- March 29, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Solana has had a solid year so far. The network has experienced a significant surge in trading volume across its decentralized exchanges (DEXs). A rising DEX volume usually indicates growing organic activity and interest in a blockchain network. Analyzing the distribution of these volumes and liquidity across Solana’s protocols helps us understand which parts of its ecosystems are thriving and where most of the activity occurs.

Solana’s DEX ecosystem is undeniably huge. Data from Dune puts the total number of traders on the network at just above 5.8 million. The liquidity, measured as the total value locked across decentralized exchanges, reached $1.2 billion on Mar. 25.

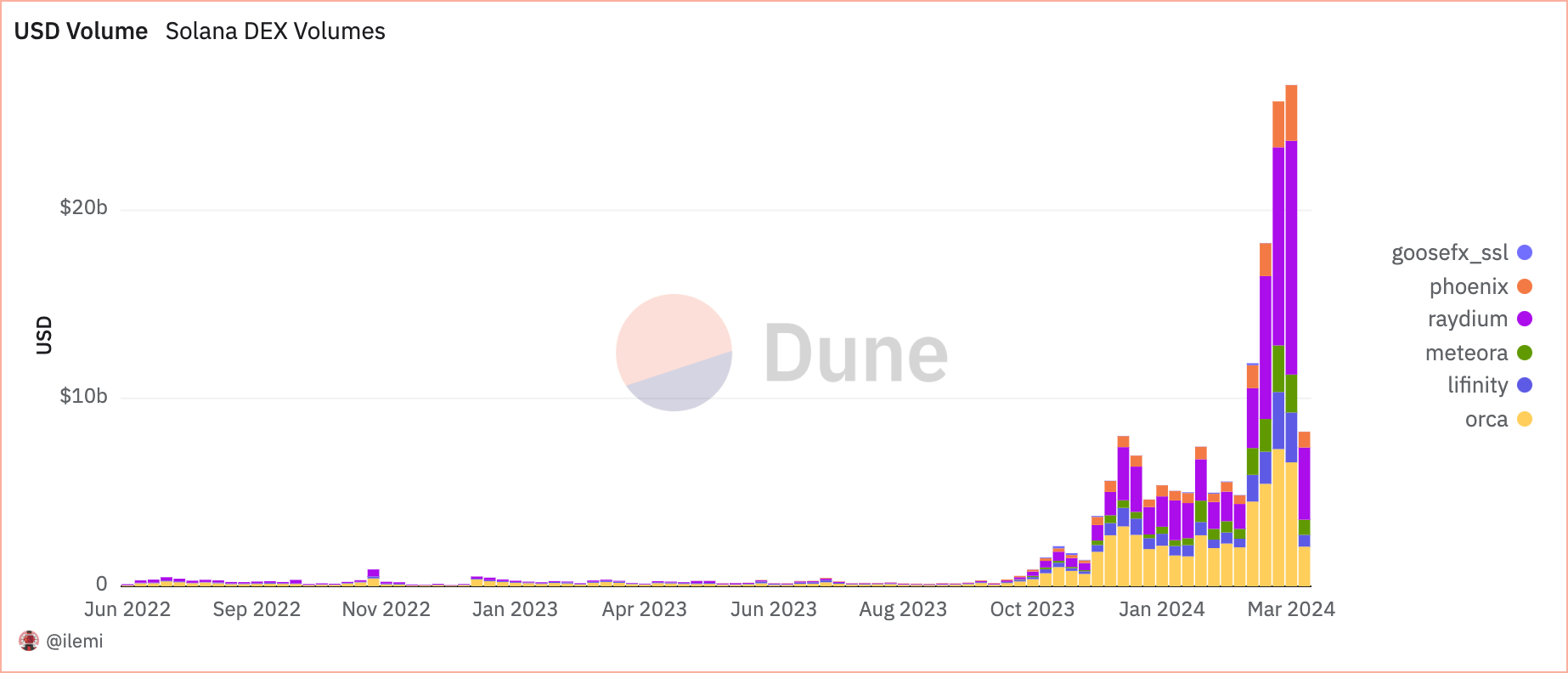

A closer look at Solana’s DEX volumes denominated in US dollars shows incredible growth this year, with volumes rising from $4.6 billion at the beginning of the year to an all-time high of $26.7 billion on Mar. 18. As of Mar. 25, DEX trading volumes settled at $8.2 billion — an expected consolidation after such a sharp spike in a short period.

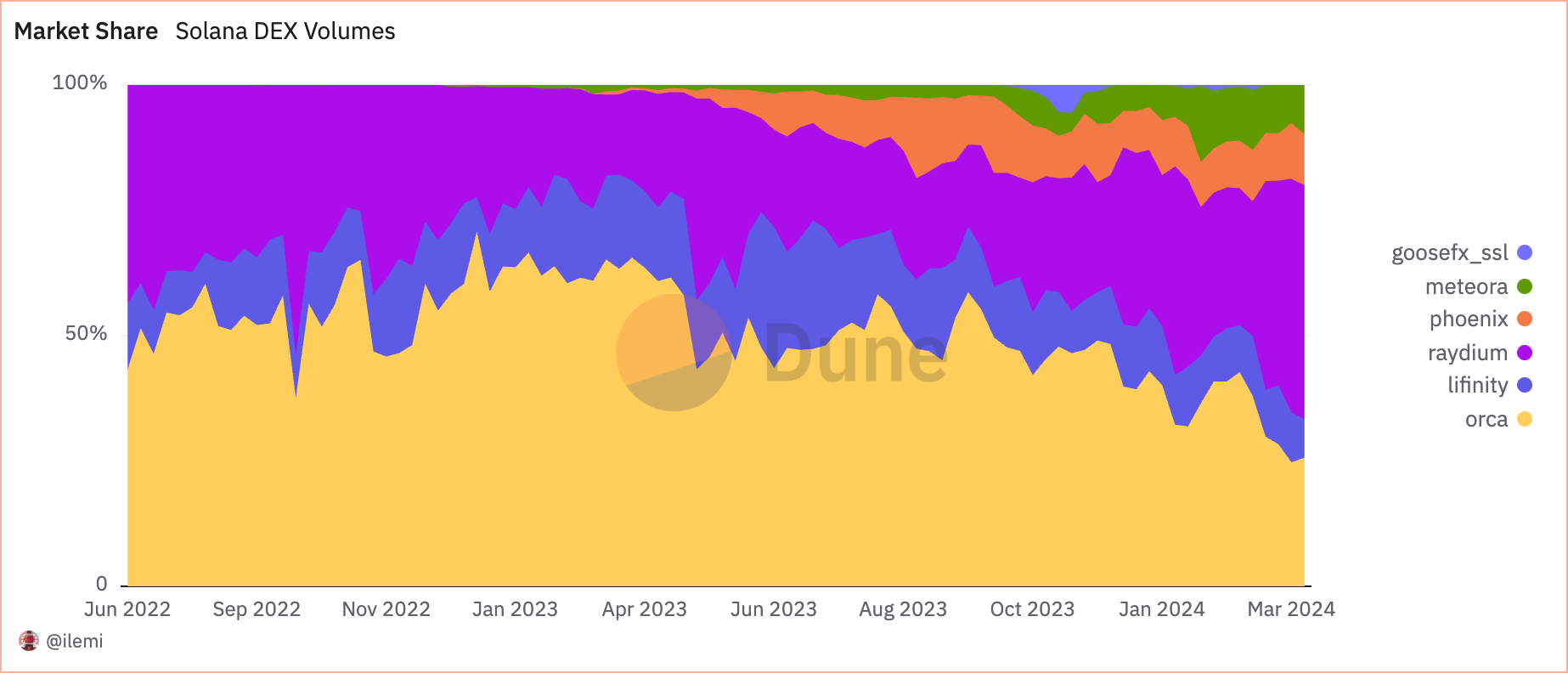

Orca dominated DEX volumes for most of 2024, recording between $2 billion and $4 billion daily trading volume. However, its dominance weathered at the end of February when Raydium ascended to become the go-to DEX for Solana traders, marking $12.4 billion in volume on Mar. 18. Despite the significant drop in volume by Mar. 25, Raydium still accounted for most of it, further cementing its position as the DEX leader.

On Mar. 25, Raydium accounted for 46.7% of the total DEX volume, followed by Orca at 25.7%. Phoenix and Meteora trailed behind, accounting for 10.2% and 9.7%, respectively.

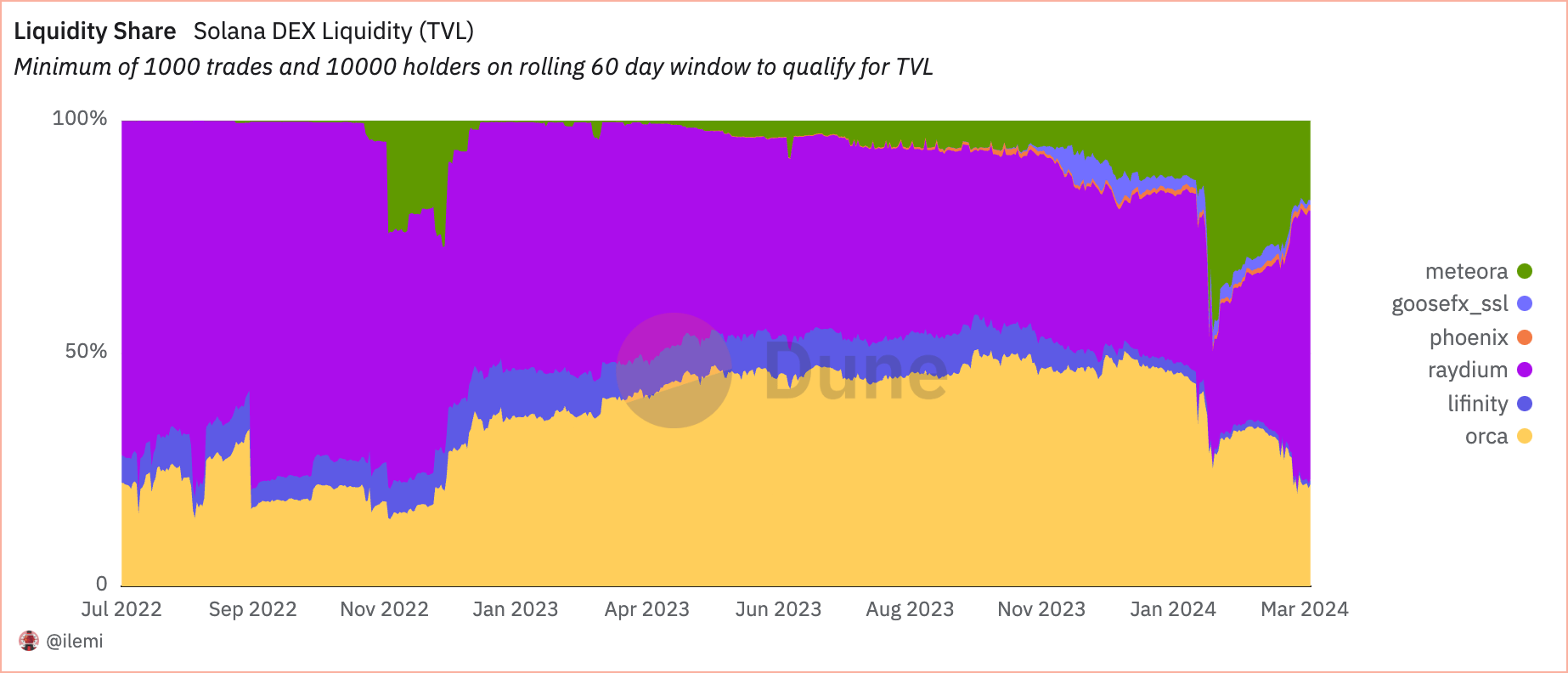

When it comes to liquidity, Raydium reigns supreme as well. As of Mar. 25, Raydium held $694.9 million worth of tokens, accounting for 58.6% of the total liquidity on Solana DEXs. Orca had $205.7 million in liquidity, or 21.1% of the share, while Meteora accounted for just over $201 million or 17%.

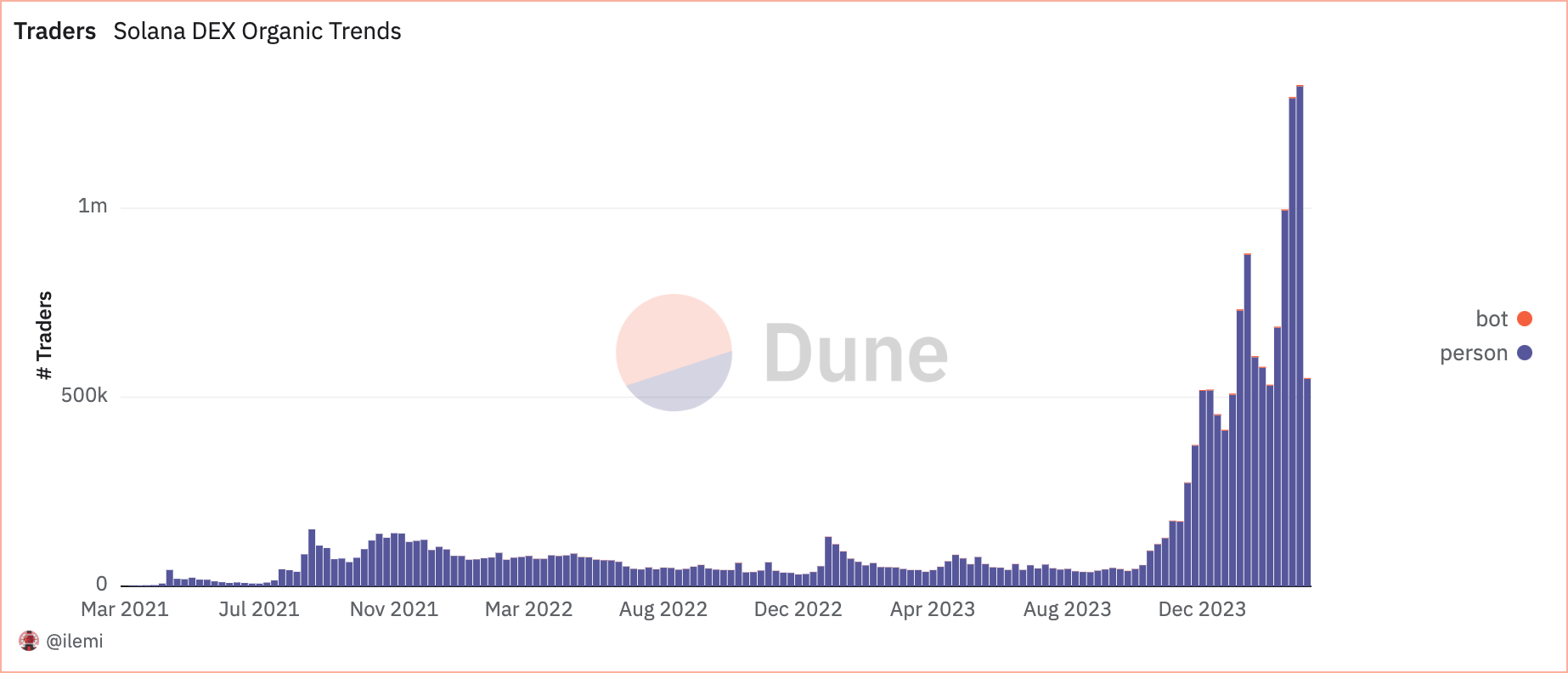

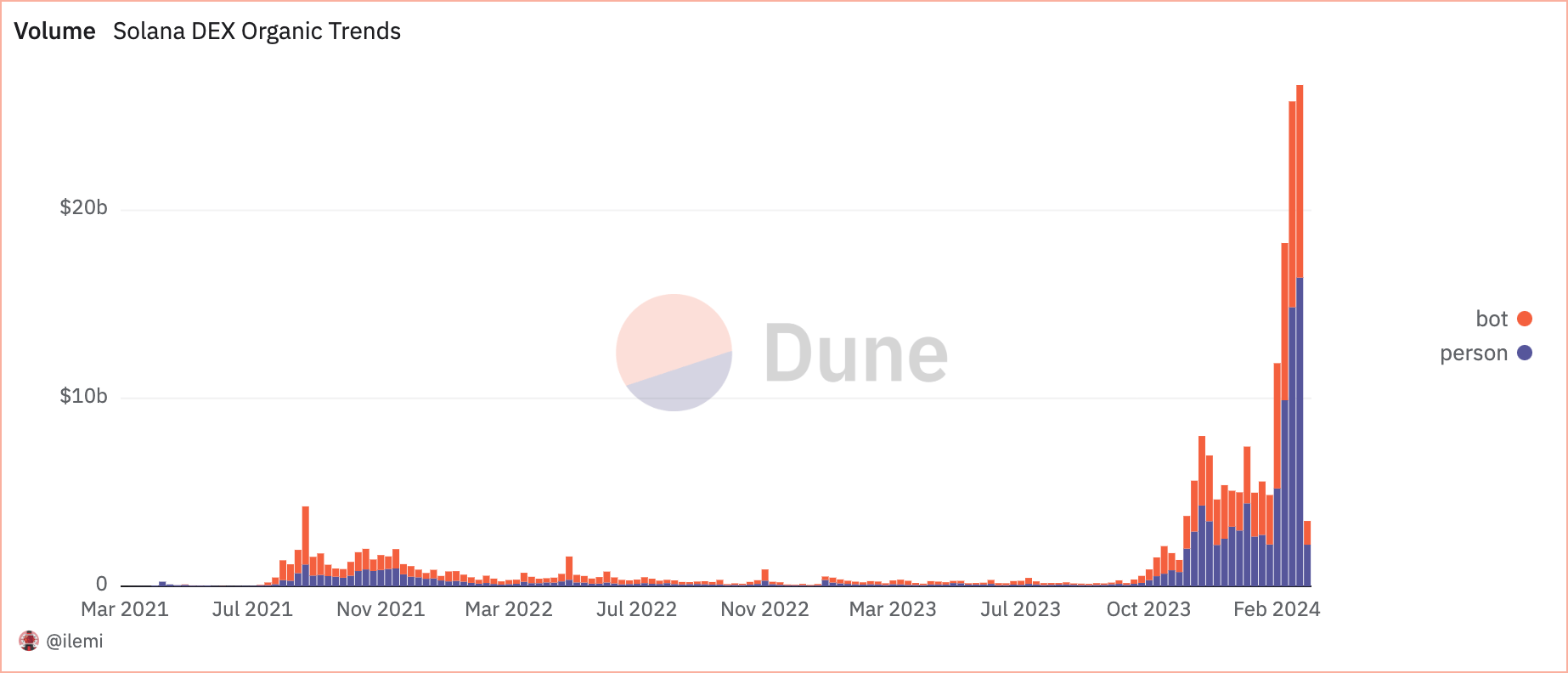

An influx of traders caused this increase in volume and liquidity. The number of organic traders on the network increased from around 453,000 at the beginning of the year to an all-time high of 1 million on Mar. 18, while only around 3,000 “traders” were identified as bots.

However, despite the relatively small number of bots, they managed to rack up a significant volume on Solana’s decentralized exchanges. On Mar. 18, out of the $26.7 billion in volume across DEXs, bots accounted for $10.2 billion. While the volume coming from bots dropped by $1.2 billion on Mar. 25, it still represented a third of the total volume recorded that day. This has been a persistent trend throughout the year, with bot volume consistently accounting for between 30% and 40% of the daily DEX volumes.

The increase in volume and liquidity on Solana’s DEXs confirms the network is booming. Data from Dune showed an increased interest and participation in the DEX market and identified Raydium as the predominant DEX platform. The significant role bots have in driving trading volume up doesn’t detract from the evident organic growth the network has experienced.

These developments can bode well for Solana. The network’s ability to attract such high levels of engagement and liquidity has put it at the forefront of DeFi. However, sustaining such high levels of engagement is where things get complicated. Suppose the network and its protocols manage to maintain performance and continue with their innovative offerings (airdrops and high-interest yield). In that case, we can expect Solana to position itself as the king of DeFi.

The post Solana DEX volumes surge with over 5.8M traders driving growth appeared first on CryptoSlate.