- April 22, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Key Takeaways

- Key operational metrics of Web3 Games include active users, retention rates, and payment-related data. Non-genuine players can disrupt the game’s balance and economic stability.

- This article takes Era7 as an example, introduces the method of identifying non-genuine players, and found that non-genuine players have a higher activity level than genuine players, with an average active durationday of 68 days and higher frequency of operations.

- Non-genuine players may consist of manual operations, group control software, and automated scripts, so methods for identifying them can be divided into funding networks and behavior patterns.

After the explosion of GameFi and the ups and downs of 2022, the industry has returned to a more rational Buidl phase. The sustainable development of game ecosystems and economies has become an important theme in the current development of Web3 games.

The value of a game can be broken down into the product of the number of players, individual player value, and average player retention time. Therefore, projects can significantly improve their life cycles and profitability by gaining insights into players and making targeted product optimizations and promotional strategies.

Insights of Web3 Gamers

According to the February Monthly GameFi Report from Footprint Analytics, the current number of active user addresses on the blockchain is 1.5 million. Due to the nature of most GameFi projects, where players can earn cryptocurrencies and NFT rewards by completing tasks, many non-genuine players have emerged to “farm gold.”

Non-genuine players in games, through concentrated and high-frequency operations to farm gold, may disrupt the game’s balance and economic stability, thereby reducing the value of the game project itself.

From the perspective of the balance of the game ecosystem, the mass operations of non-genuine players can destroy the game’s fairness, affecting its enjoyment and experience. Suppose these players gain an advantage through unfair operations. In that case, it will undermine the game’s competitiveness, leading to disappointment and frustration among other players and resulting in a decline in the number of players and average player retention time.

From the standpoint of in-game economic stability, if non-genuine players obtain large amounts of tokens or NFTs, it can lead to price imbalances within the game and create wealth inequality, negatively impacting user spending enthusiasm and damaging the number of players, retention time, and individual player value.

Case Study: Player Insights Analysis From Era7

According to Footprint Analytics’ game dashboard, Era7 is a popular project on BNB Chain. As a popular project, it attracts not only genuine players with a keen interest but also inevitably the attention of gold farming studios. This report looks at:

- What is the proportion of genuine players to gold farming studios?

- Are there any significant differences in behavior, and what impact do gold farming studios have on the game?

Era7: Game of Truth is a metaverse-style TCG (Trading Card Game), a W2E (Win-to-Earn) project developed on the BNB Chain. Unlike traditional P2E projects, W2E projects emphasize gameplay, where players generate NFT assets and game items with specific utility and collectible value through continuous level progression and challenges.

Roadmap

In December 2021, Era7 began airdropping NFTs and pre-selling blind boxes, and the Marketplace was launched. The game officially launched on the BNB chain on March 30, 2022.

Official Roadmap:

Key events and dates after the launch:

- 5.28 2022: First GOT burn

- 8.6 2022: Burning mechanism “GOT/ERA Token Auto-Burn started

- 9.11–10.1 2022: First season of Era7 World Cup Tournament

- 11.2 2022: Era7 acquired 35% stake in [ESFI], a web3 e-sports management platform at a valuation of $30M

- 11.6–11.27 2022: Second season of Era7 World Cup Tournament, broadcasted on YouTube

- 11.13–27 2022: Sales of the fourth batch of NFT blind boxes (Era7 Set-II Box)

Player Engagement Roadmap

Economic Model

The total amount of ERA to be issued is 1 billion, based on the game’s tokenomics. This is a token built by the Era7 Metaverse on the BNB Smart Chain (BSC) and currently serves exclusively as Era7’s platform token. Players can obtain ERA rewards through battling, getting involved in community incentives, and liquidity mining.

With the development of the Era7 metaverse, the functions of ERA will extend to community governance, pledging, and other rights and interests. The platform currency, the ERA token, is effectively the Bitcoin of the entire Era7 metaverse. ERA is similar to stablecoins, where supply and demand are dictated by the market. ERA obtained by the player can be exchanged for USDT or local fiat.

Main uses of ERA:

- To gain local currency via an exchange;

- To purchase GOT master cards/battle cards and NFT items/NFT mystery boxes on the marketplace;

- To enable transactions between players (ERA may be used to trade Era7 cards, GOT or other in-game items);

- To purchase land and get more ERA rewards;

- To issue a pledge for obtaining community rights, participating in governance, voting and subsequent decision-making;

- As a wager and/or as a registration fee for PVP.

How to get ERA:

- Purchase them on DEX/CEX platforms;

- Attain them via in-game rewards or airdrops;

- Acquire them via liquidity mining;

- From PVP rewards.

How to get GOT:

- Earn from in-game event rewards;

- PVE rewards

Cards

Era7 features two types of cards: Master cards (hero character cards) and Battle Cards(magic cards and monster cards summoned by heroes). Players need at least 30 battle cards to start a battle and the total number of cards in the game is expected to exceed 1,000. Both Master Cards and Battle Cards are NFTs.

Master Cards (hero character cards)

Battle Cards (magic cards and monster cards summoned by heroes)

Summoning

To obtain NFT Master Cards, players need to buy mystery boxes directly or trade with other players in the Marketplace. NFT Master Cards do not participate in the battles themselves, they Summon NFT Battle Cards which actually make up the deck to fight on the front lines. After successfully purchasing NFT Master Cards, players will need to Unseal them first before they can Summon NFT Battle Cards. If the NFT Master Cards have reached the maximum amount of Summoning, the players will need to consume ERA and GOT tokens as fuel so that they can continue Summoning.

Era7 is currently exploring user experience improvements at the infrastructure level, in addition to promoting the Esports strategy and holding ECL championships every six weeks. The Era7 team has partnered with the zkMeta platform, which builds game-specific zk-rollups on Polygon, to utilize zk technology to transform and release a new version of Era7.

Era7’s GameFi Data

In terms of active users and user retention, Era7’s performance in 2022 ranked among the Top 10.

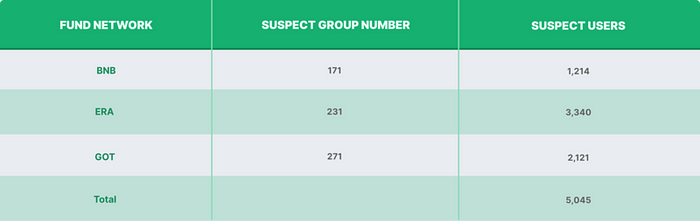

According to the latest data (as of March 7, 2023, using the current holders of Game Master Cards as the base), there are a total of 17,188 gamers. After the screening, we identified 5,045 non-genuine player addresses. These addresses may be composed of game studios or organized gangs of players, whose main purpose is to obtain returns through blockchain gaming.

By analyzing the data, we can see that there were many promotional campaigns in the early stage (such as activities on Twitter), attracting a large number of users. From May to July 2022, the number of monthly active users has been on the rise, and the proportion of female players is also increasing.

In the early stage of game promotion, the project party should try to avoid the impact of non-genuine players, give more incentives to real gamers, and appropriately weaken the impact of non-genuine players on game balance.

After July 2022, the number of monthly active users is on the decline. Correspondingly, the number of monthly active users of non-genuine players also shows a similar trend. At the same time, we can see that although the number of monthly active users has declined, the contribution of non-genuine players to the number of monthly active users is still relatively high.

Learn about the methodology for identifying non-genuine addresses at the bottom of this article.

Genuine vs Non-Genuine Users: Comparative Analysis of In-Game Behaviors

The Impact of Non-Genuine Players on Game Interaction, User Activity, and Transactions

While there are only a small number of non-genuine players, they have created a higher level of interaction, more active days per user, and higher transaction volume within the game.

Among the approximately 16,000 player addresses observed as of March 7, 2023, there were about 4,900 non-genuine player addresses, accounting for 30% of the total. However, these non-genuine players, who comprise less than one-third of the total, have generated 39% of the interactions (920,000 times), with an average of 187 interactions per user, which is nearly 1.5 times higher than that of genuine players (average of 129 interactions per user).

Non-genuine players have an average active duration of 68 days, significantly higher than the 48 days of genuine players. This also indicates that non-genuine players have a higher level of activity.

The average number of active days for non-genuine players is 68 days, significantly higher than the 48 days for genuine players. This also indicates that non-genuine players have higher levels of activity.

Behavioral Patterns of Real and Non-Genuine Players

Real and non-genuine players have similar behavioral patterns, but non-genuine players have a higher frequency of operations.

From the total number of operations, the most called methods in the game are Sign In (login), Upload NFT (list NFT for sale), Buy (buy in Marketplace), Summon (batch summon, exchange Master Card for Battle Card), Merge Card (merge Battle Cards for upgrades), and Farm (staking to earn ERA). Non-genuine and genuine players have a similar distribution of the top methods they call.

However, at the individual player level, non-genuine players have significantly more operations on Upload NFT, Summon, and Merge Card compared to genuine players.

Non-Genuine Players Show Stronger Response in Blind Box Promotion

The Blind Box Promotion in November boosted excitement in the game, but non-genuine player addresses responded much more strongly than real players.

Regarding the average number of user operations per day, non-genuine players’ frequency of Upload NFT (listing and selling NFT) was significantly higher than genuine players (about 2–3 times) at the beginning of the game and in mid-to-late November.

At the beginning of the game, non-genuine players may have profited by selling NFT obtained through airdrops before the game was launched. During the same period in 2022, from November 13th to 27th, Era7 Set-II Box was launched for the fourth time, and non-genuine players may have opened many boxes to obtain Master Card and then sold them to obtain ERA.

The following two graphs, Merge Card (combining Battle cards for upgrades) and Summon (exchanging Master Cards for Battle Cards), also follow the above trend. At the beginning of the game and during the November Blind Box event, players obtained more NFTs through Merge and Summon to use in the game or to sell for profit.

TransferFrom (transfer of Era7 NFT) had a significant increase in high-frequency operations by non-genuine players in late last year and early this year, during the decline of the game’s popularity.

Further investigation revealed that high-frequency operations are due to some addresses transferring Era7 NFT frequently to external addresses within a day. Investigation suggests that this may be an attempt to cash out and exit or to conduct bulk Merge Cards.

The Rise of Farming as Game Popularity Declines

Farming has become the main way for players to earn passive income or profit during the game’s decline in popularity.

As the game’s popularity declines, especially after the blind box activity ended in mid to late November, more players earn profits through farming (staking to earn ERA). In the below examples, we identify two cases where non-genuine players were identified through farming’s money flow. In the game’s later stages, this will be a more mainstream way of making a profit.

The project team should pay attention to the impact of a single-minded approach to gold farming, as genuine and non-genuine players show the same upward trend. It is necessary to conduct an in-depth analysis of different gold farming methods, understand the user demands and behavior patterns behind them, and carry out targeted optimization and improvements to enhance user satisfaction and gameplay.

Non-Genuine Players Receive More Game Tokens

Non-genuine player addresses receive a higher average amount of game tokens than genuine players.

By counting the number of transactions transferring game tokens from address 0 to player addresses as game reward tokens, it was found that both GOT and ERA7 game tokens have a higher average number of game tokens for non-genuine players than genuine players.

The average number of game tokens held by non-genuine players for ERA7 tokens is 2.7 times higher than that of genuine players, and non-genuine players hold 53% of the total reward token amount. Regarding game token rewards, the project team should pay more attention to the distribution of game token rewards to avoid the large amount of sell pressure caused by non-genuine players (by wallet addresses and ways of cashing out game tokens).

Summary

Project teams can identify non-genuine player groups and their common operating patterns through graph algorithms and other methods. By comparing the similarities and differences between genuine and non-genuine players in the game, we can better understand the potential impact of non-genuine players on the game. Also, it is important to actively monitor and analyze player behavior and fund pathways, clarify account relationships, identify value extraction, and incentivize user behavior, as these are crucial to prevent the project from entering a death spiral.

Methodology for identifying non-genuine addresses

Identification Methods

In general, non-genuine players may consist of a small number of manual operations, group control software, and automated scripts. This means one person can control multiple wallet addresses to achieve a batch gold-mining effect, so they are usually organized in groups.

Methods for identifying non-genuine players can generally be divided into funding networks and behavior patterns.

Funding networks refer to the transfer of assets on the blockchain, where a certain asset is transferred from one address (from_address) to another address (to_address). Many asset transfers between addresses directly form a huge fund network and suspect non-genuine player groups can be found by aggregating nodes in the fund network.

- Behavior patterns refer to various transaction behaviors of wallets on the blockchain. Based on wallet addresses, summary statistics of wallet features within a certain time period (e.g., the total number of game operations, total number of transfers, and total number of game rewards received by Wallet A from January 1 to January 7) are used, and then these feature values are used for similarity calculation (e.g., comparing the feature similarity between Wallet A and Wallet B). The higher the similarity, the greater the probability of a suspect group.

From the evidence aspect, if there are direct financial transactions between non-genuine player addresses, it is more persuasive to consider them as a group. Similarities in behavior patterns can only indicate suspect groups, and compared to funding networks, the evidence is weaker.

Therefore, this analysis uses the funding network method to identify non-genuine players. Funding networks are generally composed of nodes and edges. In this analysis, nodes represent game player addresses, edges represent asset transfers between addresses, and edges are directional, pointing from from_address to to_address.

Fund Network Selection

The funding networks analyzed in this study include BNB, GOT, and ERA. BNB is the native token of the BSC chain, and BNB is required for all on-chain transactions in the game. GOT and ERA are two game tokens that serve as rewards/consumption in the game. All three tokens play their respective roles in the game, so we chose these three types of fund networks for analysis and exploration.

Finding Typical Suspect Group Patterns

From the player path above, we can see that if a player wants to enter the game and engage in gold farming, they must hold BNB as the gas fee, then exchange other assets for game tokens and purchase NFT to start the game. In this process, if the gold farming studio has multiple accounts, there need to be other addresses to transfer BNB, ERA, and GOT game assets to the small accounts.

Token distribution occurs during this process and can be studied as a pattern. If the gold farming studio wants to cash out and exit, it needs to exchange game tokens ERA and GOT for BNB or stablecoins. Non-genuine accounts may aggregate game assets to a certain address, and then exchange them for BNB or stablecoin from that address. Token aggregation occurs during this process. The following text will also cover specific case studies for these two phenomena.

Research process

- Data preparation (NFT holder data, relevant BNB, ERA, and GOT transfer data)

- Elimination of node with noise

- Use graph algorithms to identify non-real player groups (community discovery, graph neural networks)

- Suspect group case analysis

- Comparison of genuine and non-genuine players

Statistics: How many funds were captured from various networks, and how many were captured in total (Suspect Group, Address).

Therefore, we provide examples to illustrate the two main patterns in different funding networks:

- The dispersion of external funds, such as BNB, to activate game accounts.

- After earning profits from gold farming in the game, aggregating tokens and interacting with external parties to make a profit.

The main approach is to use graph mining algorithms to identify groups with star, chain, and tree-like structures in funding networks, and analyze the behavior patterns of these groups. As shown in the two graphs below, each red dot represents a game wallet address, black edges represent financial transactions between two red dots, and the direction of the black arrows represents the direction of fund transfer.

The relationships between the points and edges form a funding network group. The funding formation and behavior patterns of some groups will be analyzed below.

Here are some specific case studies:

All cases are based on player addresses holding ERA7 NFTs at the current stage. There are three types of funding networks involved:

- BNB funding network

- GOT funding network

- ERA7 network.

The flow of funds can be roughly divided into two categories, and some cases are listed below:

Token dispersion, small accounts operate individually

Case 1: Non-genuine accounts obtain BNB as gas fees in bulk through farming operations to earn game token rewards.

The suspect group addresses are as follows:

- ‘0xf04a34702cd42c99e08f2b40fbc475c946f46b8c’,

- ‘0xe6ababb7885cd4319ae0f76262eccf435b3b643d’,

- ‘0x5f84c0bde6bade51bfbfb65355d93755cabba12b’,

- ‘0x20b4b6d703f8facbe5f89a2e8299a5b48f75fe64’,

- ‘0x44475543aa19d9a487d44b727778609668400ba6’

Subsequent addresses will be represented by the last 3 digits of the address.

In the funding network, these five addresses form a chain structure. b8c — receives BNB from these two addresses (e64 — and bA6 — ) as gas fees and carries out farming operations to obtain ERA tokens. Then, b8c transfers the earned ERA tokens to the address ending in ba6 — .

12b — and 43d — addresses also have similar operations to address b8c, which involve receiving BNB as gas fees, farming to obtain ERA tokens, and transferring them to external addresses.

Case 2: Non-genuine accounts obtain ERA tokens and engage in bulk purchase of NFTs.

The suspect group addresses are as follows:

- ‘0x4656385df61278301f3b9fa1b76e73b3ca731978’,

- ‘0x11e776124d7f5fc8875d1d322551403d6474b77b’,

- ‘0x61a76d6d535351278048705faed42a0bd742a458’,

- ‘0x74725ab50626d43b959e3be52f914e73ef264dc0’,

- ‘0xc7bcc83d279ad39c12c58cc01932320a22b8a16a’,

- ‘0x1fa47cfb1ced988ca89ca67f4656bf9721c9cd97’,

- ‘0x70603d99ca844fcdea8477c9a3d9036409ab4a0d’,

- ‘0x8c46ae8a732fecf5fb9981f30b4712265de058aa’,

- ‘0xa96099c242008324614eb3a44e43a3509fc080cc’

The transfer of ERA7 token funds in this group is unidirectional. This group has a clear strategy in its behavior patterns. The previous address provides ERA7 tokens to the next address to purchase NFTs. Afterward, the group continues to transfer ERA7 tokens to the next address and continue purchasing NFTs.

Token Aggregation, Centralized Operation by One Account

Case 1: Smurf accounts accounts’ game tokens are collected and cashed out by a master account (solely responsible for this operation)

The suspect group addresses are as follows:

- ‘0xce79295553e832941d3ebb03ff202178dd364305’,

- ‘0x78bec54ec28ef4a291957f9af80fdd2cdf5b25cd’,

- ‘0x60ff36dbf2b6829f81cc92bae2faf747b26fe535’,

- ‘0x0b01f6427dfee18809aea71a55db280a685628e3’,

- ‘0xf0f2ac2e23c0695f587b3eac602aa89200002b88’,

- ‘0xbc12df79b74a7291de0421aee928aee05a865906’,

- ‘0x453897b733cd58012fcf727c29117532fef706a1’

Address 8e3 — acts as a convergence point for funds and is designated as “A”. Other addresses aggregate their ERA7 tokens obtained from farming into A.

Finally, A performs a swap operation to convert the tokens into BUSD.

Case 2: Smurf accounts game tokens are collected by multiple non-genuine accounts and cashed out by certain master accounts.

The suspect group addresses are as follows:

- ‘0xb1f0a149efae862b8a1d32933f49c7baec0c7e6a’,

- ‘0x14beb60f3ae20c444ade67c5ce726394db72ddda’,

- ‘0x87aacff8defec51001ac41b1239d36dee15f0ed1’,

- ‘0x49433fa5ddb97d1250f7641274697485b8672e20’,

- ‘0xce0e84f6f6eee65890506f58f10bf1dc620d78a5’

- The graph shows five nodes in this fund network, and four of them can serve as fund collection points.

Taking the address ed1 — as an example, it is designated as address A.

The other four addresses have all transferred Era7 tokens to address A, which then performs a swap operation. Similar situations are also observed for the other convergence points.

This is a joint report by TrustaLabs and Footprint Analytics

- Author: @Austensfy TrustaLabs Data Analytics

- @Rael_LKun TrustaLabs Data Analytics

About TrustaLabs

TrustaLabs launched the first sybil scoring product TrustScan. TrustScan analyzes user behavior by funding network and behavior sequences with on-chain data, and the result will be integrated based on AI algorithm. TrustScan now covers EVM chains and major Layer 2s, it will help users/projects in sybil detection whenever preparing airdrops, marketing campaigns or donations. All users could query any address for its sybil score with TrustScan FOR FREE.

About Footprint Analytics

Footprint Analytics is a data platform blending web2 and web3 data with abstractions. We help analysts, builders, and investors turn blockchain data into insights with accessible visualization tools and a powerful multi-chain API across 20+ chains for NFTs, GameFi and DeFi. We also provide Footprint Growth Analytics to help with effective growth in GameFi and any web3 projects.

The post Exploring potential of blockchain gaming through player data appeared first on CryptoSlate.