- December 4, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

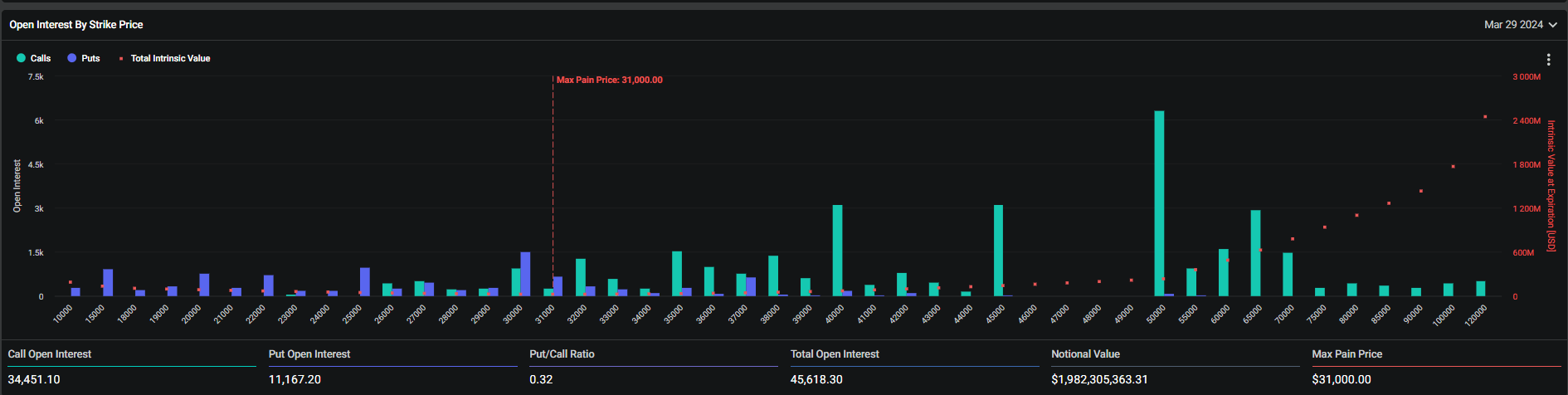

Data from Deribit paints a compelling picture of Bitcoin’s potential by the end of Q1 2024. Based on strike price, options open interest pinpoints a possible value of $50,000 for Bitcoin by March 29. The call wall at this price is robust, exhibiting a notional value of $275 million, which dwarfs the notional values of put options.

This imbalance is reflected in the put/call ratio (0.32), indicating a significantly higher call options volume. It is important to note that the total notional value set to expire is a staggering $2 billion, with a max pain price of $31,000.

The undercurrent of these data suggests a potential gamma squeeze, which, given the low levels of put options (all below $30,000), is likely to orient towards the upside rather than the downside.

This analysis proposes a potentially bullish scenario for Bitcoin as we edge closer to Q1 2024.

The post Deribit data hints at $50,000 Bitcoin value by March 2024 amid potential gamma squeeze appeared first on CryptoSlate.