- January 10, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

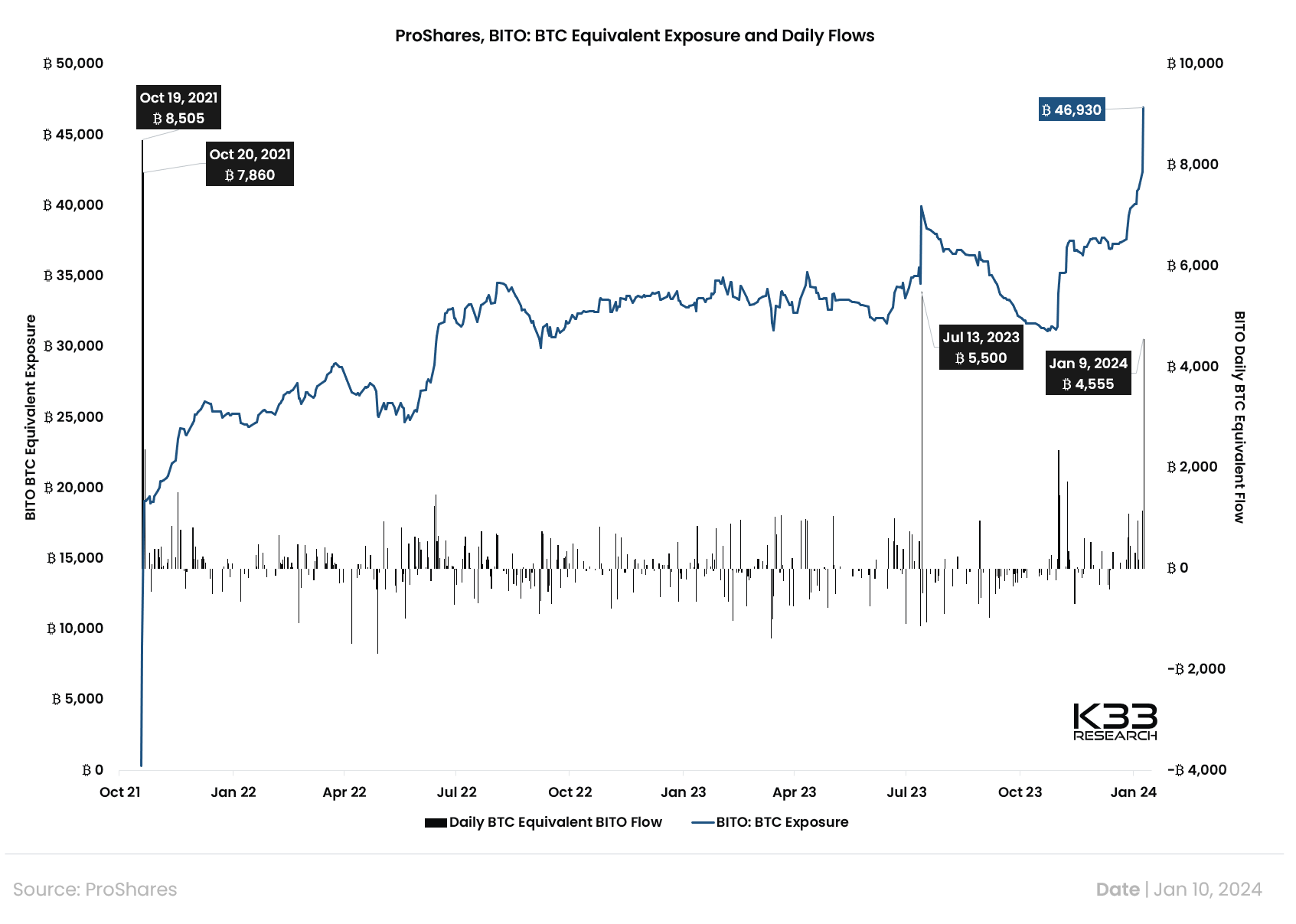

K33 Research analyst Vetle Lunde has highlighted the growing robustness of BITO’s Assets Under Management (AUM). The surge, marked by the fourth most substantial daily inflow on Jan. 9, consisted of 4,555 Bitcoin. This comes close to the standout days of its launch last year, Oct. 19 and 20, 2021, which recorded 8,505 and 7,860 BTC, respectively, and July 13 with 5,500 Bitcoin. BITO’s current Bitcoin equivalent exposure stands at 46,930, indicating a steady accumulation in the instrument, according to Lunde.

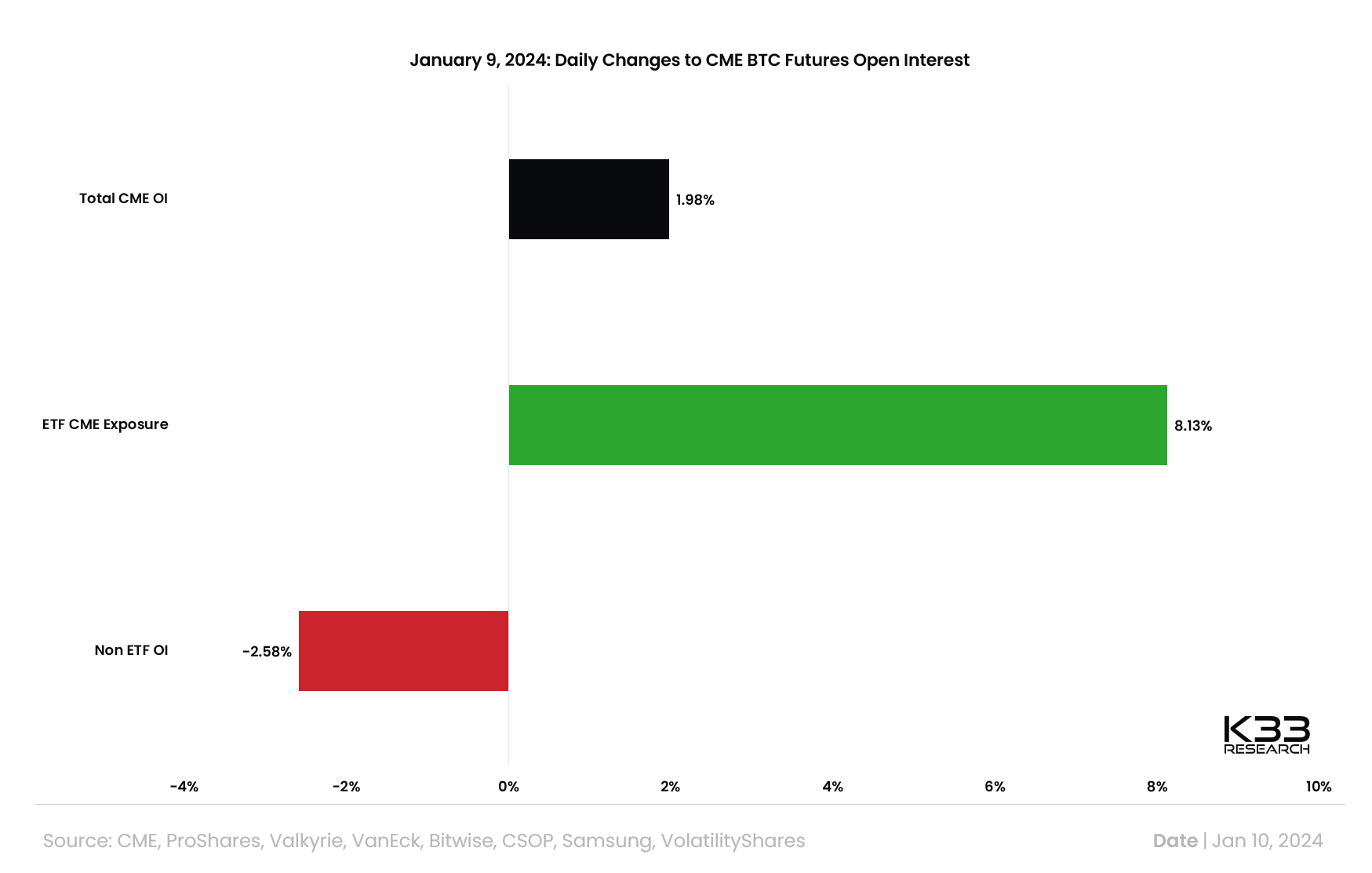

Lunde also points out that the Chicago Mercantile Exchange (CME) has seen its open interest grow by 2%, a noteworthy development given the simultaneous decline in Binance’s open interest.

Additionally, ETF CME exposure witnessed an impressive 8% growth. These numbers reflect a potential shift in investor preference towards regulated marketplaces like CME and the rising traction for Bitcoin ETFs, according to Lunde.

The post BITO registers near-historic Bitcoin inflow, indicating ETF market momentum appeared first on CryptoSlate.