- July 26, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

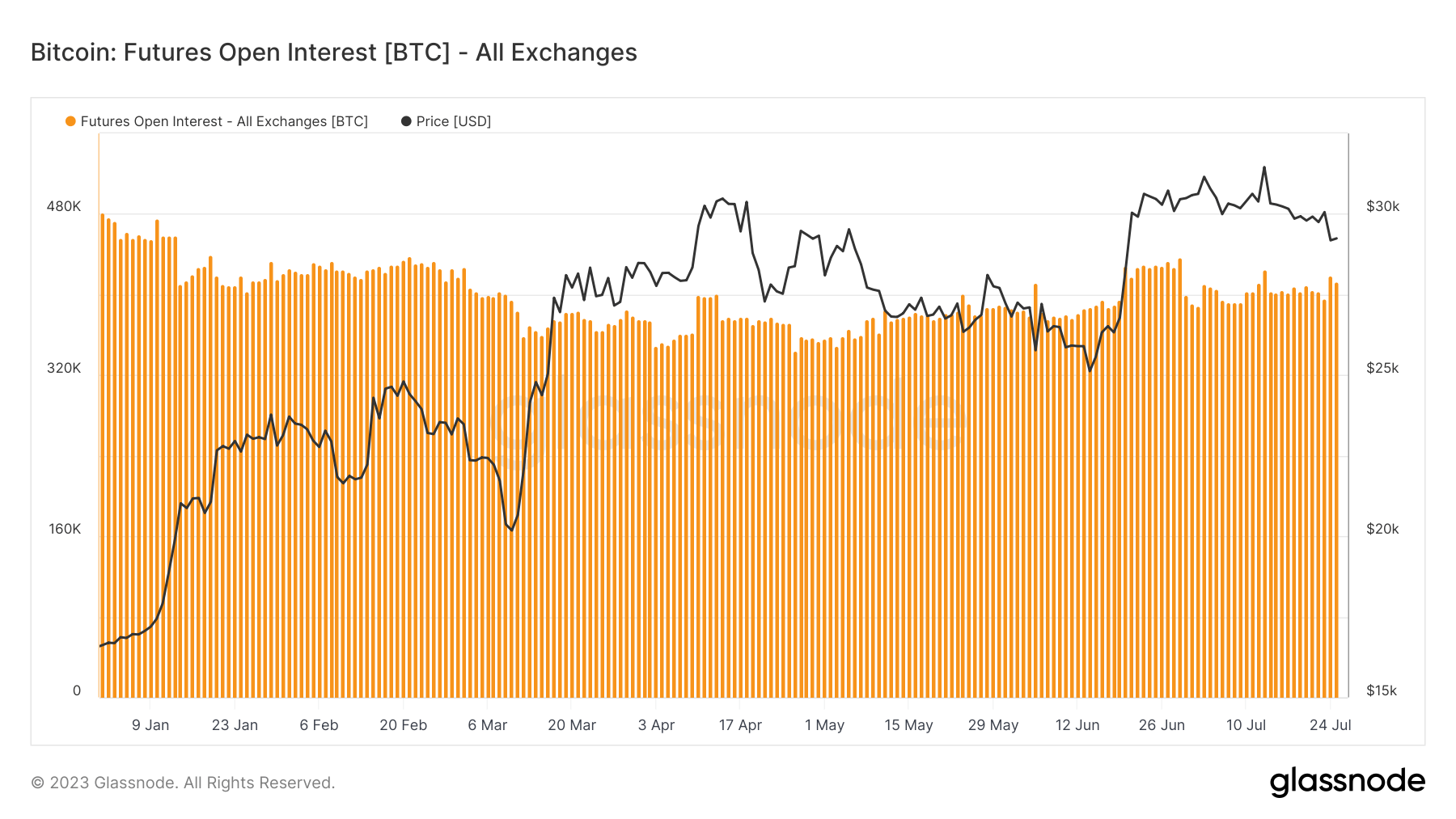

The derivatives market for Bitcoin has been instrumental in driving recent price movements, and a key metric to consider is open interest.

‘Open interest’ represents the total amount of capital committed in open futures contracts. Over the past few days, this figure has surged to over 413,000 Bitcoin, according to Glassnode.

However, when placed in the broader context of year-to-date (YTD) trends, the growth in open interest is less striking. Indeed, the YTD growth in open interest has been relatively flat, if not slightly negative. This is a promising sign, as it indicates that the market’s recent growth has been fueled predominantly by ‘spot buying’ rather than by an increase in futures trading.

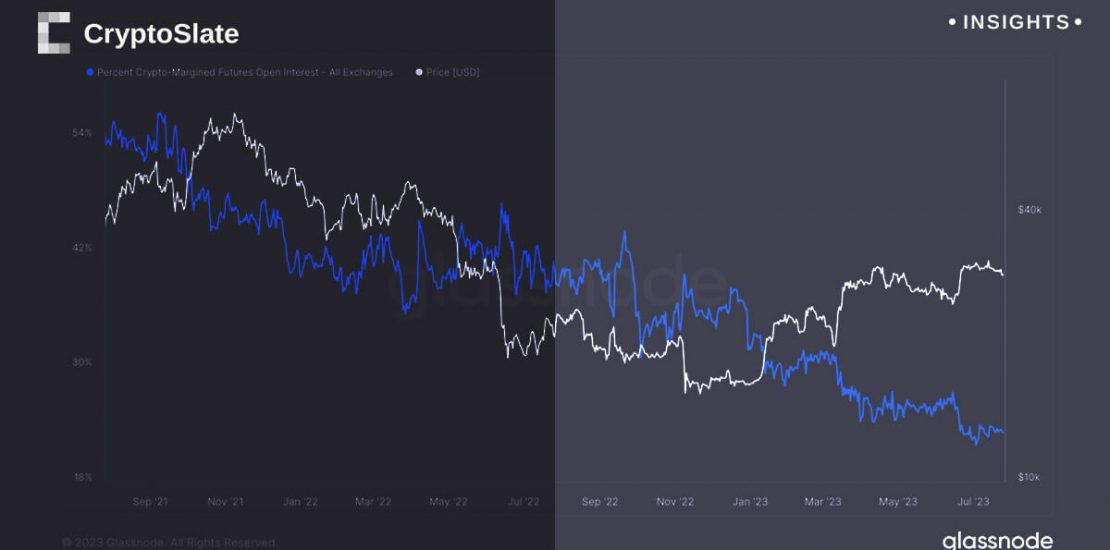

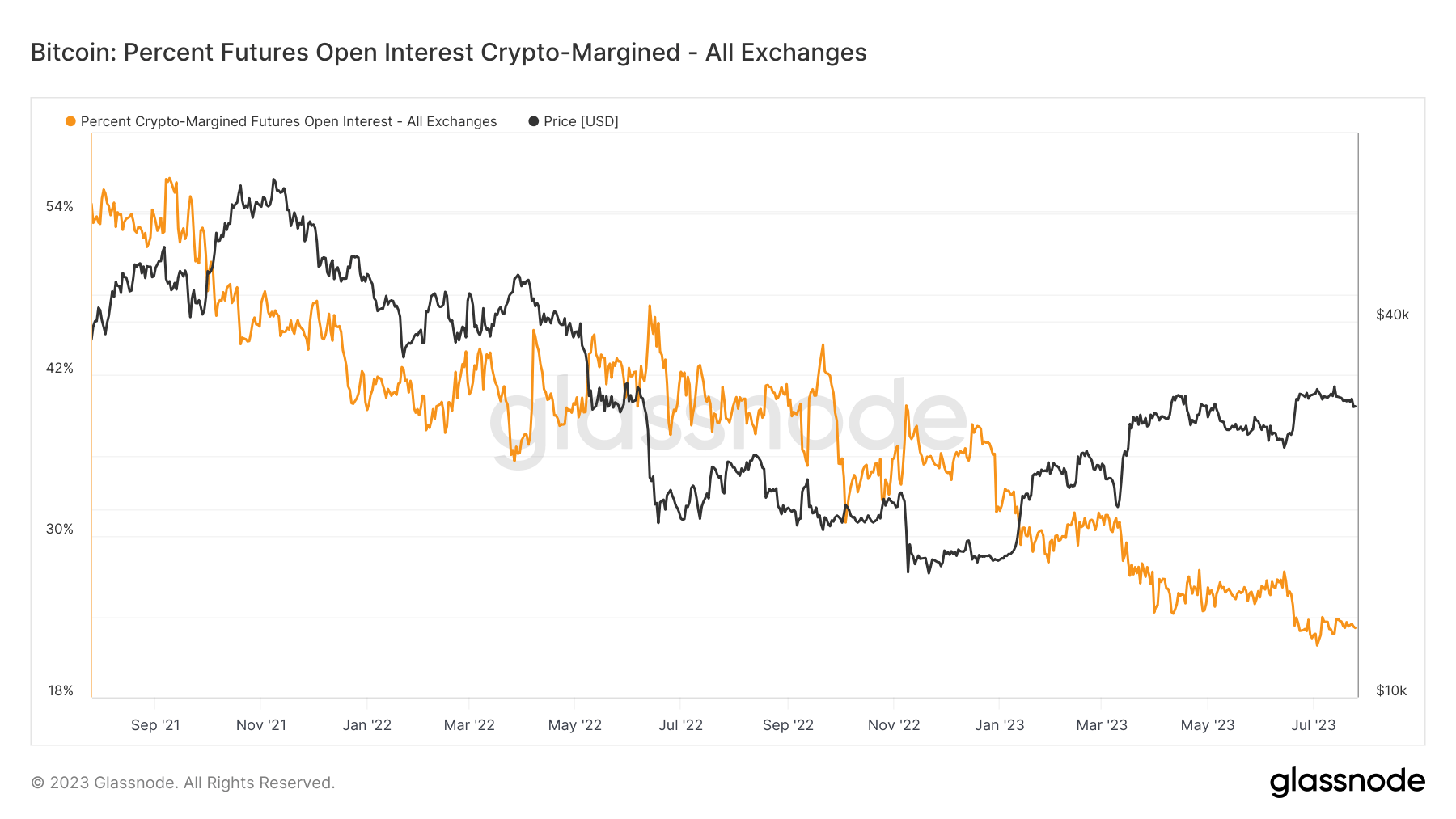

Leverage in the Bitcoin market has also seen a decrease on a YTD basis, further corroborating the shift toward spot buying. However, since May, leverage has begun to trend upward again.

A noteworthy point is that the open interest is primarily composed of stablecoins or cash margin, as opposed to crypto or Bitcoin margin. This suggests a more risk-averse stance among investors, as they seem to avoid the additional risk associated with crypto margin. In essence, despite the growing interest in Bitcoin futures, investors do not appear to be taking a risk-on approach.

The post Bitcoin derivatives market trends appeared first on CryptoSlate.