- December 29, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

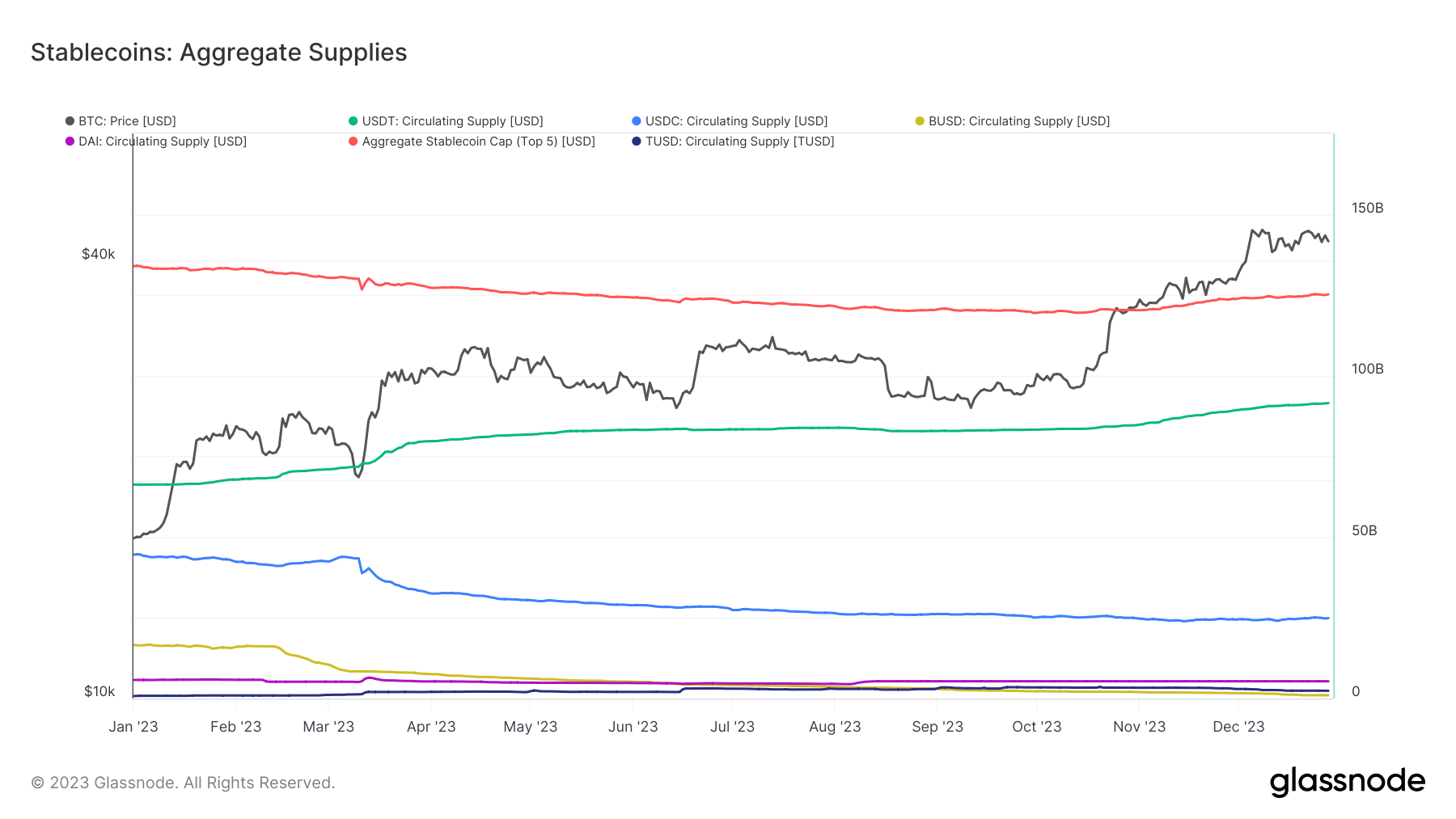

In the crypto market, tracking the supply of stablecoins is essential for understanding liquidity trends. Stablecoins, predominantly used as trading pairs for other cryptocurrencies on exchanges, reflect the flow of funds in the market.

The aggregate capitalization of the top five stablecoins – Tether (USDT), USD Coin (USDC), Binance USD (BUSD), TrueUSD (TUSD), and Dai (DAI) – saw a notable fluctuation over the year. Starting at $133.88 billion on Jan. 1, this figure dropped to $125.18 billion by Dec. 28.

However, after a decline for most of the year, the total stablecoin market cap began to recover in the fourth quarter, increasing from $119.48 billion on Oct. 14 to $125.18 billion by the end of December.

This resurgence was primarily driven by a significant increase in USDT’s supply, which soared from $66.24 billion to $91.50 billion. In contrast, USDC saw a dramatic reduction in supply, plummeting from $44.56 billion to $24.76 billion. This stark difference potentially indicates a shift in investor preference or strategic adjustments by the management of USDC. Similarly, BUSD experienced a steep decline in supply, dropping from $16.56 billion to $1.01 billion as it began sunsetting. Meanwhile, DAI’s supply slightly decreased, and TUSD showed substantial growth, though it remains smaller in market cap than USDT and USDC.

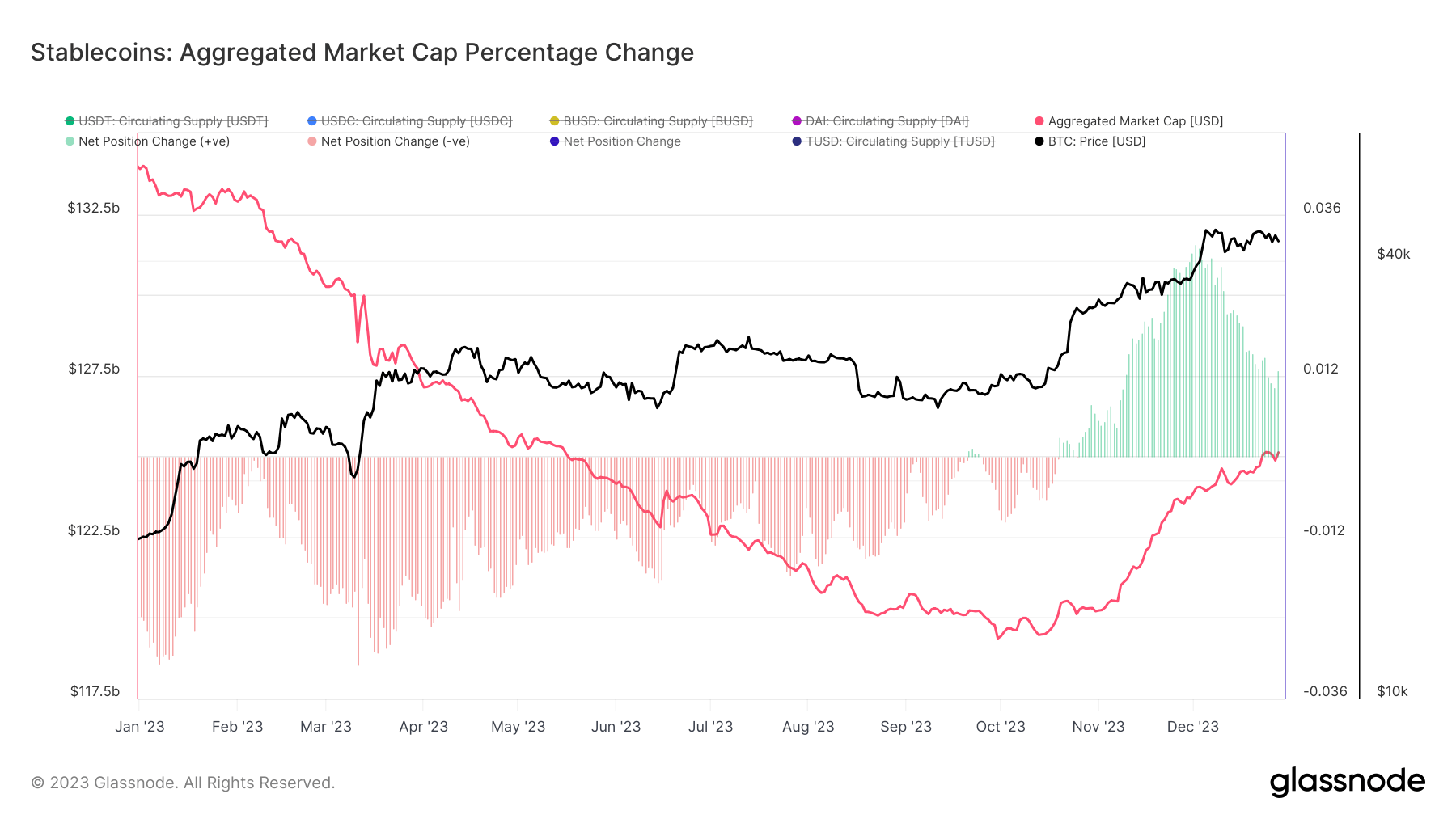

The overall trend from January to October was a decrease in stablecoin supply, followed by a resurgence in the year’s fourth quarter. Glassnode’s data showing the 30-day net change in stablecoin supply showed that the strong negative change that persisted throughout most of the year ended on Oct. 14. From Oct. 14 to Dec. 28, the stablecoin supply has been steadily increasing, peaking on Dec. 2 with a 3.16% increase.

The rise in USDT supply and the overall increase in stablecoin market cap towards year-end correlate with a notable uptick in Bitcoin’s price. This could imply that stablecoins, especially USDT, played a role in providing liquidity and capital that may have fueled Bitcoin’s price rise. The earlier decrease in overall stablecoin supply, notably in USDC and BUSD, aligns with a more modest increase in Bitcoin’s price, implying less liquidity moving from stablecoins to Bitcoin.

The varying supply and demand of the stablecoin market appears to have a significant correlation with Bitcoin’s price movement. This relationship underscores the importance of stablecoins in offering market liquidity and shows their potential impact on the valuation of cryptocurrencies like Bitcoin.

The post End-of-year stablecoin cap rally mirrors Bitcoin’s price uptick appeared first on CryptoSlate.