- August 10, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

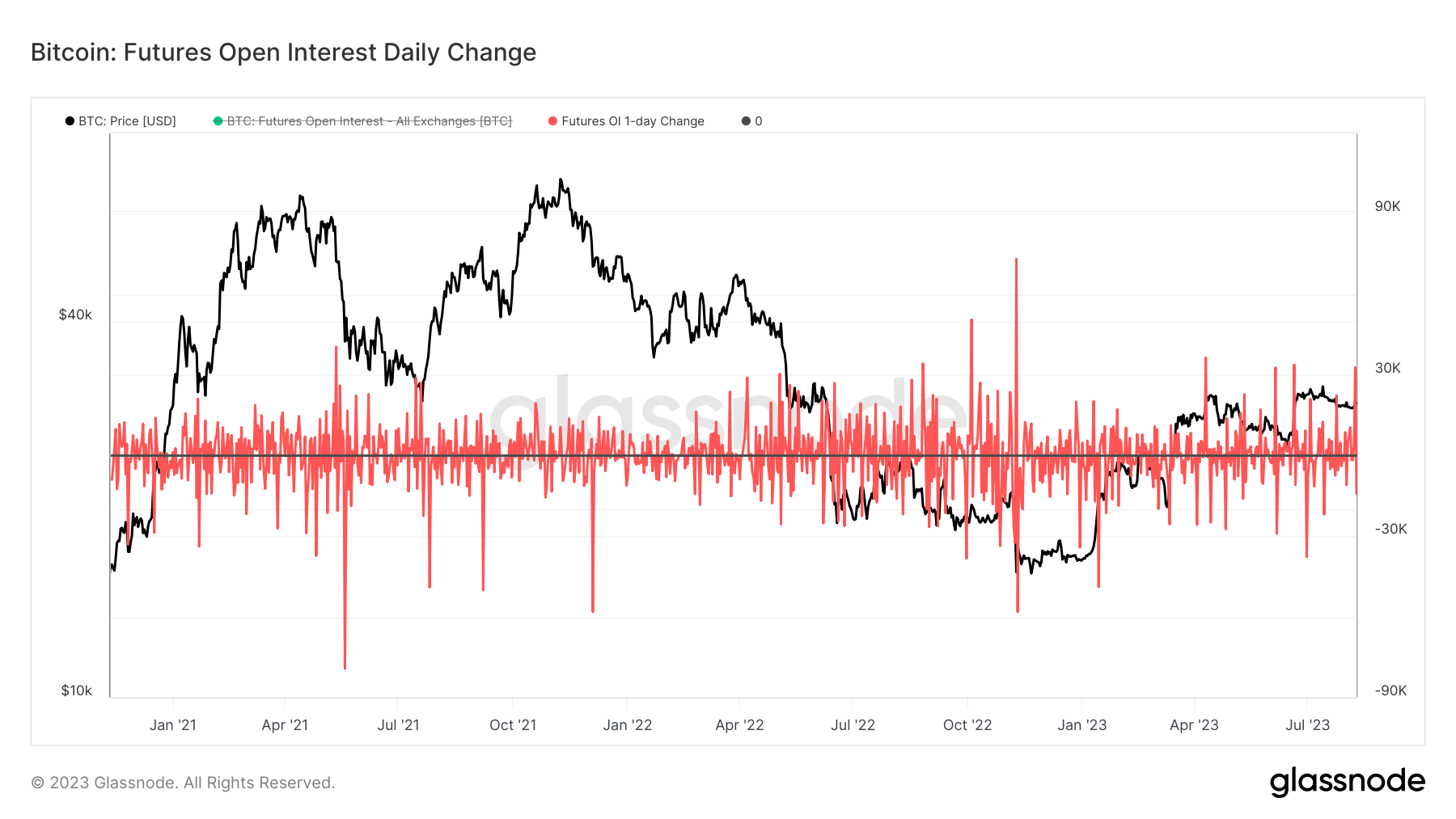

- A sharp increase in futures open interest occurred on Aug. 9 to a level seen just seven times this halving cycle, thus registering one of the largest single-day surges ever.

- An impressive addition of over 32,000 Bitcoin was channeled into futures open interest contracts, pushing the open interest close to the year-to-date highs.

- A sharp variation in Futures Open Interest often indicates deleveraging events and liquidation cascades and can swing both ways – long and short.

- Significant positive spikes typically signify substantial inflows of Open Interest, hinting at fresh capital venturing into the market and an upswing in leverage.

- On the other hand, large negative spikes usually emerge from short/long squeezes or liquidation cascades, which results in a massive volume of open contracts being margin called and closed.

The post Bitcoin futures surge suggesting fresh capital entering market appeared first on CryptoSlate.