- June 5, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

- A futures contract is an agreement between two parties to buy or sell an asset (in this case Bitcoin) at a predetermined price at a specific future date. These are used for hedging risk or speculating on price changes.

- Open interest is the total number of these contracts that are currently “open” — that is, contracts that have been created but have not yet been exercised, offset, or delivered.

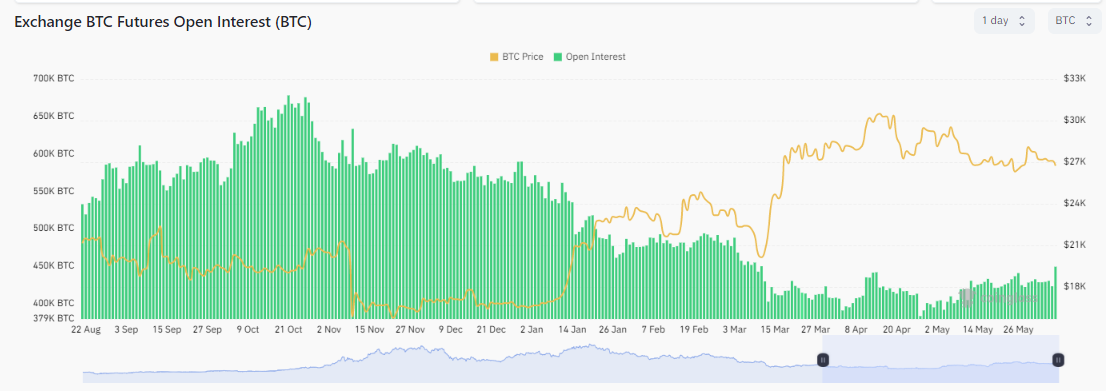

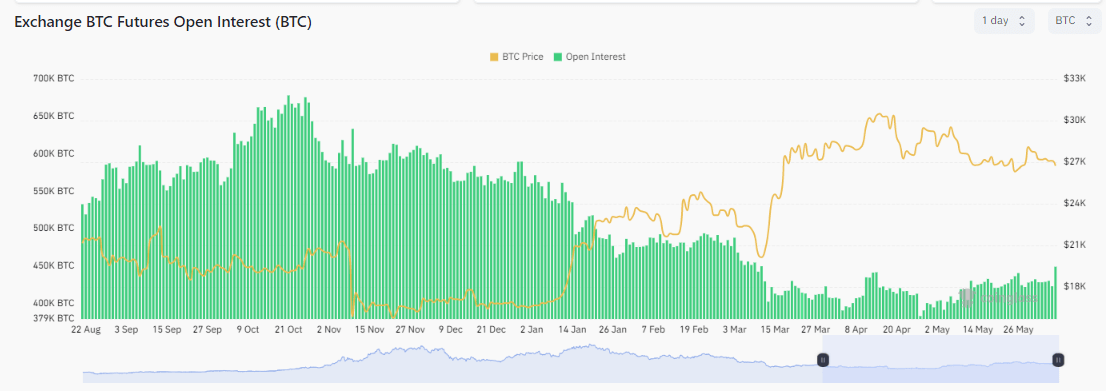

- In the past 24 hours, we have seen a 7% surge in futures open contracts, currently at 449,000 Bitcoin, equivalent to roughly $500 million, according to Coinglass data.

- This surge in open interest is coming from Binance, which currently has 158,000 Bitcoin in open interest contracts.

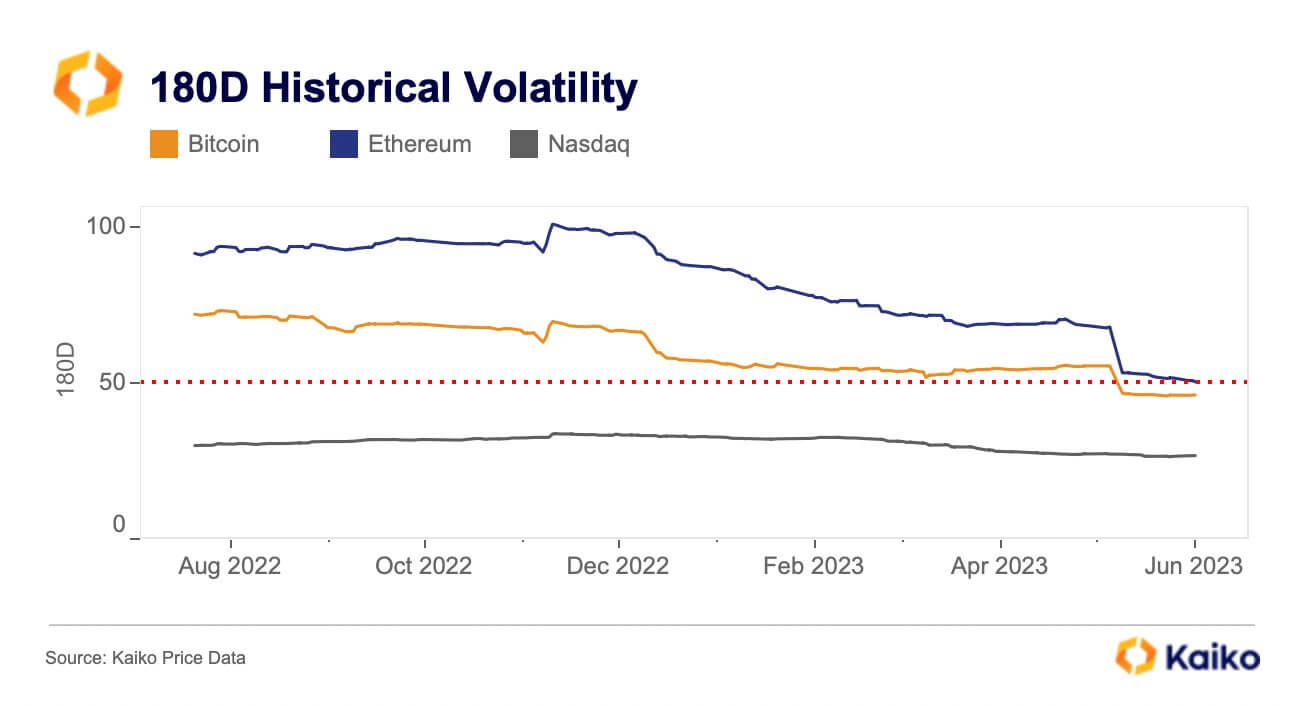

- This suggests volatility could be on the horizon, which the crypto market has been short of lately. According to Kaiko research, Bitcoin long-term volatility has been steadily declining since November 2022 and hit its lowest level in more than two years.

- In addition, SEC sues Binance for breaching securities law. Following the news, the market has seen $50 million in liquidations in 1 hour. Liquidations over the past 24 hours are over $100 million.

The post Bitcoin open interest grows $500M in 24 hours, highest level since SVB collapse appeared first on CryptoSlate.