- December 30, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The open futures interest and the futures estimated leverage ratio metrics had reached their highest levels for over a month, which indicates an upcoming Bitcoin (BTC) volatility, according to Glassnode data analyzed by CryptoSlate.

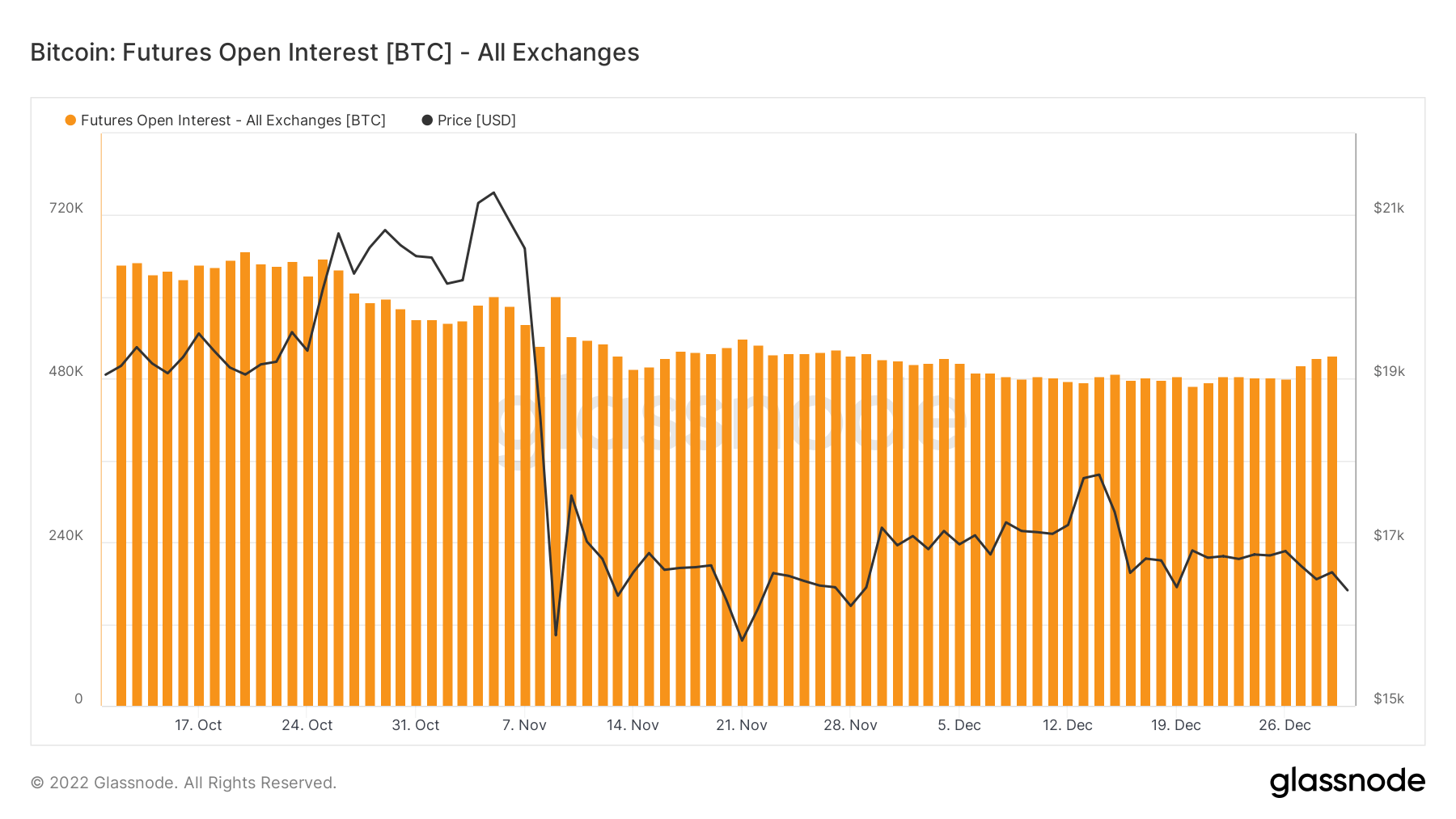

Futures open interest

The futures open interest metric reflects the USD value of the total amount of funds allocated in open futures contracts.

The chart above shows the BTC futures open interest on a daily basis since Oct. 17. As of Dec. 30, the metric exceeded over 500,000 BTC, marking its highest level for over a month.

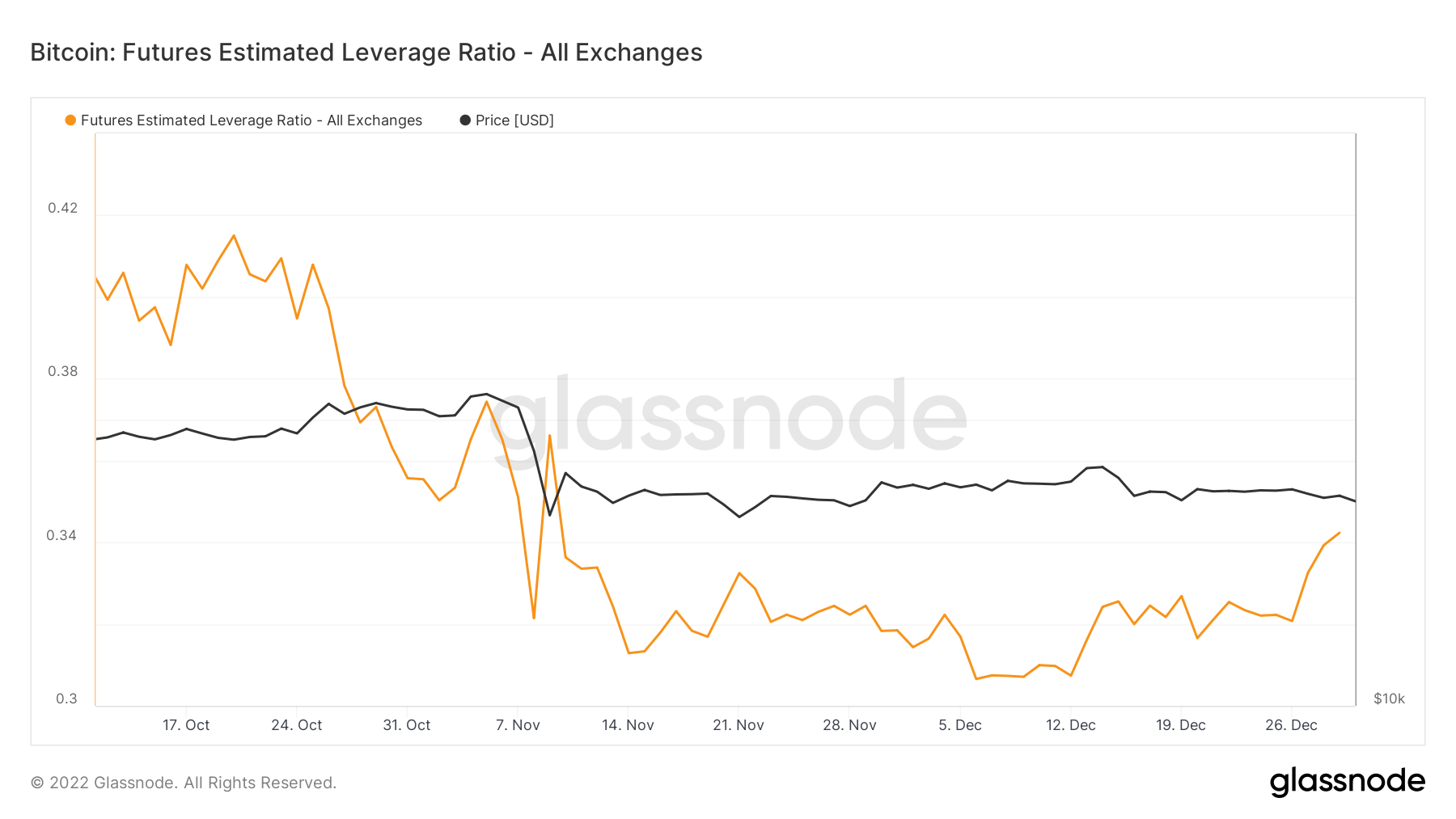

Futures estimated leverage ratio.

The Futures Estimated Leverage Ratio is a metric that represents the ratio between the open interest in futures contracts and the balance of the corresponding exchange.

The estimated leverage ratio fell as low as 0.3 on Dec. 5 after the FTX collapse. However, it quickly started to recover after Dec. 12. The ratio nearly increased by around 10% in 20 days to see 0.34 on Dec. 30.

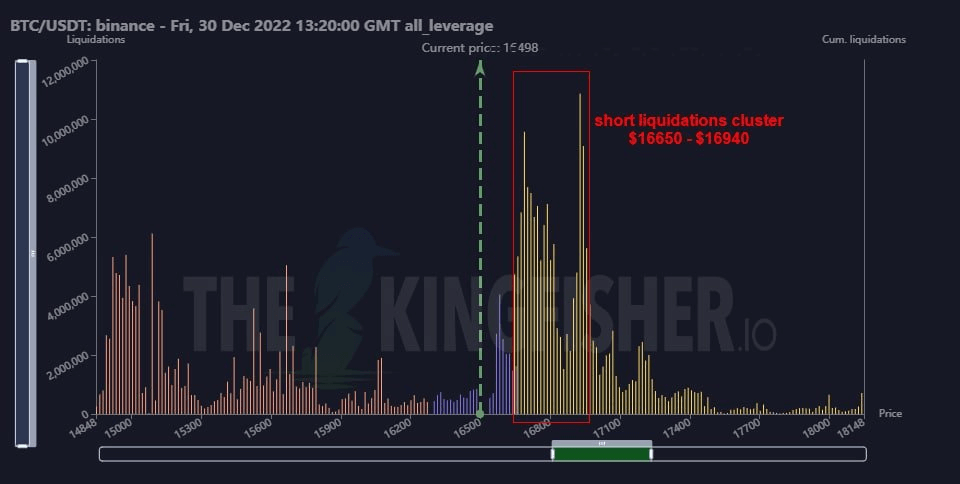

Binance liquidations

In addition to metrics signaling potential volatility, data from Binance indicates that Binance will contribute to the price swings.

A short liquidations cluster has formed in Binance between the prices of $16,650 and $16,940. The current BTC price lingers around $16,547 at the time of writing, only $100 away from entering the cluster zone.

The post On-chain metrics signal upcoming BTC volatility appeared first on CryptoSlate.