- February 27, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

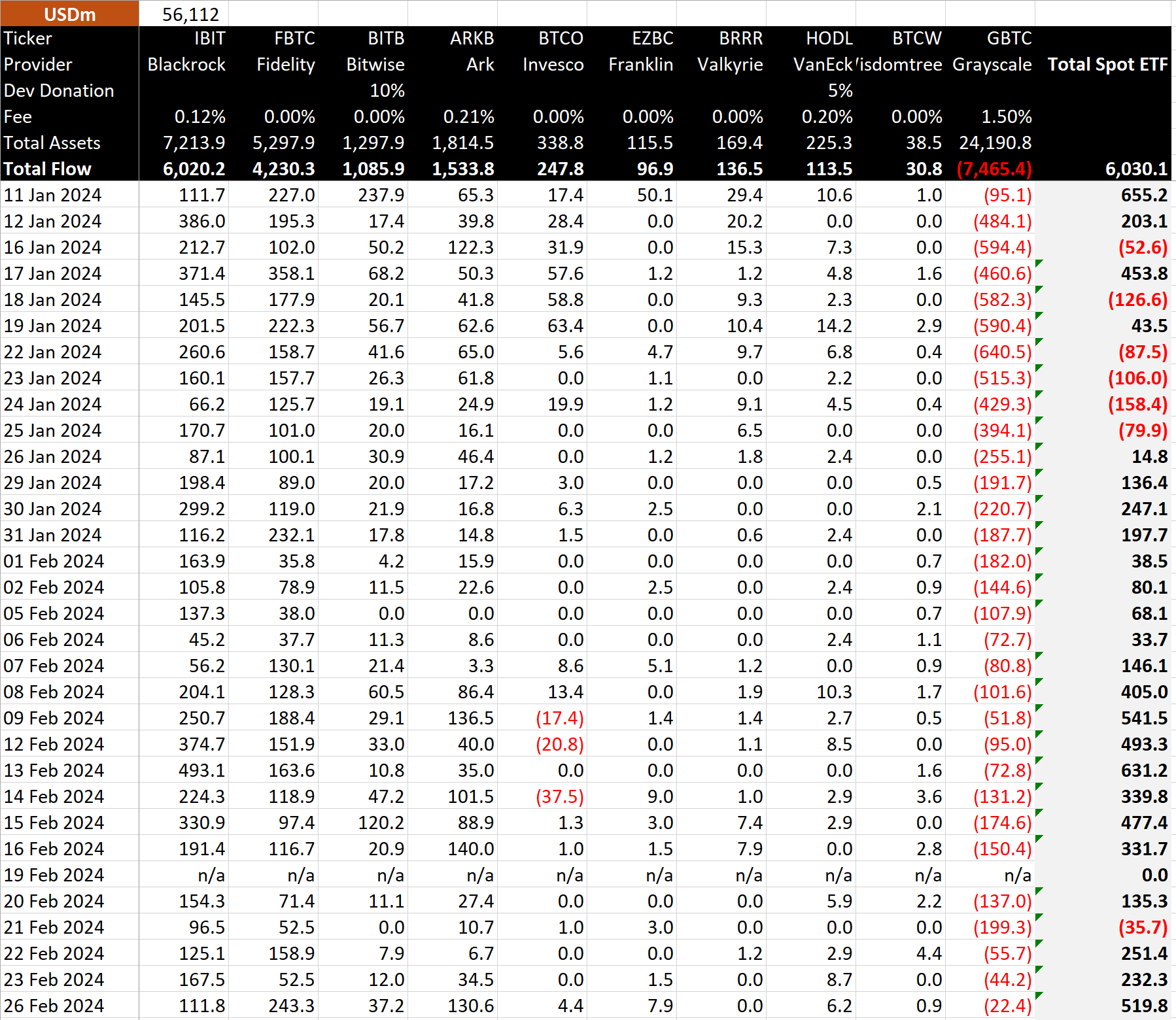

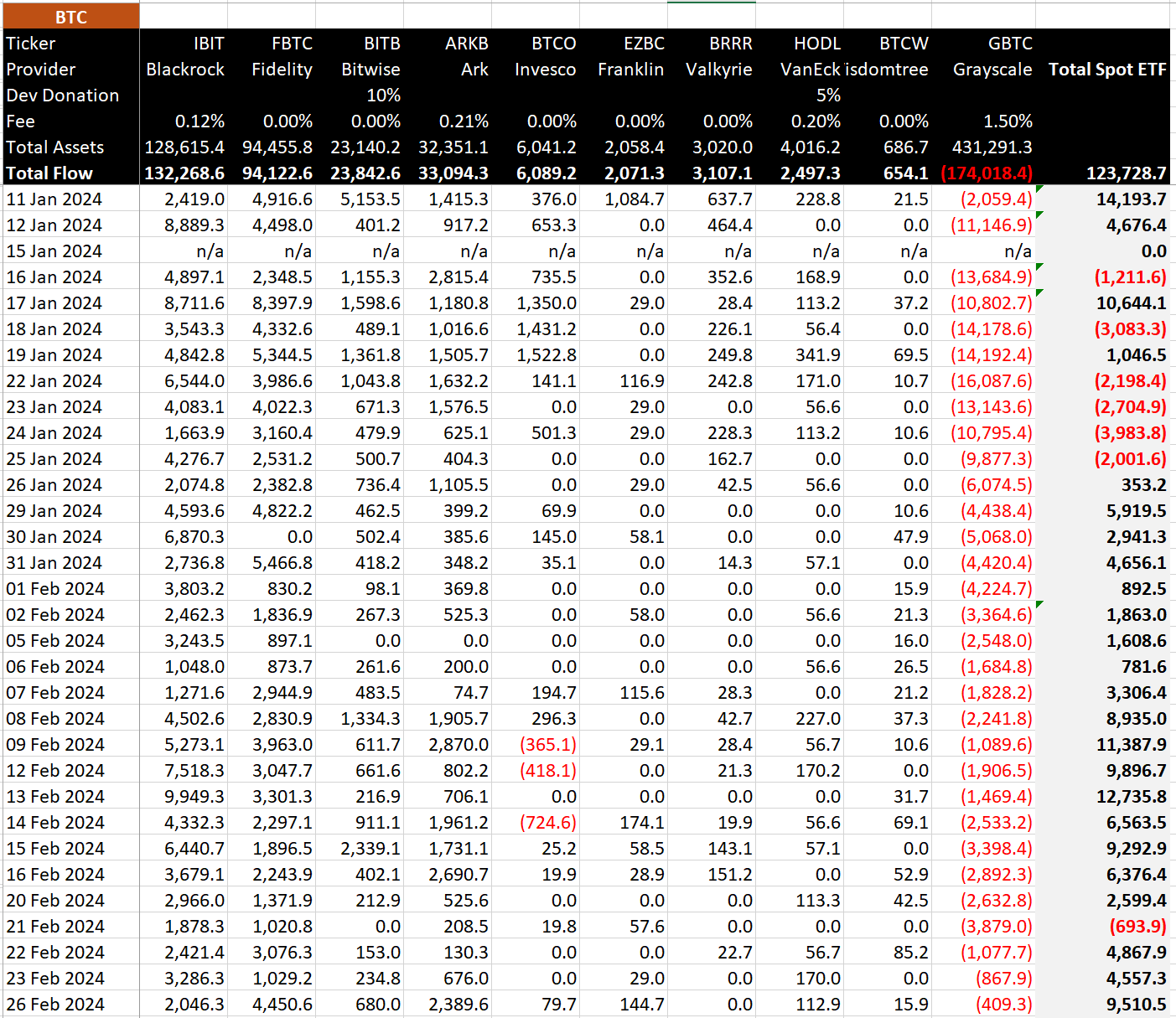

There is a notable surge in capital inflows into Bitcoin ETFs, a trend clearly highlighted by recent capital movements. BitMEX data shows that ETFs saw a massive net inflow of $520 million, or the equivalent of 9,510 BTC, on Feb. 26.

GBTC, once a favored choice among investors, continues to experience outflows with a record of $7.5 billion in total outflows. Interestingly, the outflow trend has been steadily dwindling over three consecutive trading days, dropping from $56 million to $22 million, according to BitMEX.

BitMEX data shows that Fidelity’s FBTC is experiencing a formidable upsurge, with a massive $243 million inflow on a single day, propelling their total net flows to an impressive $4.2 billion. Similarly, Ark Invest ARKB and BlackRock IBIT enjoyed strong inflow days, adding $131 million and $112 million, respectively, to their coffers.

This trend represents an aggregate net inflow of over $6 billion for all spot US ETFs or the equivalent amount of 123,729 BTC, according to Bitmex.

The post Fidelity leads Bitcoin ETFs 4th best day since launch reaching $6 billion total net inflows appeared first on CryptoSlate.