- March 5, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

In a remarkable display of bullish momentum, the Bitcoin (BTC) price has surged, nearly touching its all-time high of $69,044 set in November 2021. The cryptocurrency’s value climbed to an impressive $68,848 before facing a 5% correction, subsequently dropping to $64,200.

However, the market swiftly recovered, with BTC trading above $67,000 once again. This surge can be attributed to a combination of factors fueling the upward trajectory. Here, we delve into the five key reasons behind Bitcoin’s recent price movements.

#1 Supply Shock Due To Bitcoin ETF Demand

The spot Bitcoin ETF market has witnessed yet another day with significant inflows, particularly spotlighting Fidelity and BlackRock, which funneled more than $400 million each into BTC. Fidelity recorded a historic inflow of $404.6 million, while BlackRock followed closely with $420 million.

Record day for Fidelity today: US$404.6 million of inflow

Fidelity has more than offset the GBTC outflow on its own https://t.co/cr320pbObf pic.twitter.com/ellb4qUoNK

— Farside Investors (@FarsideUK) March 5, 2024

Eric Balchunas, a senior ETF analyst at Bloomberg, remarked on the phenomenon: “The ten Bitcoin ETFs a virtual lock to clock their second biggest volume day today. So looks like the big bump up in trading activity last week was more new normal than anomaly. Today was the second biggest volume day for the Ten at about $5.5b. $IBIT alone did $2.4b of it and has crossed $11b in aum.”

This influx is indicative of a supply shock, as the demand from ETFs absorbs a substantial portion of available Bitcoin, reducing supply and thereby pushing prices upward.

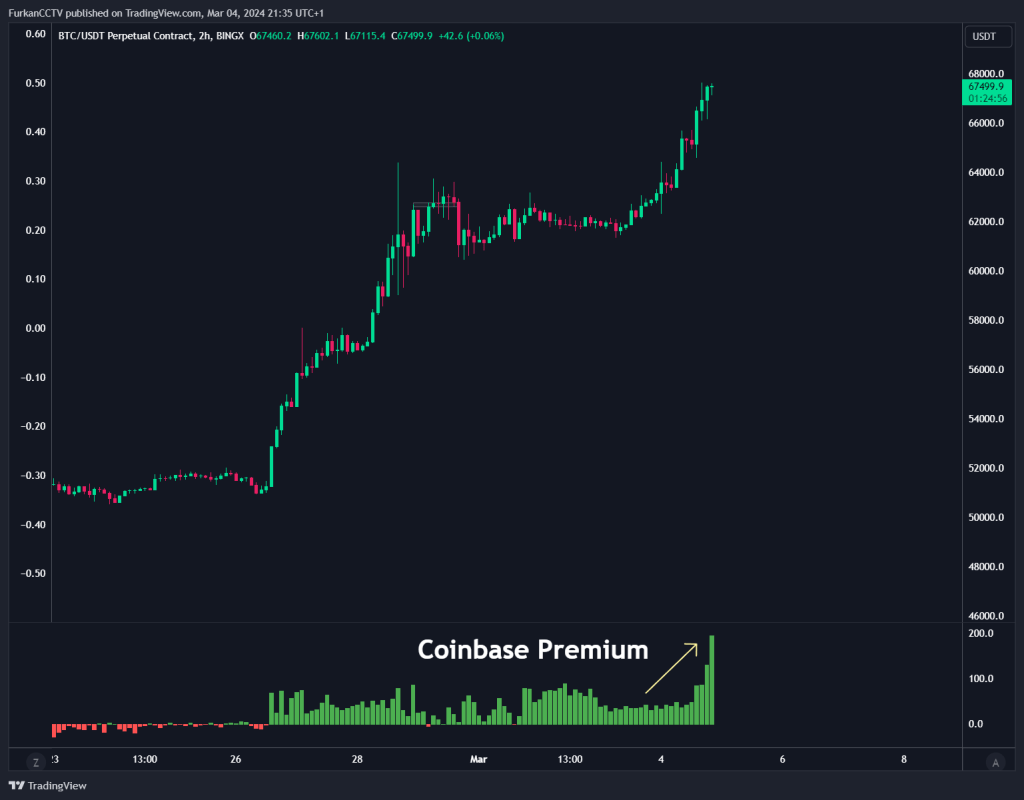

#2 Coinbase Premium Signals Institutional Buying

The surge in BTC’s price is also mirrored by the significant increase in the Coinbase Premium, a clear indicator of institutional interest. Furkan Yildirim, a noted crypto analyst, stated, “The Coinbase Premium is in full blast, signaling a potential all-time high for Bitcoin.” This sentiment was echoed by @tedtalksmacro, who observed, “Large BTC spot premium over at Coinbase. The big boys are buying. […] For context, this is the largest premium observed on this leg higher. Institutional FOMO.”

The Coinbase Premium, a metric indicating the price difference between Coinbase’s BTC price and other exchanges, serves as a bullish signal, highlighting the aggressive buying by institutions and high-net-worth individuals, especially during regular trading hours.

#3 BlackRock’s Strategic Move Into Bitcoin

BlackRock’s recent filing to integrate BTC exposure into its Strategic Income Opportunities Fund (BSIIX) is yet another watershed moment. With the fund’s substantial $36.5 billion assets under management, this inclusion signifies a major nod to Bitcoin’s growing acceptance among traditional investment vehicles.

While BSIIX is not the biggest fund, it could be the starting signal for Bitcoin ETFs to be included in larger and, above all, more investment funds by BlackRock and others. This would be extremely bullish. “Wall Street firms continue to file for Bitcoin ETF exposure in their in-house investment funds. You’re going to see a lot of this in the coming months,” commented MacroScope, a prominent crypto analyst on X (formerly Twitter).

#4 MicroStrategy’s Continued Bitcoin Accumulation

MicroStrategy announced a new issuance of $600 million in Convertible Senior Notes, earmarked for BTC purchases and general corporate purposes. This move signifies not just an investment strategy but a profound belief in Bitcoin’s value proposition. This strategy not only underscores Saylor’s bullish outlook on BTC but also introduces a significant buying pressure in the market.

MicroStrategy Announces Proposed Private Offering of $600 Million of Convertible Senior Notes $MSTR https://t.co/PEN5dxesIb

— Michael Saylor

(@saylor) March 4, 2024

#5 The ‘Kimchi Premium’ Phenomenon

The ‘Kimchi Premium‘—the price gap between South Korean exchanges and foreign ones—has re-emerged as a notable factor. On Upbit, South Korea’s largest exchange, BTC and ETH were trading at premiums of approximately 6% and 7%, respectively.

This shows that it is not only the US market which is driving the BTC price. The Kimchi premium is a testament to the high demand and speculative interest within the South Korean market.

At press time, BTC traded at $67,008.