- April 5, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

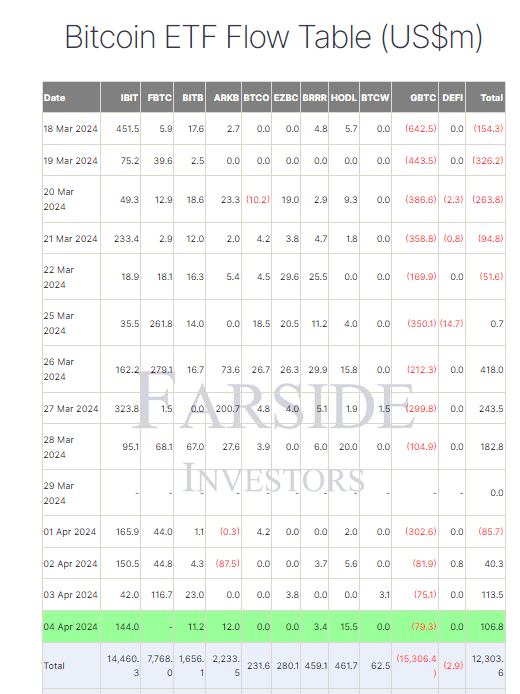

Farside data reports that Bitcoin (BTC) exchange-traded funds (ETFs) continued to see strong inflows, with a collective net inflow of $106.8 million on April 4. This marks the third consecutive net inflows, adding to seven out of the last eight trading days with net inflows.

Farside data reports the Grayscale GBTC fund registered a third straight double-digit outflow of $79.3 million, increasing its total net outflow to $15,306.4 billion. In contrast, the BlackRock IBIT ETF experienced a robust net inflow of $144.0 million, raising its total net inflow to $14,460.3 billion.

Ark’s ARKB ETF also recorded its first net inflow since March 28, adding $12.0 million to its $2,233.5 billion total. Similarly, the VanEck HODL ETF saw its strongest net inflow since March 28, with $15.5 million in new investments. This brings its total net inflow to $461.7 million, according to Farside data.

The total net inflow across all Bitcoin ETFs now stands at $12,303.6 billion, reflecting the continued positive momentum in the digital assets market.

The post Grayscale GBTC ETF records third consecutive double-digit low outflow appeared first on CryptoSlate.