- March 6, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

The market’s response to Bitcoin’s approximate 15% decline from just over $69,000 to roughly $59,500 showcases a clear distinction between long-term holders (LTHs), who have retained Bitcoin for more than 155 days, and short-term holders (STHs), whose holding period is less than 155 days.

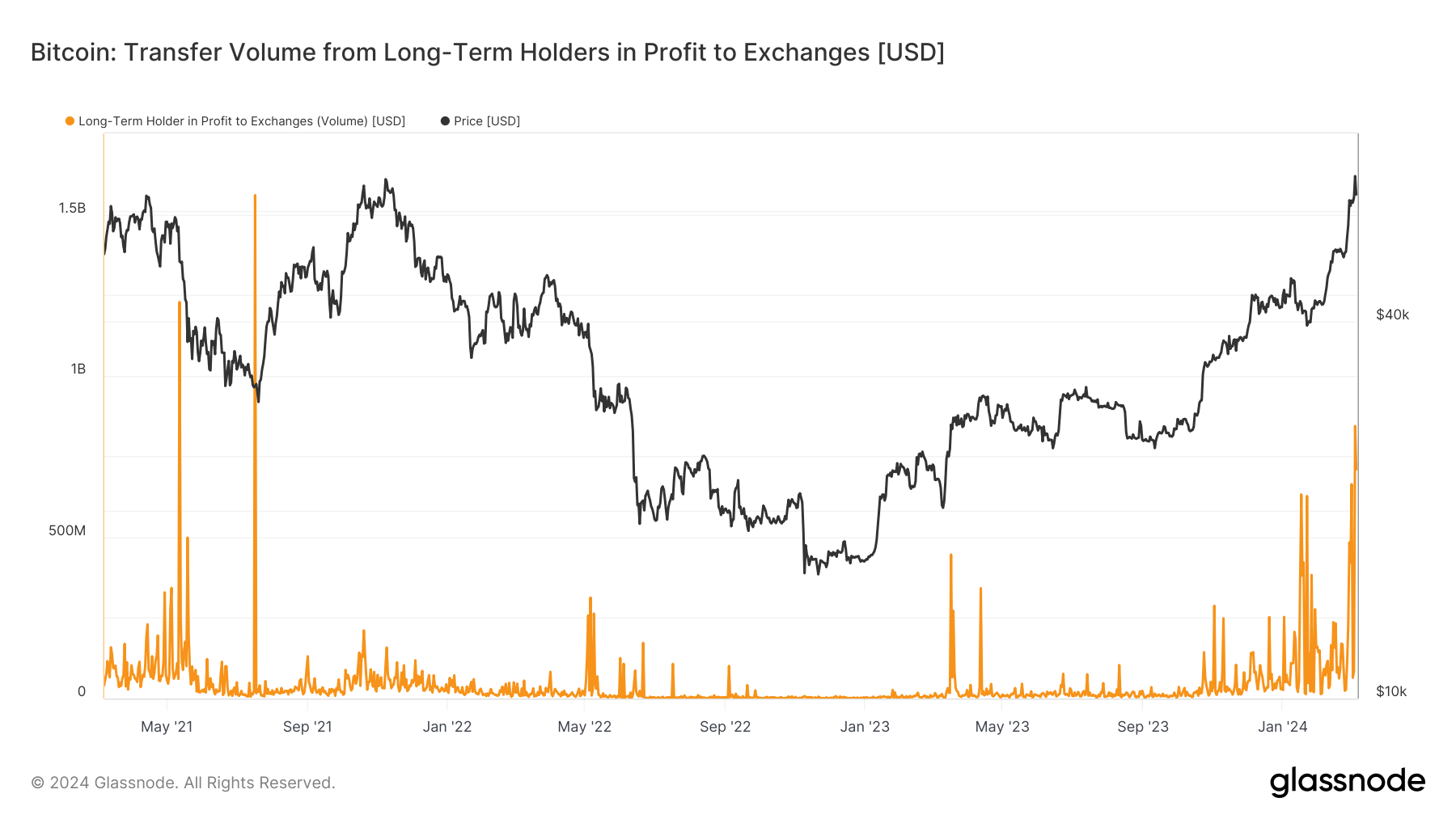

LTHs, who typically accumulate Bitcoin during bear markets, have been capitalizing on the bull run, sending $1.5 billion in profits to exchanges on March 4 and 5, marking nearly a three-year high since July 2021.

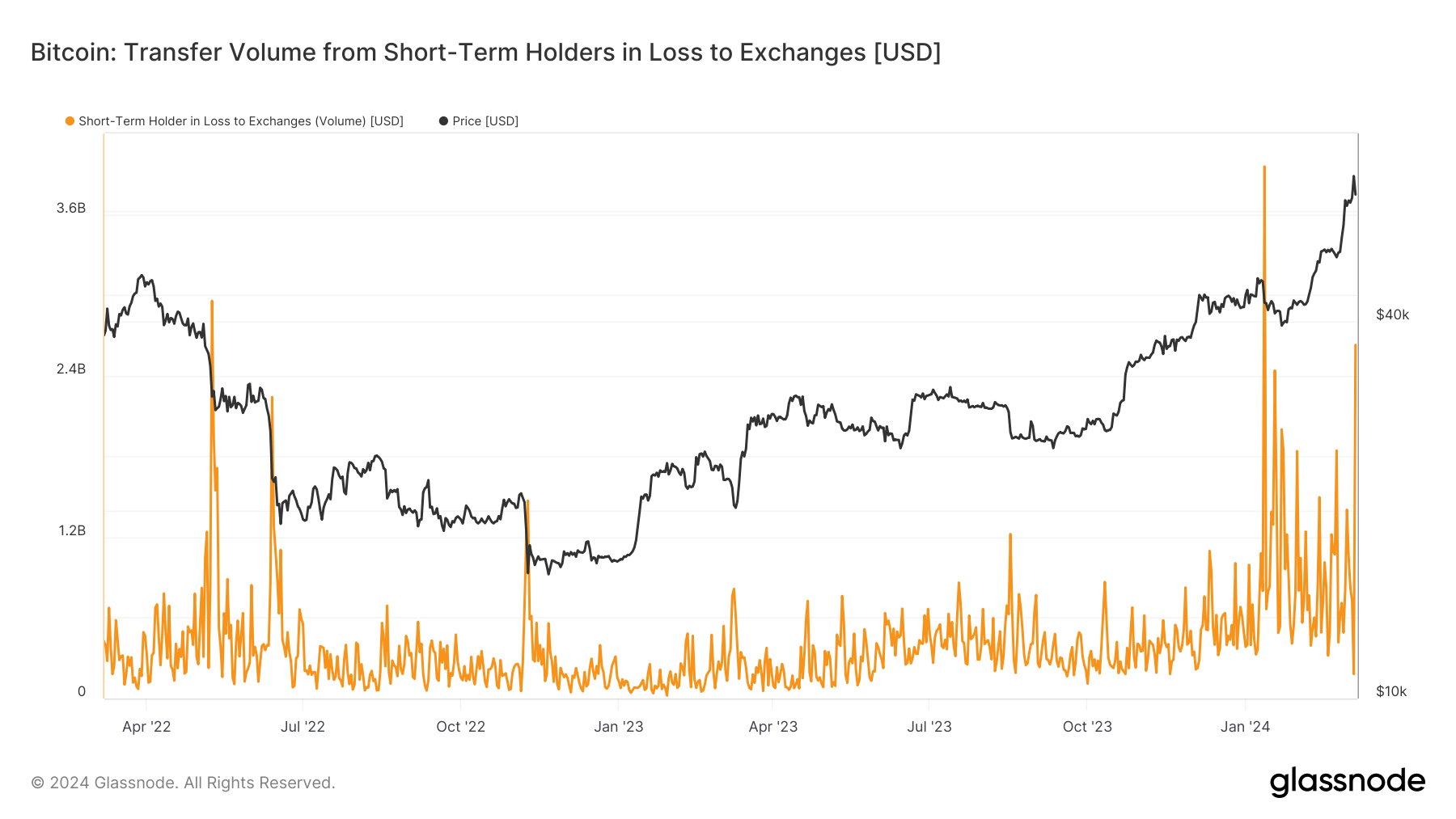

Conversely, STHs, known for their susceptibility to Bitcoin’s price volatility, sent substantial losses. Following the sell-off, they transferred $2.6 billion of losses to exchanges, the third highest since May 2022. The peak loss incident occurred on Jan. 12, with approximately $4 billion sent to exchanges following the ETF launch.

The post STHs transfer $2.6 billion at loss to exchanges, marking third highest since May 2022 appeared first on CryptoSlate.