- August 29, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Mastercard held its first-ever blockchain innovation sprint in London last week as part of the development of its Multi-Token Network (MTN.)

Among the participants was fintech startup Polytrade, which showcased how its blockchain-based platform for trade financing could integrate with the MTN.

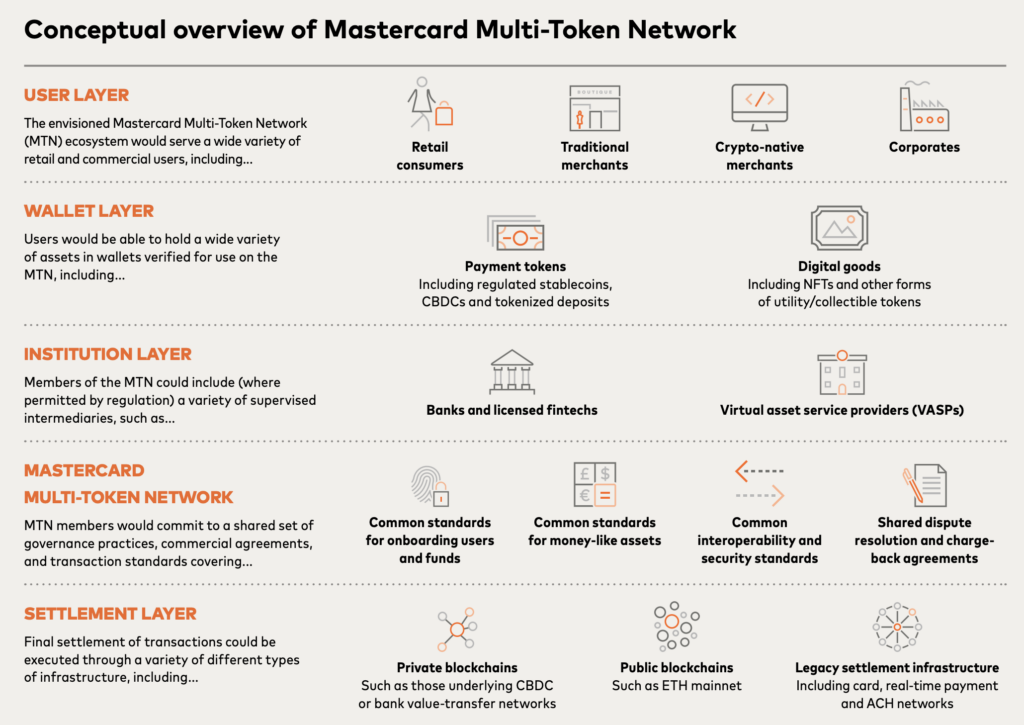

The network aims to enable consumers, merchants, and banks to transact seamlessly and securely using blockchain-based digital assets. Mastercard published a whitepaper for the network, which acts as a kind of ‘multi-chain layer-2′ but without any consensus mechanism. It is described as a “network overlay” designed to optimize blockchain transactions for legacy finance systems.

“Our goal is for the MTN to include a group of validated counterparties that would form a secure network overlay on top of existing blockchains”

As outlined in the whitepaper, Mastercard views the MTN as a way to mitigate risks and overcome challenges that have thus far limited mainstream blockchain adoption. The network would establish standards for compliance, governance, interoperability, and stability of payment tokens. The whitepaper defines the MTN as,

“The Mastercard Multi-Token Network

(MTN), which would serve as an entirely new scheme composed of a group of validated counterparties that form a secure network overlay that sits on top of, and extends across, multiple public and private blockchains.”

Mastercard views the MTN as a critical layer in a holistic system of digital networks. The diagram below outlines how MTN would integrate with web3 by acting as a transactional layer between banks, service providers, and the settlement layer.

Polytrade showcases the power of MTN.

Polytrade is developing a decentralized protocol to enable small and medium enterprises to access funding for cross-border trade transactions. It facilitates lending and investment from a global pool of capital providers by tokenizing invoices and other trade-related assets. The process essentially decentralizes invoice financing, whereby companies can access funds at a time when they would otherwise be illiquid.

According to Piyush Gupta (PG), co-founder of Polytrade, the startup sees strong potential synergies with Mastercard’s MTN vision. PG said,

“We are super bullish given the amazing pace of the Mastercard Multi-Token Network and the Mastercard team.

Thank you Mastercard for giving us this opportunity to work on a use case leveraging the Mastercard Multi-Token Network.”

By bringing together traditional financial institutions and crypto-native companies, Mastercard looks to create a network that unlocks the potential of blockchain and digital assets for mainstream payments and commerce.

Founder of Farmsent, YOG, commended the progress, stating, “So happy to see the #RWA project like Polytrade getting all the deserved attention and success.” RWA stands for real-world asset and is a burgeoning sector of web3 with developing and scrambling to offer the best method of tokenizing assets from the physical world, on-chain.

According to the whitepaper, the MTN pilot aims to address concerns around compliance, governance, and interoperability that have thus far limited adoption.

How MTN compares to blockchain networks.

MTN is designed as an overlay network that sits on top of existing public and private blockchains to offer additional security, compliance assurance, and interoperability among them.

MTN lacks the hallmarks of a standalone blockchain. It does not have its own consensus mechanism or validate transactions. Instead, transactions are settled on underlying blockchains connected through MTN.

MTN is described as a network overlay extending across multiple chains rather than its own blockchain. Its main purpose is establishing common rules, compliance standards, and governance procedures.

By leveraging the security and immutability of connected blockchains while adding compliance and interoperability, MTN aims to provide a framework improving the trustworthiness and flexibility of transactions across different ecosystems.

So while MTN connects various blockchains together, it does not appear to function as a blockchain itself based on the details provided in the whitepaper. The value proposition focuses on network effects in linking chains instead of a new consensus mechanism.

The post Mastercard Multi-Token Network moving at ‘amazing pace’ as Polytrade tests RWA token integration – report appeared first on CryptoSlate.