- June 29, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin’s (BTC) correlation with the Nasdaq sank to 3% in June, according to data from Kaiko – indicating diverging sentiment between cryptocurrencies and tech stocks.

The price-performance for the leading cryptocurrency in June was between $24,800 and $31,360, opening the month at $27,200.

BlackRock’s spot Bitcoin ETF filing on June 15 was a bullish catalyst, reversing the prior downtrend to a new year-to-date high of $31,440 some eight days later.

Since then, Bitcoin has been trading in a narrow band between $29,860 and $31,030 – falling 3% since its YTD high on June 23.

Meanwhile, the tech-heavy Nasdaq 100 has been in a continuous uptrend since the start of the year – reaching a YTD high of $15,230 on June 16. Since Bitcoin’s year-to-date high on June 23, the Nasdaq has risen 0.7%.

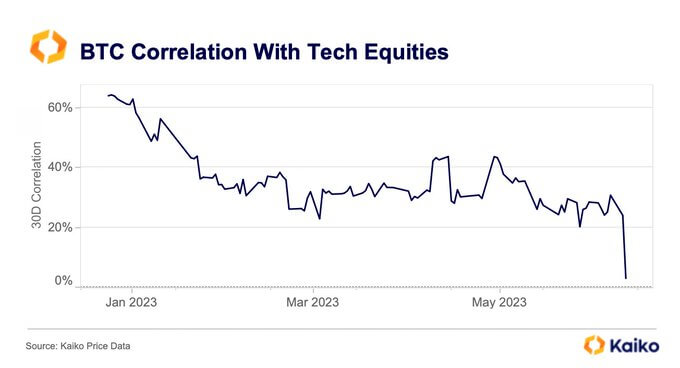

On a 30-day basis, the Bitcoin-Nasdaq correlation started the year at 60% and slipped to 22% by March, indicating a decrease in the similarity of price movements between the two. This period of change consolidated somewhat, with the correlation struggling to rise above 45%.

The Bitcoin-Nasdaq correlation has continued to move lower throughout the year, dropping sharply to 3% this week from over 20% in May.

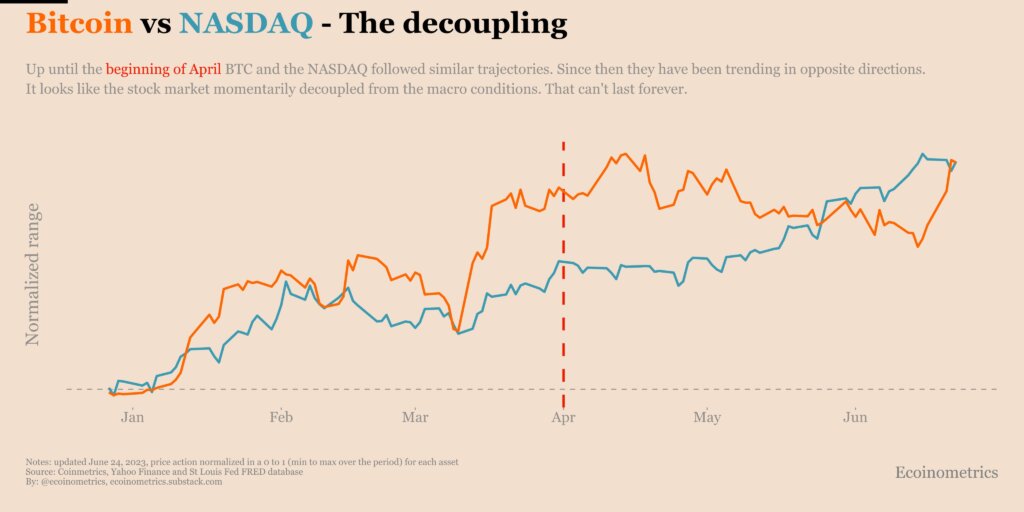

Data research firm Ecoinometrics published a chart of Bitcoin-Nasdaq range movements from the start of the year to June 24. It showed a similar trend between the two until April, after which a “nice decoupling” occurred.

Ecoinometrics further commented that the Nasdaq’s performance is disconnected from the broader macroeconomic landscape – implying an uptrend reversal is on the cards.

“But this bear market rally for stocks cannot escape the bleak macro picture forever.“

The post Bitcoin correlation to Nasdaq sinks to 3% low in June appeared first on CryptoSlate.