- August 8, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

The landscape of Bitcoin ownership is experiencing an unprecedented shift as the divergence between long-term and short-term hodlers reaches a historical high.

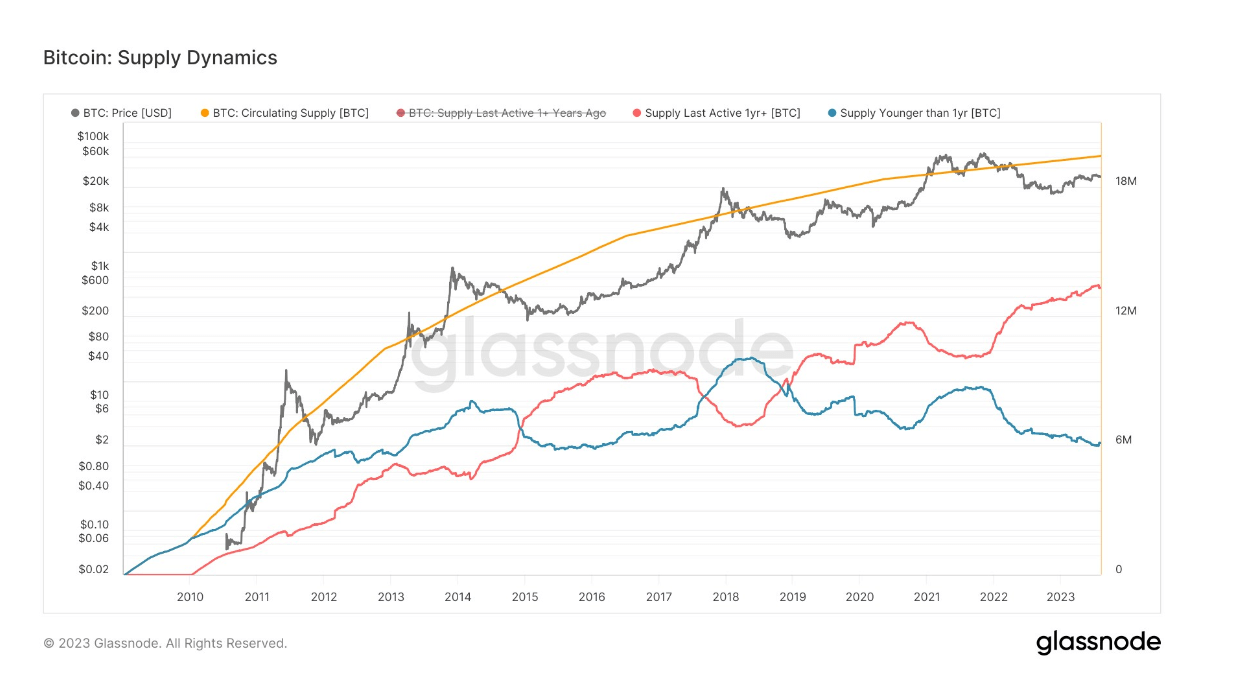

Currently, the Bitcoin market is overwhelmingly dominated by long-term hodlers, with 13.3 million entities that have held Bitcoin for a year or more. Contrarily, short-term hodlers, those who have held Bitcoin for less than a year, amount to only 6.1 million.

This change signifies a notable shift in market dynamics that typically occur during Bitcoin bull runs.

Historically, as Bitcoin prices surge, long-term hodlers begin to distribute their holdings, paving the way for short-term speculators to accumulate.

The current data suggests a deviation from this pattern, indicating that long-term hodlers are retaining their positions despite market fluctuations. This pattern could potentially signal more steadfast confidence in Bitcoin’s long-term value.

The reverse scenario—long-term hodlers purchasing Bitcoin when prices are suppressed—further highlights the strategic approach of these individuals, who seem to perceive suppressed prices as an opportunity to acquire Bitcoin relatively cheaply.

The post Long-term HODLers rule Bitcoin landscape amid strategic cling to value despite price swings appeared first on CryptoSlate.