- December 5, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

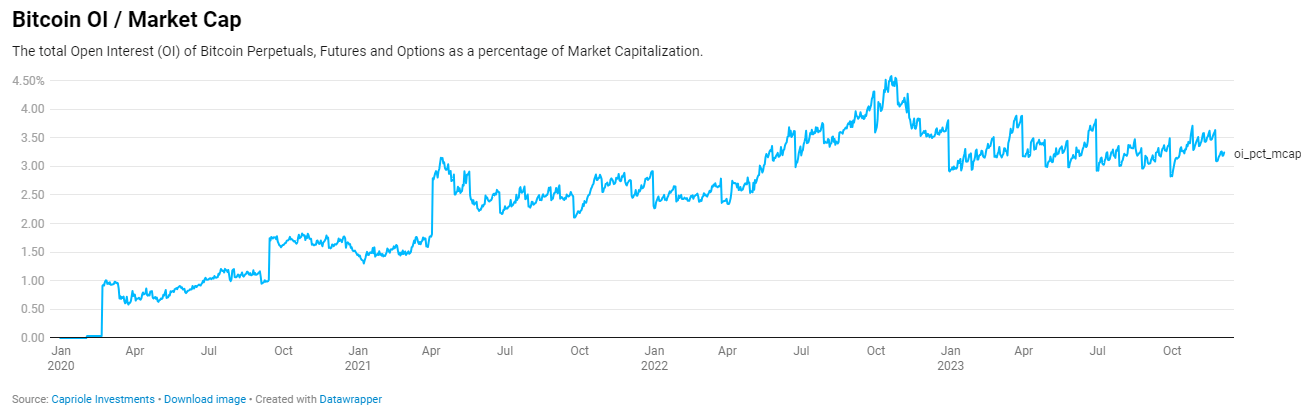

An analysis of derivative market indicators presents an encouraging health check. Historically, an open interest as a percentage of Bitcoin’s market capitalization around 2% is considered healthy.

Advancing this measure, the total open interest (OI) of Bitcoin perpetual, futures, and options, as a percentage of market capitalization, is currently standing at 3.24%, according to Capriole Investments. This figure has maintained a steady range throughout 2023, swinging between 3.00% and 3.5%, with brief overheating noted in March and June.

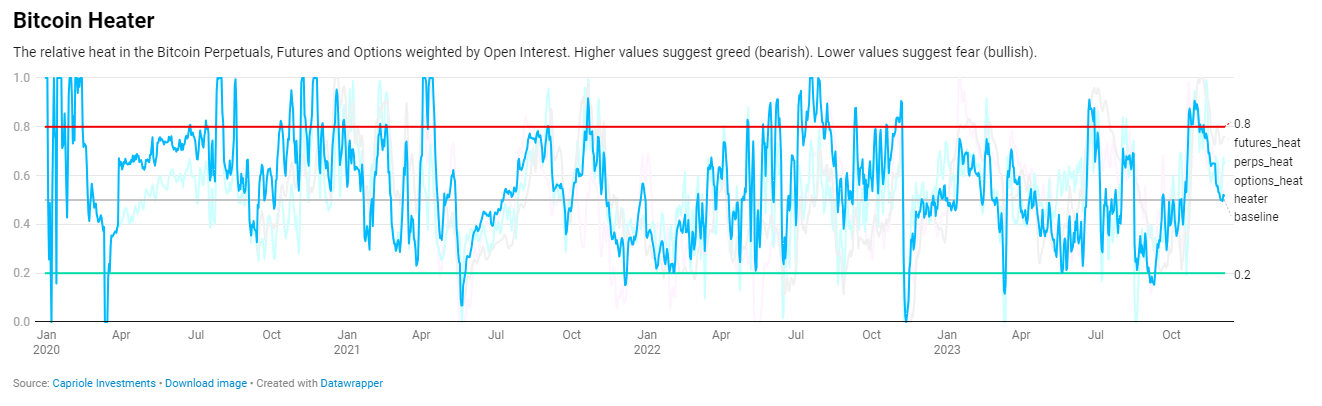

Complementing this data, examining the Bitcoin heater model by Capriole Investments – which measures the relative heat in the Bitcoin perpetual, futures, and options weighted by open interest – provides further evidence of market balance. Higher values here indicate a greed-driven market (bearish), while lower values suggest a fear-driven market (bullish). Current figures place the market squarely in the middle of the range, indicating a balanced state. Along with a steady OI as a percentage of market cap throughout the year, these metrics suggest the Bitcoin derivatives market is in a healthy condition

The post Bitcoin derivatives market shows stability with balanced open interest levels appeared first on CryptoSlate.