- August 15, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

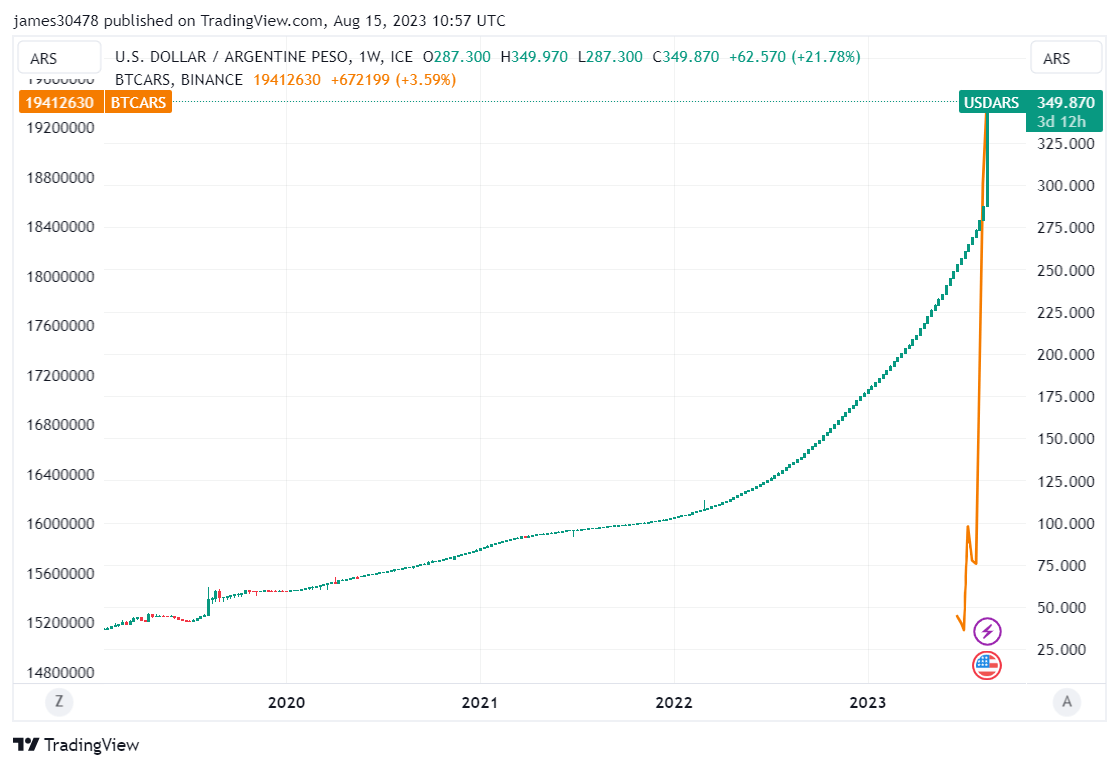

Argentina’s economy is experiencing intense fluctuations, as demonstrated by the country’s history of nine monetary defaults. According to Bloomberg, the recent overnight devaluation of its currency by nearly 20% has introduced severe economic pressures on consumers and citizens. With an already staggering inflation rate of 115%, the Central Bank has introduced further measures to curtail escalating prices by hiking interest rates an additional 21%, leading to a total interest rate of 118%, according to analyst Mohamed A. El-Erian.

The stark contrast emerges when comparing the Argentine peso with Bitcoin. Presently, one US dollar equals 350 Argentine pesos. However, in the Bitcoin exchange, the figures are incredibly higher, with one Bitcoin equating to over 19 million pesos. This comparison underscores the economic volatility in Argentina and the growing digital asset market’s potential as an alternative store of value in the face of the traditional financial system’s instability.

The post Bitcoin emerges as alternative store of value amid Argentina’s surging economic volatility appeared first on CryptoSlate.