- December 6, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

As recent data suggests a potential economic deceleration, traditional market indicators and digital assets seem to be subtly treading two different paths.

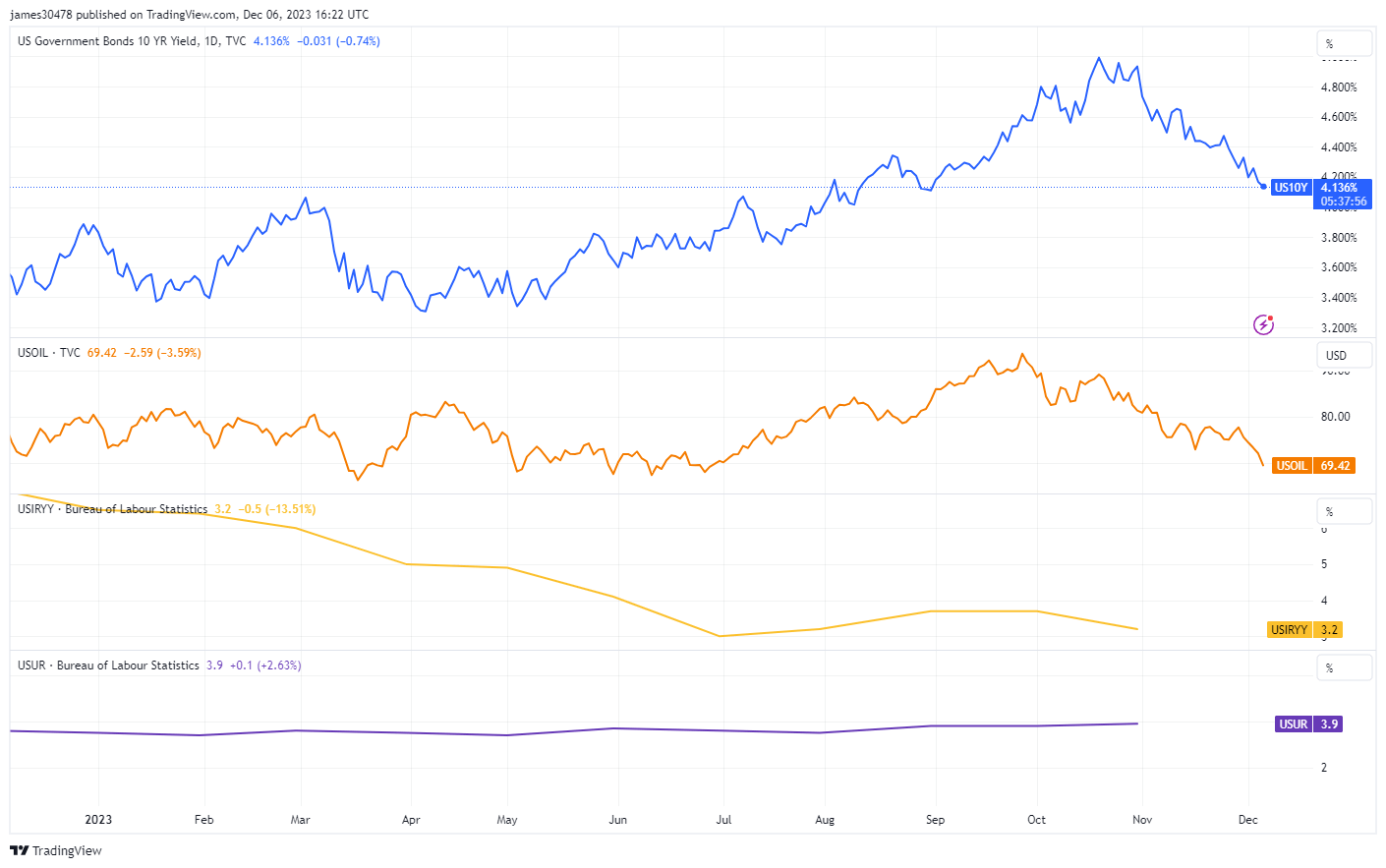

Notably, US oil prices have dropped over 20% from $90 a barrel in October to below $70, a significant movement as oil often reflects global demand.

Simultaneously, the US10Y yield, a global benchmark for interest rates, continues its downward trend, now at 4.125%, its peak since August. This declining yield, juxtaposed with falling inflation at 3.2% and a rise in unemployment in the US at 3.9%, strengthens the recessionary hypothesis.

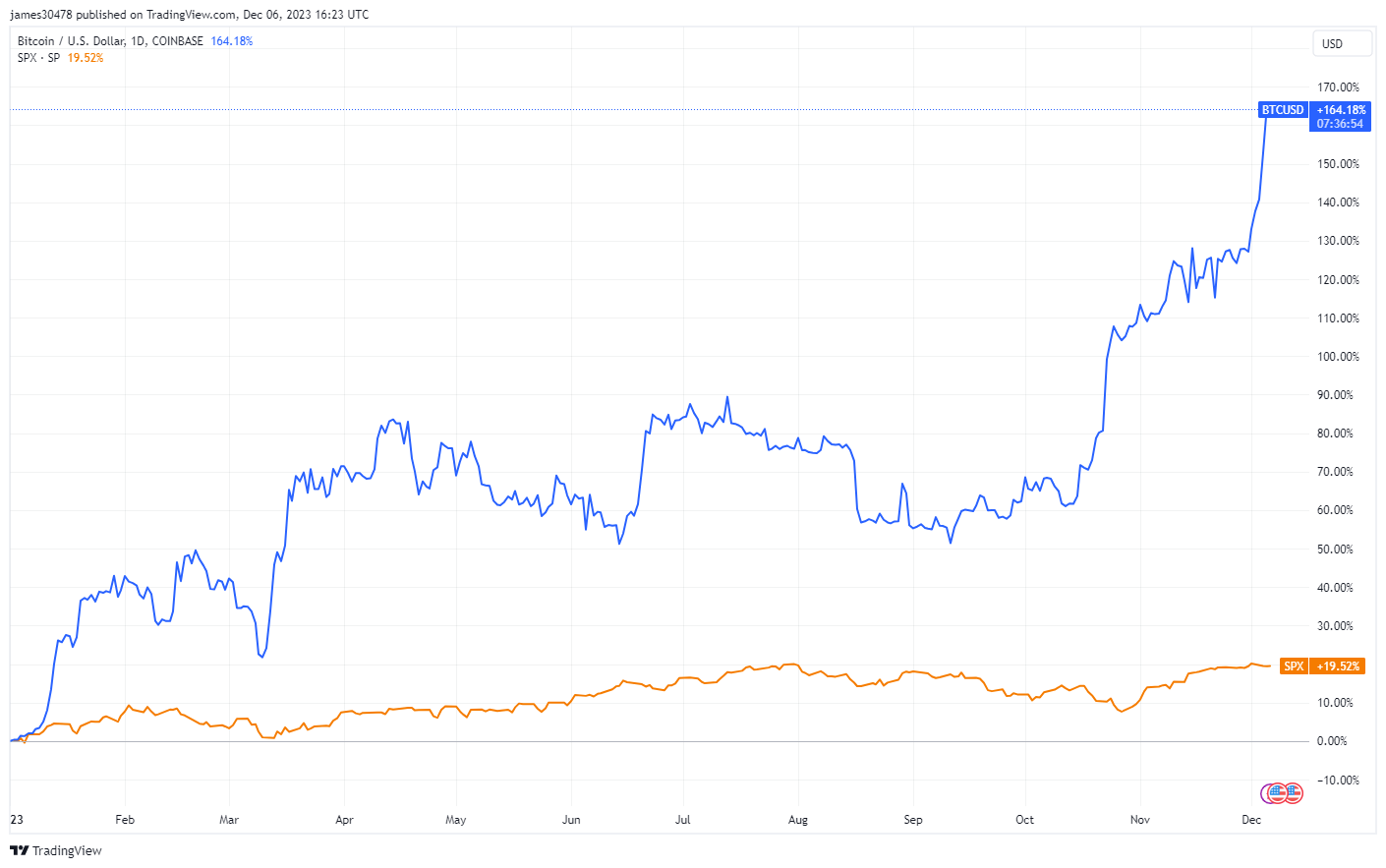

Strikingly, however, many digital currencies, including Bitcoin, and equities have displayed indifference to these developments, maintaining their trajectory.

This apparent disconnect may suggest a shift in market dynamics, wherein digital assets respond differently to macroeconomic changes or are potentially lagging in response.

The post Digital assets defy traditional market trends amid signs of economic slowdown appeared first on CryptoSlate.