- February 29, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

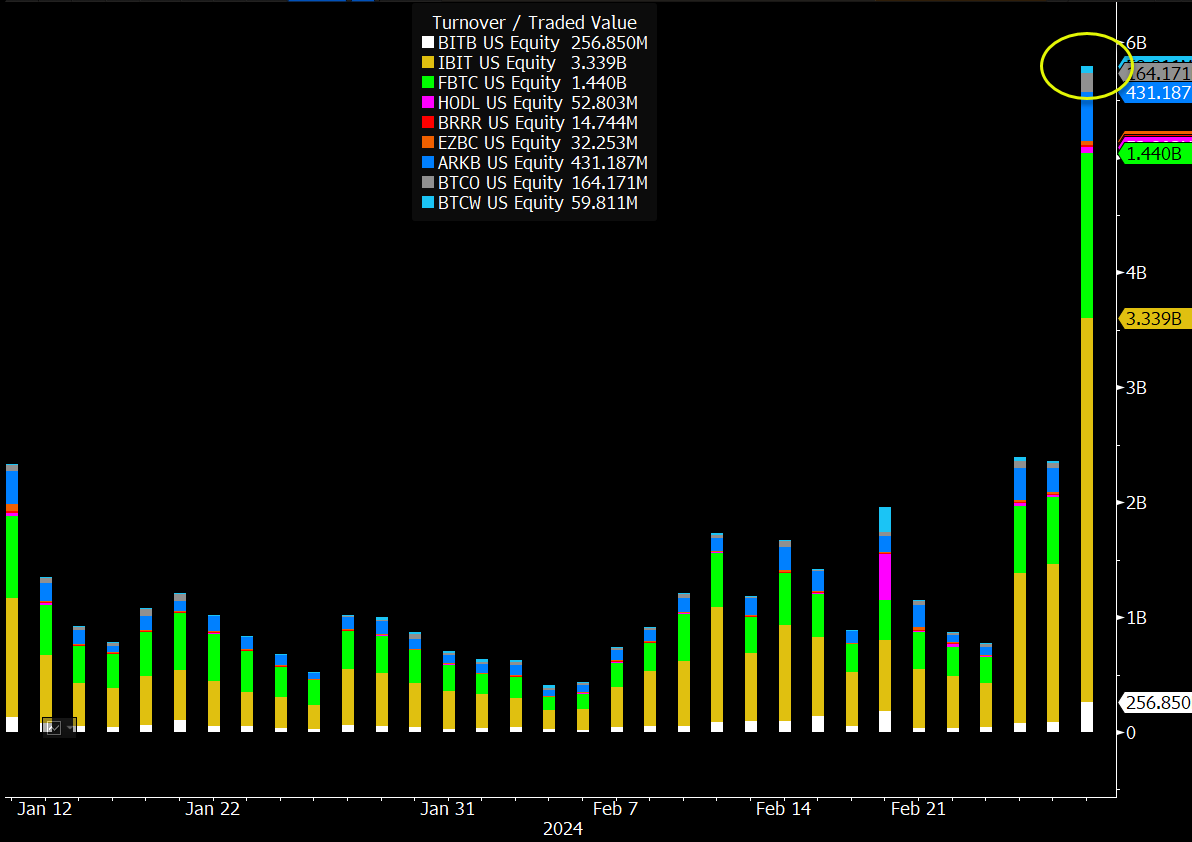

Yesterday, Feb. 28, the newborn-nine spot Bitcoin ETFs doubled their trade volume record, with roughly $6 billion traded.

BlackRock IBIT emerged as the frontrunner with $3.3 billion, followed by Fidelity with $1.4 billion. In addition, IBIT surpassed the Invesco QQQ ETF on its own, according to senior Bloomberg ETF analyst Eric Balchunas.

The previous record of $2.4 billion was set on Feb. 26, as reported by CryptoSlate, citing an analysis from Eric Balchunas.

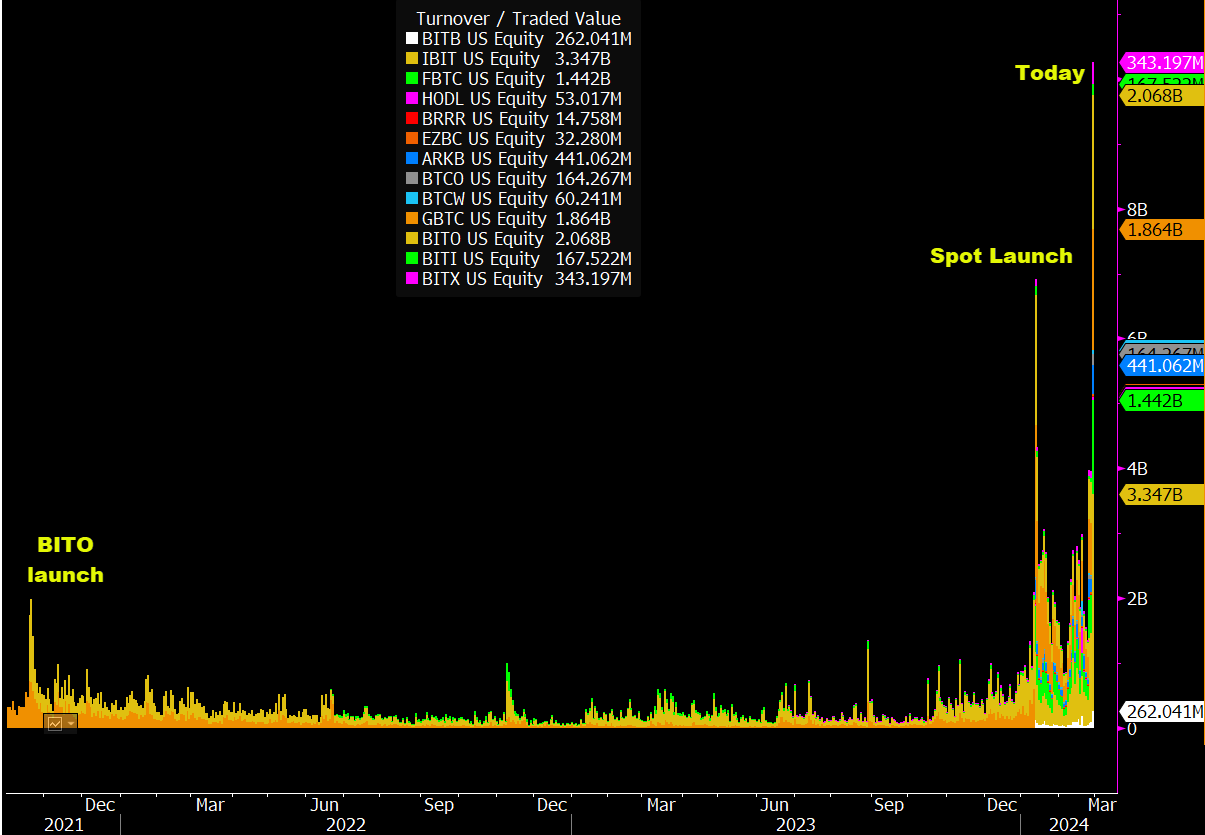

Balchunas reports that when taking Bitcoin futures ETFs like BITO into account, in addition to the ten-spot Bitcoin ETFs, the total trade volume soared to $10 billion. This surge presents a new record, significantly surpassing previous milestones, such as the BITO launch in 2021 and the ETF launch on Jan. 11, which were considerably lower in comparison.

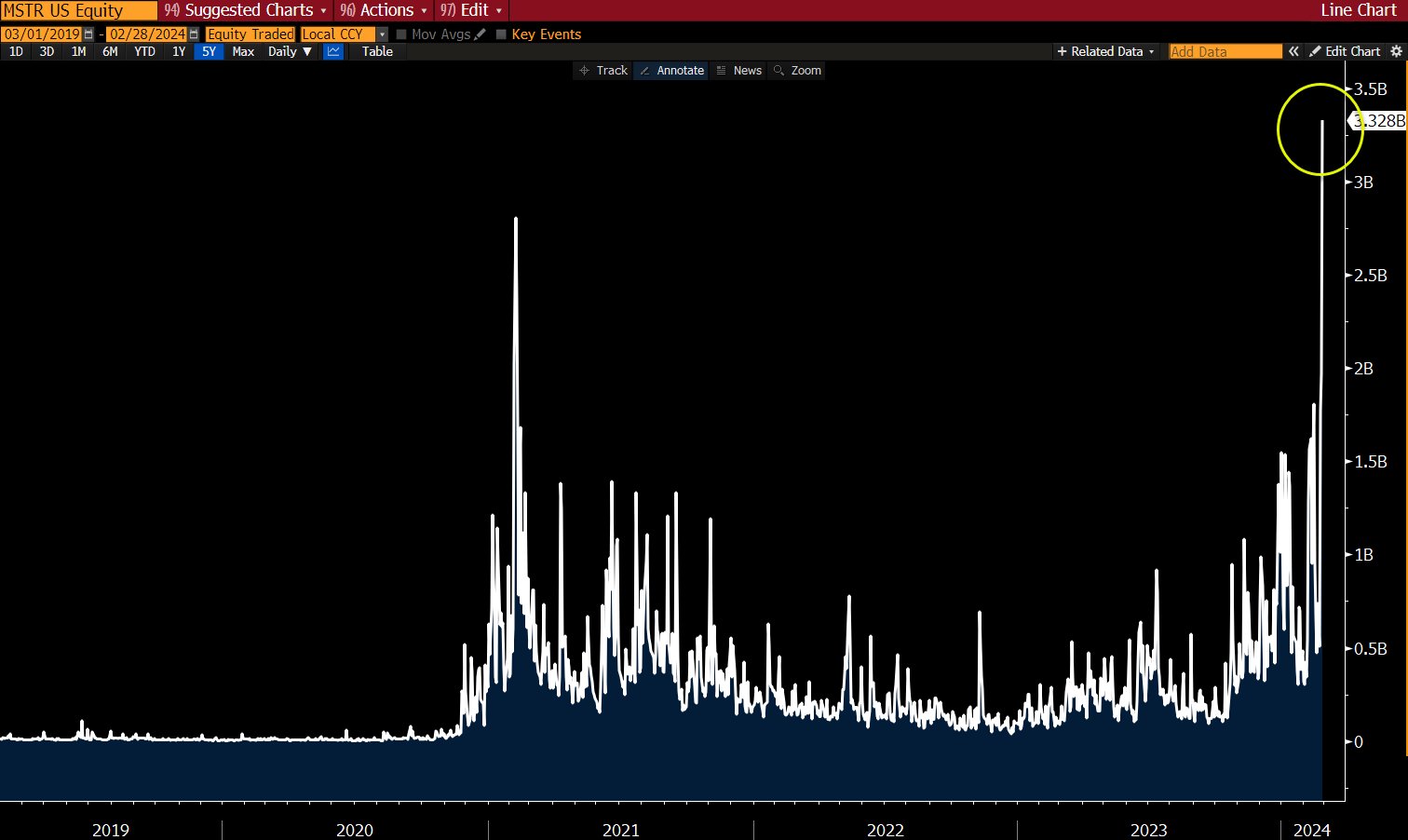

This trading tempest also spilled over to stocks, propelling Microstrategy into record-volume territory, according to Blachunas.

Coinciding with this trading frenzy was a record inflow of $673 million into ETFs, largely driven by BlackRock, with an influx of $612 million.

The post Newborn Nine hits new peak with $6 billion in total trade volume appeared first on CryptoSlate.