- January 29, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Crypto investment products saw their second consecutive week of outflow this year, with $500 million leaving the funds, according to CoinShares’ latest weekly report.

Bitcoin dominate

Bitcoin investment products experienced significant outflows last week, with a total withdrawal of $479 million.

The top cryptocurrency has faced significant headwinds since the U.S. Securities and Exchange Commission (SEC) approved spot exchange-traded funds (ETF) in the country. Its value has declined by more than 12% to around $42,500 as of press time.

This downturn has spurred bearish investors to turn to short BTC products, resulting in nearly $11 million in inflows last week.

Conversely, prominent alternative digital assets like Ethereum, Polkadot, and Chainlink also saw outflows, with $39 million, $700,000, and $600,000, respectively. However, Solana defied this trend by recording a modest inflow of $3 million.

Across regions, U.S.-based funds dominated the scene, experiencing net outflows of $409 million. Switzerland and Germany followed with outflows of $60 million and $32 million, respectively. Brazil emerged as the exception, with the most significant net inflows of $10.3 million.

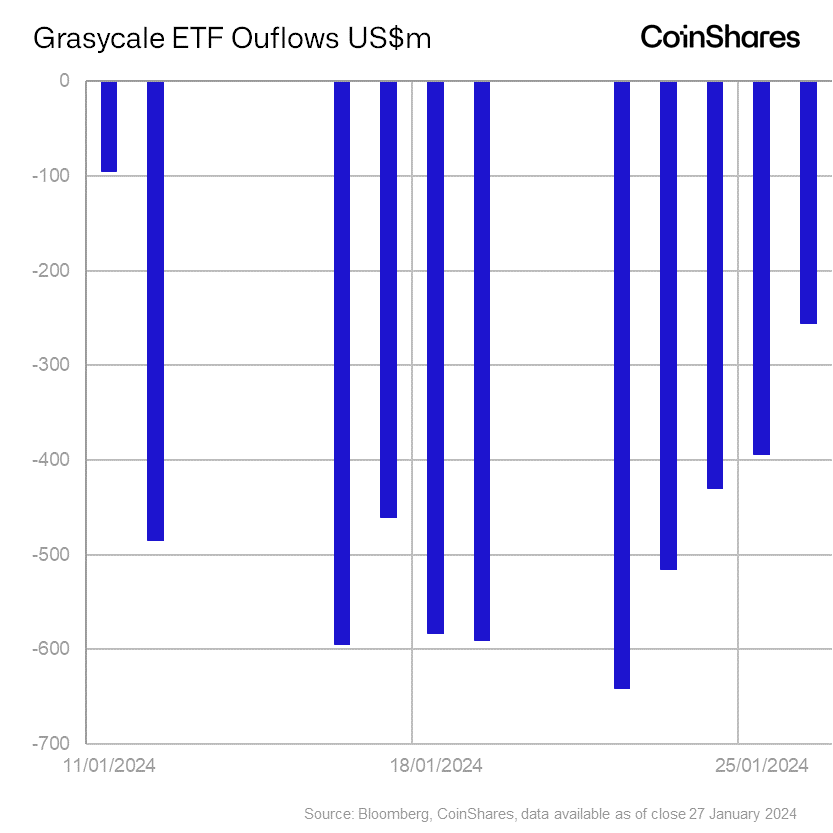

“Recent price declines prompted by the substantial outflows from the incumbent ETF issuer (Grayscale) in the U.S. totaling $5 billion, have likely prompted further outflows from other regions,” CoinShares Head of Research James Butterfill explained.

Grayscale outflows ‘subside’

The post Global Bitcoin ETP holdings over 900,000 BTC as Grayscale outflows ‘subside’ appeared first on CryptoSlate.