- March 6, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

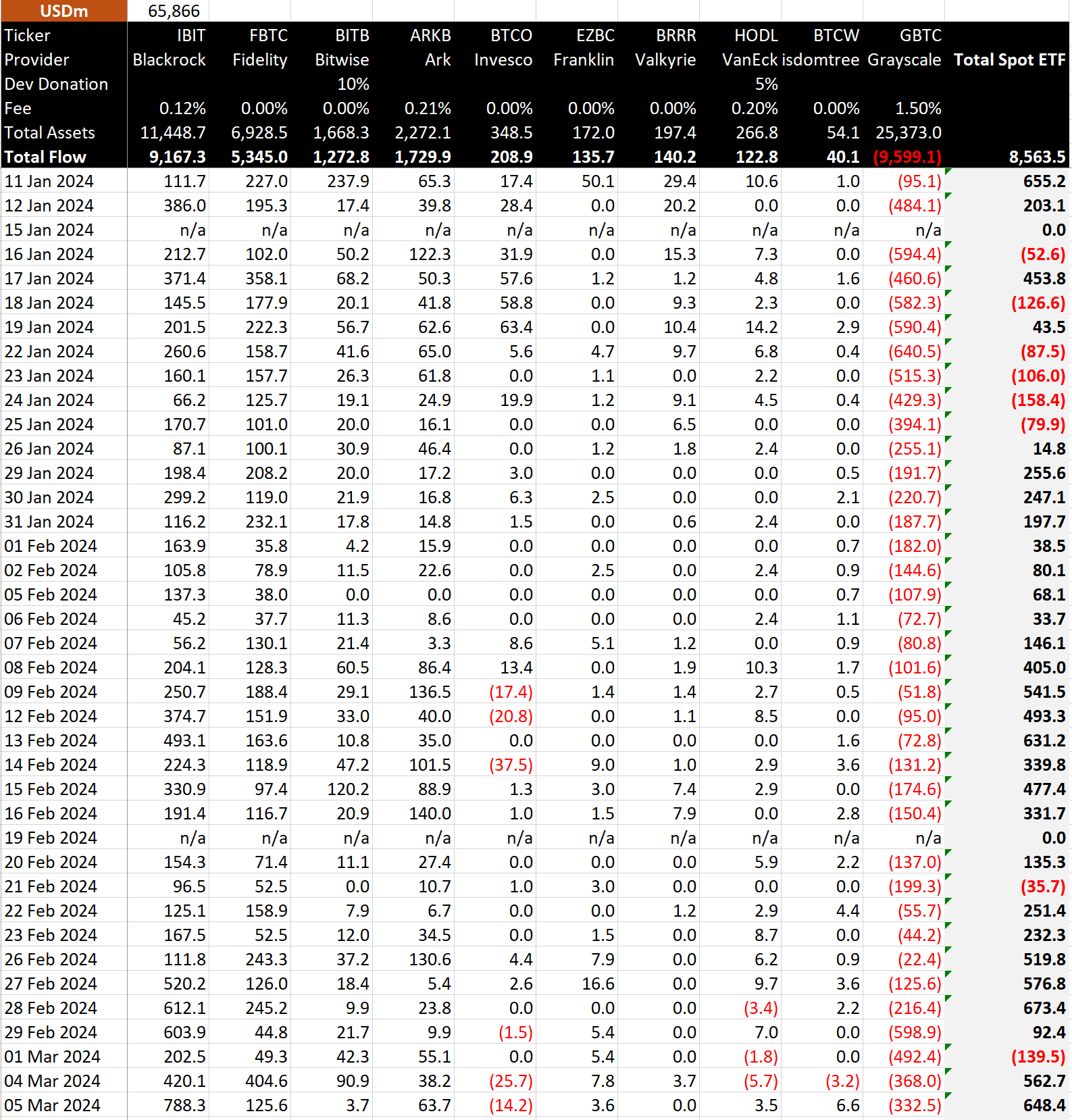

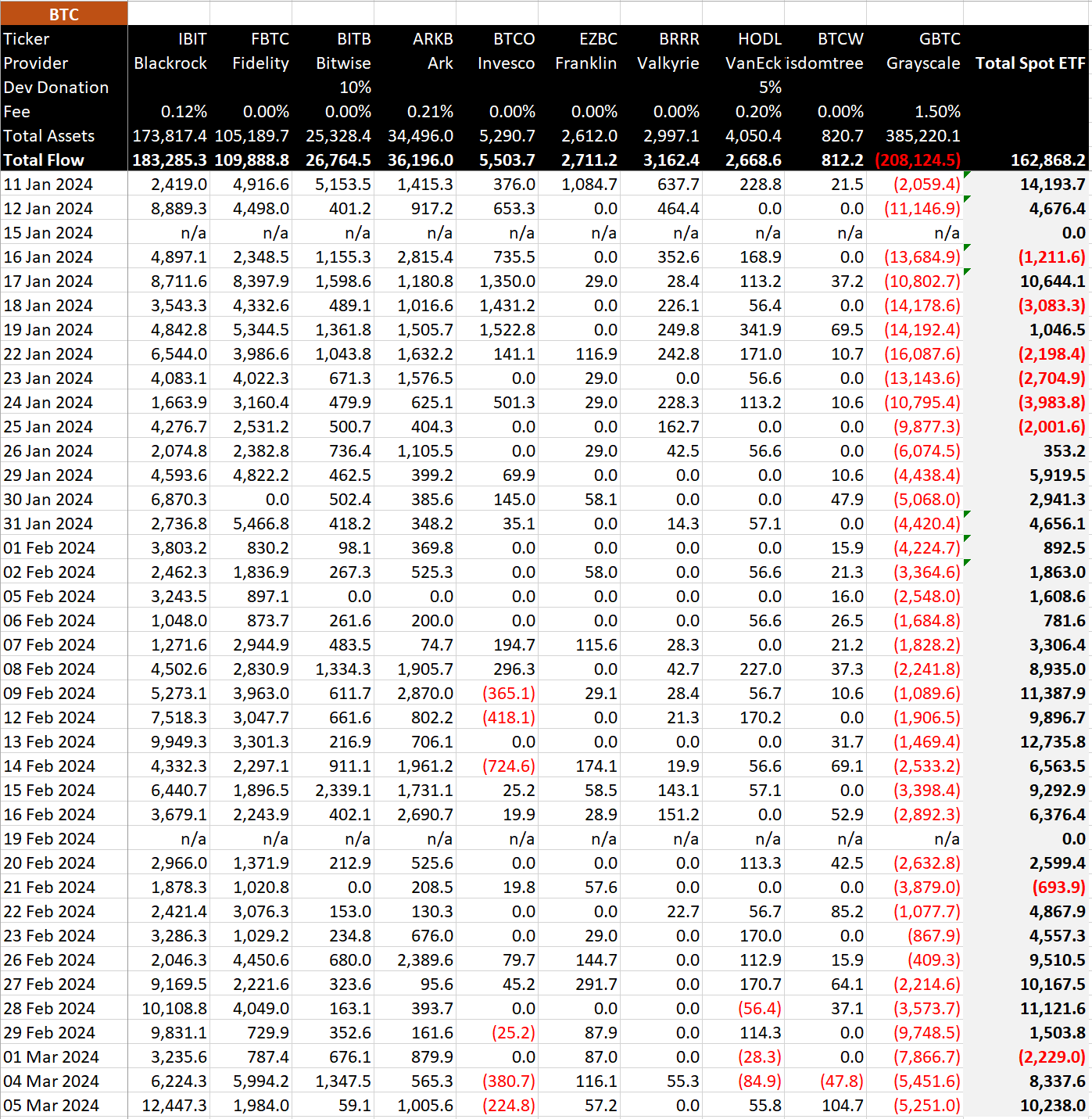

Data from BitMEX shows that on March 5, a staggering $648 million inflow was recorded into the US Bitcoin ETFs, which equates to approximately 10,238 BTC. This was the third biggest day in terms of net inflows since trading began. The principal driver was BlackRock IBIT, with a substantial inflow of $788 million, or another 12,447 BTC, increasing their total net inflows to an impressive $9.2 billion, roughly 183,000 BTC. The $788 million inflow by BlackRock represents the most substantial inflow ever recorded from an ETF provider.

Fidelity’s FBTC also had a significant inflow of $126 million, pushing their total net inflows to $5.3 billion. Simultaneously, GBTC witnessed an outflow of $333 million, marking a continuation of decreasing outflows and suggesting a positive trend. Despite this, GBTC’s total outflows have hit $9.6 billion, according to BitMEX.

Overall, the total net inflows for Bitcoin ETFs stand at an imposing $8.6 billion, the equivalent of 162,868 BTC.

The post Historical day for Bitcoin ETFs as BlackRock’s inflow hits a record $788 million appeared first on CryptoSlate.