- February 10, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Blood is spilt as the king of crypto, Bitcoin, staggered and started a cascade of pain for the crypto market. At the time of writing, Bitcoin has gone down 4% in the daily time frame with the biggest loss occurring in the weekly with nearly 8%.

The coin’s rejection at $24k earlier this month can be the culprit to this bearish attitude by investors. However, there might still be hope for the alpha coin.

Analysts are very bullish in the long term prospect of Bitcoin, with some touting that BTC will make the $21.5k support as its springboard.

Economic Woes Strengthen Resistance

The broader financial market is gripped by fear of a global recession with company CEOs facing pay cuts. In the UK, recent news shows that the country narrowly missed a recession last year.

However, with the UK being a major participant in the European financial market, it still set off a cascade of pain in the European stock market.

In the US, inflation cooled down but this hasn’t affected the public’s sentiment in terms of the looming recession, with the majority still completely pessimistic about the economy.

Even with a somewhat healthy job market and a declining inflation rate, the dollar still slipped as the US Federal Reserve’s recent interest rate hikes worried investors.

With Bitcoin having some correlation with the broader financial market, the coin can be strongly affected by macroeconomics in the long-term.

At $21.7k, Will This Correction Lead To More Pain?

As of writing, February 10th, Bitcoin is continuing its way toward $21.5k support which may or may not hold. In case the support holds, a long position targeting $24k resistance and above is viable.

However, this may only happen if the bears meet a strong resistance at $21.5k which, at the current momentum, might be a major obstacle.

If the bears break through $21.5k support, BTC might see December 2022 price levels which would be a big loss on investors. Worsening macros and pessimistic public sentiment will strengthen the bearish decline.

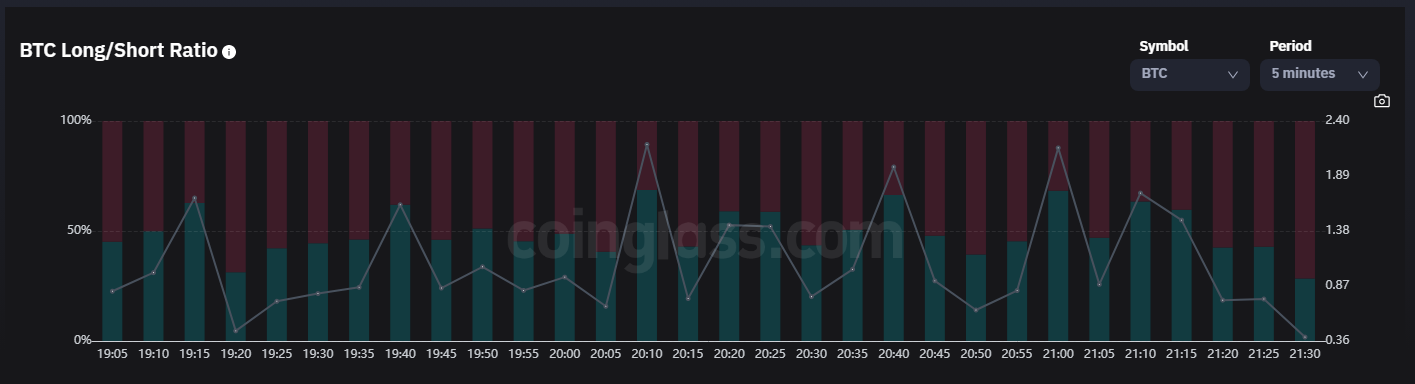

For now, short sellers would have a field day in the markets. According to CoinGlass data, short sellers are currently outnumbering long buyers by a small margin. This will manifest as a strong sell pressure, further driving the price of the coin downwards.

With this in mind, investors and traders should watch BTC’s price movement in the medium to long term before making a significant decision.

Featured image from Axcet HR Solutions