- October 4, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows more than 50% of the Bitcoin supply in circulation has remained dormant since at least five years ago.

Bitcoin Supply Aged More Than 5 Years Is Only Continuing To Grow

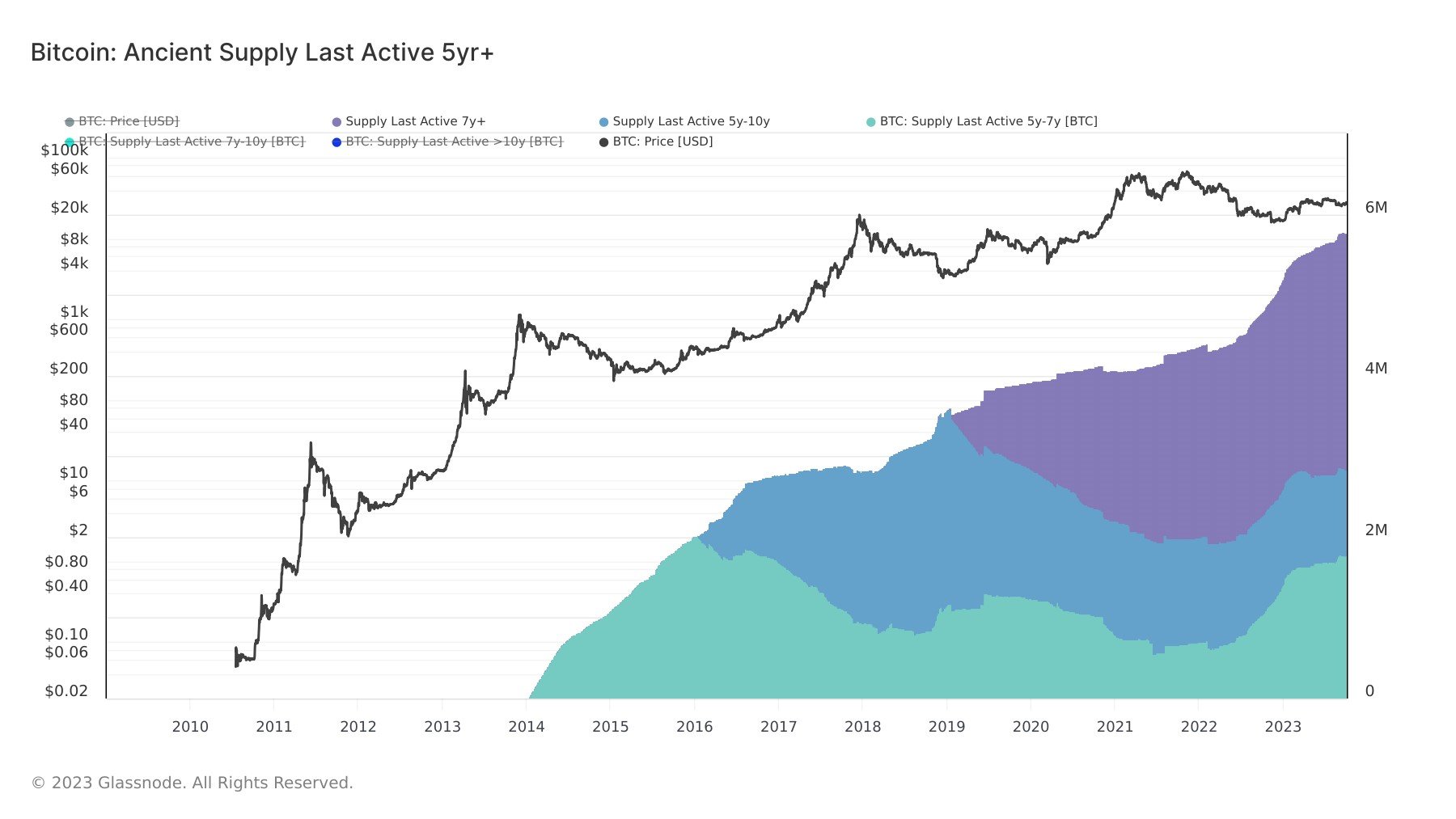

In a new post on X, analyst James V. Straten shared a chart that reveals the supply distribution of coins aged more than five years. The investors with coins this old make up a segment of the “long-term holders (LTHs),” which is a cohort that includes all addresses carrying their Bitcoin since at least 155 days ago.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell or transfer the coins at any point. Due to this reason, the LTHs are the resolute hands of the market, who rarely sell even during periods of high profits or losses.

Since the investors with coins aged more than five years have been holding for quite a time even among these LTHs, these holders would be the strongest-minded bunch in the entire sector.

Here is a chart that shows how much percentage of the circulating Bitcoin supply falls under this age category right now:

According to Straten, the Bitcoin LTHs carrying coins between five and seven years old currently hold a combined 1.8 million BTC. The seven to 10-year-old cohort carries 2.8 million BTC, while the group even beyond this mark is holding 5.7 million BTC.

These holdings all add up to about 10.4 million BTC, which is equivalent to about 53.3% of the cryptocurrency’s entire supply. This means that more than half of the circulating supply has been dormant since at least five years ago.

Something that should be noted, however, is that a large chunk of this dormant supply would in fact be coins locked inside addresses that have been forgotten or have had their keys become inaccessible.

This part of the supply isn’t dormant because their investors are willingly HODLing, but because they are simply lost. That said, the entire five+ year supply wouldn’t be lost, of course, there would also be many real LTHs part of this segment.

Either way, whether lost or HODLed, this supply is essentially locked away from trading. And since this supply has only continued to grow over the years (as the chart displays), Bitcoin is constantly becoming locked in this way.

Due to how supply-demand dynamics tend to work out, this development can naturally have some bullish effects on the cryptocurrency’s price, although they may only be visible when studying over long spans.

BTC Price

Following the retrace from the recent highs, Bitcoin has continued to consolidate sideways around the $27,500 mark over the last couple of days.