- February 22, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Fed minutes in-brief:

- 2% targeted inflation

- Low unemployment, 3.5%

- Fed funds target rate, 4.5% to 4.75%.

- Debate among meeting participants whether to raise interest rates by 50 basis points

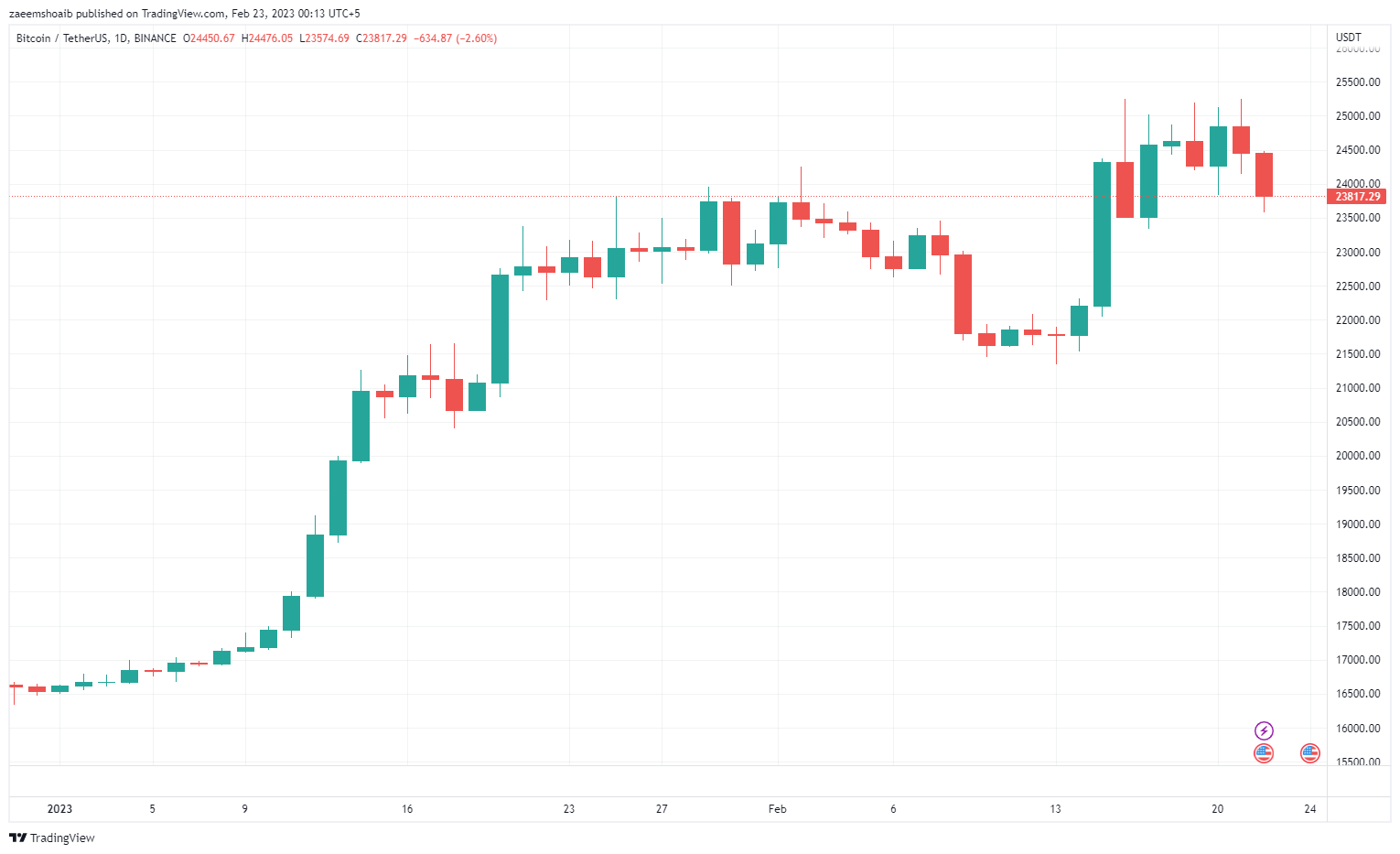

- BTC remains stable at around $23.8k

Committee outlook

The Fed released its latest round of minutes today, announcing that job market conditions in the US remain restricted in December, as reflected by the unemployment rate reaching a historic low, tumbling back down to 3.5% in December.

As expected, the Fed also said the percentage change in the price index for personal consumption expenditures (PCE) over the course of 12 months indicated a decline in consumer price inflation during November and December. However, despite the downward trend, the inflation level remained high, at 5% in December, the minutes showed.

During a meeting, some participants expressed their support for raising the target range for the federal funds rate by 50 basis points, as they believed it would achieve a sufficiently restrictive monetary policy stance, per the minutes.

However, most participants agreed that while the committee had made progress in tightening the monetary policy, inflation remained above the committee’s 2% target, and the labor market was still tight, contributing to upward pressures on wages and prices.

The participants believed that monetary policy should remain restrictive until incoming data provided confidence that inflation was on a sustained downward path to 2%. They also stated that future increases in the target range should take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

Price of Bitcoin

At press time, the price of Bitcoin is $23,825.59 USD with a 24-hour trading volume of $30,541,075,235 USD, down 3.35% since yesterday.

The post Fed minutes do little to shake crypto markets with BTC down 3.5% appeared first on CryptoSlate.