- February 7, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

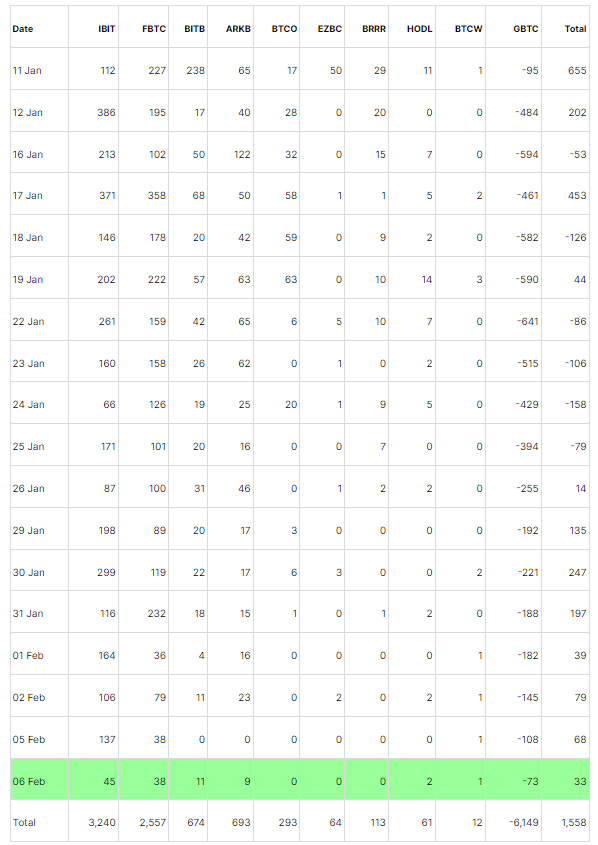

According to data from Farside Investors, spot Bitcoin ETFs continued with net inflows on Feb. 6, recording an intake of $33 million. This marks the eighth straight trading day of net inflows. However, the momentum seems to be slowing down. BlackRock IBIT saw its smallest net inflow since its inception, a mere $45 million, bringing its total net inflow to a commendable $3.2 billion.

On the other hand, the Grayscale Bitcoin Trust (GBTC) registered another day of outflows, but with a diminishing volume of $73 million, the lowest recorded in any trading day. Farside Investors data shows that the ongoing outflows at GBTC have accumulated to an estimated $6.15 billion.

The ETFs continue to demonstrate resilience despite the slowing net inflows, with total net inflows reaching $1.56 billion, according to Farside Investors. If these trends persist, they will be worth observing.

The post BlackRock Bitcoin ETF’s growth cools off with its smallest net inflow to date appeared first on CryptoSlate.