- April 8, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Solana recently encountered a significant challenge with an unprecedented number of transaction failures. On Apr. 5, the network saw over 75% of its transactions fail, highlighting a critical issue for a network that has rapidly become a key player in the DeFi space, handling massive trading volumes. This surge in failed transactions raised concerns about the network’s capacity to sustain its growth and maintain operational efficiency.

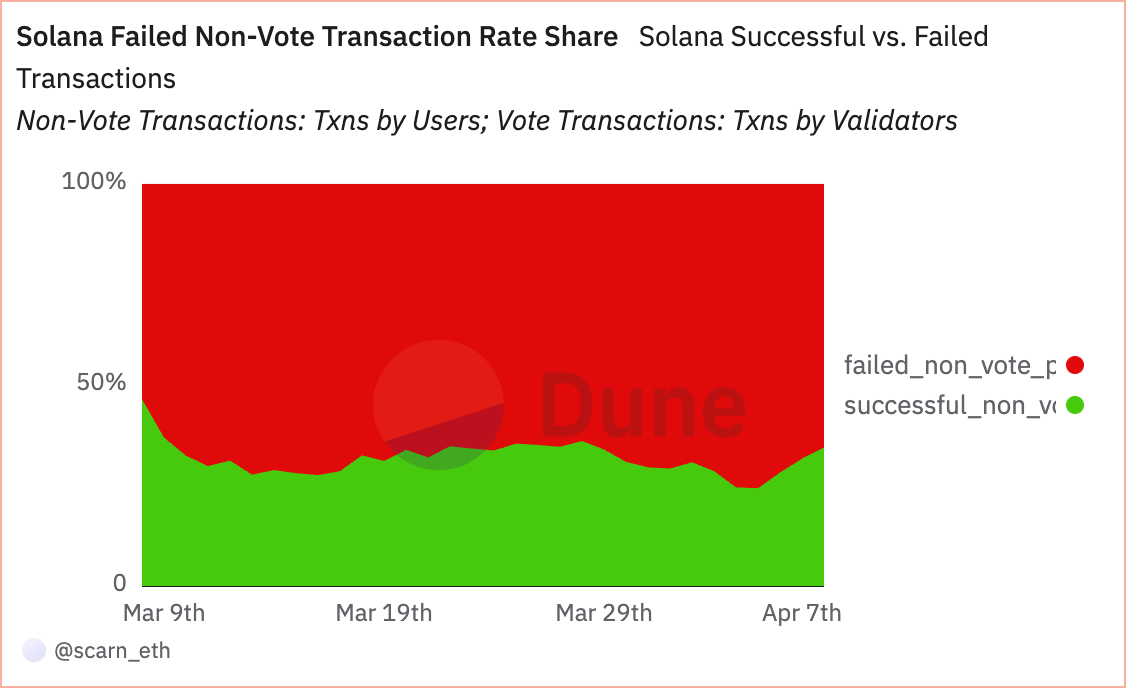

Transactions on Solana are categorized into two types: vote and non-vote transactions. Vote transactions are related to the consensus mechanism, essentially votes by validators on the state of the blockchain. Non-vote transactions encompass all other types, including transfers, smart contract executions, and DEX trades. The sharp increase in failed non-vote transactions, with rates as high as 75.68%, points to severe limitations in handling user-initiated activities.

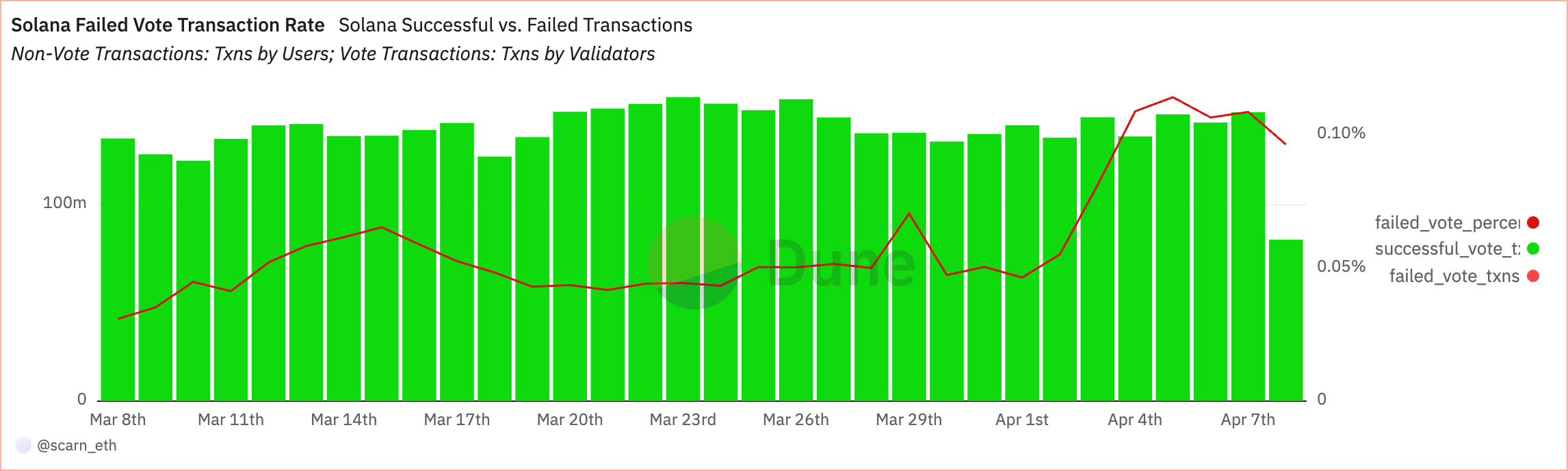

Conversely, the low failure rates of vote transactions, which have also increased significantly but still remain under 0.11%, indicate that the consensus mechanism itself remains stable despite the stress on the network.

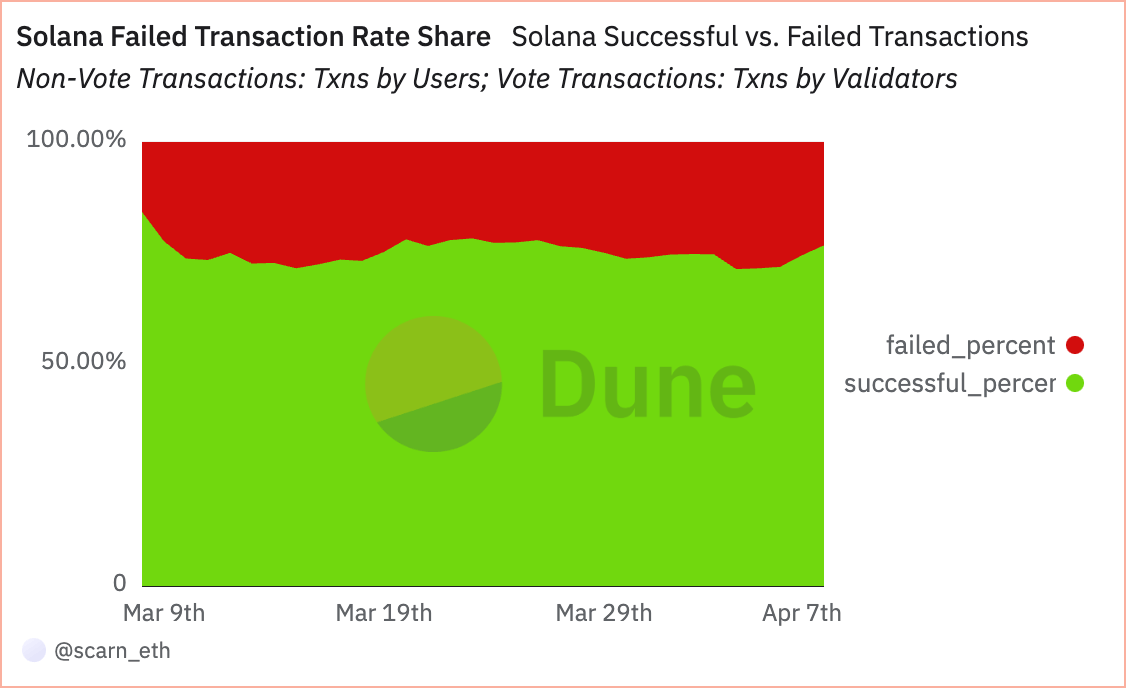

Looking at the share of vote versus non-vote transactions reveals notable shifts in network activity. Although a significant portion of the network’s transactions are for voting purposes, the substantial share of non-vote transactions shows that most of Solana’s use cases go beyond consensus tasks.

However, the total failed transaction rate reached a record high of 28.50% on Apr. 5, although lower than the non-vote failure rate, still indicates a troubling trend that could undermine user trust and network utility.

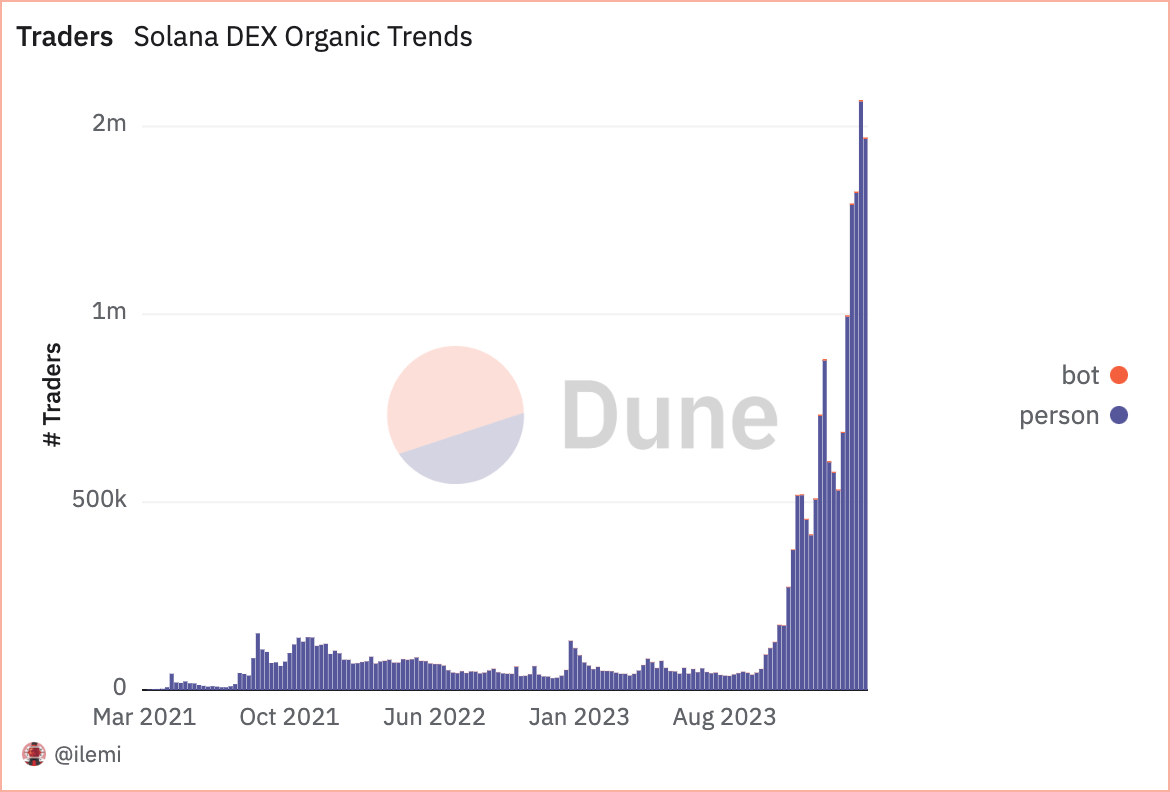

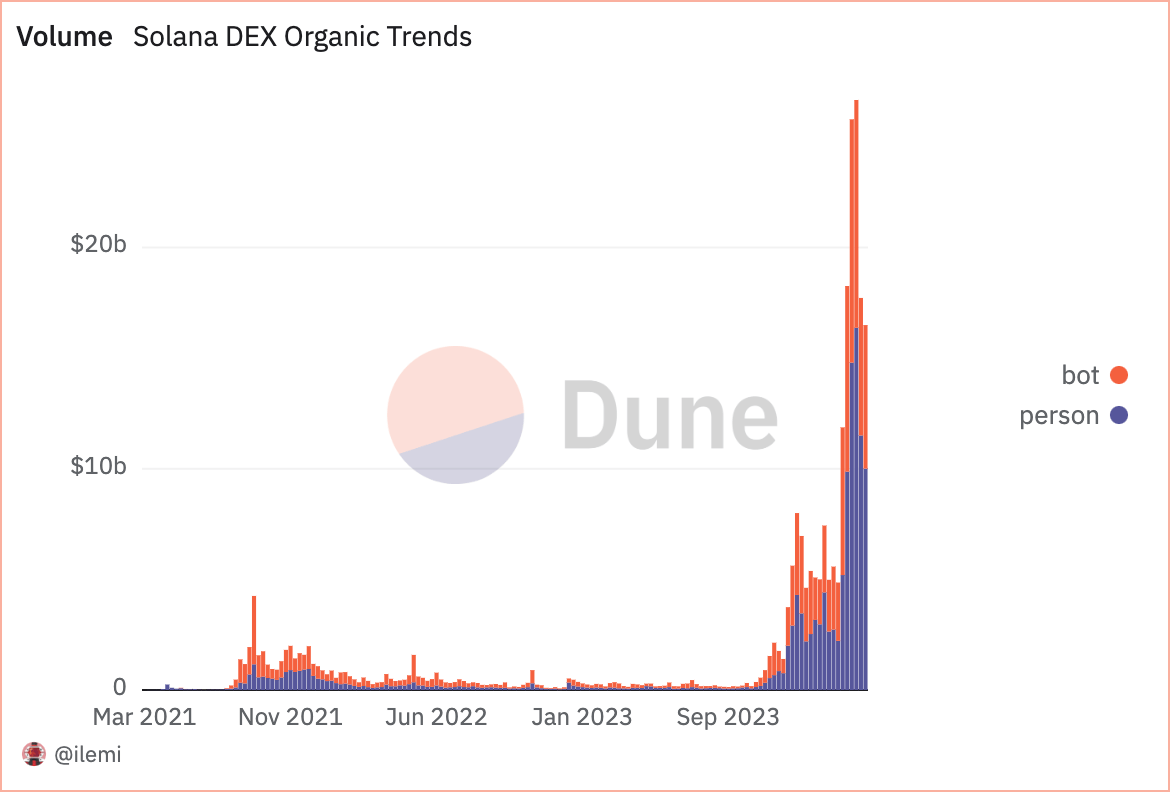

Multiple different factors have contributed to the high failure rate on the network. However, the proliferation of bots on the network seems to be the dominant one. Bots are automated programs designed to execute transactions at high speeds and have been considered a significant strain on Solana’s infrastructure for quite a while. Despite representing a small fraction of the network’s users, bots account for a disproportionately large volume of trading activity.

On Mar. 18, Solana recorded its largest DEX trading volume ever, with $26.7 billion, of which $10.3 billion was attributed to bot activity. This discrepancy highlights the impact of bots on network congestion and the transaction failures that result from it.

Solana could face severe consequences from such high failure rates. These failures translate into lost opportunities and potential financial losses for users, especially in DeFi. For the network, persistent issues with transaction reliability could deter developers and users from building on or using Solana, favoring more stable alternatives.

Addressing these challenges is the hard part, though. Enhancing network infrastructure to manage high volumes of transactions efficiently is paramount, but implementing it at the speed and scale this problem requires will remain extremely difficult. While this could involve processes like upgrading consensus mechanisms and optimizing transaction processing, implementing better measures to manage bot activity should be prioritized.

While the network faces significant challenges with transaction failures, mainly due to non-vote transactions and bot activity, on-chain data shows its foundational stability remains relatively intact.

The post Solana’s growing pains: Why 75% of non-vote transactions failed appeared first on CryptoSlate.