- October 10, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The realized price represents the average cost at which all current Bitcoin holders bought their coins. Essentially, it provides a snapshot of the “collective memory” of the market, capturing the price at which the last transaction of each Bitcoin took place. Determining Bitcoin’s realized price is crucial as it offers insights into the actual profitability of the market’s participants. However, like any metric, it’s not without flaws. A potential drawback is that it doesn’t account for lost or dormant coins, potentially skewing the estimation.

The True Market Mean Price, commonly called the Active-Investor Price, is a novel metric pioneered by ARK Invest in collaboration with Glassnode. Rather than relying on historical transactions, this measurement emphasizes the actions of current market participants. Specifically, it calculates the average price at which Bitcoins were last transacted, considering only those coins that have changed hands within a defined period. This approach filters out the influence of long-dormant coins and focuses on recent market sentiment. As a result, the True Market Mean Price delivers a precise representation of the value at which active Bitcoin participants, those genuinely involved in the market dynamics, have acquired their assets.

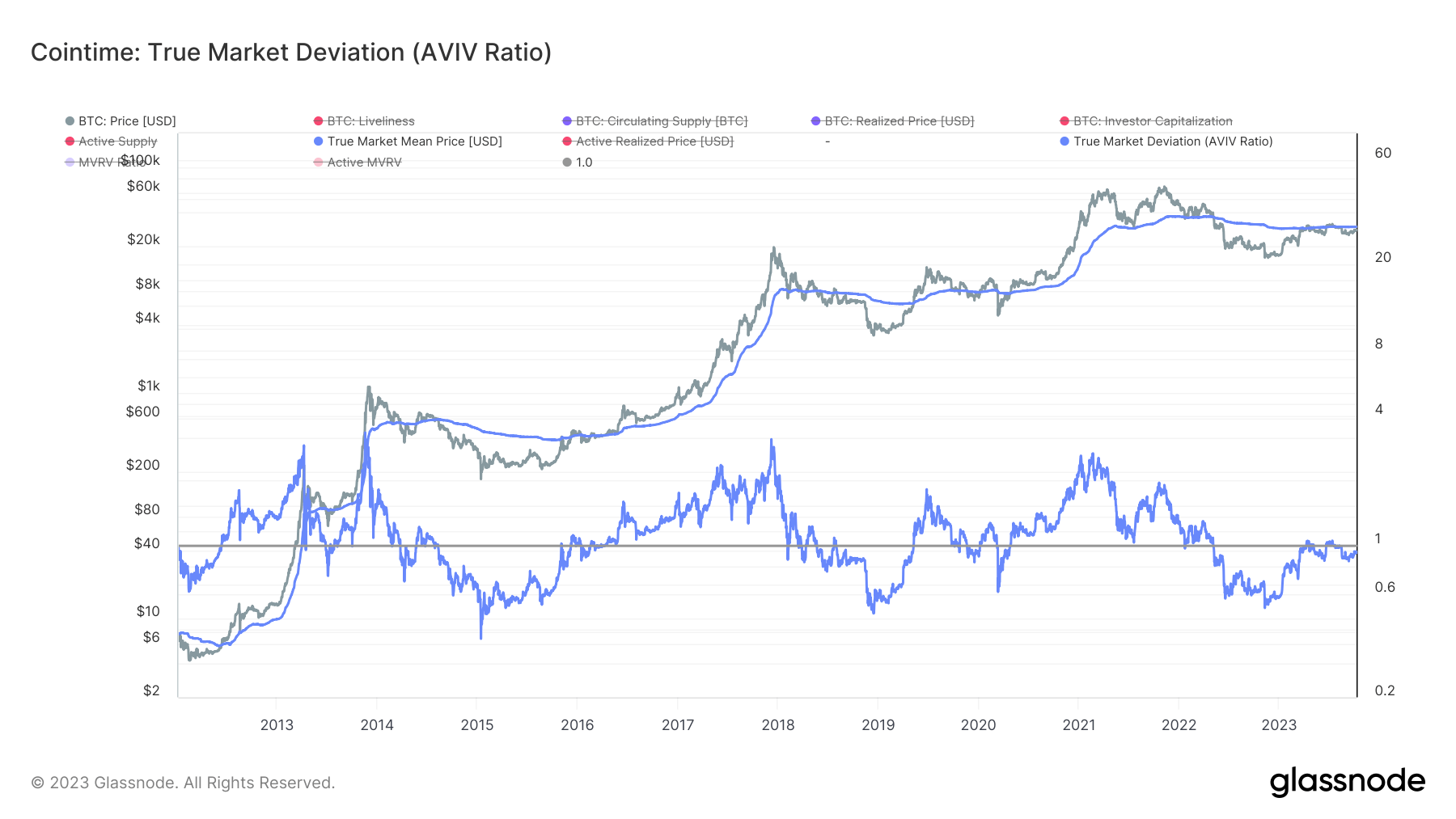

Building on this metric is the True Market Deviation, which calculates the ratio of the current spot price of Bitcoin to the True Market Mean Price. The higher the ratio, the greater the deviation from the average price paid by active investors. Essentially, this metric can indicate whether Bitcoin is currently overvalued or undervalued based on active market participation.

Recent data from Glassnode sheds light on the importance of this deviation. Historically, dips in the True Market Deviation below one have consistently correlated with price drops. On the other hand, spikes above one have signaled bull rallies. This implies that when Bitcoin’s spot price surpasses the True Market Mean Price, it often indicates a market top, signaling a potentially good selling opportunity. Conversely, when the price drops below this mean price, it has traditionally signaled a robust buying window.

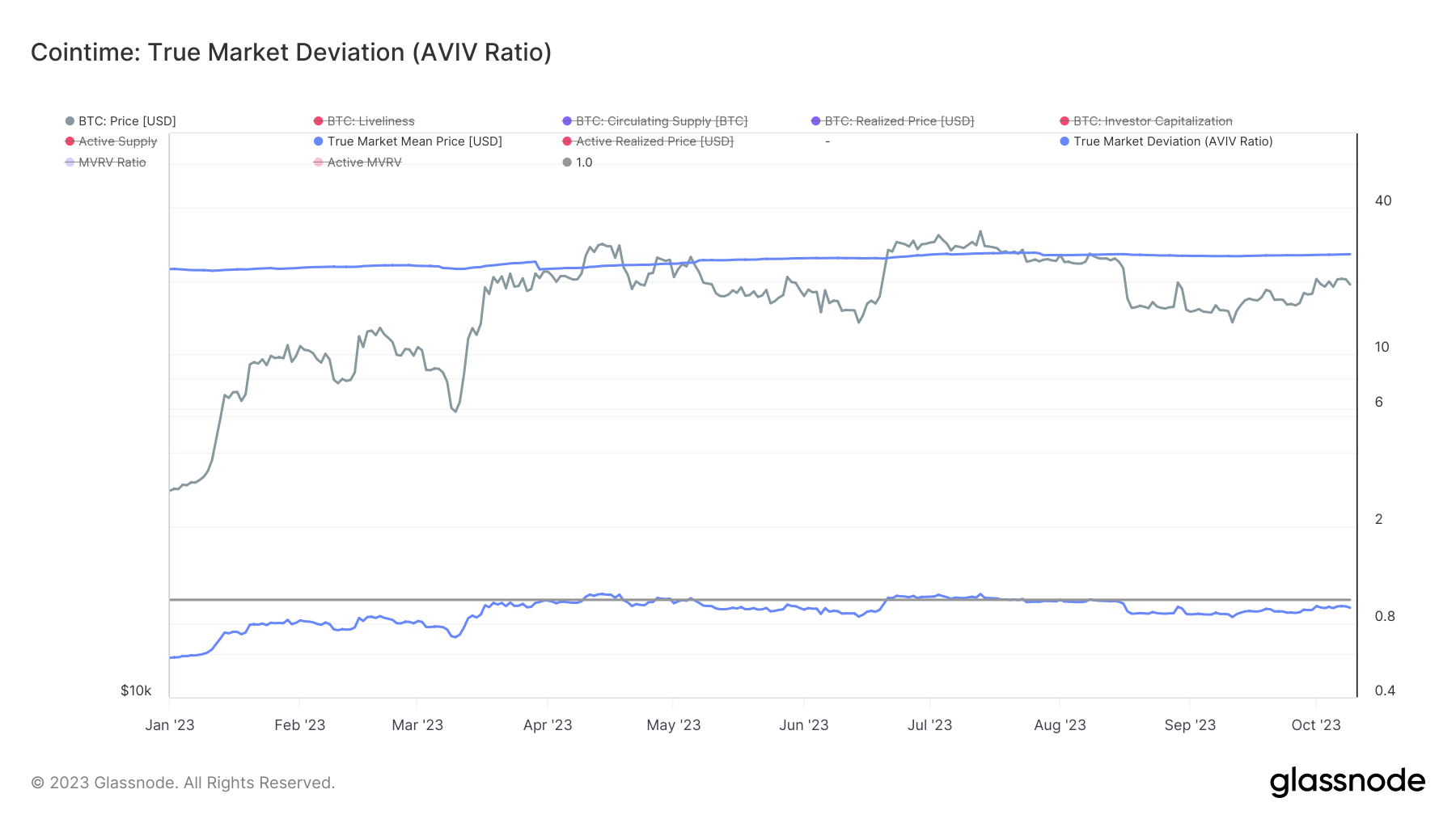

Fast-forward to this year’s data. Since the beginning of the year, the True Market Mean Price for Bitcoin has seen a modest uptick, moving from $28,660 to $29,720. Intriguingly, Bitcoin’s price has remained above this mean for less than 30 days throughout the year. With Bitcoin’s jump above $27,000, the AVIV ratio has increased, standing at 0.928. At the time of writing, Bitcoin’s spot price is around $27,590, notably below the True Market Mean Price of $29,720.

The data suggests that despite the recent surge, Bitcoin might still be undervalued when considering the price at which active market participants acquired their coins. This could hint at a potential upward movement in the near future, provided other market factors remain conducive.

The post Active investor price: a fresh perspective on Bitcoin’s valuation appeared first on CryptoSlate.