- August 1, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

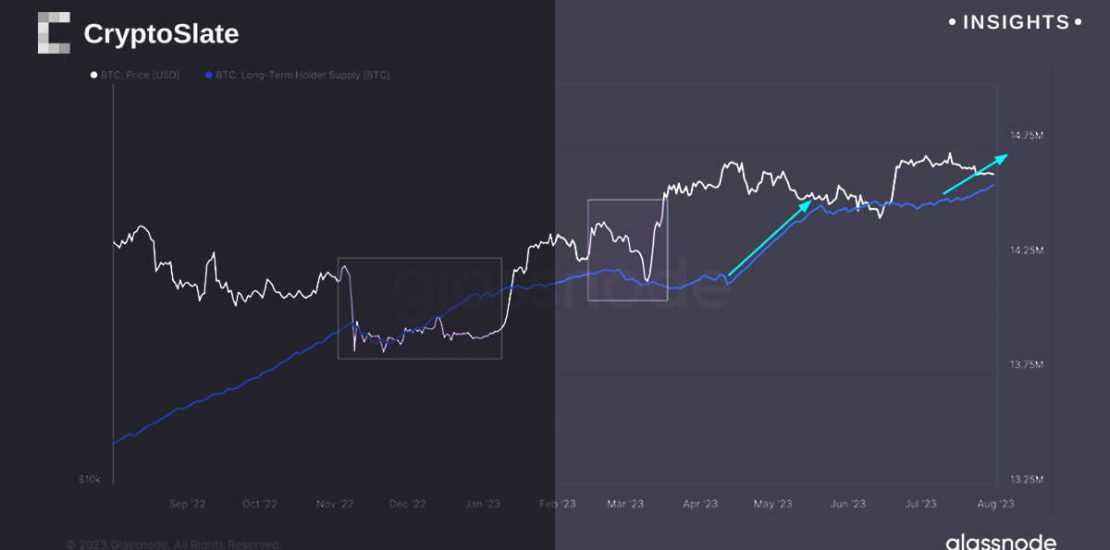

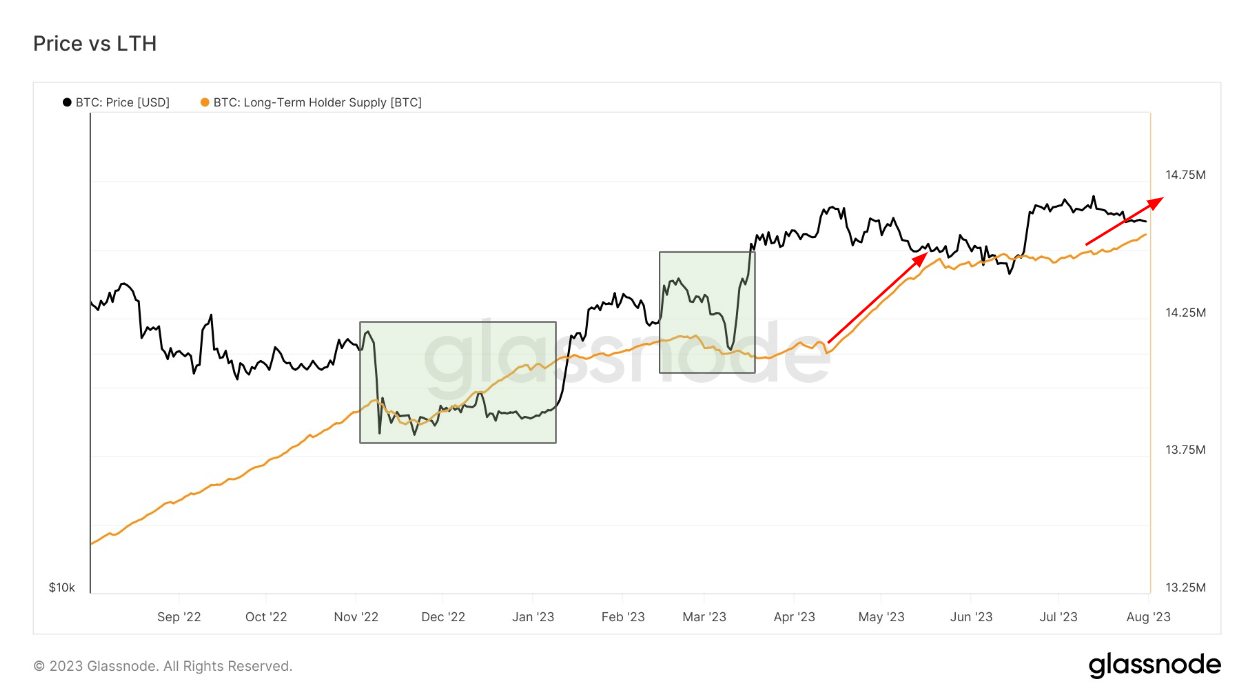

The study of long-term Bitcoin holders’ behavior, especially those who have maintained their investments for over 155 days, provides fascinating insights into market patterns. Our analysis employs historical data and current trends to anticipate potential future developments concerning long-term Bitcoin supply.

Long-Term Holder Supply Reaches All-Time Highs

At this juncture, we’ve observed an all-time high (ATH) in the long-term holder supply, reaching an impressive 14.5 million Bitcoin. This significant growth trend is not only worthy of attention but is also expected to escalate further.

155-Day Cycle and Market Events

- Before the FTX Collapse: Approximately 155 days before April 12th, the market witnessed the dramatic FTX collapse. This event represents a critical juncture in the recurring 155-day cycle, seemingly affecting the pattern of the long-term holder supply.Following the SVB Collapse: Currently, we are nearing the completion of 155 days since the SVB collapse, with approximately ten days remaining in this particular cycle

Conclusion

The recurring 155-day pattern tied to significant market events offers a compelling viewpoint on long-term holder behavior. With the long-term supply already at ATHs and showing signs of further acceleration, understanding these cycles could prove invaluable for investors and market analysts alike. As we approach the end of the current 155-day cycle since the SVB collapse, careful observation and strategic planning will be vital in anticipating the potential impact on the Bitcoin market.

The post Decoding the 155-day cycle: An analysis of long-term Bitcoin holders and market trends appeared first on CryptoSlate.