- October 11, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

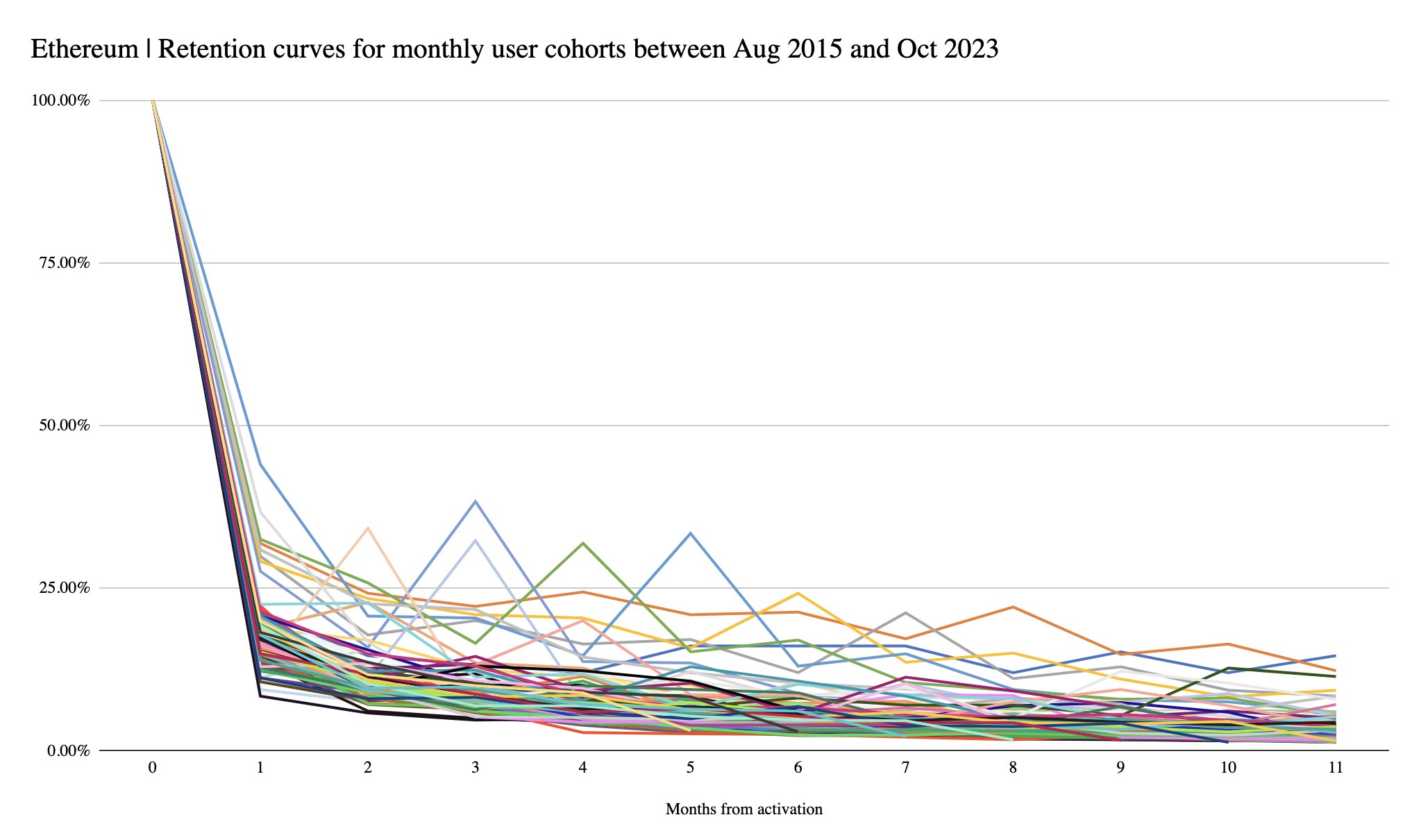

Only 7% of users who first interact with Ethereum will continue to do so even after a year, latest Token Terminal data on October 9 shows. This statistic means that roughly 93% of users will stop using the platform to transfer tokens or deploy smart contracts within a year. This suggests that the platform (or its underlying technology) is still perceived to be complex, or users might not be too eager to engage and interact.

Ethereum Is Struggling With User Retention

Despite its clear lead and popularity, what could disincentivize users from using Ethereum is not immediately clear. Token Terminal, an analytics platform, posted a graph showing fast-falling interest over time based on data collected between August 2015 and October 2023.

Ethereum first launched in July 2015. However, its developers have continuously enhanced the platform, making it more performant, specifically emphasizing improving scalability.

The ledger is the first to allow users to launch decentralized applications (dapps). These protocols are immutable and powered by smart contracts in a generally secure environment guided by globally distributed validators.

The distribution and decentralization of validators mean protocols launching on Ethereum, such as Uniswap, are censorship-resistant. Ethereum is popular because of Ether (ETH), its native currency, now the second most valuable coin after Bitcoin. Beyond this, the chain anchors decentralized finance (DeFi), non-fungible token (NFT) activities, and others.

Scalability, Security, And Complex User Interfaces Can Discourage Interaction

While the prominence of Ethereum is apparent, and billions of transactions are moved through the platform every year, the network struggles with on-chain scalability. At peak, the blockchain can only process 15 transactions every second.

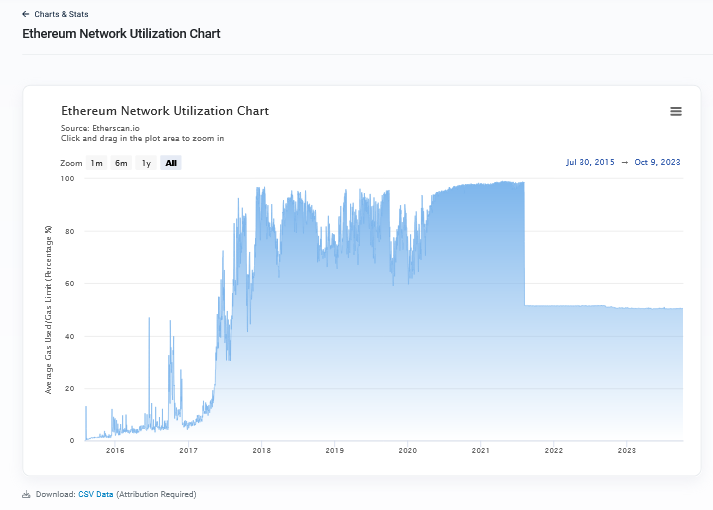

Subsequently, transaction fees are relatively higher since the demand for block space is also high. As of October 10, the network utilization rate stood above 50%, meaning more users demand a slot in every block space added to the Ethereum blockchain. The high demand translates to more fees than those observed in competing networks like Solana or TRON, which are more scalable.

The possibility of high gas fees dampening engagement can be one factor. A level deeper, challenges related to user interfaces, hacks of protocols deploying on Ethereum, and rising competition, even from traditional applications, might explain why users are giving up or considering alternatives.

Users rely on non-custodial wallets like MetaMask to directly engage with the network. The need to download and install a third-party application before posting transactions or swapping can discourage some from proceeding.