- March 13, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

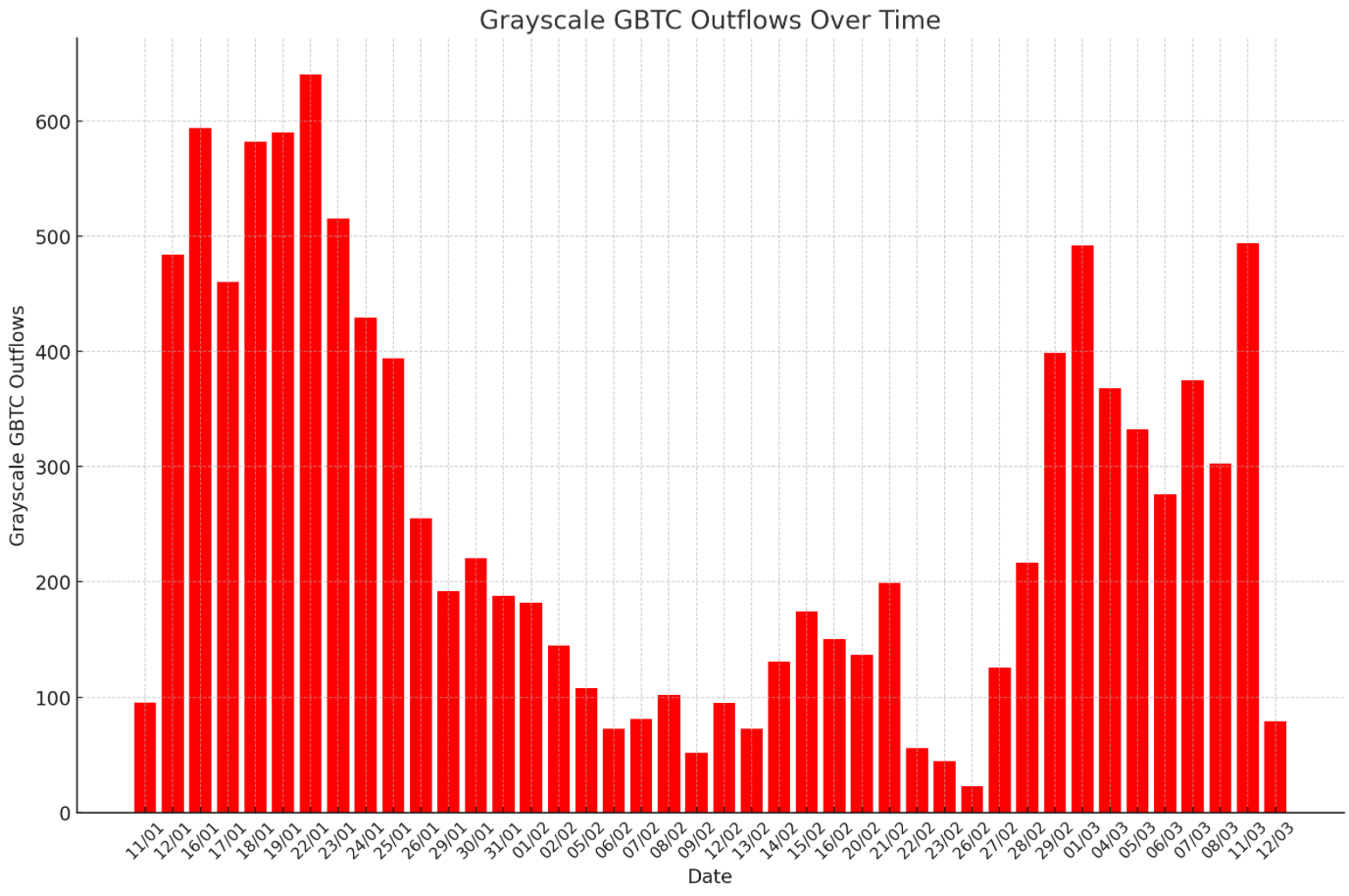

Grayscale Bitcoin Trust (GBTC) has experienced a potential shift in investor sentiment, as evidenced by the significant drop in outflows on March 12. The data reveals that outflows plummeted to just $79 million on this date, starkly contrasting the substantial outflows observed in the preceding weeks and months.

This sudden change in investor behavior can be attributed to the recent announcement of Grayscale’s plans to launch a mini Bitcoin ETF. The filing with the US Securities and Exchange Commission (SEC) has seemingly restored confidence among GBTC investors, who have grappled with the trust’s high fees and increasing competition from more cost-effective alternatives.

Before the March 12 announcement, GBTC had been experiencing a consistently high outflow trend. Outflows in the first week of March alone ranged from $276.2 million to $492.4 million, with every day higher than any day in February. However, the filing appears to have acted as a catalyst for a dramatic shift in a 83% outflow drop, suggesting that investors are now more inclined to maintain their positions in GBTC, anticipating the potential benefits of the proposed mini ETF.

As Grayscale moves forward with its plans to introduce a more cost-effective investment option, it will be crucial to monitor the impact on GBTC’s outflow trends. If the mini ETF successfully retains investors and attracts new capital, it could be significant for the entire industry as GBTC outflows have subdued inflows into the Newborn Nine, thus causing overall supply pressure.

The post Grayscale sees 83% decrease in outflows as mini BTC ETF filing stems bleed appeared first on CryptoSlate.