- March 4, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

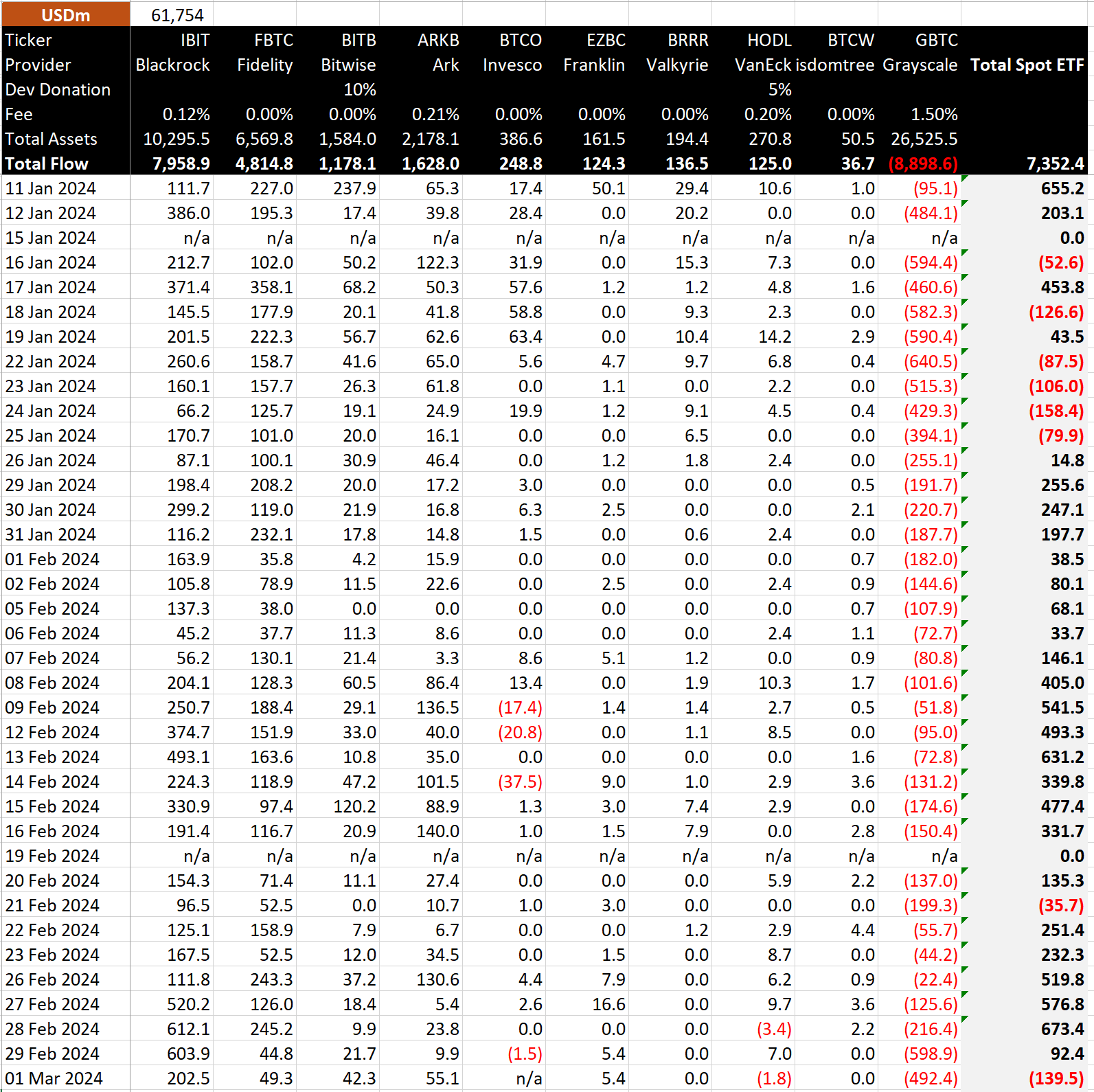

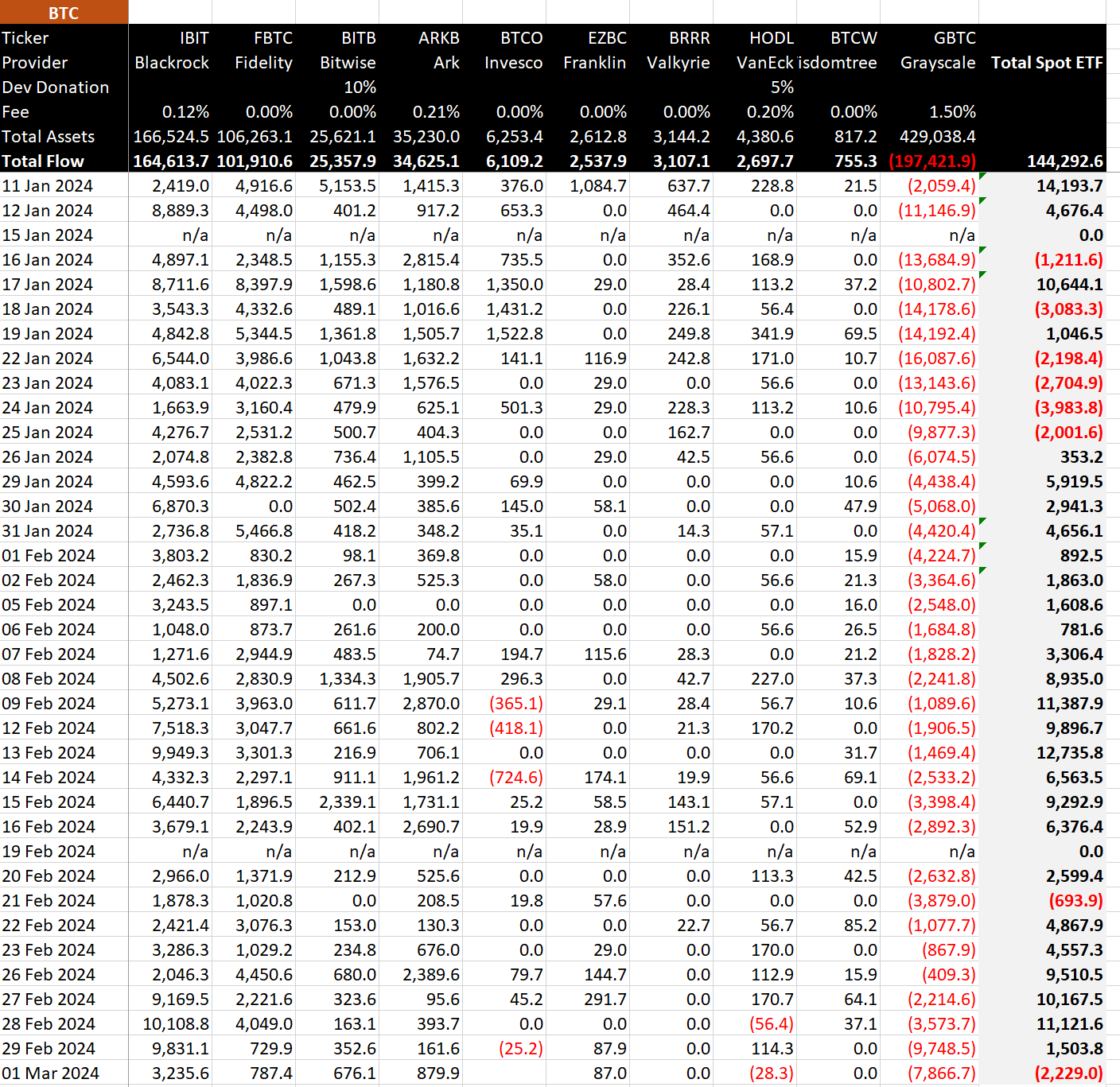

Data from BitMEX shows March began with the first total outflow since Feb. 21. The day saw an outflow of $140 million, significantly impacted by a massive $492 million outflow from the Grayscale Bitcoin Trust (GBTC), marking one of the largest single-day outflows.

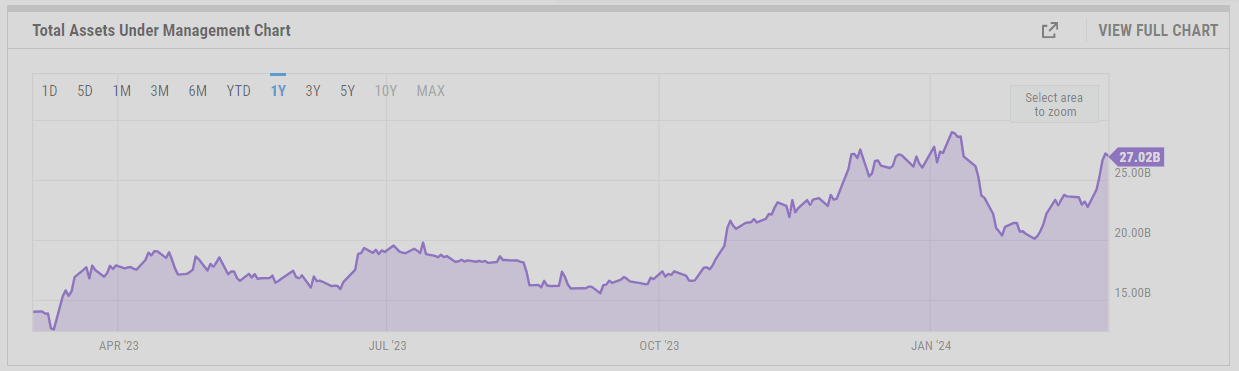

According to BitMEX data, the Grayscale Bitcoin Trust (GBTC) has experienced outflows totaling $8.9 billion. Despite this significant outflow, the assets under management (AUM) of GBTC only decreased by $1.6 billion, moving from $28.6 billion to $27 billion, as reported by ycharts.

This relatively small decrease in AUM, in the face of large outflows, can be attributed to the increase in Bitcoin’s price, which rose from $49,000 to $65,000 since the ETF was launched on Jan. 11.

Despite these outflows, GBTC maintains a strong market presence with a 55% share, though down from 100% two months ago, as noted by ETF Store President Nate Geraci.

Furthermore, GBTC’s annual fee revenue stands at a significant $398 million, dwarfing the $53 million from the nine new ETFs, not including fee waivers, according to Geraci.

Meanwhile, BlackRock’s IBIT saw much quieter inflows of $203 million on Mar. 1, following consecutive record-breaking days. These inflows have taken their total net inflow to $8 billion, roughly equivalent to holding 165,000 Bitcoin, according to BitMEX.

BitMEX has noted that Invesco Galaxy Bitcoin ETF (BTCO) has not disclosed its data for Mar. 1.

The post GBTC AUM sees modest $1.6 billion drop post-ETF launch, despite major outflows appeared first on CryptoSlate.