- May 22, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

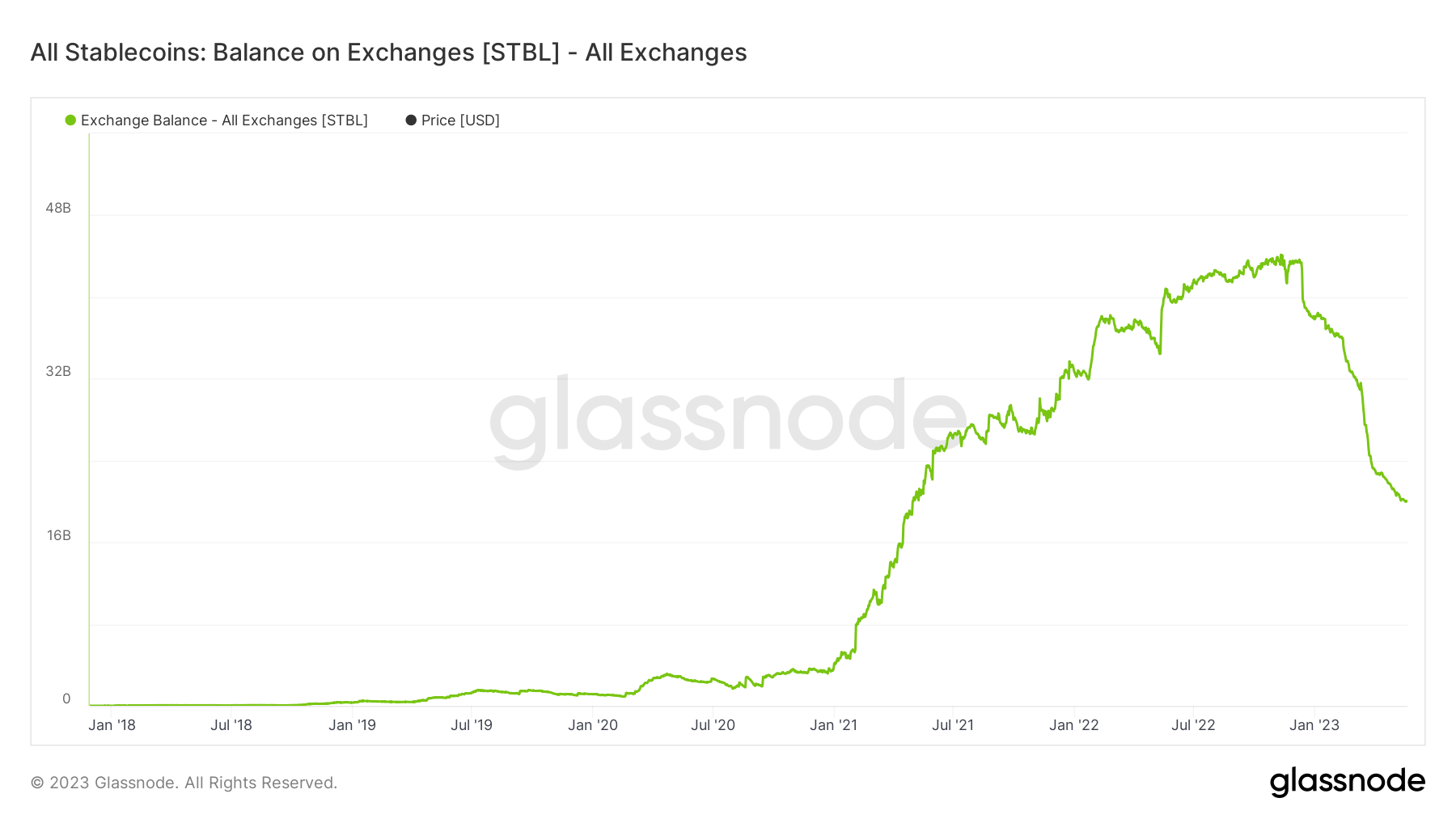

The volume of stablecoins held on centralized exchanges has fallen below $20 billion—its lowest since April 2021, according to Glassnode data as analyzed by CryptoSlate.

According to the chart below, the stablecoin balance across exchanges peaked at over $44 billion in December 2022 when the market was still smarting from FTX’s collapse.

However, that figure has steadily declined since the beginning of the year as the industry faced a new wave of crises, including increased regulatory scrutiny and the capitulation of several crypto-friendly banks.

The stablecoins in the metrics include the following: BUSD, GUSD, HSUD, DAI, USDP, EURS, SAI, sUSD, USDT, and USDC.

Why are exchanges’ stablecoin balances dropping?

The exchange stablecoin decline can likely be tied to the heightened regulatory risks associated with the crypto industry. Financial regulators have increased their scrutiny of the space following the collapse of Terra’s algorithmic stablecoin and the subsequent implosion of several crypto-related firms.

The decline in stablecoin balances also indicates a minimal inflow of liquidity into the crypto ecosystem this year despite the market recovery. CryptoSlate Insight reported USDT, and USDC’s exchange liquidity is now at a low not seen since early 2022.

Tether grows; BUSD, USDC lead redemptions

Meanwhile, CryptoSlate Insight reported that most withdrawals came from BinanceUSD (BUSD) and USD Coin (USDC).

For context, Arkham Intelligence reported that Binance conducted its most significant direct burn of BUSD since February on BNB Chain. The exchange burned 700M BUSD and $250M USDC by the Mint&Burn address.

The two stablecoins have faced significant challenges, with Paxos ending other mints of BUSD to comply with New York regulators. At the same time, investors’ confidence in Circle’s USDC has dropped after it briefly lost its peg to the US Dollar in March.

Following these events, BUSD’s supply has shrunk to $5.5 billion from a peak of over $20 billion, while that of USDC dropped to $29 billion from more than $40 billion.

Meanwhile, Tether’s USDT has continued to grow in leaps and bounds, adding more than $15 billion to its market cap this year.

The issuer reported strong financial records for the first quarter and intentions to invest its profits in Bitcoin.

The post Stablecoin exchange balance drops below $20B appeared first on CryptoSlate.