- February 20, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The Commercial International Bank (CIB) of Egypt has entered into a partnership with Ripple Labs, marking a significant milestone in the adoption of blockchain technology for cross-border payments within the Egyptian financial sector. This collaboration, as detailed in the “Egypt Fintech 2024” report by Shehata & Partners Law Firm, aims to revolutionize the efficiency of international remittances, positioning CIB at the forefront of Egypt’s burgeoning blockchain landscape.

The bank was founded in 1975 as a joint venture and has evolved into a leading private bank in Egypt. It offers a wide range of financial solutions, including personal, corporate, and investment banking. It has received accolades such as “Best Bank for SMEs” by Euromoney and recognition for corporate responsibility.

Ripple Enters The Egyptian Private Banking Sector

According to the report, “CIB Bank: Commercial International Bank Egypt collaborates with Ripple to implement blockchain technology, enhancing the efficiency of cross-border payments.” This partnership signals a major leap forward in leveraging blockchain technology to streamline financial transactions and represents CIB’s commitment to innovation in the financial services industry.

The significance of this development is further highlighted by comments from the community. Wrathof Kahmeman, a prominent XRP community member, confirmed the partnership’s impact, stating, “Nice! New #Ripple user confirmed. #XRP?” This comment not only underscores the enthusiasm within the XRP community but also points to the potential for increased adoption of Ripple’s technology and possibly its cryptocurrency, XRP, in Egypt.

Before this partnership, the National Bank of Egypt (NBE) was the only confirmed Egyptian financial institution to have engaged with blockchain for cross-border payments, specifically through its collaboration with LuLu Exchange. The involvement of CIB with Ripple expands the blockchain ecosystem in Egypt beyond NBE’s initial foray, suggesting a broader trend of adoption within the country’s banking sector.

Sean McBride, a former Ripple Director, drew parallels between this new partnership and the company’s existing collaborations in other parts of the world, such as with SBI Remit in Japan. McBride’s insights suggest that Ripple is replicating its successful model of integrating blockchain technology within financial ecosystems globally, establishing a significant foothold in the Middle Eastern market through strategic partnerships like the one with CIB.

He stated:

Similar to the relationship they’ve built with SBI Remit in Japan. This is how Ripple is establishing their foothold and unfolding their technology within the ecosystem.

The integration of Ripple’s technology by CIB is expected to transform the efficiency and cost-effectiveness of cross-border transactions, a critical development given Egypt’s position as a significant remittance-receiving country.

While specific details regarding the extent of Ripple’s technology implementation remain undisclosed, the community certainly hopes for an integration of XRP. However, Kahneman noted: “Not known if they are using Ripple or XRP in Egypt, though volume suggests not.”

Notably, this development is part of a broader movement within Egypt towards embracing blockchain technology, as evidenced by various initiatives and the recent issuance of Decision No. 140 of 2023 by the Financial Regulatory Authority (FRA).

This decision outlines compliance requirements for digital identity, contracts, and the utilization of financial technology in conducting non-banking financial activities, indicating the country’s commitment to fostering innovation across diverse sectors through blockchain.

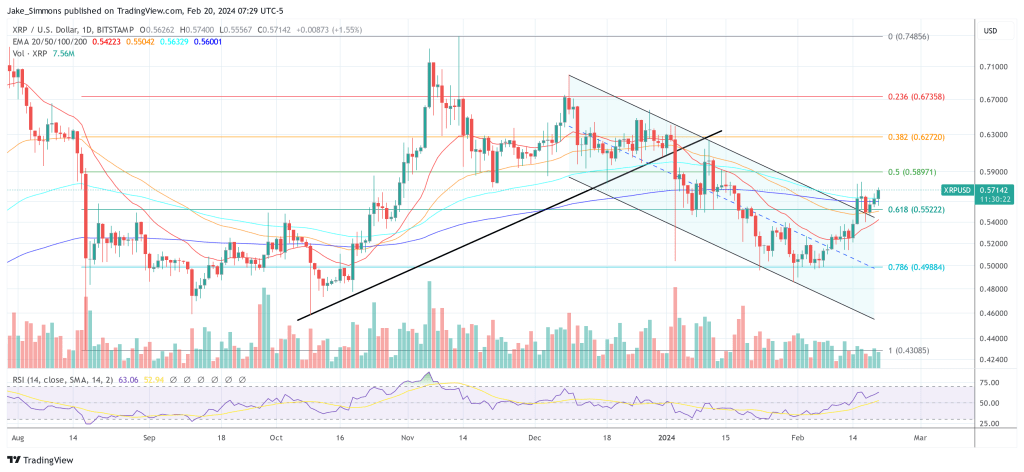

At press time, XRP traded at $0.57142, up 2.4% in the last 24 hours.