- July 21, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

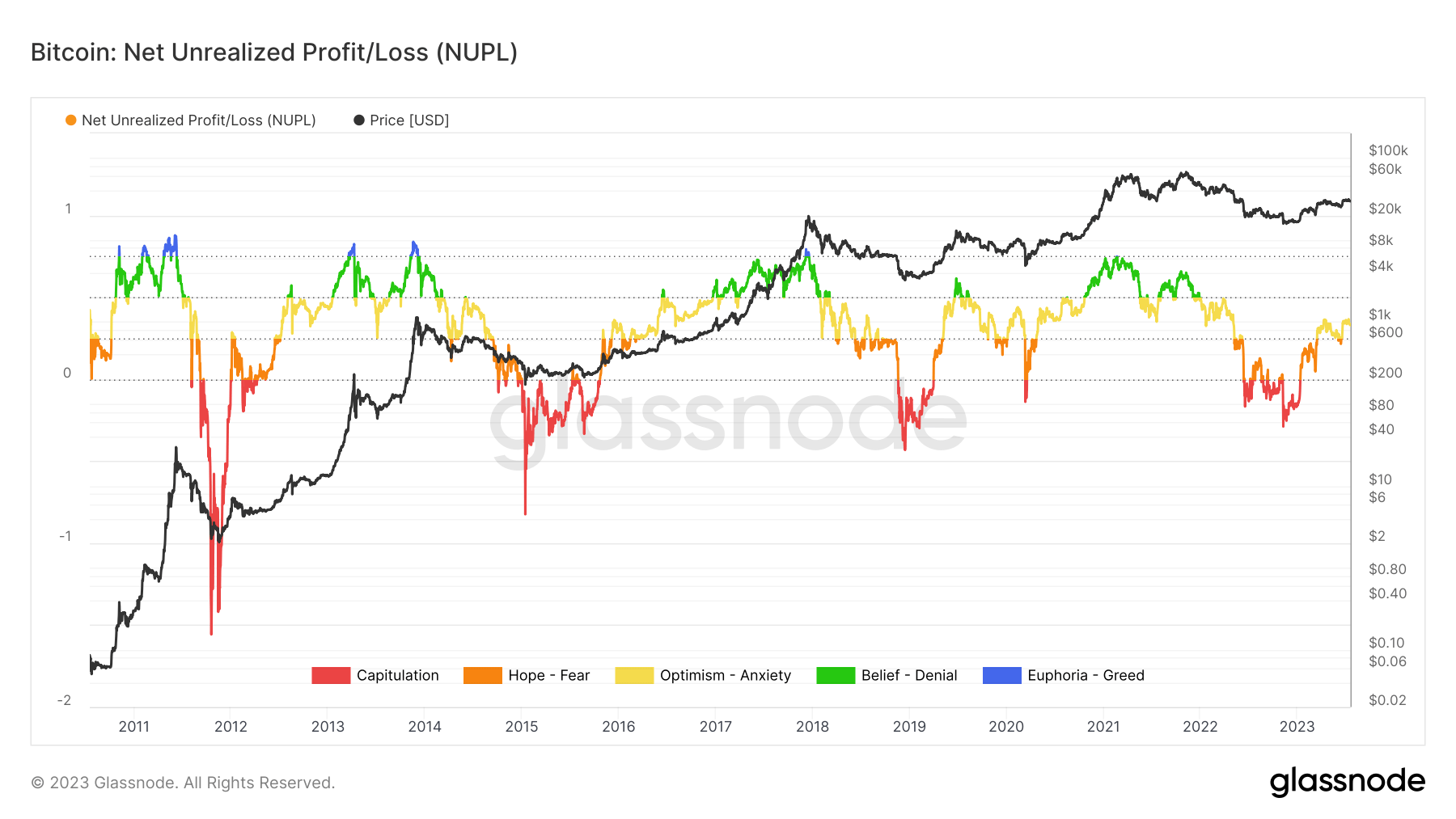

The cryptocurrency market is a complex ecosystem, requiring numerous metrics and indicators to gauge its health and predict future trends. One such metric, the Net Unrealized Profit/Loss (NUPL), provides a nuanced view of market sentiment.

NUPL indicates market sentiment by highlighting the difference between unrealized profit and unrealized loss in the Bitcoin supply.

The ‘unrealized’ aspect refers to gains or losses not actualized by selling the asset. The realized cap measures the value of all coins at the price they last moved, effectively capturing the net investment of coin holders.

NUPL is calculated by subtracting this realized cap from the market cap and dividing the result by the market cap. It’s a valuable tool that offers insights into the collective market sentiment.

A NUPL score below 0 has historically correlated with periods of price capitulation, indicating a bearish market sentiment.

Conversely, a NUPL score higher than 0.75 typically correlates with periods of extreme greed and euphoria, suggesting a bullish market sentiment. The transitional periods, where the NUPL ranges between 0 and 0.25, have historically indicated fear during downtrends and hope during uptrends.

A NUPL score between 0.5 and 0.75 has correlated with periods of firm belief in Bitcoin’s rally.

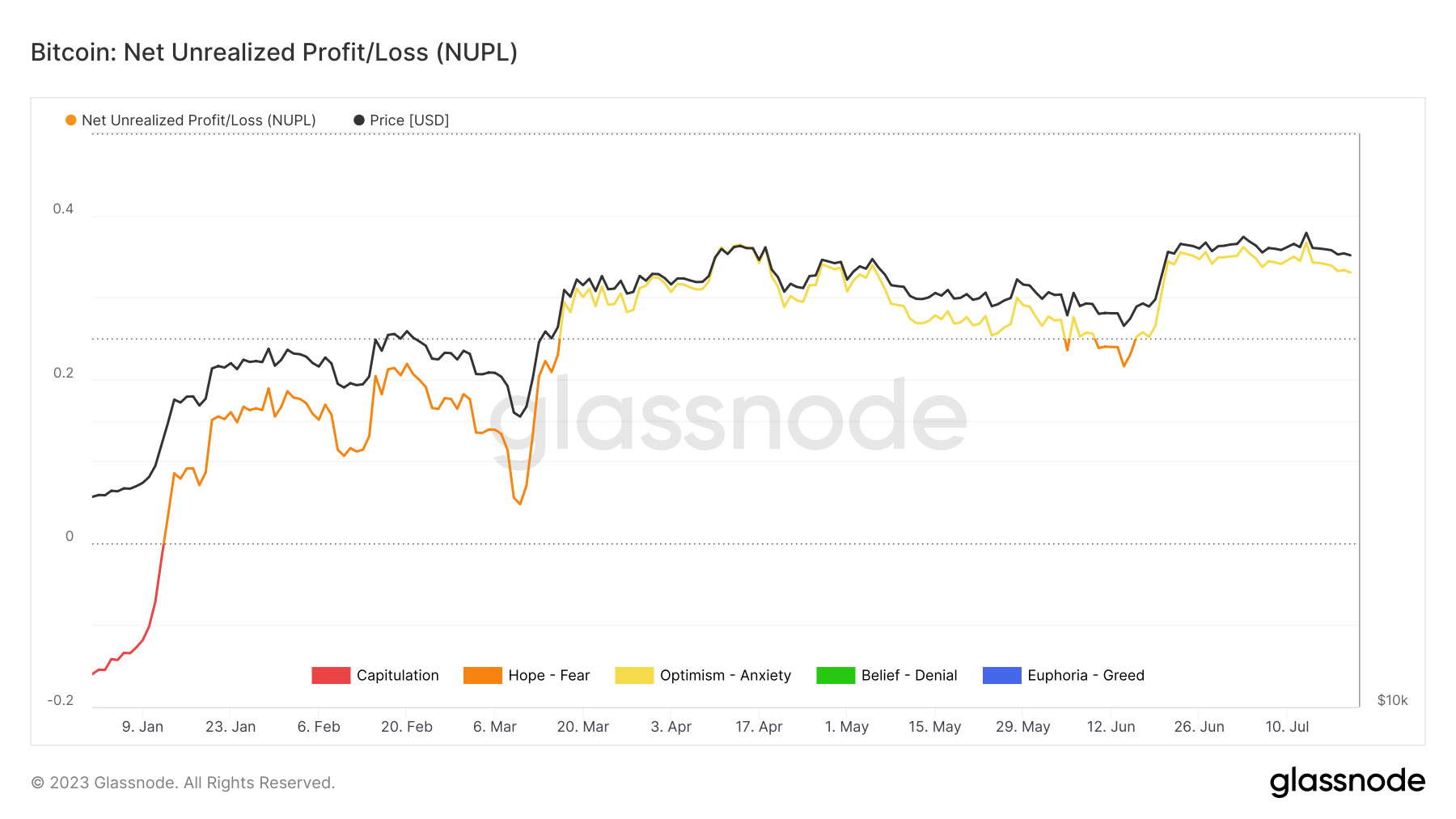

Since the beginning of the year, NUPL has been on a steady rise, growing to 0.33 on July 20 from -0.15 on January 1. This indicates that Bitcoin came out of capitulation in mid-January and spent two months in the hope phase.

Since mid-March, NUPL has seen notable growth, showing the market’s optimism has been growing. After a brief dip below 0.25 on July 13, NUPL had increased by 31% by July 20.

This upward trend in NUPL suggests that the market is becoming more optimistic, potentially leading to increased buying pressure and higher prices.

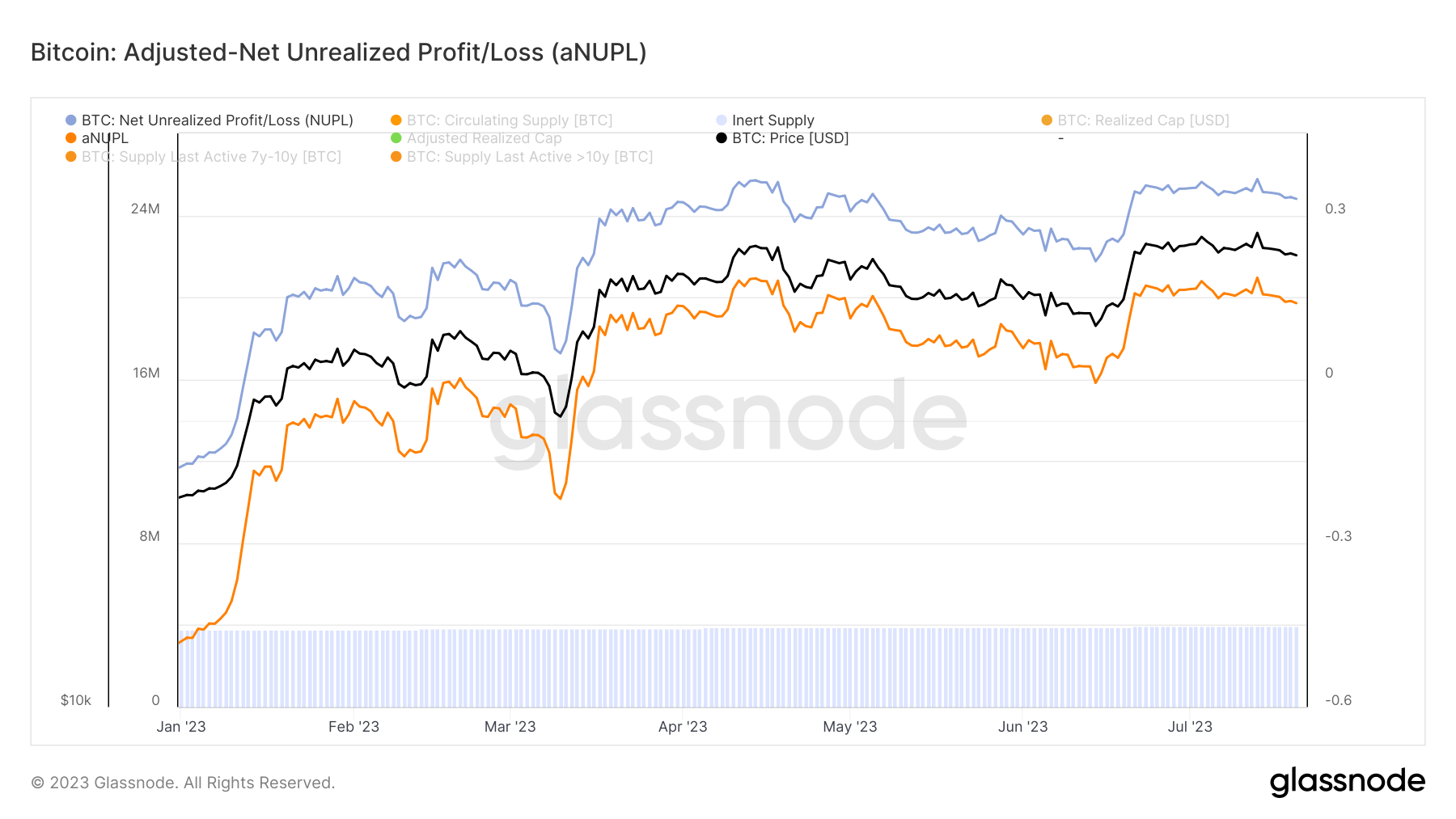

However, the NUPL can sometimes be skewed by dormant or lost coins. We use the adjusted NUPL (aNUPL) to account for skewed data. This metric adjusts the market cap and NUPL to discount the effect of such coins, assuming that the coins that haven’t been transacted with for over seven years are equivalent to an inert supply.

The aNUPL has also seen a significant increase, rising by almost 130% since the beginning of the year.

The growing NUPL and aNUPL indicate a more optimistic market sentiment. This could potentially lead to increased buying pressure and higher prices in the near term. However, it’s important to note that NUPL is a relative measure, meaning it can be influenced by extreme movements in the market, making it less reliable during periods of high volatility.

While NUPL provides valuable insights, it should be used in conjunction with other metrics and fundamental analysis for a more comprehensive perspective, mainly because NUPL alone, like all indicators, may not be a strong predictor of long-term price movements.

The post Rising unrealized profits indicate a more optimistic Bitcoin market appeared first on CryptoSlate.