- October 12, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

A closer examination of the roughly 8,000 Bitcoins (BTC) transferred into exchanges on Oct. 12 reveals a heightened sense of trepidation among short-term holders, affirmed by trading activities highlighted in CryptoSlate insights earlier today, Oct. 12.

Large-scale ‘whale’ activity, a trend seen throughout 2023, has often coincided with Bitcoin price fluctuations without an exclusive link to bullish or bearish events. However, short-term holders (STH) also play a crucial role in the Bitcoin economy.

Defined as investors who have retained Bitcoin for fewer than 155 days, STHs are often viewed as more speculative than long-term holders as they are often more price sensitive.

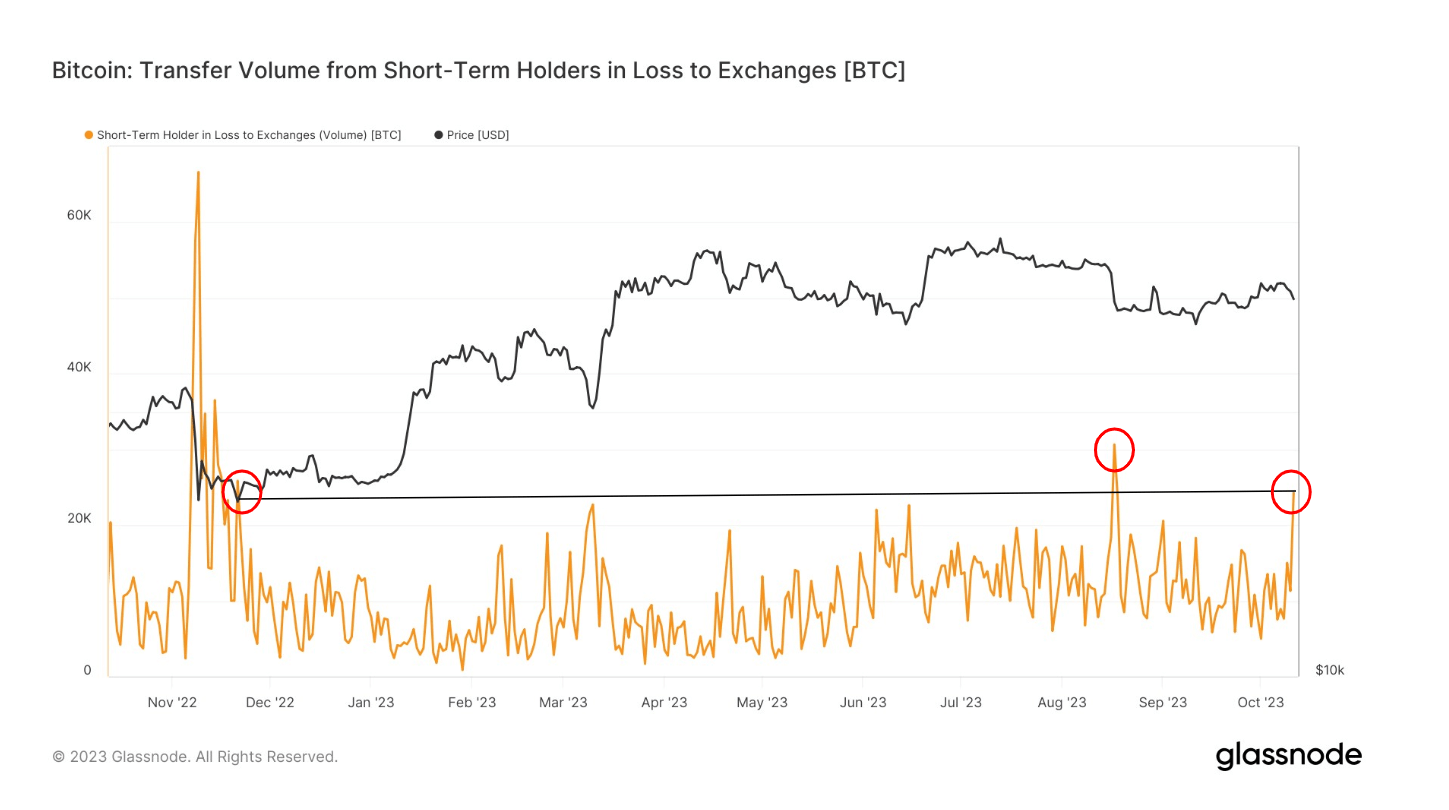

STH Bitcoin holders sold approximately 24,000 BTC at a loss to exchanges under unfavorable conditions. This activity marks the second-highest volume this year. Further, these investors typically entered the market when Bitcoin was trading above $29,000 back in July and August.

The dread within the market was only more intense once this year on Aug. 17. On this day, the Bitcoin market took a significant hit, with the value plummeting from $30,000 to $26,000. Consequently, around 30,000 BTC were sold at a loss by the same cohort.

Notably, the FTX collapse in November 2022 saw STH transfers peak to around 65,000 BTC.

The post Bitcoin selloff by short-term holders spikes amid market fears, data shows high volume of losses in 2023 appeared first on CryptoSlate.