- April 5, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

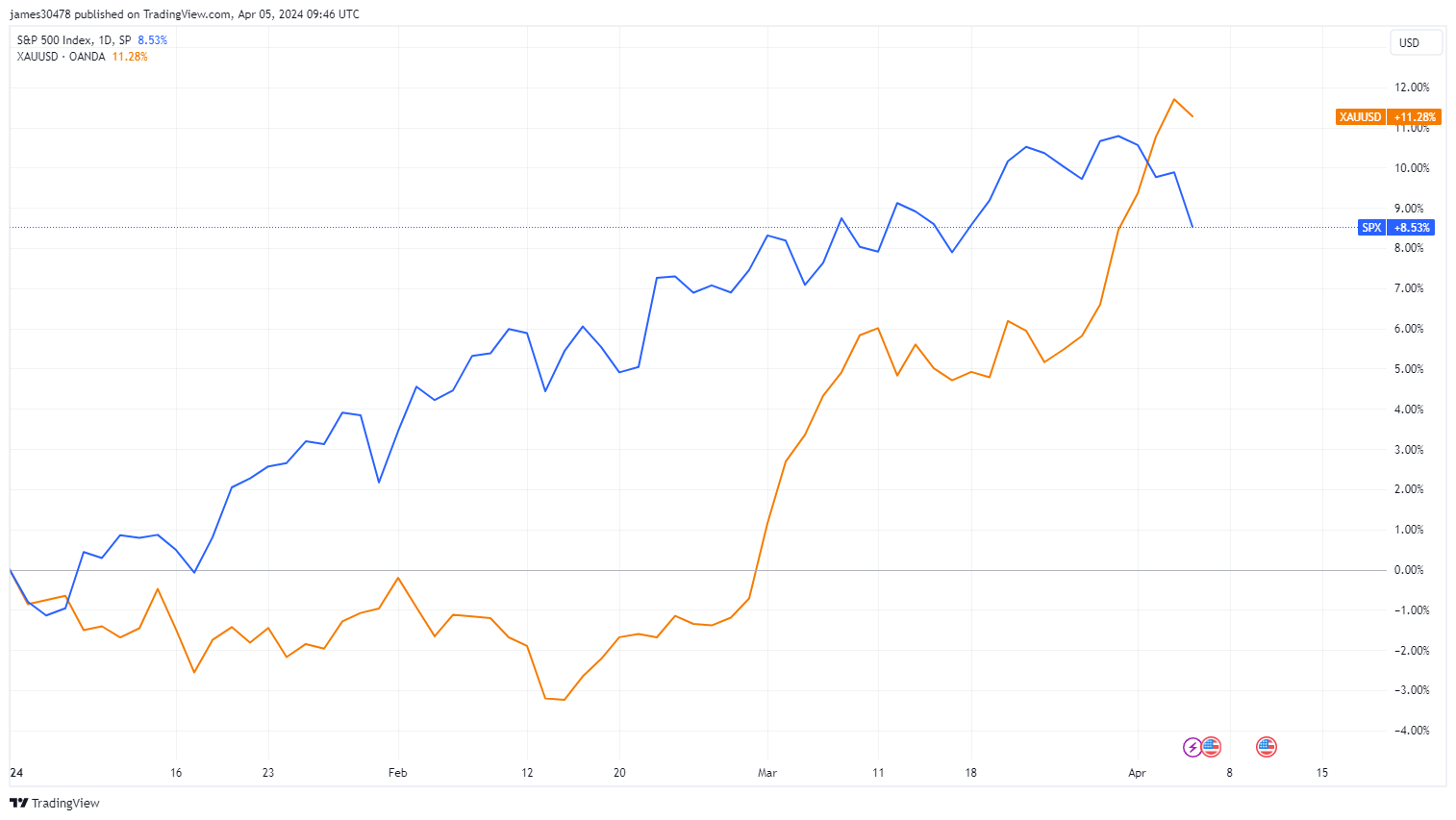

Notably, in 2024 thus far, gold has outpaced the broader equity market, rising approximately 11% compared to the S&P 500’s 9% gain.

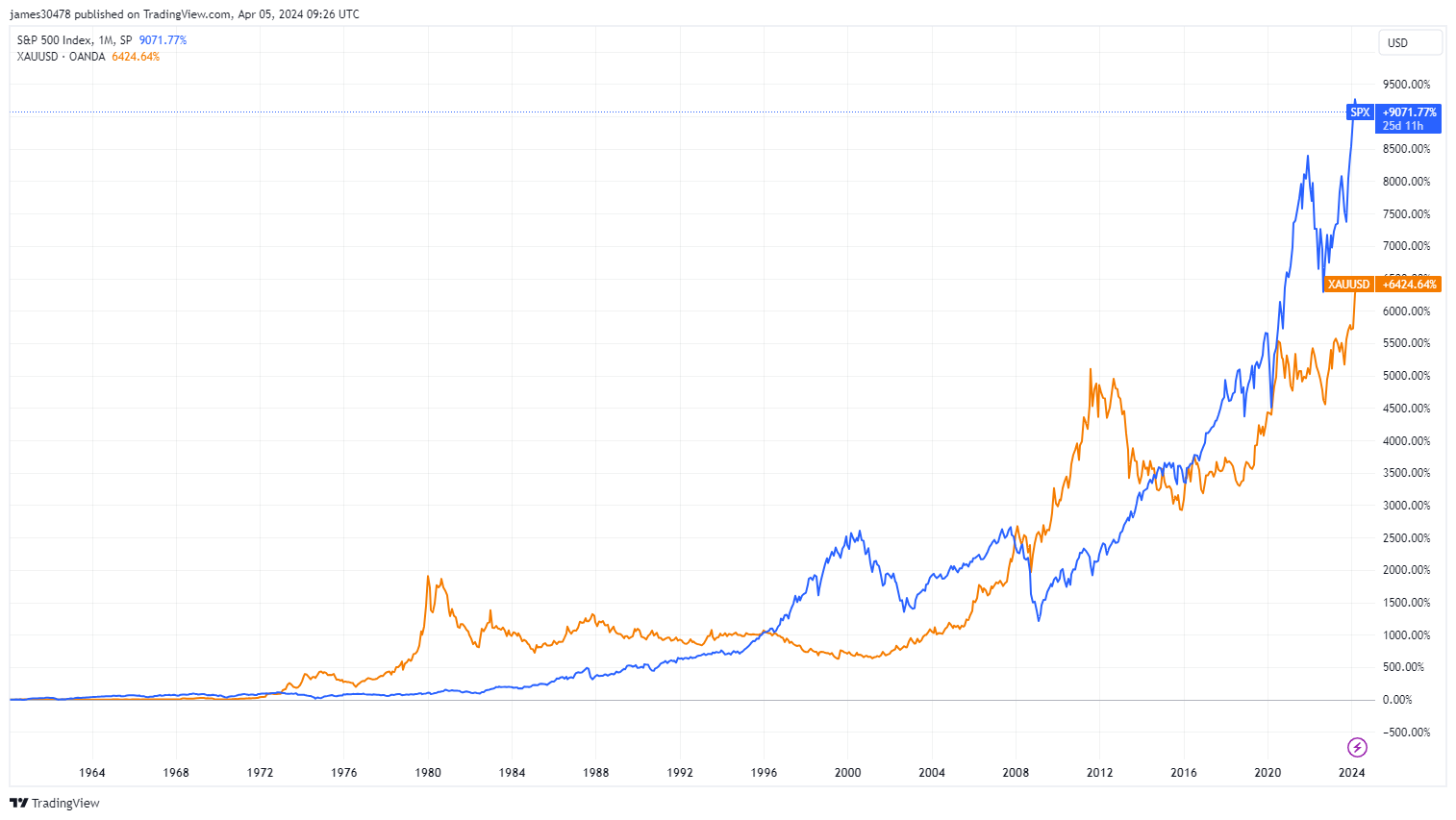

Over the past 70-80 years, the relative performance of the S&P 500 and gold has fluctuated, with each dominating at different times, underscoring gold’s historical role as a hedge against economic uncertainty.

Historically, gold has demonstrated a tendency to outperform the S&P 500 during periods of uncertainty, notably observed from 1972-1996, which encompassed five recessions and in the aftermath of the 2008 financial crisis.

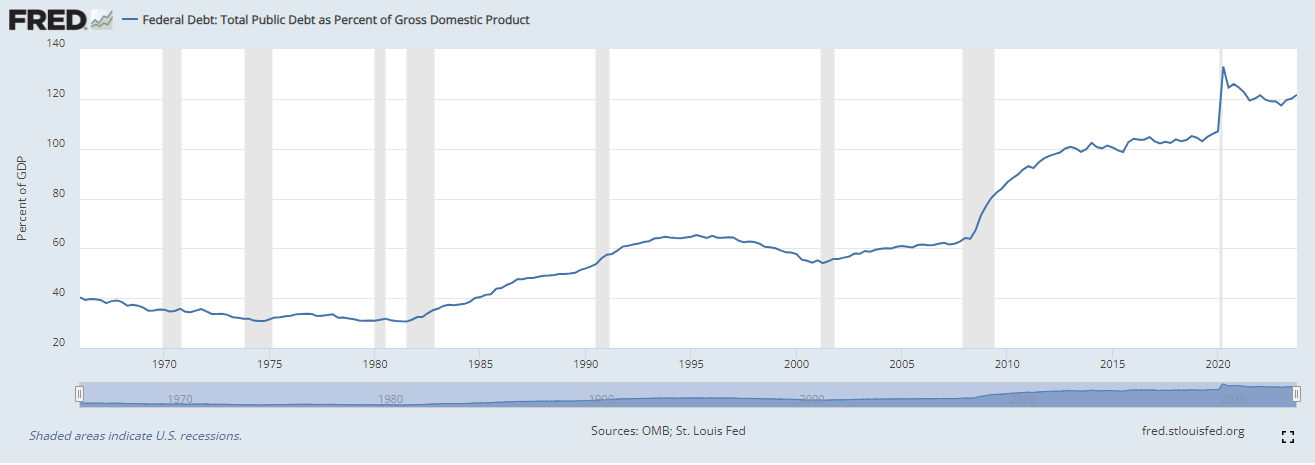

Several macroeconomic factors likely contribute to gold’s current robust performance. According to FRED data, the United States sizable deficits, total public debt as a percent of GDP exceeding 120% in Q4 2023, and escalating commodity prices suggest a potential for an inflationary rebound and ongoing global conflicts.

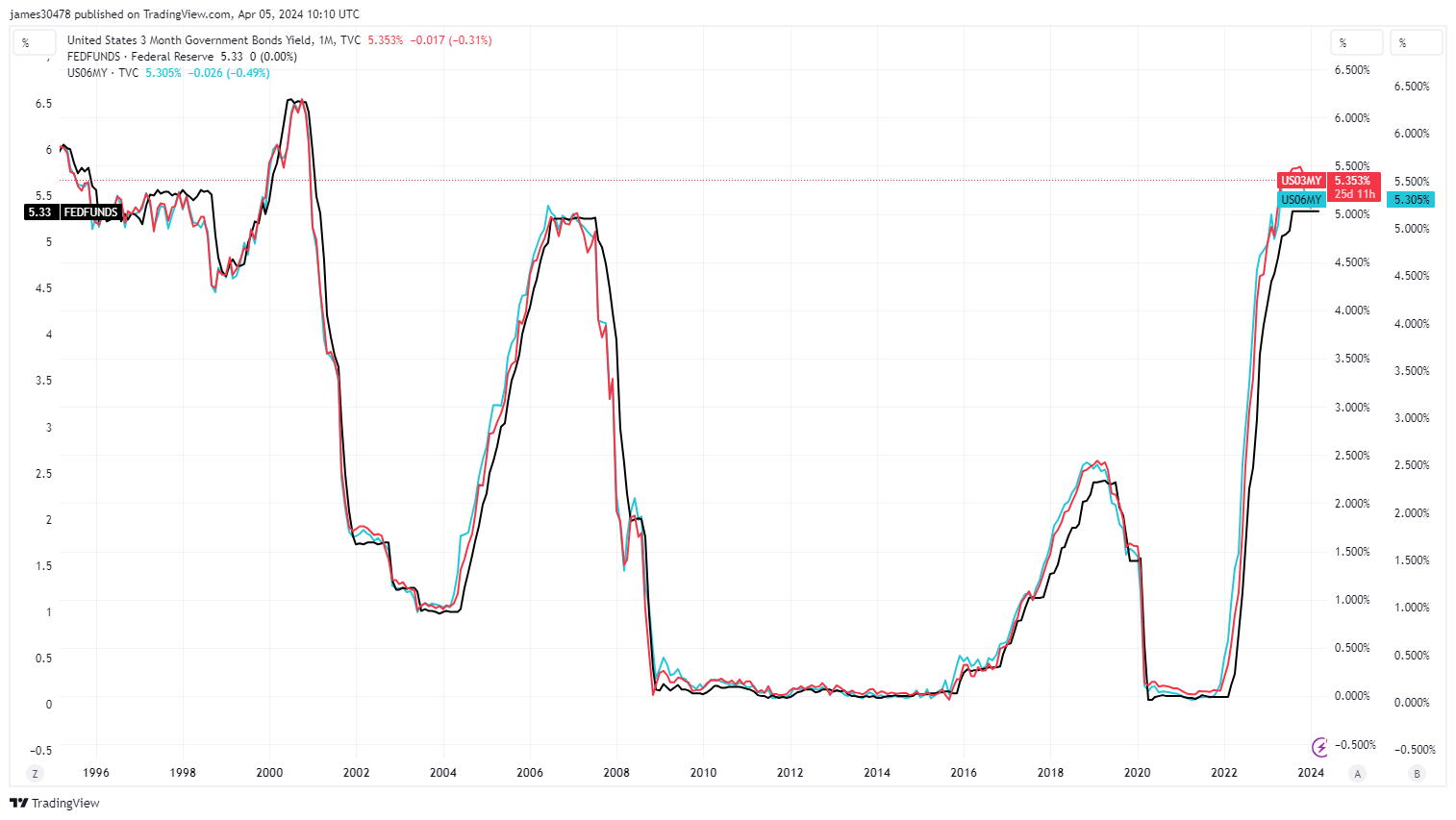

With the federal funds rate at 5.25-5.50%, companies may encounter mounting challenges in servicing their debt in the upcoming year.

While rate cut expectations continue to be pushed back, the short-term treasury market is not anticipating a rate cut within the next six months because the yields on 3-month and 6-month treasury securities are higher than the Effective Federal Funds Rate (EFFR), according to Caleb Franzen, Founder of Cubic Analytics.

Interestingly, Bitcoin, often likened to “digital gold,” has surged over 50% year-to-date. Should the digital asset continue to rally following the halving, it would reinforce its narrative as a hedge against economic uncertainty.

The post Gold outperforms S&P 500 YTD as economic uncertainty looms appeared first on CryptoSlate.