- April 16, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

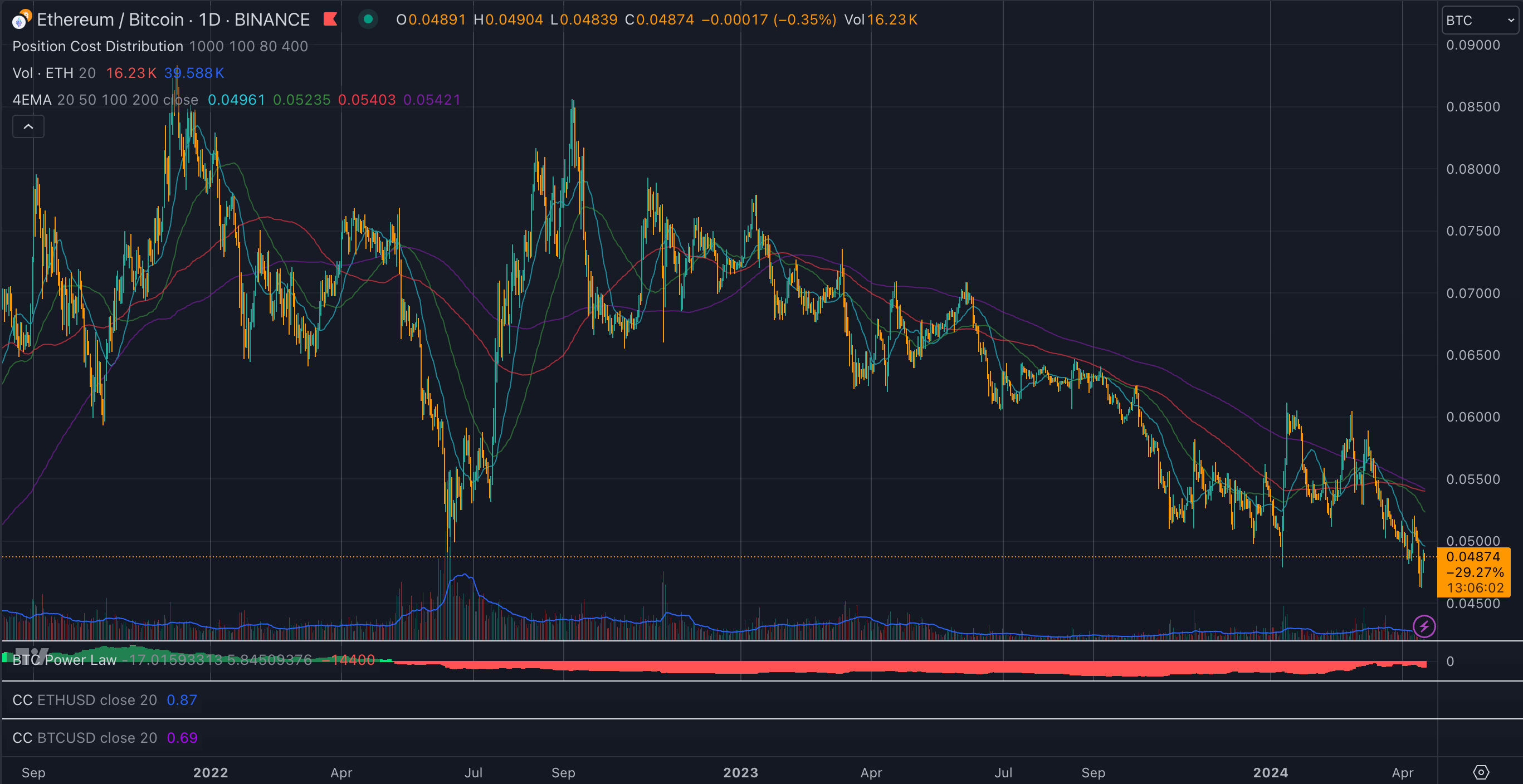

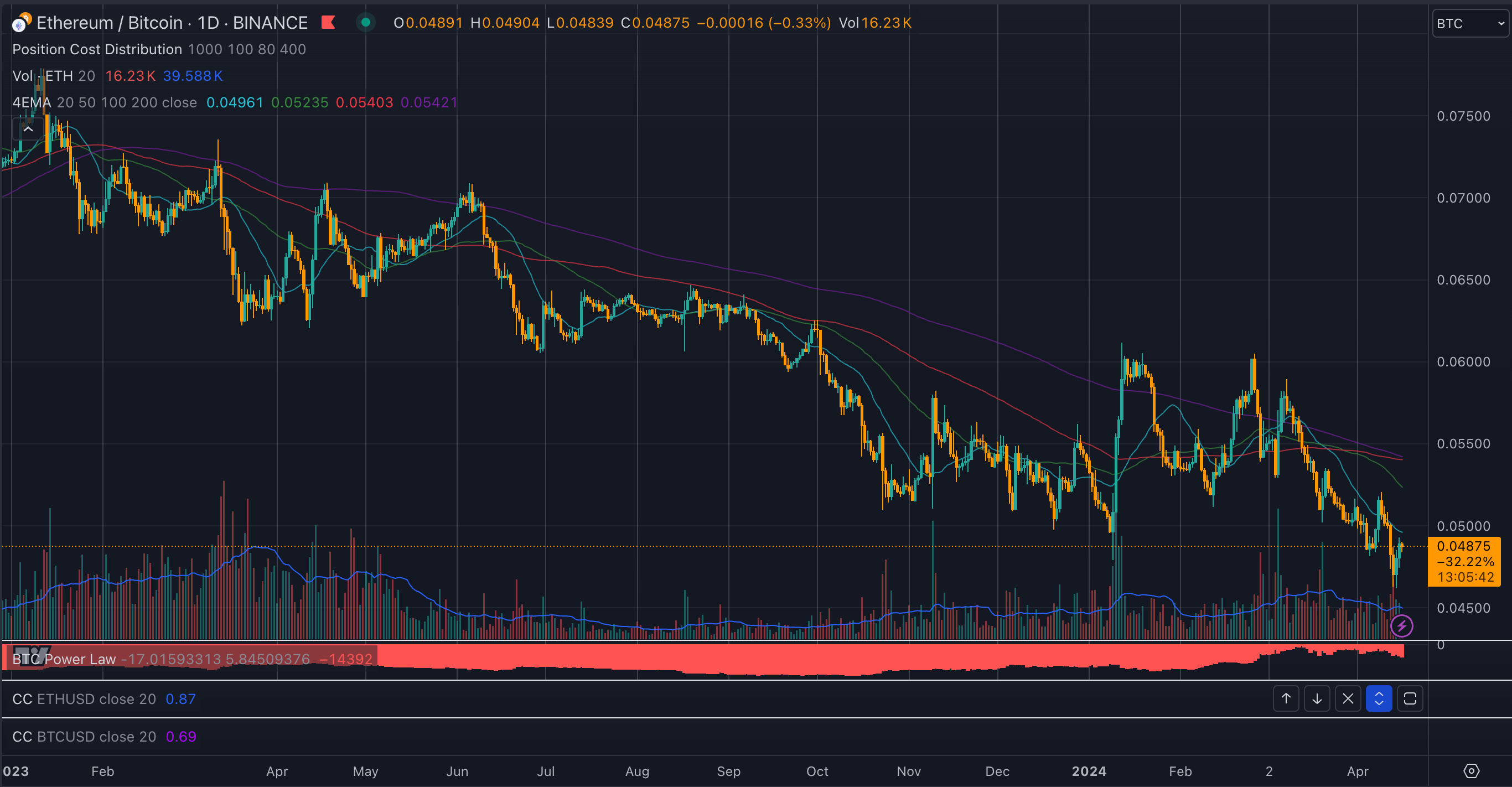

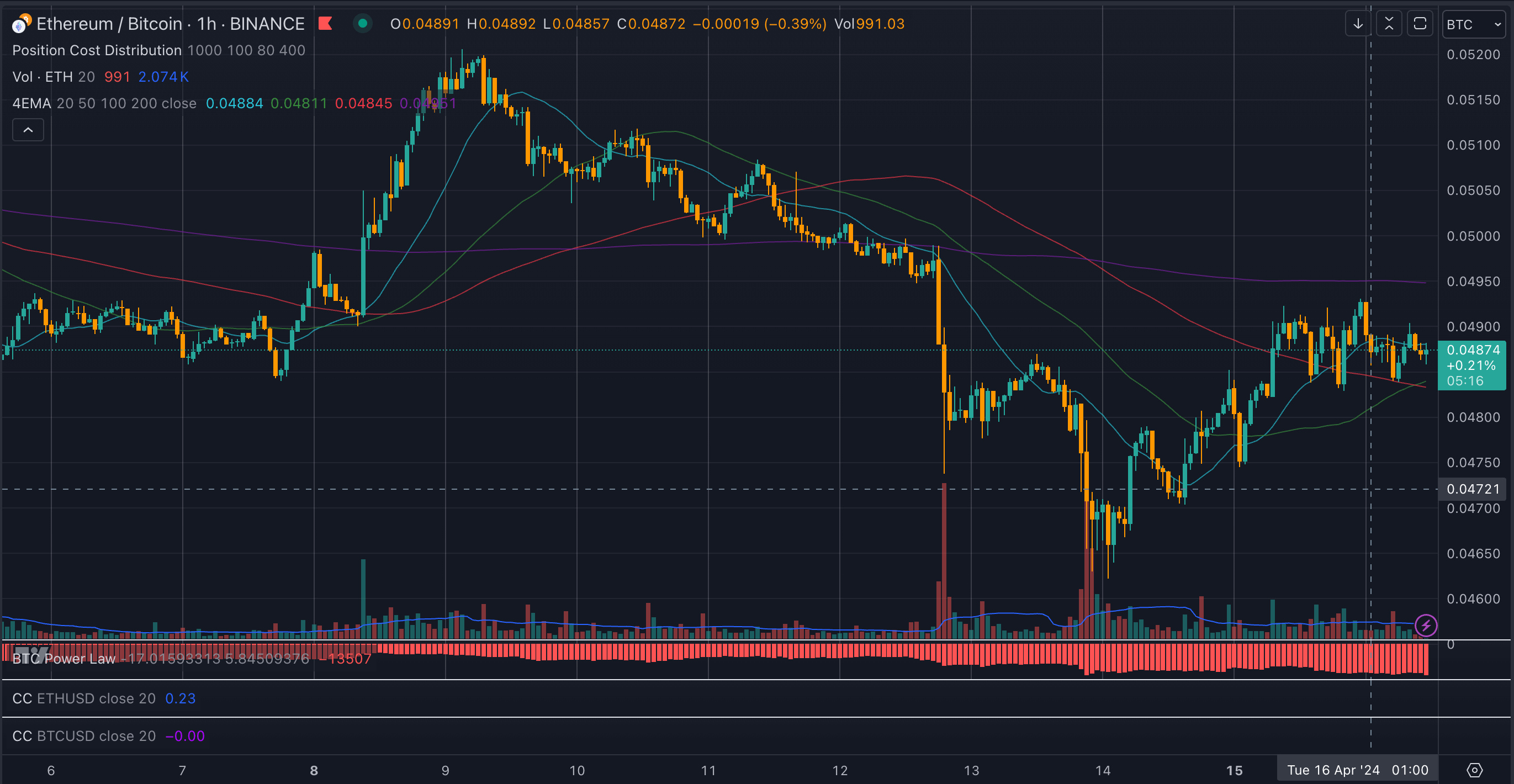

Ethereum fell against Bitcoin to its lowest point in three years amid the carnage that followed Bitcoin’s fall from $70,000 over the weekend. The ETH-BTC chart reached as low as 0.0462 BTC on Saturday, April 13, down 24% from the year-to-date high of 0.085 BTC.

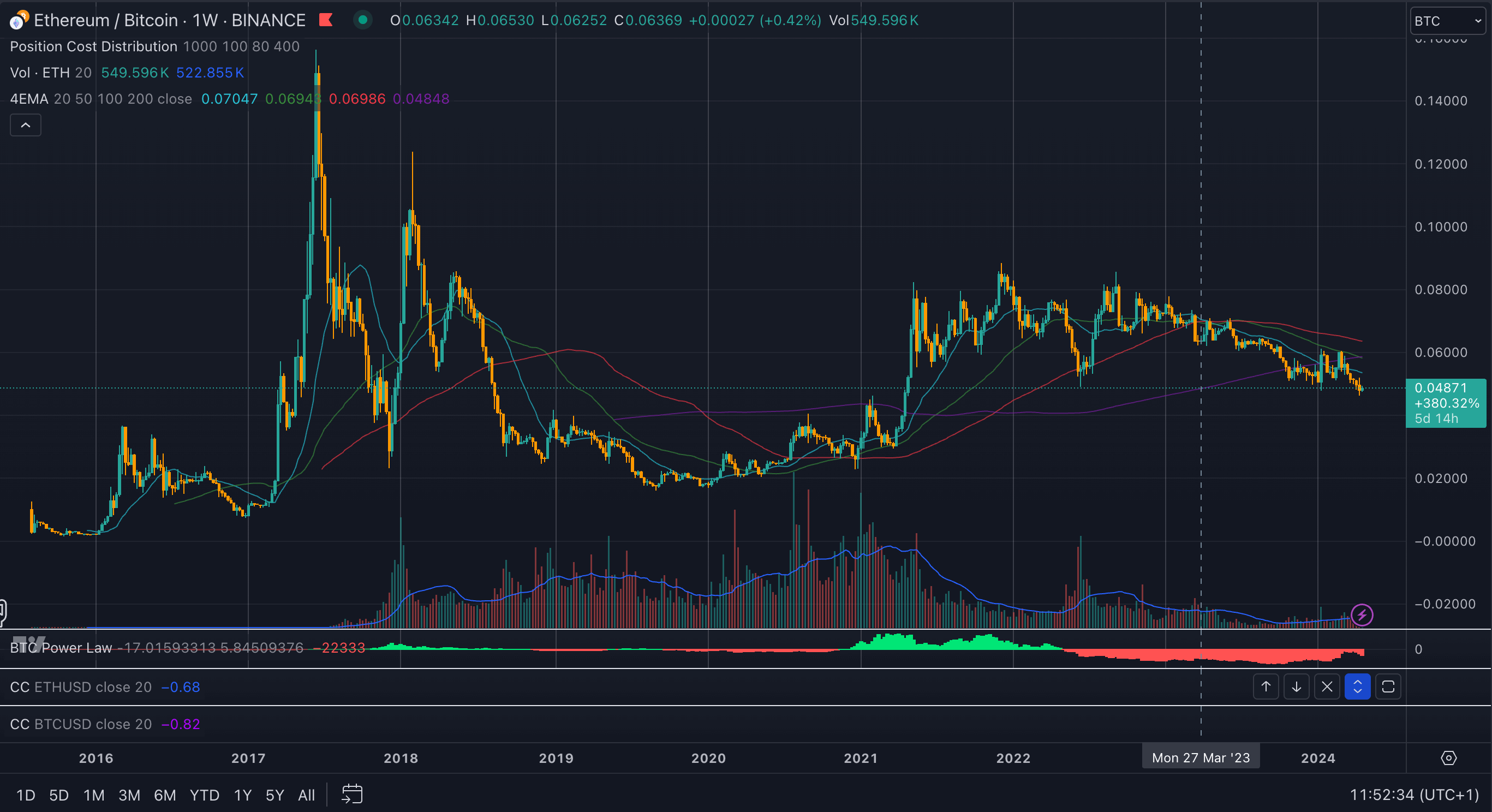

Ethereum’s all-time high against Bitcoin came in 2017 when it touched 0.16 BTC before closing the year around similar levels to now at 0.048 BTC. It has since recorded lows around 0.018 BTC in late 2019 before rising significantly throughout the 2020 – 2021 bull market.

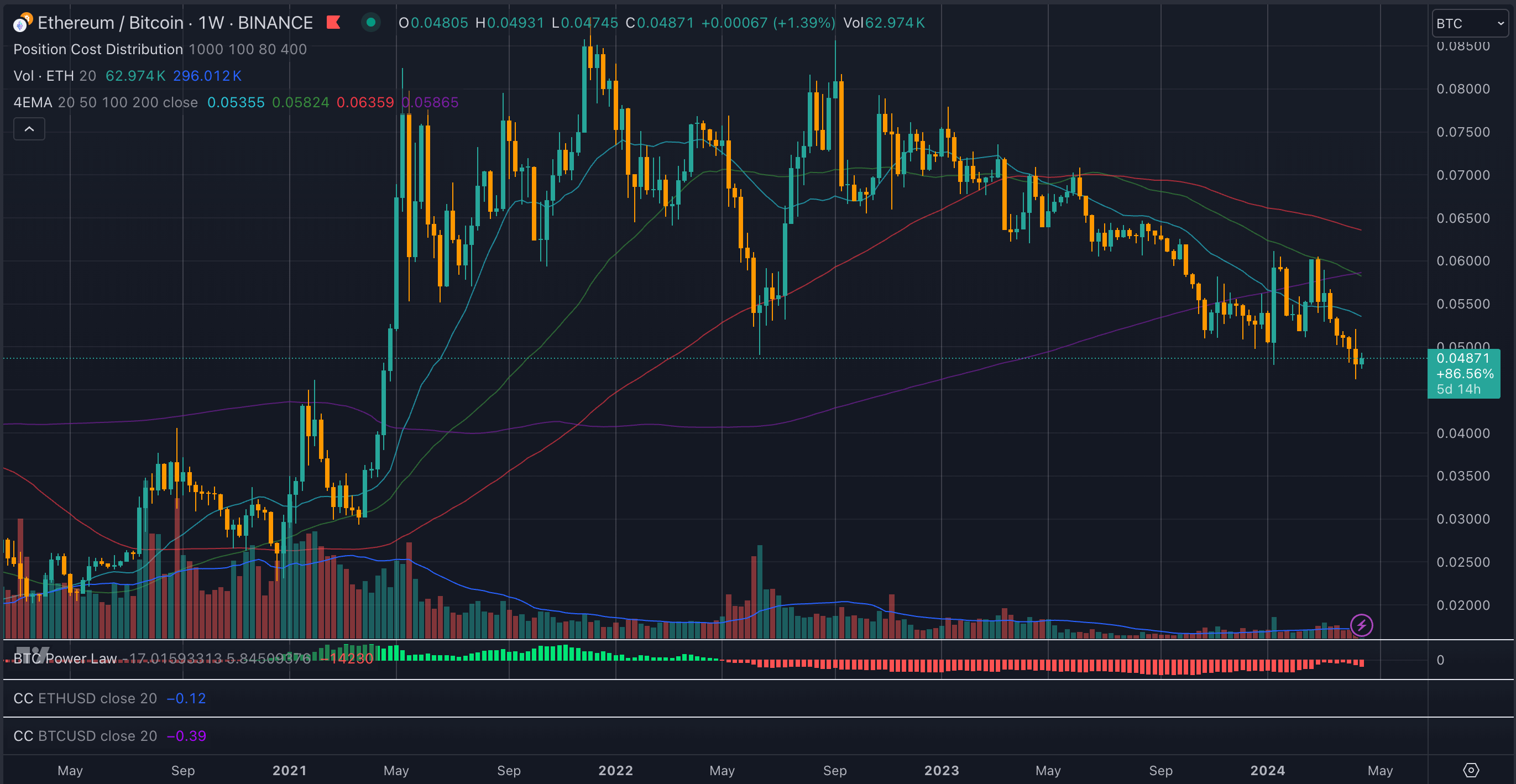

The cycle peak of 0.088 BTC was met with a steady decline throughout 2023, 2022, and 2024. The 0.05 BTC level had been acting as a lower support level until it was breached this month. While the price remains within 7% of the support, it has been almost three years since we’ve seen these prices.

The decline has been gradual and steady since the start of 2023, with a few bullish breakouts shut down within a couple of months.

While Ethereum remains below the 0.05 BTC support level, it has recovered almost 7% from its weekend lows, holding relatively steady amid Bitcoin’s continued struggles. Bitcoin fell from $70,000 to $61,700 over the weekend before recovering to $66,000. However, Bitcoin has retested $61,700 again and is trading around $62,000 as of press time. Ethereum initially followed Bitcoin down from $3,600 to $2,800 – it has since consolidated around the $3,000 mark, aiding it in its price war with Bitcoin.

While the overall crypto market often follows Bitcoin, much of the altcoin market follows Ethereum. The ETH-BTC chart highly influences the delicate relationship between digital asset price movements, and it is one of the staples of the industry. Bitcoin dominance, another critical factor, reached a 3-year high this weekend, touching 57%, while Ethereum dominance dropped to just 15% from a recent high of 19%.

The post Ethereum falls to lowest level against Bitcoin in 3 years amid panic selling appeared first on CryptoSlate.