- August 14, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin futures are financial derivatives, essentially agreements to buy or sell Bitcoin at a predetermined price at a specific date. These offer a way for traders to speculate on the future price of Bitcoin. Open interest refers to the total number of outstanding futures contracts that have not been settled. Futures contracts can be collateralized in various ways, including using the native coin of the contract (BTC or ETH), USD, or USD-pegged stablecoins.

Monitoring the difference in open interest in crypto-margined and cash-margined futures is crucial for understanding market dynamics. When Bitcoin futures contracts are collateralized with Bitcoin, the risk of liquidation increases. If an investor is long Bitcoin with Bitcoin as collateral and the market experiences a sharp downturn, the net loss of the position and the value of the collateral decrease simultaneously. This dual loss makes the position more susceptible to being liquidated or stopped out.

In simpler terms, using Bitcoin to back a long position on Bitcoin amplifies the risks. If the price of Bitcoin falls, not only does the value of the position decrease, but the collateral itself also loses value, creating a compounded risk.

On the other hand, collateralizing futures contracts with USD or stablecoins can significantly reduce the risk of large leverage cascades during market downturns. Using a stable asset as collateral, the value of the collateral remains constant, even if the underlying asset’s market price fluctuates. This stability provides a buffer against sudden market movements and reduces the likelihood of forced liquidations.

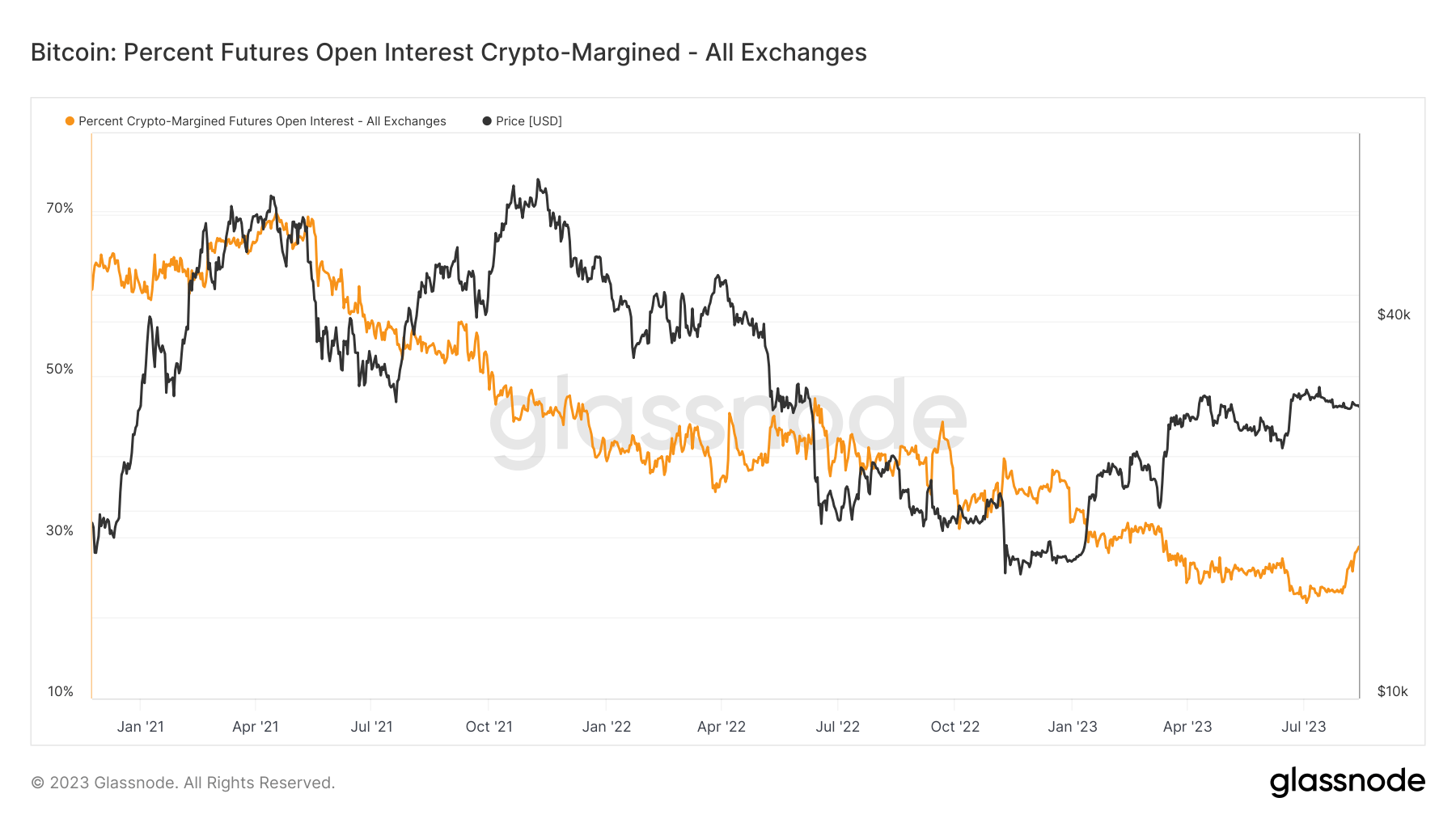

According to data from Glassnode, the percent of futures open interest that is margined in the native coin of the contract (e.g., BTC and ETH) currently stands at 28.8%. This figure reached an all-time low on July 3, dropping to 21.8%.

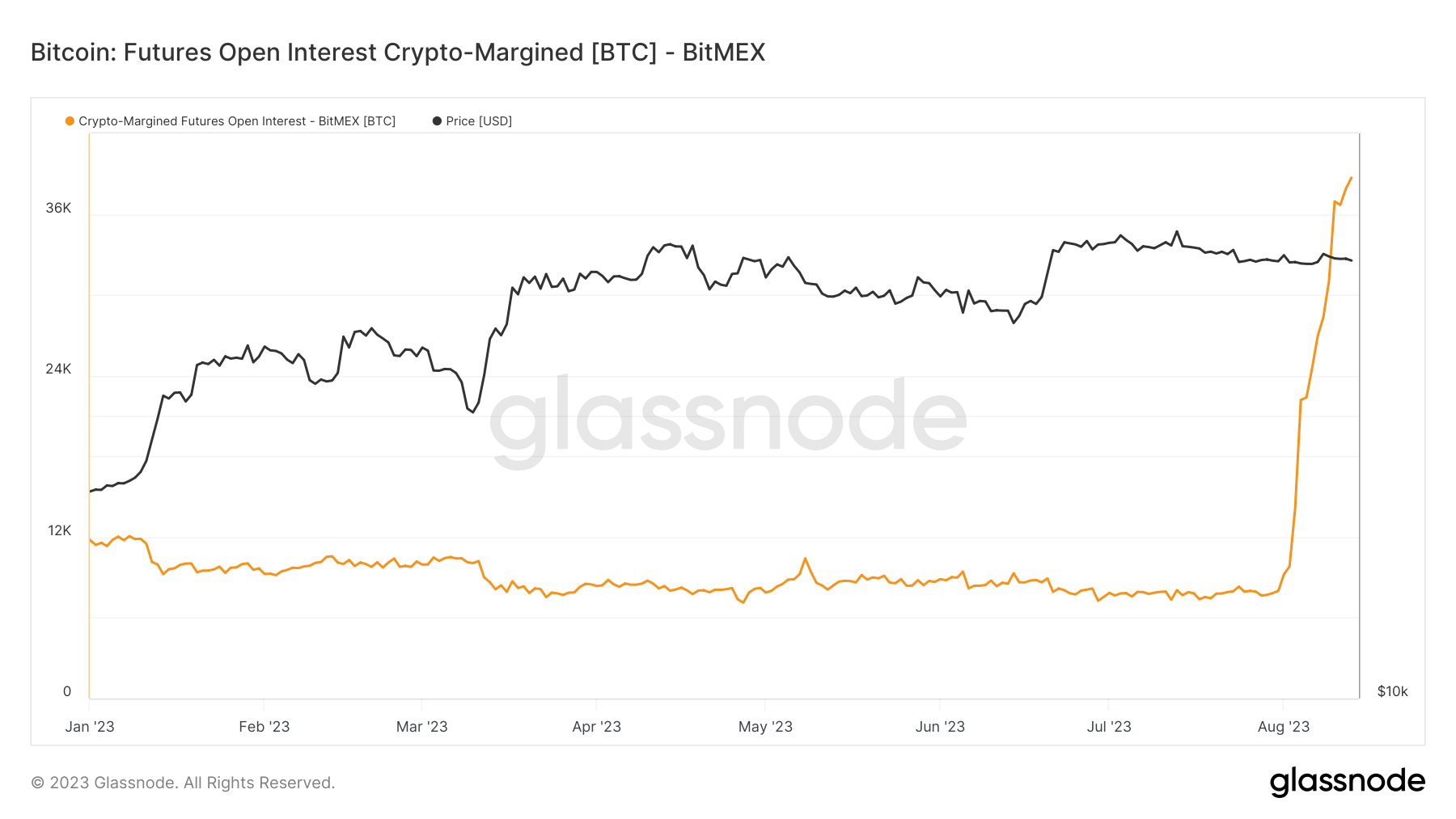

The recent increase in crypto-margined open interest can be attributed to BitMEX, which saw an aggressive spike in August. The total amount of futures contracts open interest collateralized in crypto increased from 7,998 BTC on July 31 to 38,712 on August 12, representing a 384% increase.

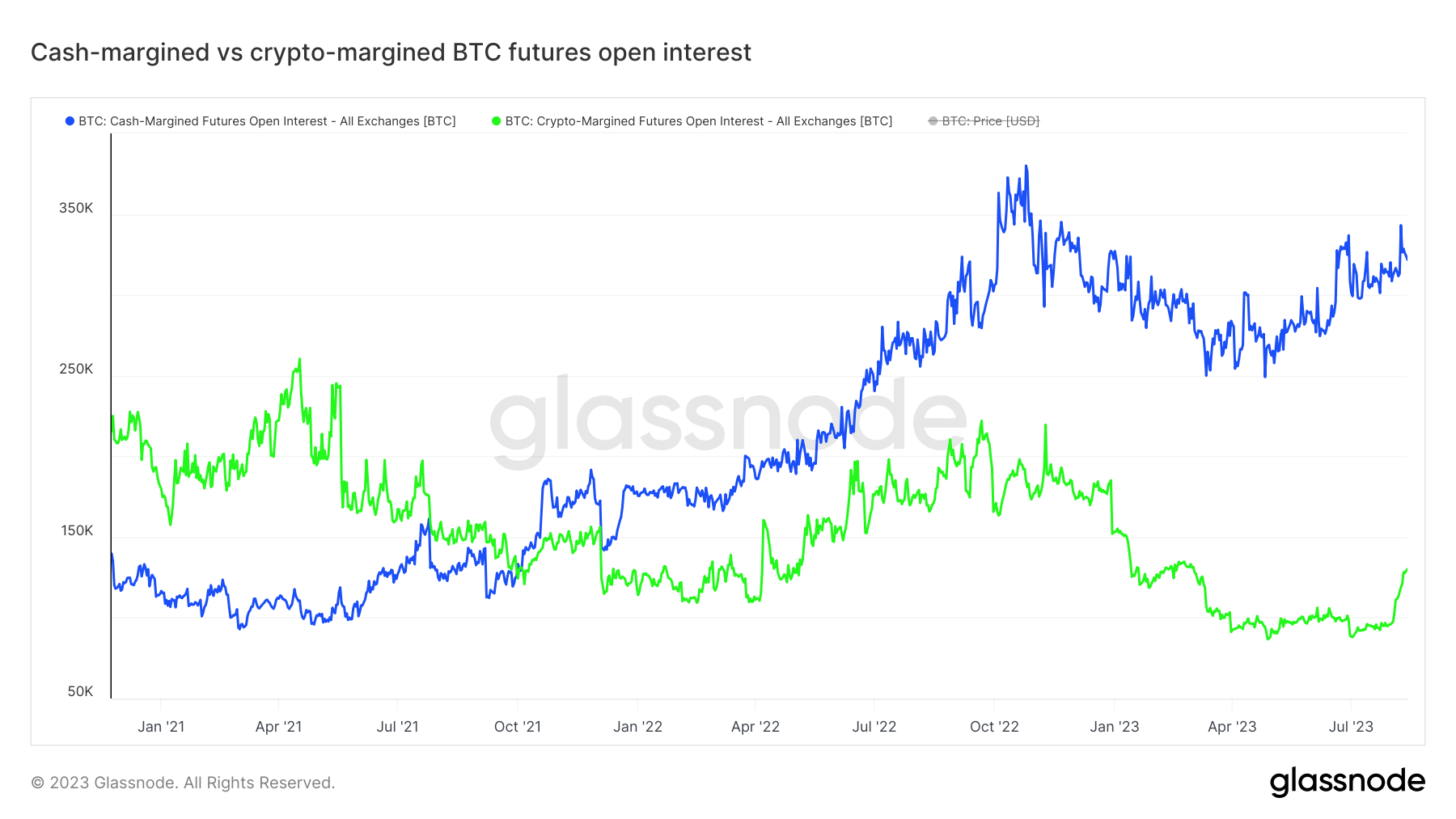

Comparing the crypto-margined and cash-margined futures open interest reveals a discrepancy that has never been higher. This divergence indicates a growing market preference for stability and risk mitigation as more traders opt for USD or stablecoin collateralization.

The shift towards cash-margined futures may signal market participants’ new, more cautious approach, reflecting concerns over potential volatility and the desire to minimize exposure to liquidation risks.

The post Decline in crypto-margined futures may signal market maturity appeared first on CryptoSlate.