- April 21, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

- Due to the economy being built on credit, both growth, and expansion are necessities. As such, central banks’ biggest fear is deflation and stagflation. Take the U.K. as an example — though this can be attributed to many Western countries.

Three metrics that contribute to stagflation;

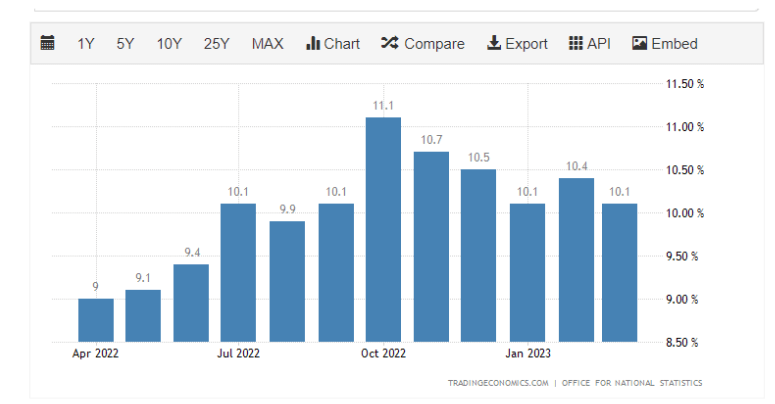

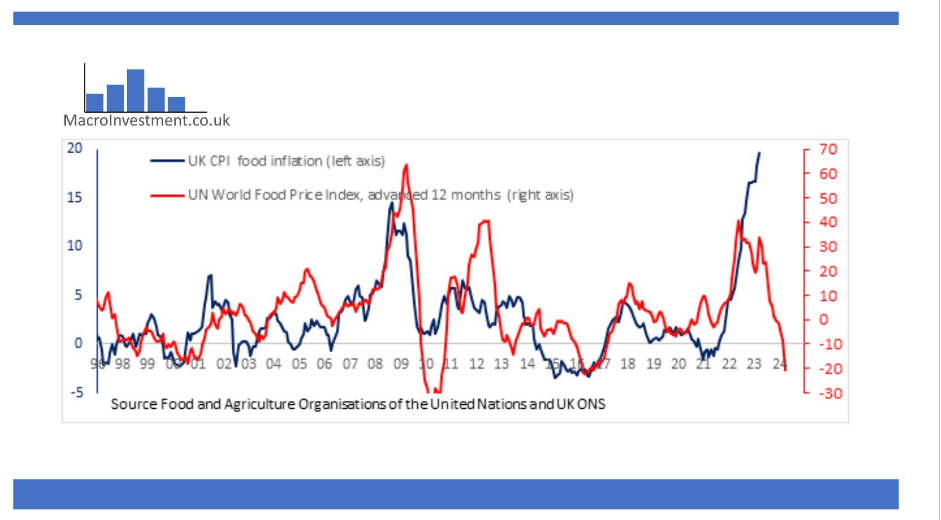

- Persistent high inflation: Inflation has been higher than the CPI goal of 2% for over a year now, and the biggest worry for central banks is entrenched inflation. For example, in the U.K., CPI Inflation has been double digits for almost a year — while core inflation has been as high as 6% for over a year.

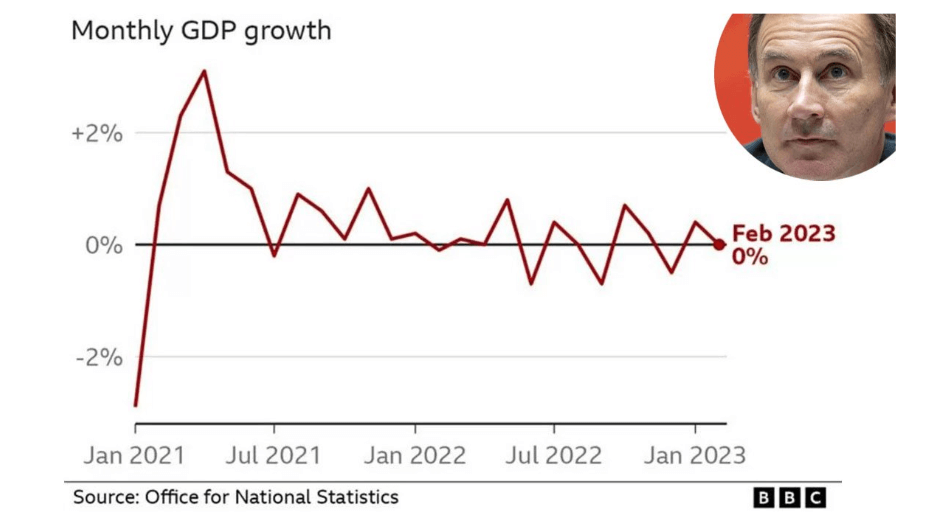

- Stagnant demand in a country’s economy: U.K. real GDP is still below Q4 2019.

- High unemployment: We aren’t here yet, but the U.K. unemployment rate did spike from 3.7% to 3.8%. As interest rates continue to rise and stay elevated, this will further pressure the labor market.

Stagflation was last seen in the 1970s, and consumer good prices tend to rise — while asset prices tend to deflate. Central banks are getting caught between a rock and a hard place.

CryptoSlate previously covered an insight into asset prices between the 1970s and the 2020s.

The post The central banks’ dilemma: inflation, stagflation, and the cryptocurrency response in today’s economy appeared first on CryptoSlate.