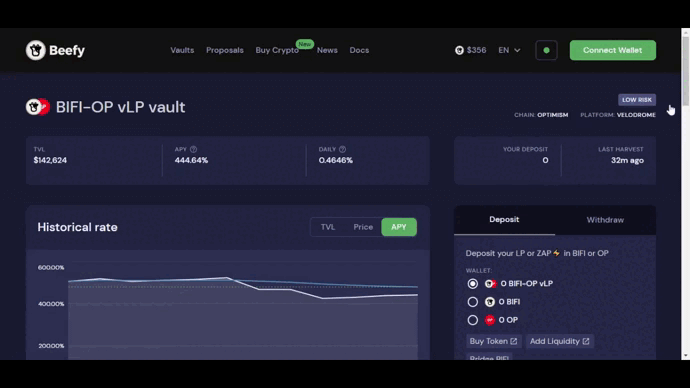

Beefy Finance Features

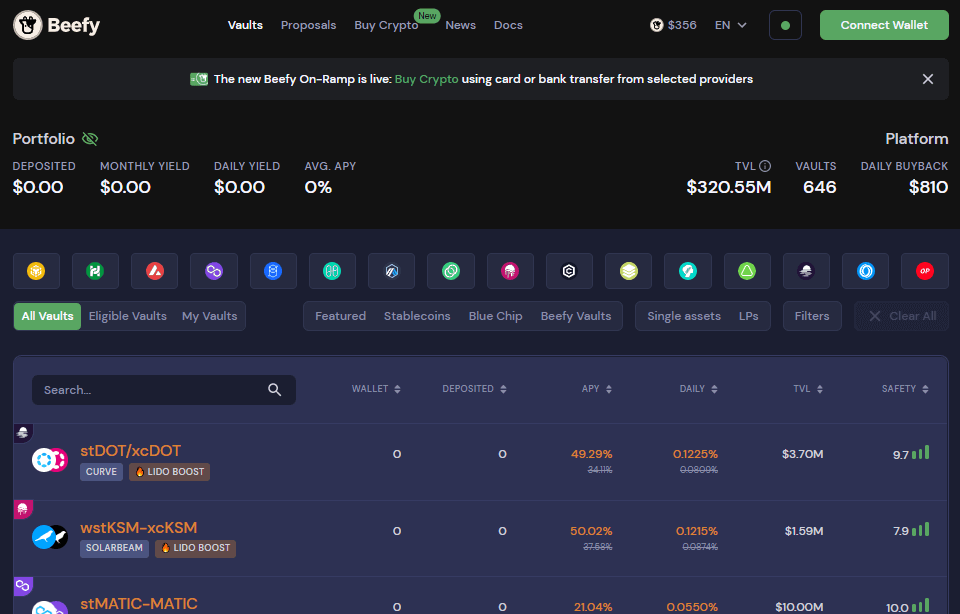

Its main product also is the Vault, but the breakdown of it is different. Instead of having an asset vault and linking it with different strategies, Beefy Finance creates a new vault for each strategy it develops. It currently has 646 vaults.

The vaults can be filtered by the chain, asset type, and also APY, daily return, TVL, and Safety score. When clicking on any vault, the Overview page is shown.

On this page it is possible to access extra information about the vault, like the description of the strategy used, the assets that compose this vault, and a chart with past metrics of it. Beefy Finance also offers the “Zap” feature, but with limited functionality: It is available only at some vaults, and the swap is enabled for the assets that make part of that vault.

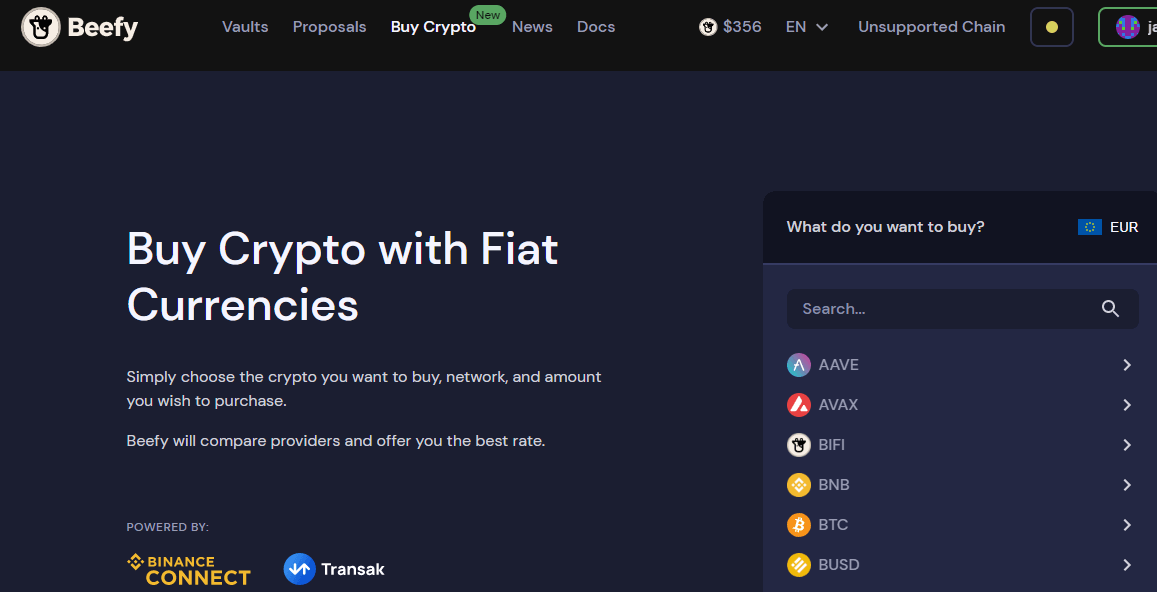

Beefy Finance also offers an on-ramp option, where the investor can buy crypto with fiat currencies to later deposit at one of their vaults.

Beefy Finance Token: BIFI

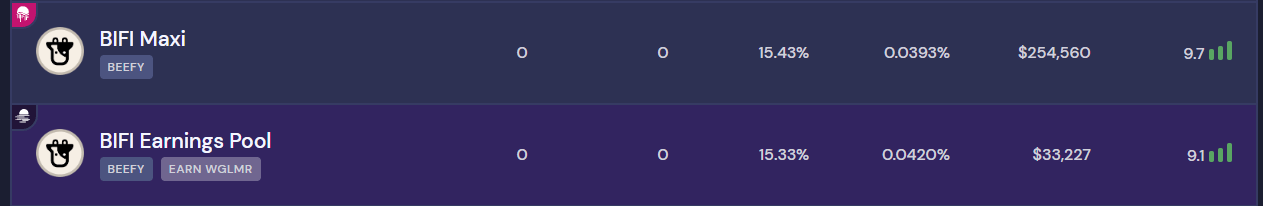

Beefy Finance token is BIFI. It can be used for governance (to vote on proposals to improve the protocol). The investor can deposit it in two special vaults: BIFI Maxi and BIFI Earnings Pool.

The first one takes the revenue share to be distributed to the token holder, buys BIFI on the market, and distributes it to the pool participants. As no new BIFI will be minted, this buyback and distribution increase the relative share of each token holder.

The second pool takes the revenue generated (in the native token of the blockchain) and distributes it to the pool participants. Each chain will distribute a different token.

Beefy Finance Pros and Cons

Pros

- The protocol has a huge selection of assets and chains

- The protocol shares revenue with token holders

Cons

- The protocol is not deployed at Ethereum Mainnet

- The Zap Function is limited

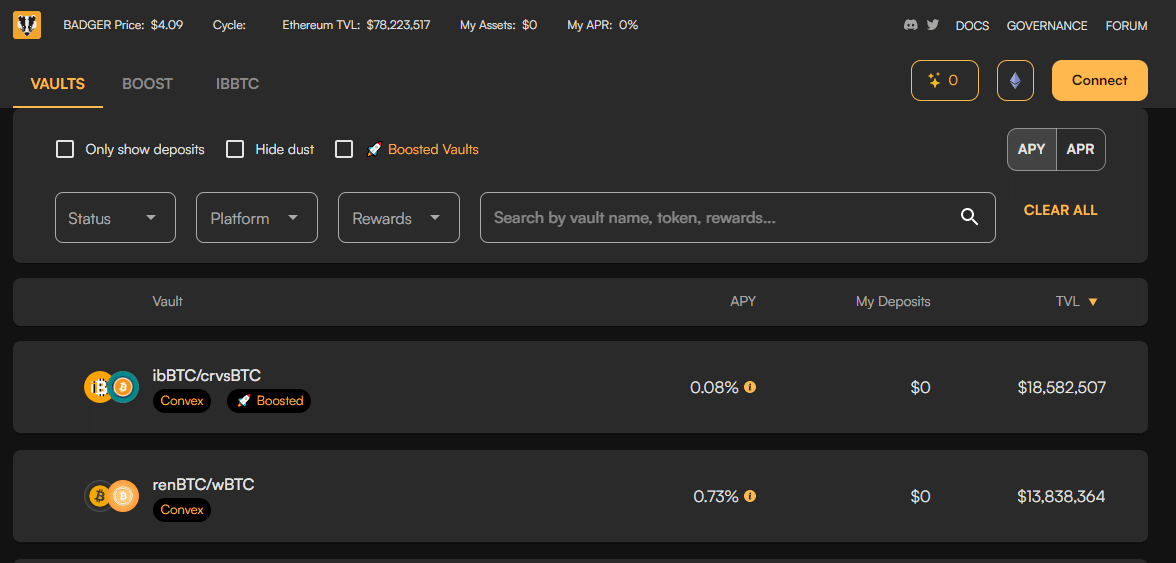

Badger DAO

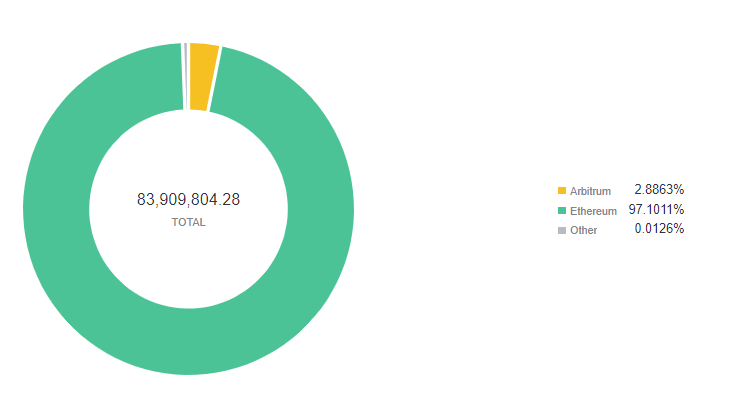

BadgerDAO is a decentralized autonomous organization (DAO) focused on enhancing Bitcoin utilization in Decentralized Finance (DeFi) across multiple blockchains. It was launched on December 3rd, 2020, and now operates on Ethereum, Polygon, Arbitrum, and Fantom. The chart below shows the TVL distribution between chains.

Most of the TVL is concentrated on Ethereum, but this is a reflection of the asset Badger DAO has focused on: Bitcoin wrapped into other blockchains. The majority of it is available on Ethereum Mainnet.

Badger DAO main features

Its main product is a vault (also called sett) that works the same way as in the other yield farming aggregators but is focused on tokenized BTC.

The investor makes a deposit into the vault. After that, the smart contract puts those assets to work by executing the selected strategy for the particular Sett the user deposited funds on. Badger doesn’t offer the “Zap” function to exchange the assets for the desired one.

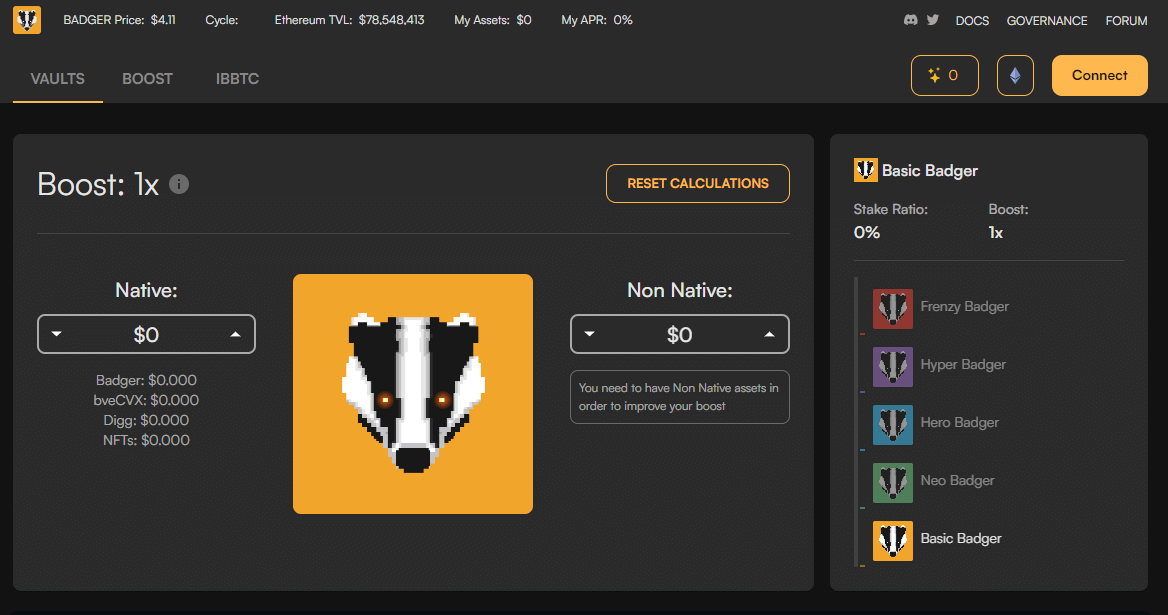

The investor can boost the deposit returns by holding the native assets from the protocol. The ratio between these native assets and the non-native will dictate the boost received.

Badger DAO Token: Badger

Badger is the native governance token of BadgerDAO, so its holder can vote on the proposals held by the DAO. It has a maximum fixed supply of 21 million, and can also be used as collateral on different platforms across DeFi.

Holding Badger in your wallet increases your APYs in other Sett Vaults as part of the Badger Boost system.

Badger DAO Pros and Cons

Pros

- The protocol provides high APY to BTC into DeFi

Cons

- The protocol doesn’t share revenue with token holder

- There is no Zap Function

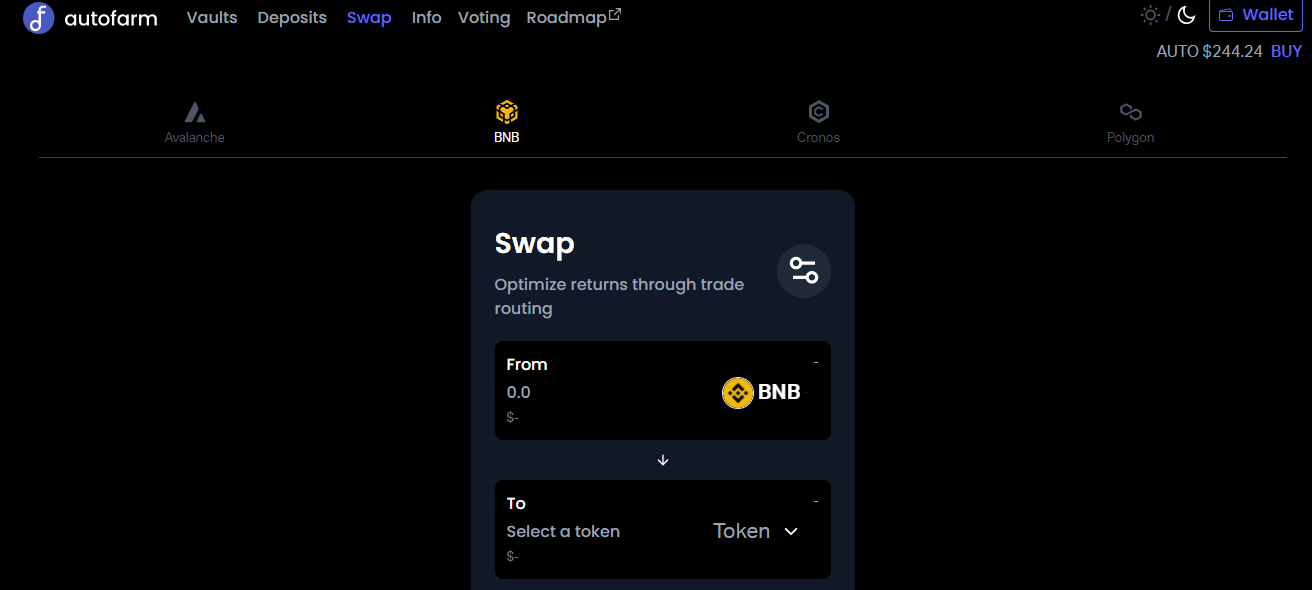

Autofarm

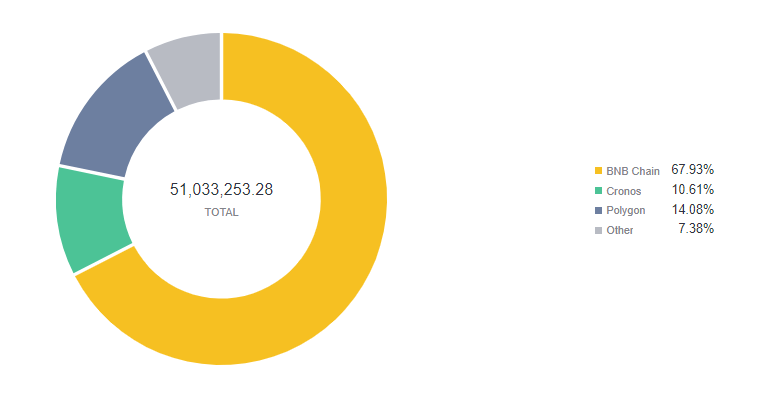

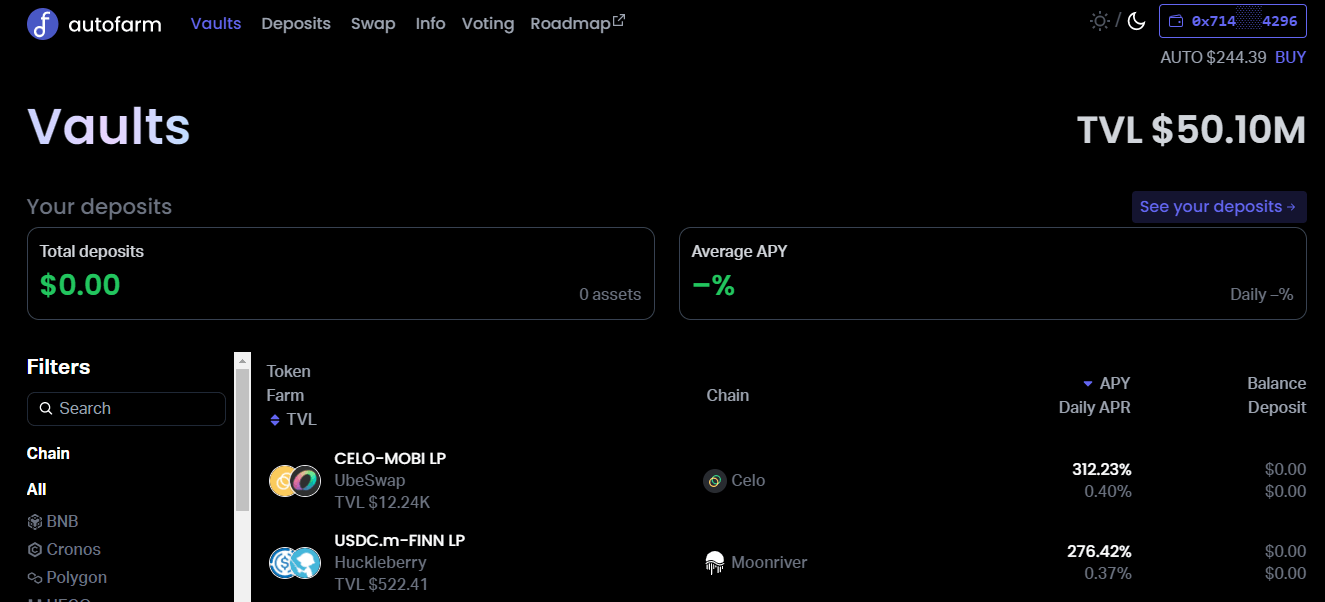

Autofarm is a protocol that offers a DeFi tool suite. It was launched in December 2020 on BNB Chain and has expanded to a total of 19 chains. The chart below shows the TVL distribution between all chains:

Autofarm TVL continues to concentrate on BNB Chain (USD 34 million), but Polygon (USD 7.18 million) and Cronos (USD 5.41 million) also have a significant TVL.

Autofarm Main Features

It presents two products: A Yield Aggregator and a Swap Aggregator. The swap aggregator compares the best routes to make the swap the user wants. It is available in BNB Chain, Avalanche, Cronos, and Polygon. So, while it doesn’t provide the native Zap function, in these chains the user can exchange the asset without having to leave the protocol interface.

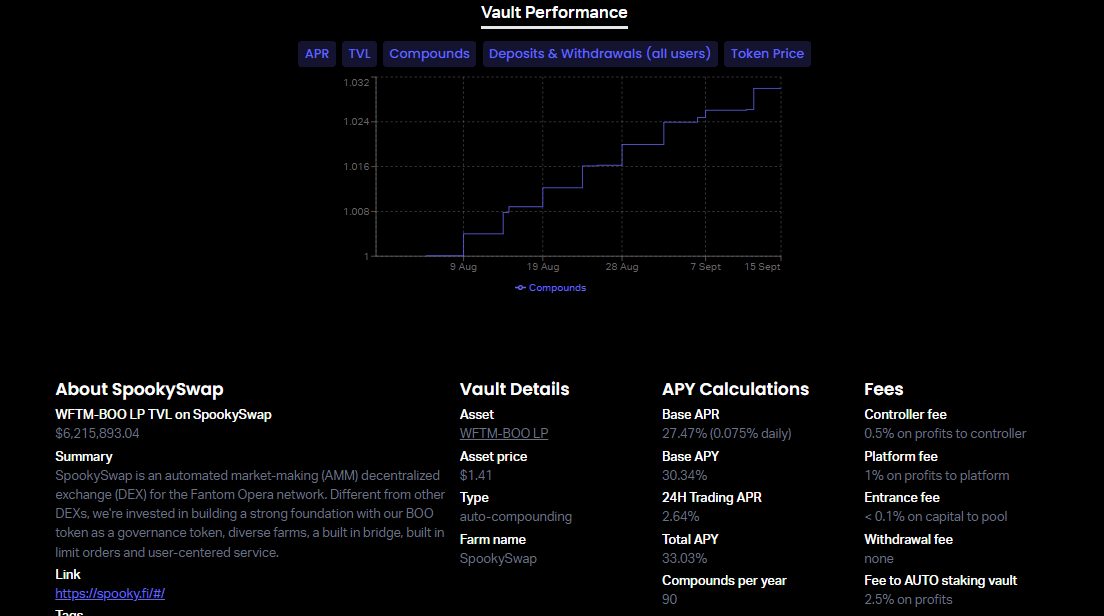

The main product is also the vaults. The investor can use the filters to select the chain, asset, and order by APY.

When clicking on a vault, its page opens with detailed information about the vault’s performance, the strategy it uses, and the assets on it.

Autofarm Token: Auto

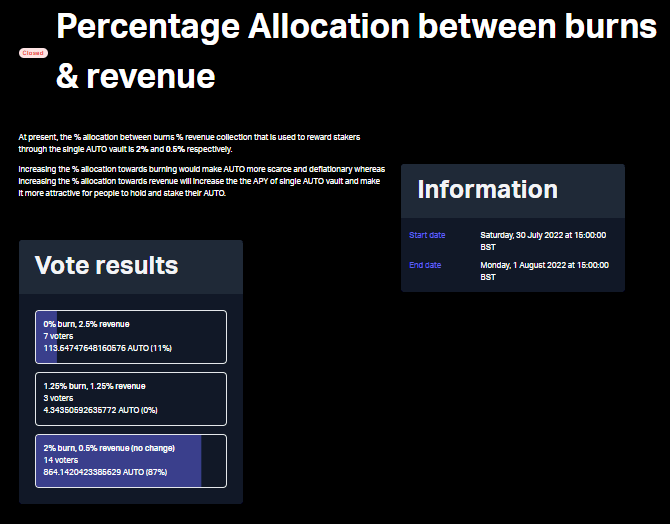

Auto is the native governance token of Autofarm. It is used to vote about the amount of Auto that will be burnt or distributed as revenue to Auto holders that stake it on the Auto Vault. This vote is held monthly.

Autofarm Pros and Cons

Pros

- The protocol shares revenue with token holders

Cons

- The interface is confusing

- There is no Zap Function

Idle Finance

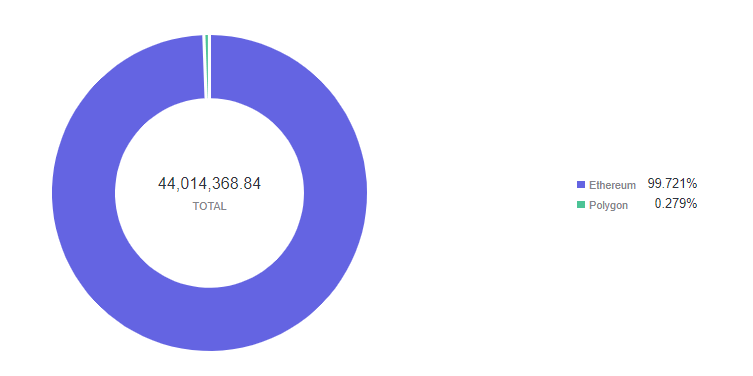

Idle Finance is a protocol with a set of products that allow users to optimize their digital asset allocation algorithmically across leading DeFi protocols. The current iteration went live on May 18th, 2020, and its TVL is shown in the chart below.

Despite launching at Polygon on November 10th, 2021, almost all liquidity remains on Ethereum Mainnet.

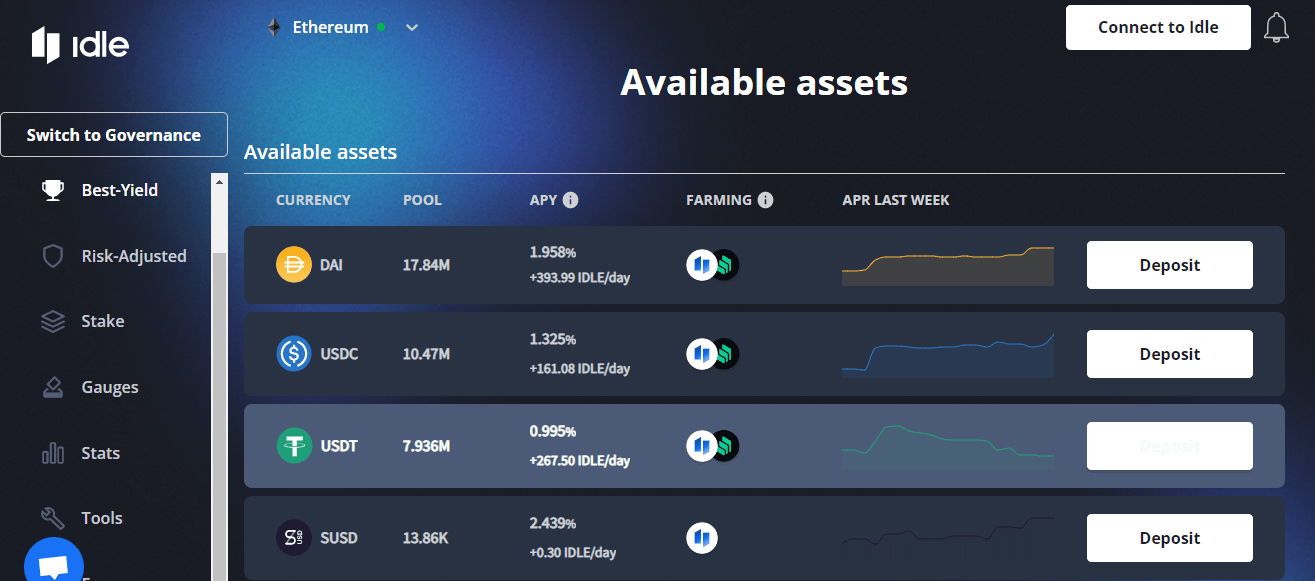

Idle Finance Main Features

It presents two products: Best Yield and Tranches. The Best Yield product aims to automatically get the best supply rates from different lending protocols, so the investor doesn’t need to do that manually.

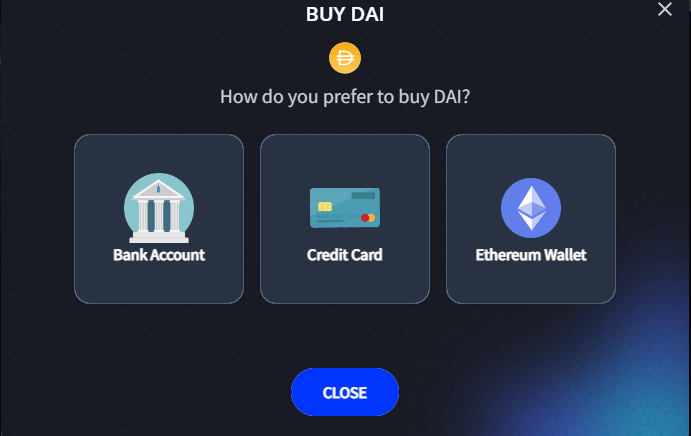

If the investor doesn’t have the asset in the wallet, it can be purchased with fiat or crypto.

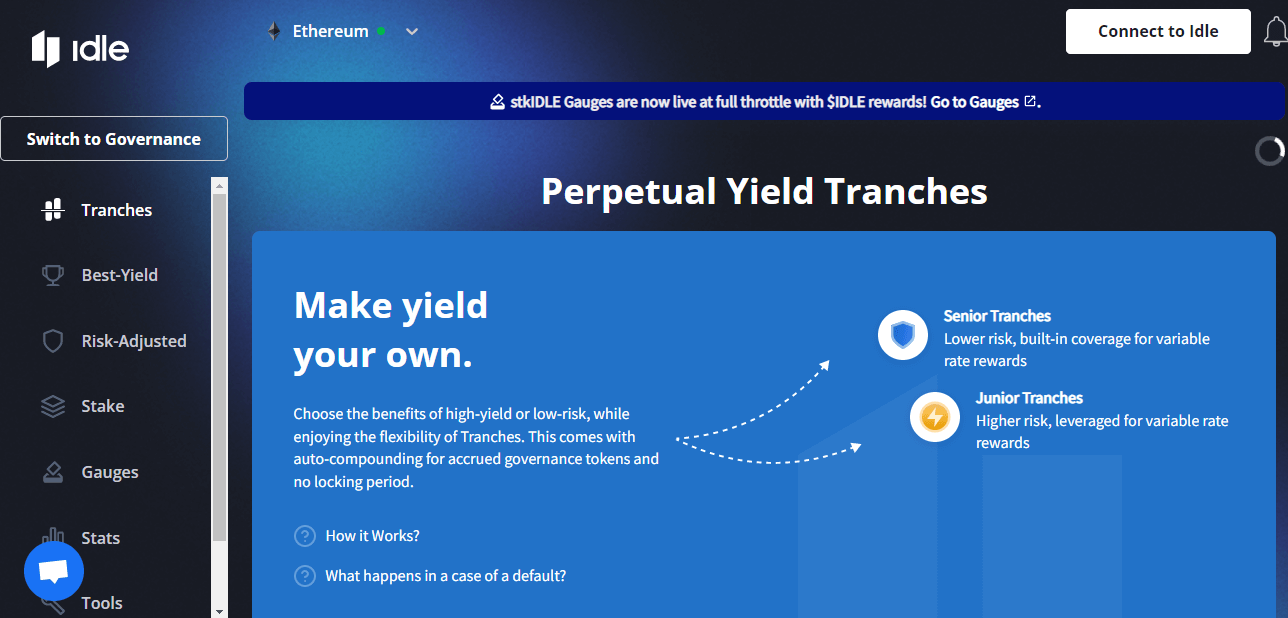

The Tranches product is divided into two: Junior and Senior Tranches. The main difference between them is the risk exposure. Junior tranches can achieve better results by taking extra risks.

When the investor clicks on any tranche, the vault page is loaded, where all the information about it is available.

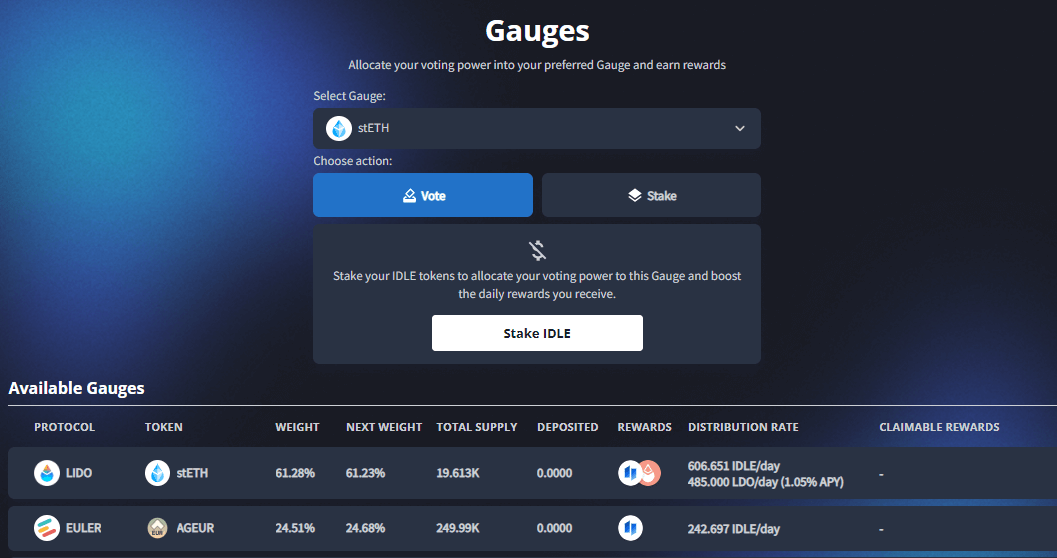

Idle Finance Token: Idle

Idle Finance Token is Idle. It is used for governance and can be staked to boost the returns of the deposit on a vault. The protocol also uses to incentivize investors to deposit assets on the protocol.

Idle Finance Pros and Cons

Pros

- Tranches with risks well-defined

Cons

- Only available on Ethereum Mainnet

- There is no Zap Function

Metrics

-

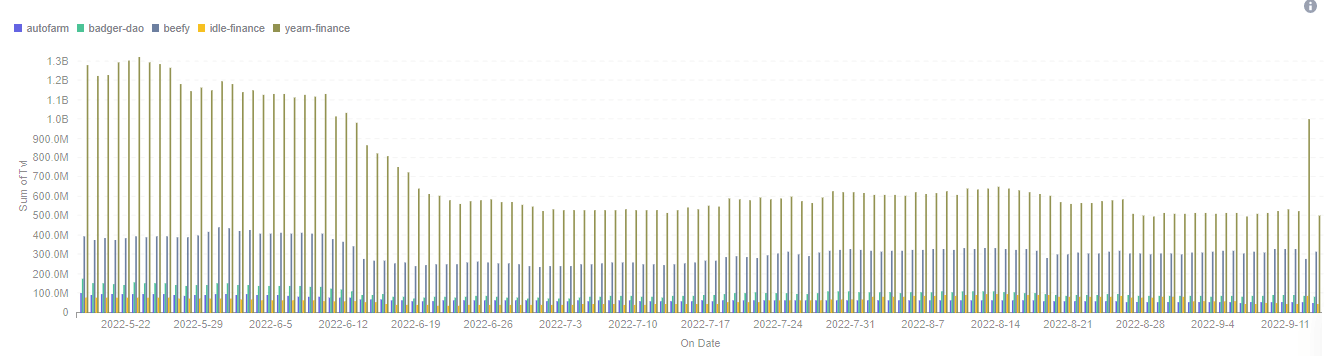

TVL Variation

Looking at the TVL variation in the last 120 days, Yearn Finance had a big drop in value (from USD 1.2 billion to USD 500 million), while Beefy Finance fell from USD 420 million to USD 300 million. Yearn Finance was heavily impacted by the aftermath of Luna + 3AC downfall.

-

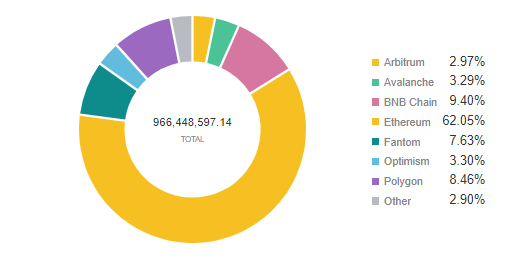

TVL By Chain

Ethereum remains the preferred investment destination, as it has more DeFi protocols deployed and is part of the yield aggregators’ strategy to farm new tokens offered by new protocols.

This also helps to explain why Arbitrum and Optimism are in the top 5, as it launched campaigns to retain users and protocols recently (Arbitrum Odyssey and Optimism token airdrop).

-

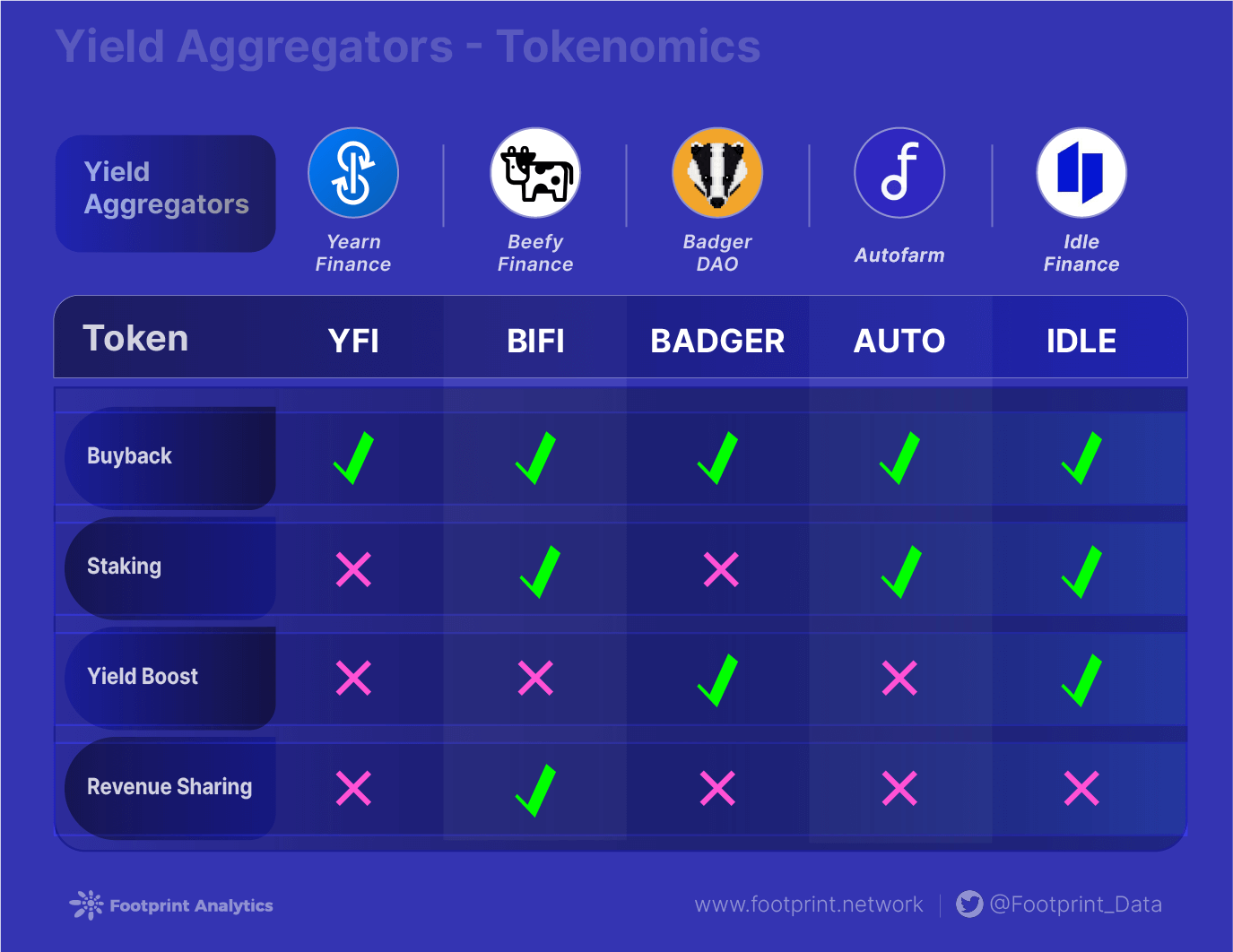

Tokenomics Comparison

Each yield aggregator has a different strategy for its native token. Badger and Idle use it as a boost to the vaults’ rewards. All protocols execute buybacks with profits to lower the circulating supply, but Beefy Finance is the only one to take part of the revenues and share with token holders (with their BIFI earnings pool).

Each yield aggregator has a different strategy for its native token. Badger and Idle use it as a boost to the vaults’ rewards. All protocols execute buybacks with profits to lower the circulating supply, but Beefy Finance is the only one to take part of the revenues and share with token holders (with their BIFI earnings pool).

Main takeaways for investors

A yield aggregator is a protocol that takes all the burden of managing the yield farming from the investor. Nowadays, it is possible to use one in almost all chains available.

For the investors, there are two clear opportunities:

- Use it to manage their investments. All it takes is to look for the protocol/chain offering the best returns for the asset of interest and make a deposit there. There are options for different risk profiles.

- To invest in their token. Almost all yield aggregator protocols have their own token. Besides the price variations that are linked with the market and with the performance of the protocol, the best tokens are the ones that make their owner eligible to receive part of the protocol’s revenue.

This piece is contributed by Footprint Analytics community.

Sept. 2022, Thiago Freitas

Data Source: Footprint Analytics-Yield Aggregators Comparison

The Footprint Community is a place where data and crypto enthusiasts worldwide help each other understand and gain insights about Web3, the metaverse, DeFi, GameFi, or any other area of the fledgling world of blockchain. Here you’ll find active, diverse voices supporting each other and driving the community forward.

The post What features differentiate the top yield aggregators? appeared first on CryptoSlate.