- May 24, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

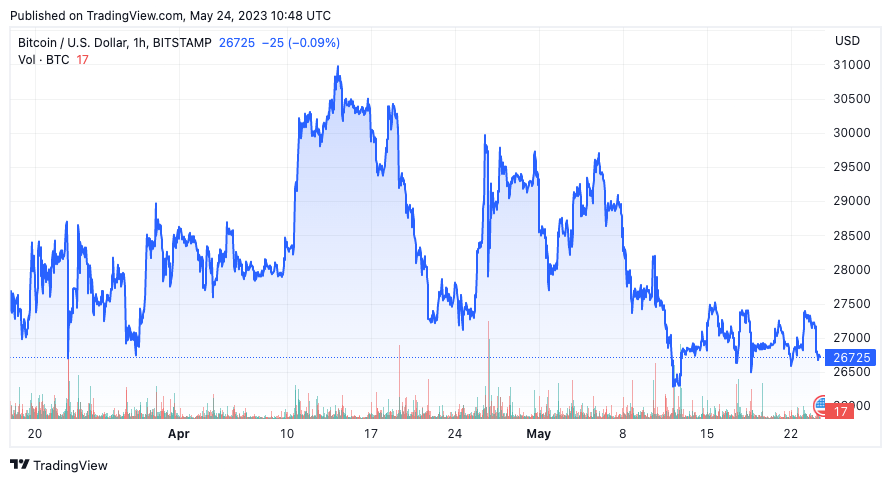

The Bitcoin market has been calm for the better part of May, as prices hover in a relatively stable range between $26,000 and $28,000.

However, beneath this seemingly tranquil surface, several on-chain metrics indicate potential shifts in market sentiment and investor behavior.

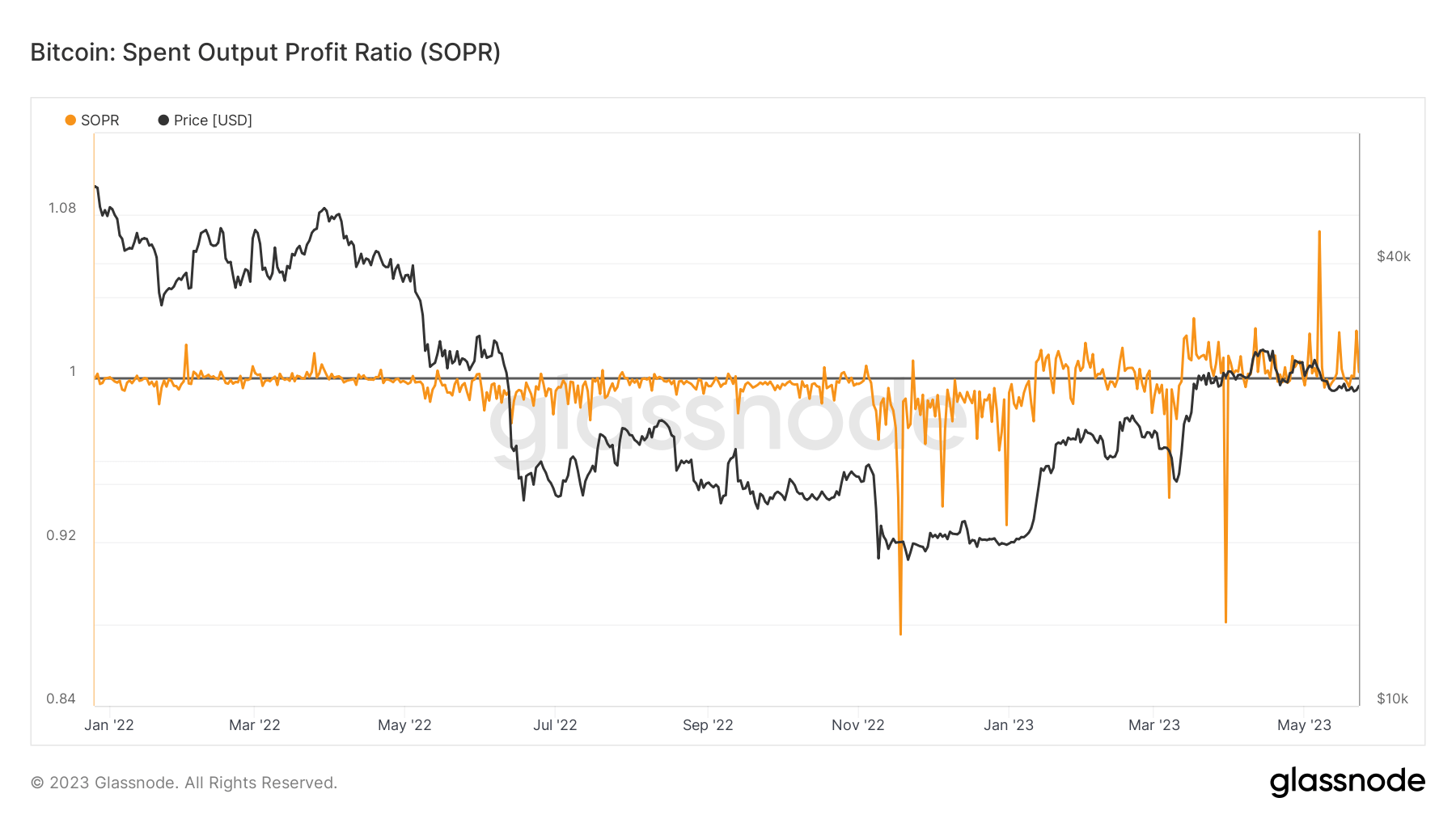

The Spent Output Profit Ratio (SOPR) is a valuable gauge of profitability and losses that the market has incurred. SOPR value greater than 1 suggests that, on average, the coins moved on-chain during that period are being sold at a profit. Conversely, a SOPR value less than 1 implies that coins are, on average, being sold at a loss.

SOPR is trending lower and is gradually approaching the critical threshold of 1. While this may seem like a cause for concern, it is important to note that declining SOPR values may also indicate a market phase where investors are holding their assets, anticipating favorable market conditions or higher prices in the future.

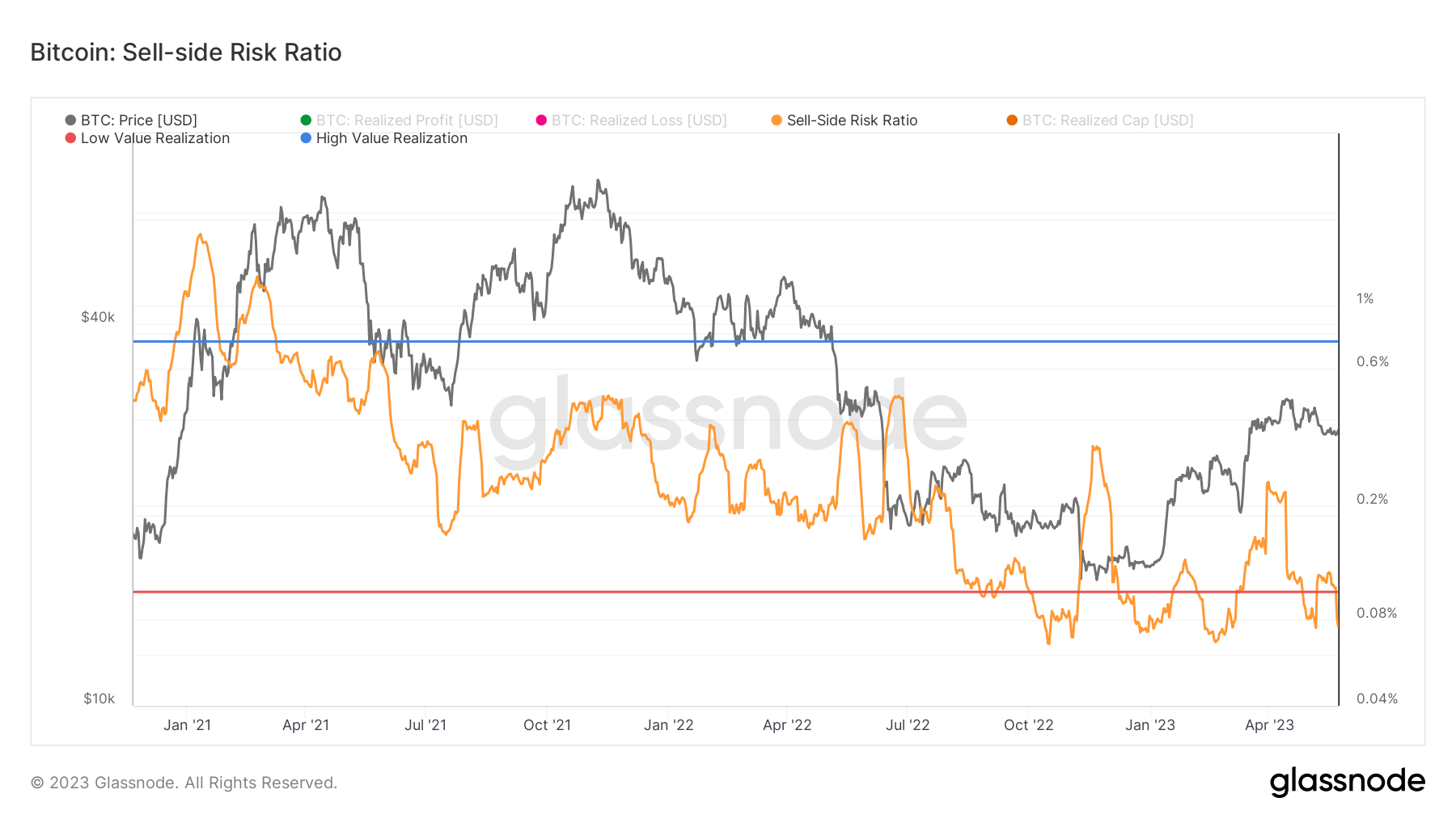

The Sell-side Risk Ratio provides valuable insights into the overall sell-side pressure in the market, comparing the total USD value spent by investors on-chain to the total realized market capitalization. When the ratio is low, it indicates that the aggregate sell-side risk in the market is relatively minimal. This suggests a period of low-value realization and reduced market volatility, which is often associated with market consolidation and sideways trends.

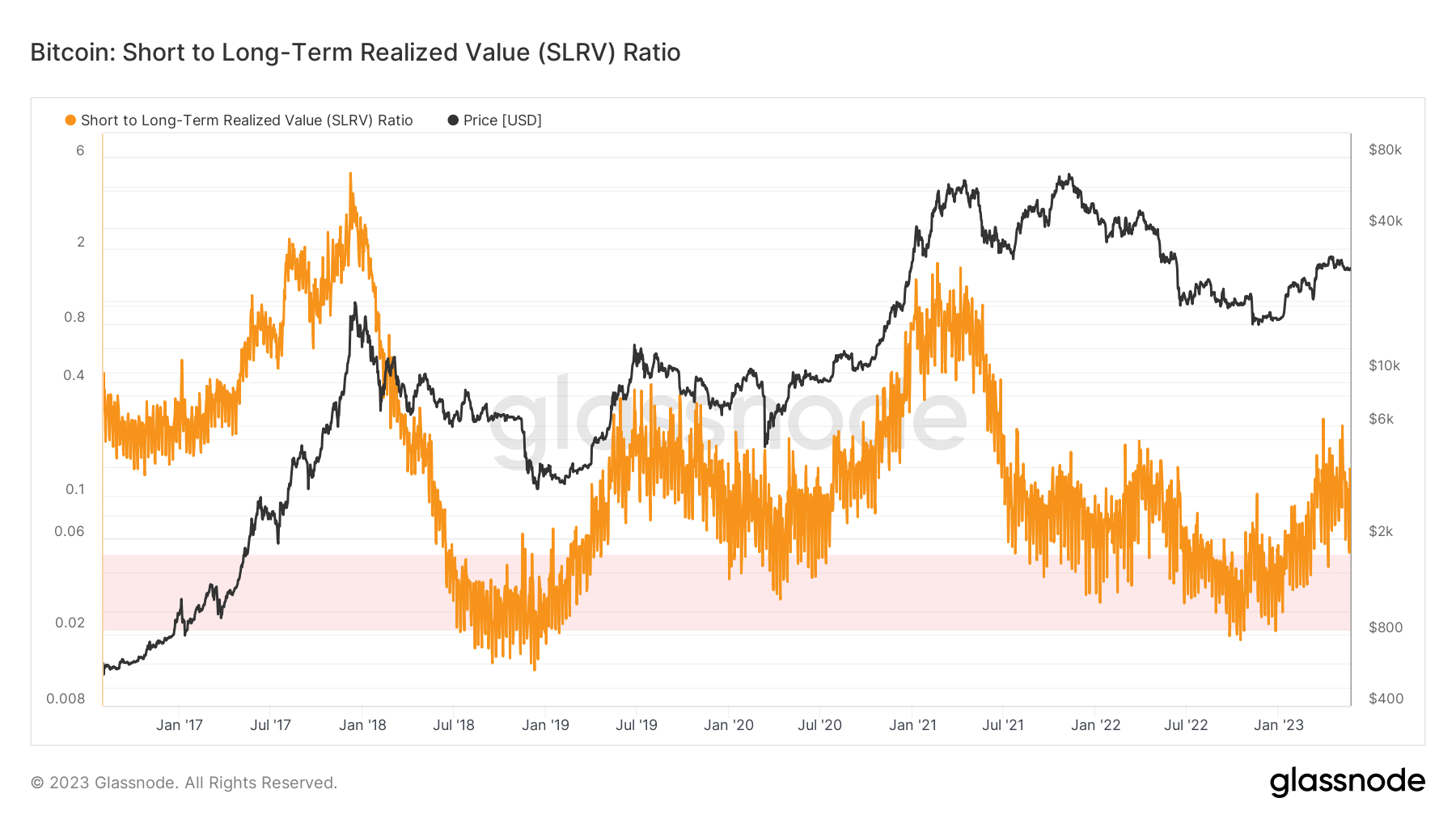

The Short-to-Long-Term Realized Value Ratio assesses short-term transactional activity versus long-term holding. A low SLRV ratio suggests limited short-term activity and interest in Bitcoin or the emergence of a growing base of long-term holders. This can indicate an accumulation phase and a relatively low sell-side risk environment.

A CryptoSlate analysis earlier today found that whales holding over 10,000 BTC accumulated for the better part of April and have entered another accumulation spree.

Since the beginning of May, the SLRV Ratio has been exhibiting a downward trend. This is in line with previous findings and further confirms the broader market trend of low sell-side risk, creating fertile ground for accumulation.

The current state of the Bitcoin market presents an uneventful facade, but a deeper analysis of on-chain metrics reveals subtle nuances that could shape its future price movements. The declining SOPR, low Sell-side Risk Ratio, and SLRV ratio indicate a market environment characterized by reduced volatility, consolidation, and a potential accumulation phase.

The post Despite recent stillness, on-chain metrics indicate possible volatility ahead for Bitcoin appeared first on CryptoSlate.