- February 1, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

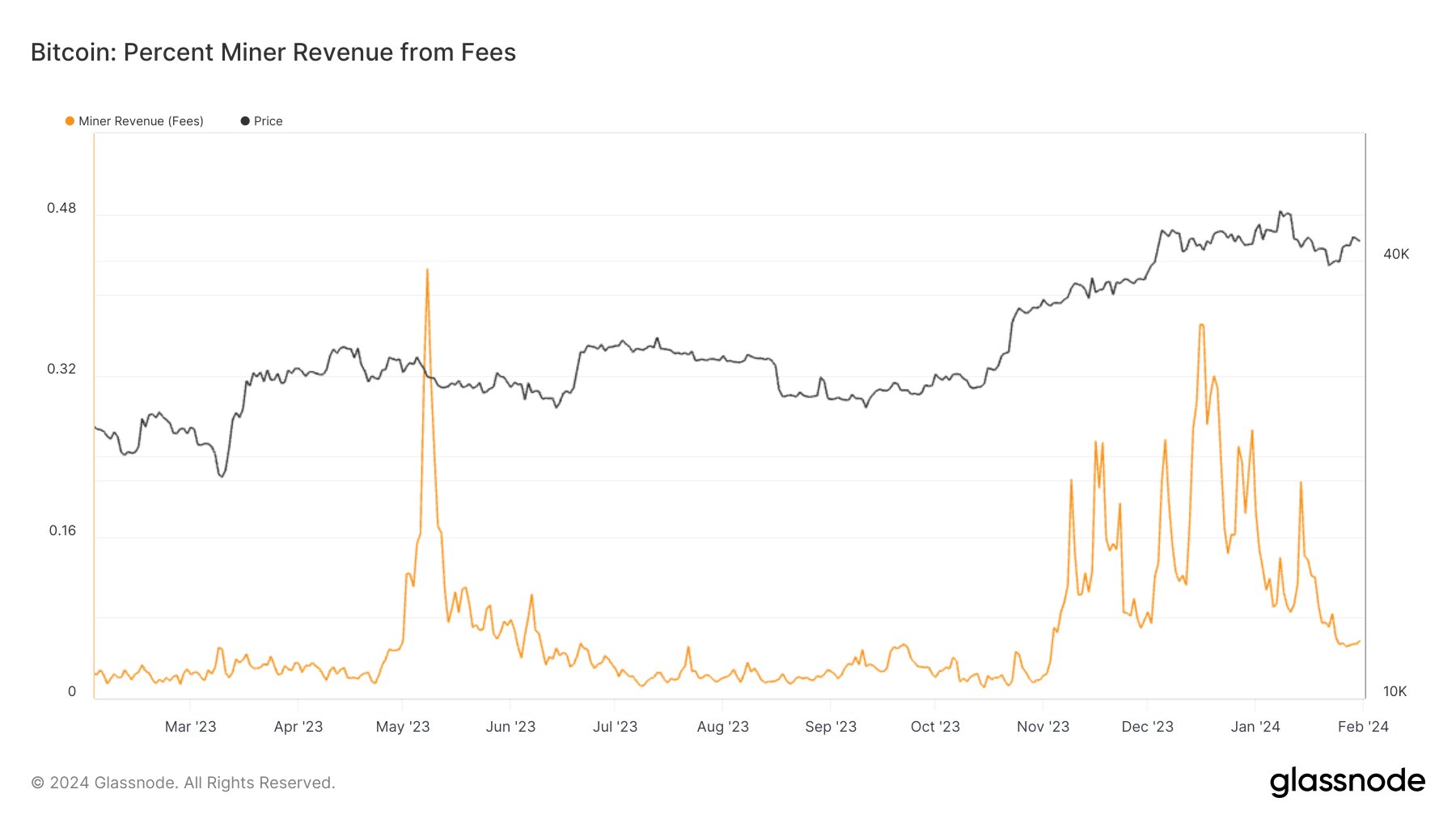

On-chain data shows the Bitcoin Inscription craze is dying as the miner revenue from transaction fees has plunged.

Bitcoin Miner Revenue From Fees Has Dropped To Just 6% Now

At the end of 2022, a new application of the Bitcoin blockchain emerged: the “Inscriptions.” In simple terms, an Inscription is metadata “inscribed” onto the smallest unit of Bitcoin, the satoshis (sats).

Any data type can be attached with BTC transactions this way, as long as it abides by the block size limit of 4MB. Over 2023, applications of the technology like non-fungible tokens (NFTs) and BRC-20 tokens gained life on the network.

Since the Inscriptions arrived on the scene, the popularity of these transactions was especially high during two periods in particular. They drastically affected the mining economics of the blockchain, at least for a brief while.

As the Inscriptions are like any other transactions on the network, they affect the metrics related to them. The transfer fee is one metric on which the Inscriptions had a sizeable impact.

The fee in question is naturally the one any sender on the network has to attach with their transactions as a reward for the miner, who would add it to the next block.

How much fee a user would be willing to attach with their transfers depends on the traffic conditions. During periods of congestion, transfers can end up waiting a while in the mempool, so those who don’t want to risk waiting can choose to go with a higher-than-average fee.

In times of especially high traffic, the average fee can blow up as users compete against each other in this manner to beat the rush. On the other hand, periods of low activity usually witness low network fees, as users have little incentive to go for any high amounts.

The periods of Inscription-craze mentioned earlier naturally saw the fees shooting up, as this type of transaction flooded the network, forcing users to pay higher amounts.

The latest of these periods occurred over the last few months, but as analyst James Van Straten explained in a post on X, this recent Inscription boom appears to be over for the cryptocurrency, at least for now.

The chart shows that the transaction fee contribution towards the miner revenues (which have block rewards as their other component) blew up to extremely high levels during the recent and earlier Inscription booms.

These latest periods were sustained for a significant amount of time. Still, the popularity of the Inscriptions has waned now, as the fees only contribute to 6% of the total miner revenues.

Something to note, though, is that while this amount is low, the fees have contributed even less towards the miner revenues historically. For perspective, the current value is over double that of before this latest Inscription boom.

BTC Price

At the time of writing, Bitcoin is trading at around $42,100, up 6% over the past week.