- November 21, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin is the first line of defense for people when they have restricted access to their money or inflation is eating away at their savings.

This is an opinion editorial by Dustin Lamblin, a portfolio manager and AI quantitative researcher.

When people work, they trade their personal time on Earth in exchange for money. As the old adage goes, “Time is money.” When people lose control over their money, they give up their most precious resource they have in their limited time on Earth: the control of their time and thus, their freedom. Unfortunately, this nightmare is a reality for billions of people around the world. People get robbed of different forms of their hard-earned savings everyday. It can happen during wars or under authoritarian regimes, but sometimes it can even be as subtle as the passing of time with the insidious form of wealth erosion that we commonly call inflation.

The invasion of Ukraine has reminded us how fragile life is and how everything can be taken from us in the blink of an eye. In life, nothing can be taken for granted: freedom, sovereignty, money. Between the war in Ukraine, rampant inflation all over the world, increasing measures from authoritarian regimes, it is worth shedding a light on the humanitarian benefits of Bitcoin and how Bitcoin is becoming a lifeline for many. In this world where so many things are outside of our control, we still have the freedom to choose how to respond to it. Bitcoin can offer economic freedom. For skeptics, I hope to challenge your current beliefs and show you another side of the story, far away from the Ponzi scheme and speculation that mainstream media loves to talk about.

Bitcoin Is Censorship Resistant

At first sight, If you are living in the Western world, it can be hard for you to imagine why bitcoin could be useful. You and I both probably live in a democracy. We have access to capital and banking services. As we lay down at night, we don’t need to wonder what’s happening to our euros and dollars sitting in our bank account, wondering if they are safe. It would never cross our minds that someone would confiscate our life savings, nor that our money could be worthless overnight. As a matter of fact, the vast majority of people do not actually understand how our economic system works or how money itself is constructed. Most of us just use it. We trust the system. This tells a lot about the blind confidence we tend to have in our institutions.

If you recognize yourself in what I just described, congratulations, you already won at the lottery of life. Understandably, when people tell you about bitcoin, you wonder how this new currency could be useful. Fortunately for you, you are not part of the vast majority of the world population, for which this kind of problem keeps them awake at night.

“A housewife who has had no experience of the horrors of currency depreciation has no idea what a blessing stable money is, and how glorious it is to be able to buy with the note in one’s purse the article one had intended to buy at the price one had intended to pay.” — Adam Ferguson, “When Money Dies,” Germany, 1920.

At the moment, 2.6 billion people live in nations without the freedoms which most of us take for granted. In these countries, your whole life savings could be taken from you at any time. Any assets you own could be frozen overnight, no question asked. You don’t need to be any kind of terrorist or evil person to be targeted. Simply speaking your mind and opinions can get you thrown in jail or worse. This could mean you are forced to leave your relatives behind with no income for support. One of the most important features of bitcoin solves this problem: censorship resistance. Bitcoin is a defense mechanism to preserve your wealth from external threats. As modern stoics would say, “You can’t control what happens to you, but you can shield yourself from financial threats with bitcoin.”

What makes bitcoin censorship resistant? It all comes down to decentralization. Centralized systems being the norm can be explained by the Byzantine Generals’ Problem, a game-theory problem that describes the difficulties of reaching consensus in a decentralized system without relying on a trusted central party. How can members of a decentralized system collectively agree on a truth, without knowing and trusting each individual member? Central figures, e.g., governments, banks, etc., are commonly established to settle what is true or to give commands. The trade-off for this efficiency is quite typically corruption and abuse of power.

However, when it comes to Bitcoin, nobody is in control of the protocol. There is no button that someone can push or someone who can be pressured in order to change the code to seize your money. Nobody controls the system. You have the custody of your own money. You do not need a bank anymore because you are your own bank. You can store your entire wealth on a device that is the size of a USB key (a “signing device,” more commonly called a hardware wallet). No supranational entity can decide what you do with your bitcoin; it is yours and it is unseizable without the password, which is represented by 12 or 24 words. Living in the Western world, this may sound silly to you, but in many countries in the world, holding bitcoin is the only way to protect the savings of your family. Worldwide, 31% of adults are unbanked, but 83% of the world population owns a smartphone. You do not need a bank to own bitcoin, a smartphone is sufficient.

And if you think seizure of funds by banks or governments only happens under authoritarian regimes, I advise you to look at what happened in Cyprus in 2013. While the country was on the brink of bankruptcy, they decided to tax 6.75% on all savers of the country and up to 10% for those with more than 100,000 euros in their bank account. Just like that, in one night, 10% of your money was gone.

In fact, when economic or political situations start to quickly deteriorate, governments have often restricted access to foreign capital and hard currency. In Lebanon in 2021, people were limited to withdraw a certain amount in local currency in order to avoid a bank run. Then in early 2022 the government announced that while there was over $104 billion of hard currency in the Lebanese banking system, they only planned to allow savers to redeem $25 billion of their own money. That is a heartbreaking 75% haircut on the hard-earned savings of citizens.

Another example of financial censorship happened recently during the Freedom Convoy protest in Canada. People supported this protest by sending bitcoin to truck drivers. When the government figured out what was happening, they forced exchanges with know-your-customer laws (KYC) to reveal identities behind addresses and used an emergency law to freeze personal banking accounts and credit cards. These people were banned from the financial system for showing financial support to a peaceful protest. Regardless of your political view on the subject, what happened there is just morally wrong. And it happened in Canada, one of the leading democratic countries in the world. This is frightening. People do not value privacy until someone comes knocking on their door.

Bitcoin Protects Your Wealth During Wartime

Bitcoin can play a major role for savings preservation when war breaks out. When violent conflict emerges, money is probably the last concern as people scramble to save their lives. Being forced to leave your life behind and perhaps becoming an immigrant in another country is already a tough spot to be in, but it can reach a new layer of hell if you do not have access to any money.

If or when it happens, it happens fast, and usually access to banking is shut down or limited. Most people’s traditional assets are illiquid: If you have a business, a house or a car, there is usually no way to quickly convert these to fiat on such short notice. With bitcoin, you can leave with your entire wealth stored on a device the size of a USB drive. You can cross oceans, lands and borders with your life savings in your pocket. Try to do the same with gold or any other type of asset. Bitcoin enhances all the properties that make for a good store of value: It is recognized by hundreds of millions of people around the world, it is portable and can be exchanged for local currency at typically low fees.

Most people emigrate with cash and face incredible dangers during their journey with the risk of losing their money, getting mugged or assaulted. If a hardware wallet is too intimidating, people can store their bitcoin on a smartphone application, leave the country and have access to their liquidity the whole time.

As a real-life example, Francesco Madonna explains how his webmaster escaped Ukraine right before they enforced martial law. At that moment, the webmaster couldn’t get any access to his money because ATM withdrawals were restricted and his bank blocked all international transfers. How are you supposed to feed your family and find shelter in another country if you do not have access to money? Because this man had a bitcoin wallet, he was able to find a bitcoin ATM abroad and withdraw cash to pay for his survival.

Bitcoin Solves Issues With Remittances

Once people immigrate, regardless of the reason, they can provide for any family or friends back home with bitcoin and the Lightning Network, where people can send and receive payments across the world at almost no cost. Remittances like these are a lifeline for many, providing them money that will be used for their basic human needs — such as food, housing and education — as well as money that can be used to lift people out of poverty and stimulate local economic activity. Remittance fees, however, decrease the disposable income of migrants and also reduce their incentive to send more money abroad to help their loved ones. In sub-Saharan African countries, remittance fees are particularly expensive at 8%, but in other parts of the world it can be in the double digits. Without mentioning the hours of walking or potential to get robbed when going to the closest Western Union, it is easy to underestimate the impact that bitcoin and the Lightning Network can have to develop economic activity in these regions. Bitcoin is cheaper, faster and safer. People can receive bitcoin directly into their wallet instantly while safe at home. They are able to shield themselves from external threats.

We can envision a world through the Lightning Network of microcredit activity between people lending and borrowing money without financial intermediaries: a world where merchants could set up shop anywhere and get the full benefit of their sales without being ripped off by credit card processing fees; a network that promotes inclusion regardless of social background and therefore provides equal economic opportunity.

Bitcoin Is A Hedge Against Inflation

“Sound money is the first bastion of a society’s defense.” — Adam Ferguson, “When Money Dies”

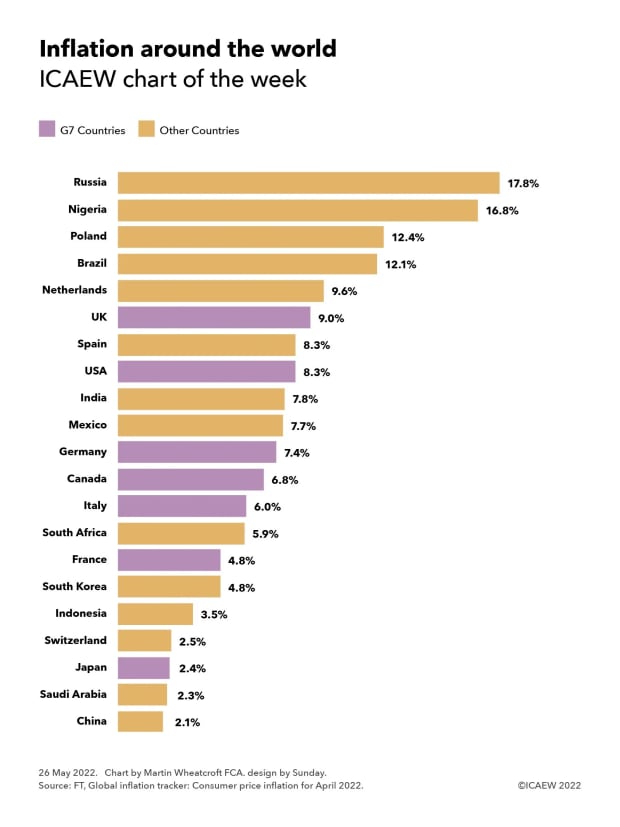

Protecting your wealth does not only mean making sure your assets are safe. Savings are the only hedge you have for whatever surprise life is going to throw at you. Around the world, people have seen their savings deteriorating and being eroded by inflation and currency depreciation. According to recent data, more than 2 billion people live under double-digit inflation. Even if you do not have to worry about your money being seized, it could be on a fast-eroding path due to several factors: monetary policy by the central bank, mismanagement of resources by the government, world supply chain issues and many more.

“The wife of a doctor whom I know recently exchanged her beautiful piano for a sack of wheat flour. I, too, have exchanged my husband’s gold watch for four sacks of potatoes, which will at all events carry us through the winter.” — Adam Ferguson, “When Money Dies,” Austria, December 1918

Inflation is insidious; it starts by slowly eroding people’s purchasing power, but can very quickly become exponential and spiral out of control. Once it goes down this path, it is very hard to combat and it can bring out the worst in people. When basic needs are not met anymore, people may act against each other to do whatever it takes to protect their future. Society and norms become secondary. Hyperinflation fosters polarized ideas, populist claims, extreme regimes and people looking for a scapegoat to blame their situation on.

“The pie was growing smaller and more and more people wanted to have pieces of the pie and so, there was nothing left from the ‘good neighbor’ atmosphere of former days. Everybody saw an enemy in everybody else.” — Frau von Pustau, Germany, 1922

The saddest thing about inflation is that it affects a population in drastically different ways. If you are wealthy and from the Western world, you likely have access to capital, therefore you have many different ways to protect yourself from inflation through that capital: real estate, commodities, gold, bitcoin. On the other hand, middle class and lower class income-earners are the ones that suffer the most. They have less tools available to shield themselves from inflation. For those living in developing countries, your chances of suffering drastic inflation are high and your tools to fight it are limited.

“When people do not understand what is happening, or why it is happening, and have no idea about what to do about it, and are not told, panic must follow.” — Adam Ferguson

“Nothing is durable, whether for an individual or for a society.” — Seneca

Governments, at least those in the developed world, are often seen today as infallible entities, where we should put all our trust. This is why people see government bonds as risk-free assets, thinking that it is the safest place to invest. That may very well be true, but only for a certain period of time. History has shown us that in the end, empires always fall. The Ottomans, Romans, even the British Empire — no matter how big and powerful — have all ended up failing. What makes you think that it will be any different for the modern U.S. empire? How far do you think we are from the tipping point? Do you think the probability of the U.S. failing in the coming decades is null? Then why do you own 100% of your wealth in USD?

Ultimately, we don’t know what the future will be. That is why we need to be prepared for a black swan scenario. In finance we have terms for it: We call it insurance, or a hedge. Bitcoin is the insurance policy on the current economic system. A small allocation could provide the asymmetric payoff that will provide economic freedom for your future generations.

“Yes, but mine are government securities: Surely they can’t be anything safer than that?”

“My dear lady, where is the State which guaranteed these securities to you? It is dead.” — Anna Eisenmenger diary, December 15, 1918 in Austria, the day she lost 75% of her wealth.

Indeed, bitcoin is volatile and still speculative. At this point people shouldn’t put more money than they can afford or are willing to lose. As the adoption rate keeps growing and more people start to recognize bitcoin as both a store of value and a means of exchange, I believe the volatility will progressively stabilize over time. I think that people investing now will get rewarded for riding the steepest part of the adoption curve. Over the past few years, we have seen a persistent adoption of the technology: El Salvador made bitcoin legal tender in 2021; many S&P 500 companies now hold bitcoin on their balance sheets, e.g., Tesla and MicroStrategy; an increasing number of companies have started to accept bitcoin as payment method, e.g., Microsoft and PayPal; even pension funds start to offer bitcoin in their 401(k) plans, e.g., Fidelity.

I feel lucky to be part of a generation that now has an alternative to the current economic system. You don’t have to use bitcoin, but at least it is an available option. Regardless of where you come from, you will have access to a fundamental right: a cross-border, censorship-free form of money. Bitcoin is freedom money and nobody will be able to take that option from you anymore.

“Concentration camps offer sufficient proof that everything can be taken from a man, but one thing: the last of the human freedoms — to choose one’s attitude in any given set of circumstances, to choose one’s own way.” — Viktor Frankl

Bitcoin Is Different

The most beautiful thing about Bitcoin is that nobody owns the protocol. Like I mentioned, there isn’t a single person who can make overarching decisions for the system. We don’t have to worry about who is going to be the next person in charge and what politics they will run on next. In modern society, centralization is the norm: governments are centralized, money is centralized, the education system is centralized. This is how we grew up, we didn’t have any alternatives and therefore we never had to question it. Now, we have an alternative. The 18th century was driven by the Enlightenment movement that pushed the separation of the church from the state. I believe the 21st century will be the century of the separation of the money from the state.

The open-source protocol of Bitcoin is entirely decentralized and left to the users. There is no central entity, such as the government, involved in the policy. The monetary policy is very clear, transparent and hard-coded. There will be 21 million bitcoin issued, no more. A disciplined monetary policy completely independent of political lobbying is an important feature for a sound monetary system because decentralized systems are resistant to corruption. This is contrary to the current monetary policy which is dictated by a few central bank officials who make politically influenced decisions behind closed doors. Central bankers do not bear the consequences of their actions but still affect the lives of hundreds of millions of people around the world. Unfortunately, humans are corruptible and greedy, and power makes this worse. This is why Satoshi Nakamoto came up with this decentralized system. With Bitcoin, we don’t have to trust each other in order to cooperate. As explained, Bitcoin is the answer to the Byzantine General’s Problem.

Some Closing Thoughts

Bitcoin has been painted by Western media as an evil bubble of speculation. From our very privileged perspective, it is hard to grasp that most of the world still does not have access to basic human rights, and even less access to economic freedom. It is easy to dismiss when we have access to stable currency, equal economic opportunity, banking and capital in a free country. We should have the decency to admit that the system is broken for most people and respect their decision to choose another path deemed more sustainable. People have the right to decide what is best for them.

Bitcoin is the fastest adopted technology in human history for a reason. It offers economic freedom for billions of unbanked people around the world. It is also the most democratic weapon ever invented. Bitcoin builds bridges between cultures and religions all over the world. When using bitcoin, it does not matter which faith you believe in or where you came from. Bitcoin has no religion, no political agenda, no flag and no border to protect. Bitcoin does not discriminate between participants. Rich or poor, people have the same value in the Bitcoin network. Regardless of how much money you have, you cannot corrupt the Bitcoin network.

Bitcoin is an idea, a new philosophy and there is nothing more powerful than ideas. Nobody can kill an idea. They spread like fire and once they are out there, there is no way to put the genie back in the bottle.

People will argue that bitcoin is not backed by anything. Yes, bitcoin is not backed by any tangible assets, but guess what? This is literally how our entire system is built. A bank can loan 10 times more than they have on their balance sheet. Central banks can print trillions of dollars out of thin air. Everything is in our head; it’s called the “cognitive revolution.” This ability to envision things that didn’t physically exist is what made us — homo sapiens — the most deadly species on Earth. Trust is the sole thing backing most things in life, and in terms of money, Bitcoin is the ultimate form of trust.

This is a guest post by Dustin Lamblin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.