- January 6, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

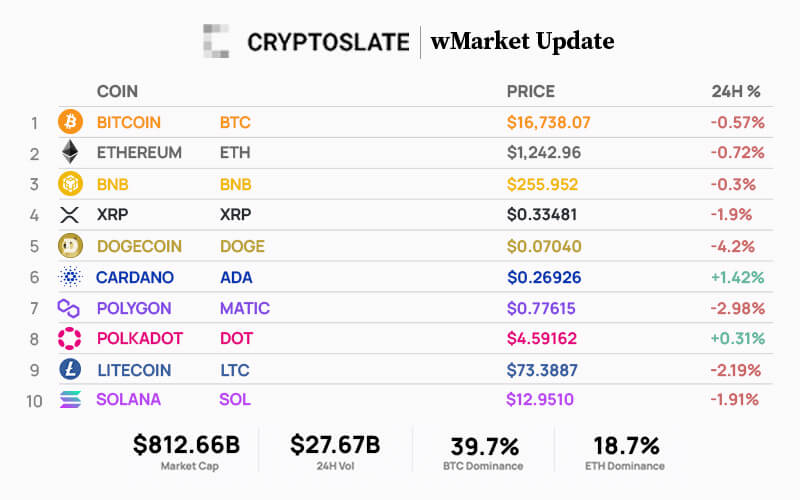

The cryptocurrency market cap saw net outflows of $6.93 billion over the past 24 hours and currently stands at $812.66 billion — down 0.86% from $819.59 billion.

Bitcoin’s market cap decreased 0.59% to $322.33 billion from $323.94 billion, while Ethereum’s market cap fell 0.86% to $152.17 billion from $153.30 billion.

In the last 24 hours, most of the top 10 cryptocurrencies printed losses — excluding Cardano and Polkadot, which recorded slight gains of 1.42% and 0.31%, respectively. Dogecoin and Polygon posted the highest loss, shedding 4.2% and 2.98%, respectively.

Meanwhile, despite the tepid market performance, Solana has re-entered the top 10 digital assets despite falling 1.91% in the last 24 hours.

Over the reporting period, the market cap of Tether (USDT) and BinanceUSD (BUSD)slightly increased to $66.25 billion and $16.68 billion, respectively. USD Coin (USDC) market cap decreased to $43.8 billion

Bitcoin

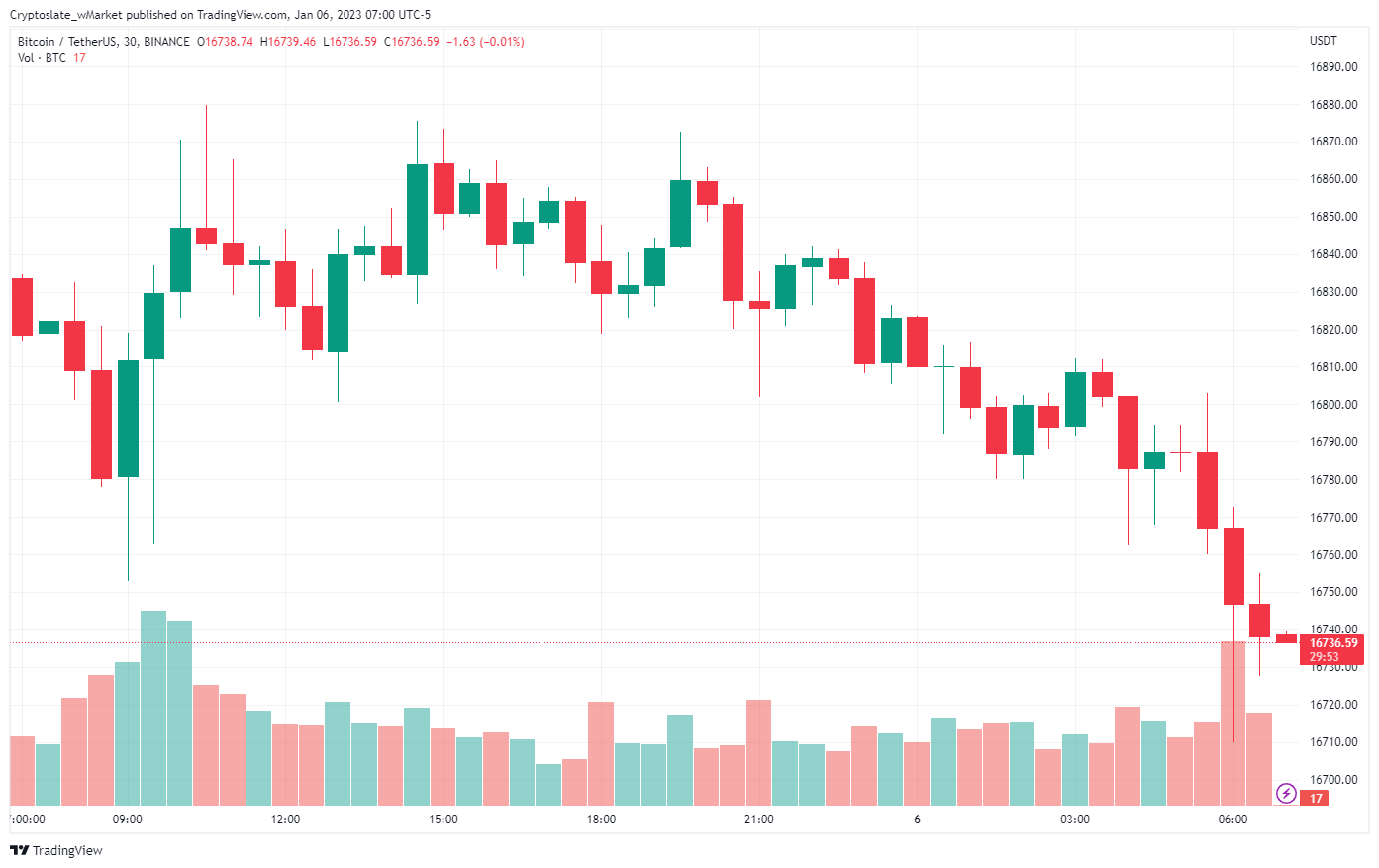

Over the last 24 hours, Bitcoin fell 0.57% to trade at $16,738 as of 07:00 ET. Its market dominance slightly increased to 39.7% from 39.6%.

BTC mostly traded sideways during the last 24 hours but began to experience a slight sell-off during the early trading hours of Jan. 6. The asset peaked at $16,878 over the reporting period.

Ethereum

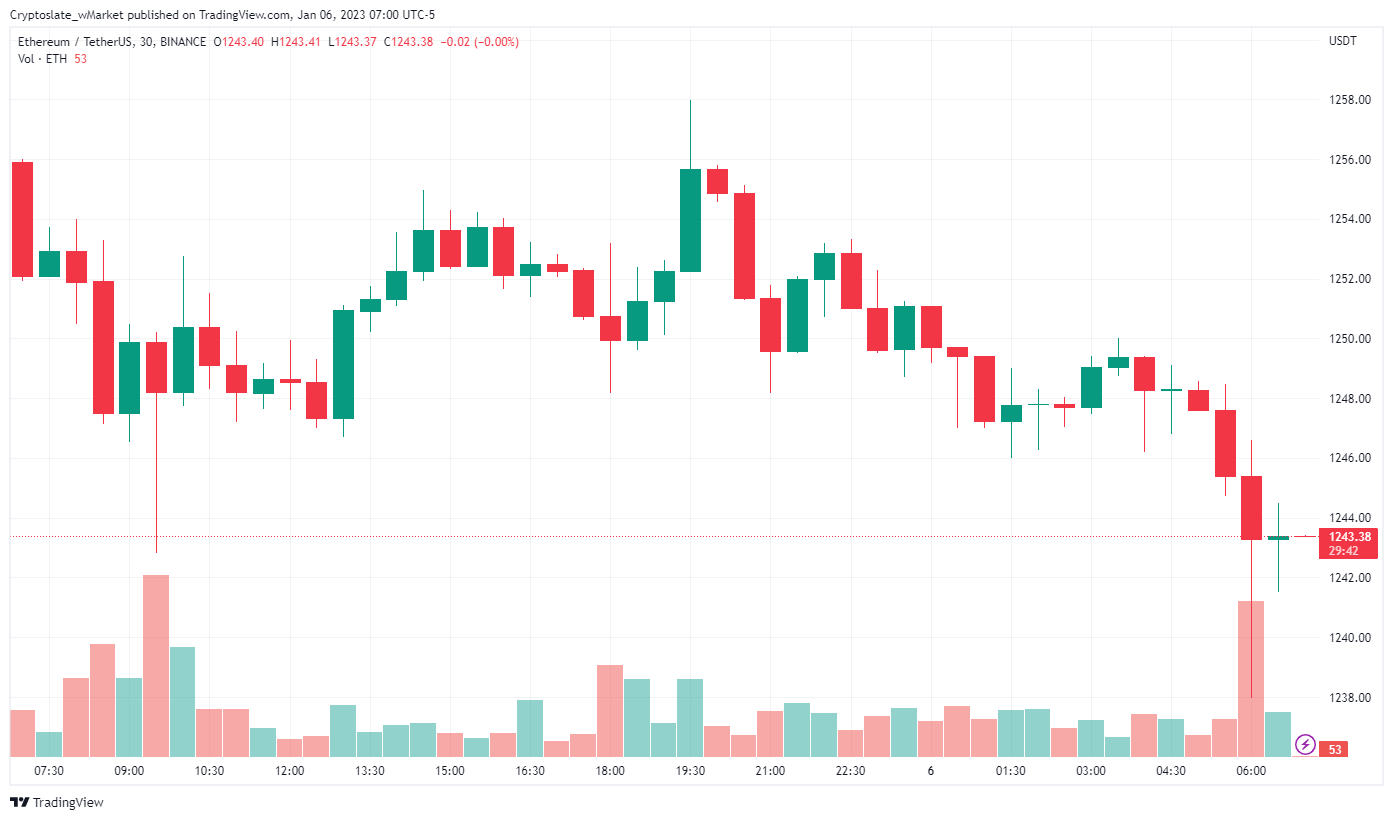

Ethereum fell 0.72% over the last 24 hours to trade at $1,242 as of 07:00 ET. Its market dominance remained flat at 18.7%.

Like BTC, ETH mostly traded sideways in the last 24 hours but experienced a slight sell-off during the early trading hours of Jan. 6. It peaked at $1255 over the reporting period.

Top 5 Gainers

Hex

HEX is today’s top gainer, rising by 17.46% over the last 24 hours to $0.02216 as of press time. The Ethereum-based token had grown by 21% in the last seven days. Its market cap stood at $3.84 billion.

Locus Chain

LOCUS is on the top gainer’s list for the second consecutive day. The token rose by 14.46% to trade at $0.038 as of press time. Its market cap stood at $80.29 million.

Nervos Network

CKB gained 11.72% over the reporting period to trade at $0.00254 as of press time. The PoW token has increased by over 5% in the last 30 days. Its market cap stood at $84.7 million.

Fetch

FET grew 10.22% in the last 24 hours to $0.11862. The AI-related token has been on a green streak over the past month, rising by over 50%. Its market cap stood at $97.4 million.

ABBC Coin

ABBC rose 4.7% to $0.09102 as of press time. Since the launch of its trade portal in December, the platform has drawn increased interest from investors. Its value has declined by over 41% in the last 30 days. Its market cap stood at $95.7 million.

Top 5 Losers

Tron

TRX is the day’s biggest loser, falling by over 8% to $0.05028 as of press time. The Justin Sun-related token has faced increased FUD over its relationship with the crypto entrepreneur and centralized exchange Huobi. Its market cap stood at $4.62 billion.

Link

LN shed 7.95% gains over the reporting period to trade at $28.24 as of press time. The token’s value had risen by over 33% in the last seven days. Its market cap stood at $190.2 million.

LUKSO

LYXe declined 7.82% to $8.48 in the last 24 hours. The NFT-related token had been on an upward trajectory over the last 30 days, rising by around 60%. Its market cap stood at $130.64 million.

BinaryX

BNX plunged 7.73% over the reporting period to $63.9958. The governance token of the Cyber Dragon play-to-earn game fell by 10% in the past week. Its market cap stood at $182.44 million.

Nano

XNO decreased 7.26% to $0.68 as of press time. The token has lost all of the gains it made on Jan. 5, when it rose by over 12%. Its market cap stood at $90.94 million

The post CryptoSlate Daily wMarket Update: Solana re-enters top 10 despite slight market sell-off appeared first on CryptoSlate.